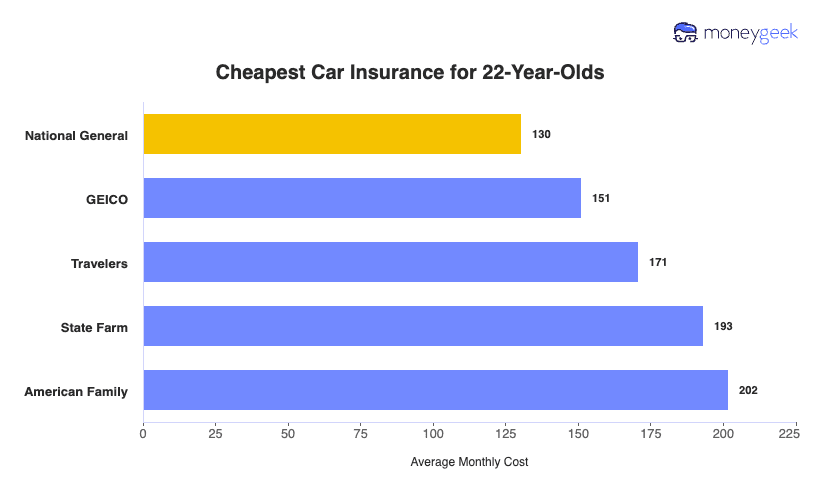

National General provides the cheapest car insurance for 22-year-olds with rates averaging $130 monthly, while GEICO offers coverage for $151 monthly, with Travelers, State Farm, and American Family rounding out our most affordable insurers for young adults list. You can compare the companies below:

Best Cheap Car Insurance for 22-Year-Olds in 2026

The cheapest car insurance rates for 22-year-olds start as low as $72 a month, with the most affordable options offered by Concord Group, National General and GEICO.

Find Out If You Are Overpaying For Car Insurance Below.

Updated: December 29, 2025

Advertising & Editorial Disclosure

The top five cheapest car insurance companies for 22-year-olds are Concord Group, National General, GEICO, Auto-Owners and Travelers.

Concord Group provides the cheapest minimum coverage for 22-year-olds at $72 monthly or $865 annually, though availability is limited. GEICO is the cheapest widely available option at $94 monthly or $1,134 annually.

Concord Group offers the cheapest full coverage for 22-year-olds at $127 monthly or $1,524 annually with limited availability. GEICO provides the most affordable widely available full coverage at $208 monthly or $2,493 annually.

Ensure you are getting the best rate for your insurance. Compare quotes from the top insurance companies.

Cheapest Car Insurance Companies for 22-Year-Olds

| National General | $130 | $1,565 |

| GEICO | $151 | $1,813 |

| Travelers | $171 | $2,049 |

| State Farm | $193 | $2,318 |

| American Family | $202 | $2,419 |

Cheapest Minimum Liability Car Insurance for 22-Year-Olds

Concord Group offers the cheapest liability-only coverage at $72 monthly or $865 annually for minimum liability but has limited availability. National General provides the second-lowest rates at $87 monthly, $15 more per month or $177 more annually, and also has limited availability. GEICO is the cheapest widely available national insurer at $94 monthly or $1,134 yearly.

| Concord Group | $72 | $865 |

| National General | $87 | $1,042 |

| GEICO | $94 | $1,134 |

| Auto-Owners Insurance Co | $107 | $1,280 |

| Travelers | $114 | $1,373 |

Rates are for a family policy for both male and female drivers with clean records and good credit insuring a 2012 Toyota Camry.

Cheapest Full Coverage Car Insurance for 22-Year-Olds

Concord Group offers the most affordable full coverage insurance at $1,524 annually, although its availability is limited. Nationally, GEICO provides the cheapest option among widely available national insurers at $208 per month or $2,493 annually.

| Concord Group | $127 | $1,524 |

| National General | $174 | $2,088 |

| GEICO | $208 | $2,493 |

| Auto-Owners Insurance Co | $222 | $2,670 |

| Travelers | $227 | $2,726 |

Rates are for a family policy for both male and female drivers with clean records and good credit insuring a 2012 Toyota Camry.

Full coverage, including comprehensive and collision, adds hundreds to your premium. Consider full coverage only if your vehicle is worth more than $4,000—otherwise, the added cost may exceed what you'd receive in a claim.

