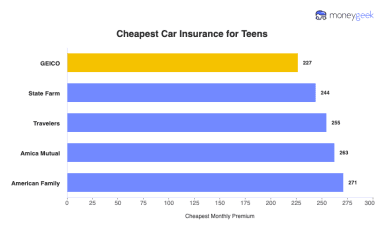

GEICO offers the cheapest minimum coverage at $237 per month. State Farm costs $238 monthly and includes local agent support if your teen needs help filing a claim.

The price gap widens rapidly compared to other national insurers. Allstate charges $407 per month, while Progressive costs $522 monthly. Your family saves $285 per month by choosing GEICO over Progressive—that's $3,420 annually that could go toward college savings or a safer vehicle.