GEICO has the lowest full coverage rate for Connecticut drivers at $74 per month or $885 per year, 51% below the state average. Kemper comes next at $117 monthly, $43 higher each month than GEICO or $516 more per year. Amica Mutual charges $128 per month.

Cheapest Car Insurance in Connecticut

GEICO provides the cheapest car insurance in Connecticut at $34 monthly for minimum coverage and $74 monthly for full coverage.

Find low-cost Connecticut car insurance for you below.

Updated: February 3, 2026

Advertising & Editorial Disclosure

Full coverage: GEICO, $74

Liability only: GEICO, $34

Teens: GEICO, $238

Young adults: GEICO, $57

Seniors: GEICO, $59

DUI: State Farm, $84

SR-22: GEICO, $67

Non-Owner: GEICO, $54

Bad credit: GEICO, $69

Why You Can Trust MoneyGeek

We analyzed car insurance rates from major insurers across all Connecticut ZIP codes for various driver profiles, including those with clean records, those with violations, and different age groups. Rates are based on averages for a 40-year-old driver with good credit and a clean record, unless otherwise noted. Your actual rate may differ based on your circumstances, location, driving history and coverage options. Read more about MoneyGeek's methodology.

Cheapest Full Coverage Car Insurance in Connecticut

Cheapest Minimum Coverage Car Insurance in Connecticut

GEICO beats all competitors for minimum coverage at $34 per month or $410 per year, 61% below the state average.

Amica Mutual charges $60 monthly, Kemper $65, State Farm $78 and Allstate $86 for identical minimum limits. Pick GEICO over Allstate and you'll save $624 yearly, almost enough for another year and a half of coverage.

For drivers prioritizing affordability, reviewing minimum coverage rates alongside affordable car insurance options for drivers with low income in Connecticut can provide useful context.

| Geico | $34 | $410 | 61% |

| Amica | $60 | $723 | 31% |

| Kemper | $65 | $778 | 26% |

| State Farm | $78 | $935 | 11% |

| Allstate | $86 | $1,034 | 1% |

Cheapest Car Insurance in Connecticut by City

Across all 20 major Connecticut cities, GEICO offers the lowest minimum coverage rates, with prices starting at $34 in Greenwich and Norwalk and reaching $53 in Bridgeport. This $19 monthly difference adds up to $228 a year for minimum coverage. Full coverage shows a similar range, from $73 in Greenwich to $115 in Waterbury.

Connecticut’s small size and stable insurance market contribute to its relatively narrow price variation compared to states with larger urban–rural gaps.

| Bridgeport | Geico | $53 | $114 | 49% |

| Bristol | Geico | $40 | $86 | 42% |

| Danbury | Geico | $37 | $81 | 48% |

| East Hartford | Geico | $41 | $88 | 49% |

| Fairfield | Geico | $35 | $77 | 51% |

| Greenwich | Geico | $34 | $73 | 50% |

| Hartford | Geico | $50 | $110 | 50% |

| Meriden | Geico | $39 | $84 | 48% |

| Middletown | Geico | $35 | $77 | 49% |

| Milford | Geico | $42 | $87 | 52% |

| New Britain | Geico | $42 | $92 | 45% |

| New Haven | Geico | $52 | $113 | 50% |

| Norwalk | Geico | $34 | $74 | 51% |

| Southington | Geico | $35 | $76 | 47% |

| Stamford | Geico | $38 | $81 | 52% |

| Stratford | Geico | $41 | $90 | 48% |

| Wallingford | Geico | $36 | $79 | 49% |

| Waterbury | Geico | $52 | $115 | 43% |

| West Hartford | Geico | $36 | $77 | 50% |

| West Haven | Geico | $44 | $95 | 51% |

Cheapest Car Insurance in Connecticut for Teens and Young Adults

Teen drivers in Connecticut see some of the highest rates, with Amica Mutual offering the lowest option for 16-year-olds at $328 per month. GEICO provides the most affordable rate for 25-year-olds at $57 per month and also leads every age in between, charging $264 for 17-year-olds, $238 for 18-year-olds, $156 for 19-year-olds and $141 for 20-year-olds. The $271 monthly gap between ages 16 and 25 shows how sharply costs drop as young drivers gain experience and move out of the highest-risk group.