Cheapest Car Insurance for 22-Year-Olds by State

GEICO offers the lowest rates in 25 states at an average of $2,493 per year, while State Farm, Allstate, Progressive, and Nationwide lead in specific regions. However, 22-year-olds pay monthly rates ranging from as low as $59 in North Carolina to $426 in Louisiana. Below are the most affordable full coverage options for 22-year-olds in each state, based on our analysis of major insurers:

| AK | GEICO | $170 | $2,042 |

| AL | GEICO | $121 | $1,446 |

| AR | Nationwide | $163 | $1,958 |

| AZ | GEICO | $94 | $1,127 |

| CA | Progressive | $196 | $2,353 |

| CO | GEICO | $130 | $1,558 |

| CT | GEICO | $168 | $2,012 |

| DC | GEICO | $108 | $1,296 |

| DE | Nationwide | $203 | $2,431 |

| FL | GEICO | $206 | $2,472 |

| GA | Allstate | $192 | $2,308 |

| HI | GEICO | $75 | $902 |

| IA | GEICO | $79 | $945 |

| ID | State Farm | $104 | $1,253 |

| IL | GEICO | $154 | $1,849 |

| IN | GEICO | $84 | $1,008 |

| KS | Allstate | $141 | $1,687 |

| KY | GEICO | $153 | $1,832 |

| LA | GEICO | $426 | $5,109 |

| MA | State Farm | $88 | $1,059 |

| MD | Allstate | $213 | $2,553 |

| ME | GEICO | $85 | $1,024 |

| MI | GEICO | $365 | $4,379 |

| MN | State Farm | $211 | $2,536 |

| MO | Allstate | $114 | $1,368 |

| MS | Nationwide | $175 | $2,095 |

| MT | State Farm | $132 | $1,586 |

| NC | GEICO | $59 | $711 |

| ND | GEICO | $104 | $1,243 |

| NE | Allstate | $110 | $1,317 |

| NH | GEICO | $112 | $1,341 |

| NJ | GEICO | $180 | $2,155 |

| NM | Progressive | $185 | $2,220 |

| NV | GEICO | $167 | $2,007 |

| NY | Allstate | $321 | $3,857 |

| OH | GEICO | $91 | $1,095 |

| OK | GEICO | $112 | $1,348 |

| OR | GEICO | $129 | $1,543 |

| PA | Nationwide | $212 | $2,541 |

| RI | State Farm | $155 | $1,865 |

| SC | GEICO | $139 | $1,674 |

| SD | State Farm | $132 | $1,578 |

| TN | GEICO | $135 | $1,623 |

| TX | GEICO | $139 | $1,666 |

| UT | GEICO | $95 | $1,140 |

| VA | Progressive | $92 | $1,099 |

| VT | Nationwide | $122 | $1,465 |

| WA | GEICO | $136 | $1,636 |

| WI | GEICO | $86 | $1,032 |

| WV | Nationwide | $120 | $1,437 |

| WY | State Farm | $127 | $1,528 |

Rates are for male drivers with clean driving records and good credit insuring a 2012 Toyota Camry with minimum coverage.

Your location determines your car insurance rates through state regulations, weather risks, population density, crime rates, and local accident statistics that insurers use for pricing.

Cheapest Car Insurance for 22-Year-Olds by Gender

Our analysis shows female drivers average $2,405 per year or $200 monthly while males average $2,525 per year or $210 monthly. This leads to 22-year-old men paying about $120 more annually than women for car insurance due to 22-year-old male drivers having higher crash rates per mile driven than females. Below, we highlight the most affordable national providers for both men and women in this age group.

Cheapest Car Insurance for 22-Year-Old Female Drivers

Travelers offers the most affordable national car insurance for 22-year-old women, with rates that are approximately 9% lower than the average for minimum coverage. Female drivers at this age typically benefit from lower premiums compared to men, as statistics show they are involved in fewer accidents.

| Concord Group | $69 | $825 |

| National General | $85 | $1,026 |

| GEICO | $96 | $1,148 |

| Auto-Owners Insurance Co | $106 | $1,277 |

| Travelers | $112 | $1,338 |

| State Farm | $120 | $1,434 |

Rates are for female drivers with clean driving records and good credit insuring a 2012 Toyota Camry.

