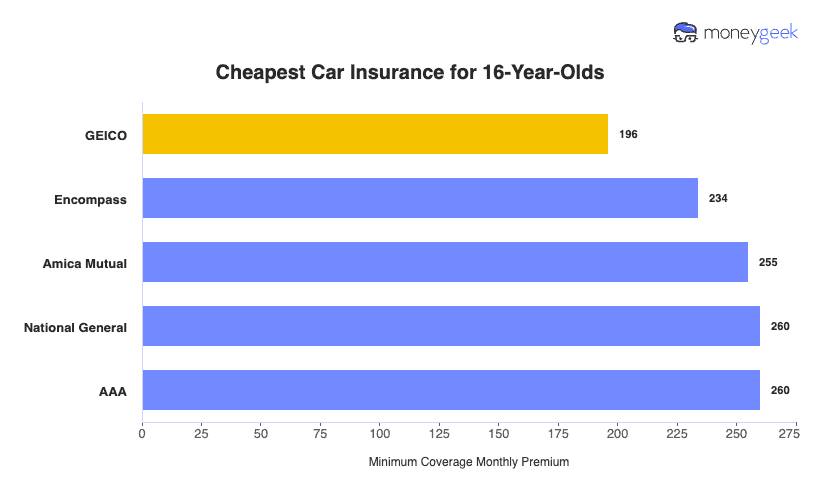

GEICO and Encompass both provide competitive rates for 16-year-old drivers, but GEICO is more affordable and easily available. It offers the cheapest minimum coverage at $196 per month. Encompass is the second cheapest option, with minimum coverage rates averaging $234 monthly.

For full coverage, GEICO maintains its affordability advantage at $456 monthly. Encompass charges $521 monthly for full coverage, while Amica costs $536 monthly but delivers superior service quality with a MoneyGeek Score of 95 out of 100.