Teens under 18 usually need a parent or guardian to cosign an auto policy. Young adults may also explore the cheapest car insurance coverages if they’re shopping for lower rates as they move into more stable pricing tiers.

Note: Young drivers often pay higher premiums due to limited driving experience and rates can vary based on state rules and individual driving history.

Cheapest Car Insurance for Seniors in Connecticut

Connecticut senior drivers get some of the lowest rates from GEICO, which charges $67 for 65-year-olds, $59 for 70-year-olds and $82 for 80-year-olds for minimum coverage.

The $15 increase from age 70 to age 80 highlights how rates begin to rise again as drivers reach the oldest age brackets, even with decades of driving experience. Across these senior groups, experienced drivers in the Constitution State pay about 45% to 49% below the statewide average.

| 65 | GEICO | $67 | $82 | 45% |

| 70 | GEICO | $59 | $125 | 48% |

| 80 | GEICO | $82 | $167 | 49% |

Cheapest DUI Insurance in Connecticut

Connecticut drivers with a DUI will find the lowest minimum rate with State Farm at $84 per month, followed by Kemper at $107. GEICO comes in at $116, Allstate averages $127, and Progressive reaches $149 for the same minimum limits. For full coverage after a DUI, State Farm still leads at $166 monthly, with Kemper close behind at $187.

The $65 monthly difference between State Farm and Progressive for minimum coverage adds up to $780 a year, which can be a meaningful savings for high-risk drivers working to rebuild their insurance profiles.

| State Farm | $84 | $166 | 44% |

| Kemper | $107 | $187 | 34% |

| Progressive | $149 | $213 | 19% |

| Geico | $116 | $250 | 18% |

| Allstate | $127 | $247 | 17% |

Cheapest SR-22 Insurance in Connecticut

GEICO has affordable SR-22 insurance in Connecticut at $67 per month for minimum coverage, 54% below the state average for drivers showing financial responsibility after a license suspension. Kemper charges $119 monthly, Amica Mutual $133 and State Farm $158 for minimum SR-22 coverage.

For full coverage, GEICO leads at $150 per month, followed by Kemper at $211 and Amica Mutual at $274. SR-22 certificates cost $15 to $50. Your insurer files them with the Connecticut Department of Motor Vehicles. Most drivers keep an SR-22 on file for three years after a serious violation.

| GEICO | $67 | $150 | 54% |

| Kemper | $119 | $211 | 30% |

| Amica Mutual | $133 | $274 | 14% |

| State Farm | $158 | $302 | 3% |

Cheapest Non-Owner Car Insurance in Connecticut

GEICO has the most budget-friendly non-owner car insurance rate in Connecticut at $54 per month, 34% below the state average. This policy works well for drivers who need insurance for SR-22 filing requirements or rent cars frequently. State Farm charges $82 monthly and Kemper $90 for identical coverage.

Non-owner policies cost less than standard auto insurance because they only include liability protection. You're covered for damage you cause, not for a vehicle you own. The $36 monthly gap between the lowest and highest rates equals $432 yearly.

| GEICO | $54 | 34% |

| State Farm | $82 | 7% |

| Kemper | $90 | 0% |

Cheapest Car Insurance After an Accident in Connecticut

GEICO has the lowest minimum coverage for Connecticut drivers after an at-fault accident at $49 per month, 58% below the state average. Amica Mutual charges $76 monthly, State Farm $84 and Kemper $105 for identical limits. For full coverage, GEICO leads at $105 per month, with Kemper at $186.

Premiums jump 20% to 40% after an at-fault accident. Higher rates stick around for three to five years depending on crash severity, your driving history and each insurer's rating approach.

| Geico | $49 | $105 | 58% |

| Amica | $76 | $163 | 35% |

| State Farm | $84 | $166 | 32% |

| Kemper | $105 | $186 | 21% |

Cheapest Car Insurance With a Speeding Ticket

GEICO has the lowest minimum coverage for Connecticut drivers with a speeding ticket at $41 monthly or $487 yearly, 54% below the state average. Amica Mutual charges $74 per month, State Farm $84, Allstate $86 and Kemper $99 for identical limits.