Cheapest Car Insurance for 22-Year-Old Male Drivers

GEICO offers the lowest monthly rate for 22-year-old male drivers at $61 when added to a family policy. However, Concord Group and Auto-Owners may provide even cheaper options for eligible drivers. Male drivers generally face higher premiums than females, as they statistically have a greater likelihood of being involved in accidents.

| Concord Group | $75 | $905 |

| National General | $88 | $1,058 |

| GEICO | $93 | $1,120 |

| Auto-Owners Insurance Co | $107 | $1,283 |

| Travelers | $117 | $1,407 |

| State Farm | $133 | $1,598 |

Rates are for male drivers with clean driving records and good credit insuring a 2012 Toyota Camry.

Cheapest Cars to Insure for 22-Year-Olds

When buying a new car for a teen driver, consider adding them to your policy with a vehicle that is both safe and one of the cheapest cars to insure. With most vehicles costing under $600 annually for minimum coverage. Below, we’ve outlined the most affordable models by vehicle type for 22-year-old drivers.

| Subaru Forester | Compact SUV | GEICO | $1,507 |

| Subaru Outback | Sedan | Nationwide | $1,563 |

| Acura MDX | Luxury SUV | Travelers | $1,641 |

| Toyota Tacoma | Pickup Truck | GEICO | $1,658 |

| Honda Passport | SUV | GEICO | $1,755 |

| MINI Electric | Compact | Nationwide | $1,761 |

| Nissan LEAF | Electric | Travelers | $1,792 |

| Ford Mustang Mach E | Sports Car | GEICO | $1,816 |

| Honda Odyssey | Minivan | State Farm | $1,844 |

| Tesla Model Y | Luxury Electric | GEICO | $1,846 |

| BMW 1 Series | Luxury Compact | GEICO | $1,903 |

| Porsche Taycan | Luxury Sports Car | GEICO | $1,922 |

| Mercedes GLA 250 | Luxury Compact SUV | GEICO | $2,028 |

| BMW 3 Series | Luxury Sedan | State Farm | $2,311 |

Rates are for drivers with clean driving records and good credit.

Average Cost of Car Insurance for 22-Year-Olds

The average annual car insurance costs for 22-year-olds are $1,635 for minimum coverage and $3,295 for full coverage. These figures reflect rates for drivers with clean records and good credit, but your individual car insurance cost for 22-year-olds may vary depending on your driving profile.

Car Insurance Cost for 22-Year-Olds by Coverage and Gender

Men pay about $60 more annually for minimum coverage and $180 more for full coverage compared to women. Your individual rates may vary based on your specific driving profile, location, and chosen insurance company.

| Female | $134 | $1,605 |

| Male | $139 | $1,665 |

Liability limits expressed above (e.g., 100/300/100) refer to bodily injury liability per person, bodily injury liability per accident and property damage liability per accident, respectively. Numbers expressed after these limits are deductible amounts for both collision and comprehensive coverage.

Average Cost of Car Insurance for 22-Year-Olds by State

Average state car insurance costs for 22-year-old drivers can differ significantly, ranging from $17 to $389 per month. These differences are driven by location-specific factors such as crime rates, weather patterns and population density. To help you understand costs in your area, we’ve provided a table below with average state rates.

