Adding your teen to your car insurance costs an average of $2,718 per year of the companies MoneyGeek surveyed. If they got their own policy, it'd cost about $5,108 annually. If getting a separate policy, you'll need to co-sign it, as minors can't legally sign contracts in any state.

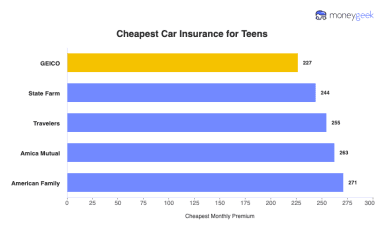

Nationwide offers the most affordable rates for adding young drivers of most ages. GEICO provides the best rates for 18-year-olds.