For full coverage after a speeding ticket, GEICO leads at $88 monthly. Amica Mutual charges $159 and State Farm $166, all well below the statewide average.

| Geico | $41 | $88 | 54% |

| Amica | $74 | $159 | 17% |

| State Farm | $84 | $166 | 11% |

| Allstate | $86 | $173 | 8% |

| Kemper | $99 | $172 | 4% |

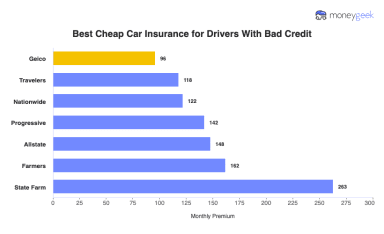

Cheapest Bad Credit Car Insurance in Connecticut

GEICO has the lowest minimum coverage for Connecticut drivers with poor credit at $69 monthly or $832 yearly, 35% below the state average. Nationwide comes next at $90 per month, Farmers $106 and both Kemper and Progressive $117 for identical limits.

For full coverage, GEICO leads at $150 monthly, $29 monthly and $347 yearly cheaper than Nationwide at $179. Connecticut allows insurers to use credit scores when setting rates, so drivers with lower credit pay more. Improve your credit score over time to lower your premiums by hundreds of dollars yearly.

| Geico | $69 | $150 | 35% |

| Nationwide | $90 | $179 | 20% |

| Farmers | $106 | $223 | 3% |

| Kemper | $117 | $213 | 3% |

| Progressive | $117 | $217 | 1% |

How to Get the Cheapest Car Insurance in Connecticut

Connecticut car insurance costs depend on where you live, your driving history, age and credit score. GEICO has the most affordable rates in the state: minimum coverage starts at $410 annually and full coverage at $885 per year. Save hundreds of dollars annually by comparing insurers and getting available discounts.

- 1Shop Multiple Carriers

Get quotes from three to five insurers. Mix national brands like GEICO and State Farm with regional specialists like Amica Mutual and Commerce Insurance. Regional carriers sometimes save you $200 or more annually compared to national brands in Connecticut markets.

Use MoneyGeek's car insurance calculator for custom estimates without sharing contact information. Learn more about how to compare car insurance.

- 2Maximize Available Discounts

Bundle your home and auto insurance with one carrier for 5% to 25% savings. Insure multiple vehicles for 10% to 25% discounts. Seniors get discounts from [defensive driving certifications](defensive driving certifications). Students with a B average or higher qualify for good student discounts of 10% to 15%. Low-mileage drivers logging fewer than 7,500 annual miles often see reductions of 15% to 30%. Maximize all available car insurance discounts.

- 3Adjust Deductibles Strategically

Raise your deductible from $500 to $1,000 to lower your premium by 10% to 15%. The higher deductible saves you more each year, as long as you have emergency funds set aside to cover it if you file a claim. Balance affordability and protection by considering the types of car insurance available and how much coverage you need.

- 4Meet Connecticut Requirements

Connecticut's legal minimums are 25/50/25: $25,000 per person for bodily injury, $50,000 per accident for bodily injury and $25,000 for property damage. These state minimum requirements seem adequate but rarely cover the full costs of serious collisions. Average vehicle repairs cost $4,500 and total loss replacements exceed $20,000, so minimum limits leave financial gaps. Learn what happens if you drive without insurance in Connecticut.

- 5Shop After Life Changes

Marriage, relocation between Connecticut cities or adding vehicles unlock new discount opportunities. Move from Hartford to Stamford and you might save $15 monthly thanks to Connecticut's rate geography. Major life transitions qualify you for improved rates or enhanced coverage options. Understand when to switch car insurance companies for optimal savings.

- 6Consider AIPSO Coverage

Connecticut's Automobile Insurance Plan Service Office gives last-resort coverage to high-risk drivers who can't get insurance through traditional channels. AIPSO rates run higher than standard market options, but the program makes sure every driver can get legally required coverage while rebuilding their profile.