| Alabama | $34 | $153 | $32 | $146 |

| Alaska | $30 | $137 | $30 | $137 |

| Arizona | $38 | $152 | $41 | $163 |

| Arkansas | $28 | $129 | $28 | $131 |

| California | $37 | $175 | $39 | $184 |

| Colorado | $42 | $177 | $39 | $166 |

| Connecticut | $40 | $152 | $46 | $177 |

| Delaware | $43 | $168 | $44 | $170 |

| District of Columbia | $39 | $165 | $41 | $171 |

| Florida | $70 | $320 | $60 | $278 |

| Georgia | $35 | $148 | $39 | $167 |

| Hawaii | $20 | $85 | $19 | $81 |

| Idaho | $20 | $83 | $24 | $97 |

| Illinois | $26 | $114 | $27 | $116 |

| Indiana | $26 | $106 | $28 | $116 |

| Iowa | $21 | $108 | $20 | $107 |

| Kansas | $25 | $129 | $26 | $132 |

| Kentucky | $36 | $149 | $37 | $154 |

| Louisiana | $70 | $389 | $63 | $348 |

| Maine | $27 | $105 | $30 | $116 |

| Maryland | $41 | $146 | $50 | $178 |

| Massachusetts | $27 | $110 | $35 | $147 |

| Michigan | $72 | $268 | $56 | $217 |

| Minnesota | $29 | $125 | $35 | $147 |

| Mississippi | $27 | $123 | $33 | $152 |

| Missouri | $36 | $173 | $41 | $198 |

| Montana | $25 | $143 | $26 | $152 |

| Nebraska | $27 | $142 | $27 | $146 |

| Nevada | $58 | $230 | $58 | $228 |

| New Hampshire | $28 | $102 | $30 | $109 |

| New Jersey | $60 | $237 | $57 | $222 |

| New Mexico | $33 | $150 | $35 | $156 |

| New York | $45 | $159 | $48 | $173 |

| North Carolina | $25 | $97 | $25 | $97 |

| North Dakota | $21 | $103 | $22 | $108 |

| Ohio | $45 | $164 | $45 | $164 |

| Oklahoma | $32 | $154 | $34 | $158 |

| Oregon | $33 | $125 | $38 | $143 |

| Pennsylvania | $27 | $141 | $27 | $143 |

| Rhode Island | $47 | $178 | $55 | $203 |

| South Carolina | $52 | $196 | $54 | $199 |

| South Dakota | $20 | $126 | $23 | $139 |

| Tennessee | $26 | $118 | $28 | $129 |

| Texas | $40 | $171 | $43 | $181 |

| Utah | $48 | $188 | $42 | $163 |

| Vermont | $19 | $91 | $23 | $109 |

| Virginia | $36 | $142 | $38 | $147 |

| Washington | $43 | $148 | $48 | $160 |

| West Virginia | $32 | $136 | $33 | $141 |

| Wisconsin | $24 | $112 | $26 | $121 |

| Wyoming | $17 | $118 | $19 | $138 |

How to Save Money on Car Insurance for 22-Year-Olds

Twenty-two-year-old drivers face some of the highest insurance premiums, but smart strategies can cut costs significantly. Staying on your parents' policy saves up to $2,000 annually, while shopping around and using usage-based programs can reduce premiums by another $500 to 1,000.

The key is combining multiple strategies. A 22-year-old using their parents' policy, maintaining good credit and driving safely in a usage-based program could easily save $1,500+ annually. Here's how to maximize your savings:

- 1Stay on a parent's policy

Staying on a parent's policy delivers the biggest savings for most 22-year-olds. While the average 22-year-old pays $2,525 annually for their own policy, adding them to a parent's plan typically costs just $800 to 1,200 extra per year. Most insurers allow you to remain on the family policy if you live at home or are a full-time student.

- 2Shop around every six months

Insurance rates change frequently. For 22-year-olds, rate differences of up to $1,500 exist between the cheapest and most expensive companies for identical coverage. Spending 30 minutes shopping could save you $30 to 50 monthly.

- 3Find discounts you qualify for

Twenty-two-year-olds can qualify for several auto insurance discounts, including good student discounts, young driver education discounts, defensive driving course discounts, and usage-based insurance plans, which can reduce premiums by up to 40%. If you rent an apartment, bundling renters insurance with your auto policy saves 10% to 25%—adding a $200 renters policy could create net savings of $50 to $425 for a 22-year-old paying $2,500 annually.

- 4Choose a safe, older car

Vehicle choice affects your insurance costs, even among safer models. For 22-year-olds, annual minimum coverage ranges from $565 for an Audi R8 to $686 for a Tesla Model Y. Choosing vehicles with high safety ratings while avoiding high-theft targets, sports cars, or modified vehicles can save you around $200 per year compared to riskier options.

- 5Adjust your coverage amount

If your car is worth under $3,000 to $4,000, dropping full coverage saves up to $900 annually. For newer cars, raising your deductibles from $500 to $1,000 saves $100 to $300 annually. Just make sure you have emergency savings to cover the higher deductible.

- 6Pay your premium in full

Most insurers charge monthly processing fees of $5 to 15. Paying your full premium upfront eliminates these fees and often qualifies you for additional "paid-in-full" discounts of 3 to 5%.

- 7Enroll in usage-based insurance programs

Programs like Progressive's Snapshot and State Farm's Drive Safe & Save track your driving habits. For a 22-year-old paying $2,500 annually, safe driving behaviors can reduce premiums by $500 to 1,000, with the best drivers cutting costs to $1,500.

- 8Improve your credit score

In most states, insurance companies use credit scores to determine rates. For 22-year-olds, excellent credit (750+) costs $2,100 versus poor credit (580) at $2,700 annually. Even improving from fair to good credit typically saves $200 to 400 per year.

Obtaining quotes from multiple insurance companies is a good idea to see which comes out as the best and cheapest for your specific profile. You also want to ensure the company has optional coverages that are good for a teen driver or any driver to have on their policy. They include roadside assistance and rental car coverage.

— Mark Friedlander, Director, Corporate Communications, Insurance Information Institute

Best Car Insurance Discounts for 22-Year-Olds

Car insurance discounts can slash your rates by 30-50% when you combine the right strategies. The biggest wins for 22-year-olds? Staying on your parents' policy saves up to 50%, while usage-based programs cut costs by 30% for low-mileage drivers.

Discount Type | Savings % | Requirements | Best for |

|---|---|---|---|

Family Policy | 30–50% | Live at home or full-time student | 22-year-olds living at home or studying away at college |

Usage-Based Programs | Up to 30% | Safe driving tracking | Low-milage drivers |

Good Student | 5–25% | 3.0+ GPA, full-time student | College students |

Multi-Policy Bundle | 7–17% | Add renters/home insurance | 22-year-olds who rent or own a home |

Multi-Car | Up to 25% | Multiple vehicles on policy | Families with multiple cars |

Military | Up to 15% | Active/veteran/family | Military members and their families |

Pay-in-Full | 3–8% | Annual payment | Everyone |

Cheap Car Insurance for 22-Year-Olds: Bottom Line

Car insurance for 22-year-olds can be expensive, but young drivers and their families can secure more affordable options by comparing quotes, staying on a family policy and utilizing available discounts. GEICO and Nationwide are typically among the most cost-effective choices for 22-year-old drivers nationwide, but shopping around remains essential to find the best rate.

Car Insurance for 22-Year-Olds: FAQ

Securing affordable car insurance for 22-year-olds can be difficult because of the risk factors that lead to higher premiums for this age group. To assist, we’ve answered some of the most common questions on this topic:

What is the cheapest car insurance for an 22-year-old?

GEICO and Nationwide are among the most affordable car insurance providers for 22-year-olds nationwide. Minimum coverage policies cost an average of $61 per month, while full coverage is around $130 per month when added to a family plan.

How much is car insurance for an 22-year-old per month?

For 22-year-olds, the average monthly cost is about $92 for minimum coverage and $217 for full coverage. However, these rates can differ greatly by state, with monthly averages ranging from $40 to $237. These estimates are based on drivers with clean records and good credit who are covered under a family policy.

Why is car insurance expensive for 22-year-old drivers?

Car insurance for 22-year-olds remains expensive because they are still considered high-risk drivers. However, 22-year-olds typically pay lower premiums compared to younger drivers. Teens, particularly those aged 16 to 19, experience higher rates of accidents and violations, with fatal crashes occurring nearly three times more often than among older drivers.

Risky behaviors such as night driving, speeding, distractions and neglecting to wear seat belts contribute to these increased rates, especially for male drivers.

Is car insurance more expensive for 22-year-old males?

Yes, car insurance is typically more expensive for 22-year-old males. Statistically, they are more likely to be involved in accidents compared to females, which leads insurers to charge higher premiums to account for the increased risk.

Auto Insurance for 22-Year-Olds: Our Methodology

MoneyGeek used a sample driver profile to determine national and state averages for vehicle insurance for 22-year-old drivers. Using this information, we assist readers in selecting the best policy at the lowest price possible.

Data Sources and Depth

We collected data from each state's insurance department and Quadrant Information Services. The data consists of 4,284 price estimates from 100 different ZIP codes and six auto insurance providers.

Sample Driver Profile

MoneyGeek calculates yearly car insurance policy estimates based on a policyholder with the following characteristics:

- Toyota Camry LE

- Clean driving record

- 12,000 miles driven every year

To determine which companies provide the most affordable policies, MoneyGeek compared rates for 22-year-old drivers across different states. We made adjustments to this profile to reflect the differences in age, location and driving behavior.

Coverage Levels and Deductibles Explained

A deductible is the money you have to pay out of your own pocket before your insurance company will pay for your claim. Most drivers would benefit from purchasing full coverage vehicle insurance, which covers both collision and comprehensive damage.

For minimum liability coverages, we used state-required limits to judge which provider was most affordable. For full coverage, we used 100/300/100 liability limits with a $1,000 deductible for comprehensive and collision coverage when researching the cheapest providers. Liability limits of 100/300/100 stand for:

- $100,000 bodily injury liability per person

- $300,000 bodily injury liability per accident

- $100,000 property damage liability per accident

Learn more about MoneyGeek's car insurance methodology.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.