Cheap Car Insurance in Connecticut: FAQ

If you're unsure where to start, our insurance experts respond to the most common questions about affordable car insurance in Connecticut.

How much does car insurance cost in Connecticut?

Connecticut car insurance ranges from $35 to $65 monthly for minimum coverage and $85 to $155 monthly for full coverage, depending on your location and driving profile. Urban areas like Hartford and New Haven have higher rates due to increased traffic density and accident frequency.

For detailed rate breakdowns across Connecticut cities and demographics, check our comprehensive Connecticut car insurance costs analysis.

Should you buy the cheapest car insurance in Connecticut?

The cheapest car insurance might seem appealing, but verify it gives enough protection for serious accidents. Pick a policy with higher liability limits or full coverage to safeguard your finances if repair or medical costs exceed state minimums. Connecticut drivers find that GEICO and other major carriers balance affordability and coverage options well.

Is state minimum coverage enough in Connecticut?

Connecticut requires all drivers to carry auto insurance to drive legally. The state operates under an at-fault system where the driver who causes an accident is responsible for damages. Connecticut mandates liability coverage for bodily injury and property damage, plus uninsured and underinsured motorist protection.

Meeting minimum requirements keeps you legal, but buying higher coverage limits gives better financial protection against costly accidents.

Is Connecticut a no-fault state?

Connecticut operates as an at-fault state. Connecticut holds the driver who causes an accident responsible for damages and injuries.

Drivers must carry liability insurance to cover harm they cause to others, and injured parties can file lawsuits against at-fault drivers to recover compensation for medical expenses, property damage, lost wages and pain and suffering.

Does Connecticut allow gender-based insurance pricing?

Yes, Connecticut allows insurers to use gender when setting car insurance rates. This often results in young men paying more than young women with similar coverage and driving records. Still, some Connecticut insurers choose not to use gender as a rating factor.

Most Affordable Car Insurance in Connecticut: Related Articles

How We Found the Most Affordable Car Insurance in Connecticut

Our Research Approach

Connecticut drivers have unique insurance challenges. Urban centers like Hartford and New Haven command higher premiums than smaller towns, while the state's mandatory uninsured motorist requirements create a different cost structure than surrounding states. We analyzed Connecticut's insurance landscape to show you which companies deliver the best value across varied regions.

We gathered auto insurance data from the Connecticut Department of Insurance and Quadrant Information Services, examining quotes from 12 major insurers across more than 200 million rate comparisons spanning every residential ZIP code in Connecticut.

Sample Driver Profile

Our baseline quotes reflect a 40-year-old driver with good credit and no violations or accidents. This represents Connecticut's average insured driver before factors like tickets, claims or credit issues push rates higher. Your actual premium depends on your driving record, credit score and home address.

Coverage Levels We Compared

We examined two insurance scenarios:

Minimum coverage: Connecticut mandates $25,000 per person for bodily injury, $50,000 per accident for bodily injury and $25,000 for property damage (25/50/25). The state also requires uninsured and underinsured motorist protection at these liability levels. This meets legal obligations, but serious accidents frequently exceed these limits.

Full coverage: Enhanced liability protection at $100,000/$300,000/$100,000 combined with comprehensive and collision insurance using a $1,000 deductible. This protects both your liability exposure and covers your vehicle's repair or replacement costs.

Location Affects Your Rate

ZIP code impacts Connecticut insurance costs. Drivers in adjacent towns see 40% to 60% price differences for identical coverage. Our analysis shows which Connecticut locations have the highest premiums and where geographic factors help lower your costs.

For more information, see the detailed methodology here.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Insurance Information Institute. "Facts + Statistics: Auto insurance." Accessed February 7, 2026.

- Insurance Information Institute. "Facts + Statistics: Uninsured motorists." Accessed February 7, 2026.

- National Insurance Crime Bureau. "Vehicle Thefts Surge Nationwide in 2023 ." Accessed February 7, 2026.

- National Centers for Environmental Information . "Climate at a Glance ." Accessed February 7, 2026.