Farm Bureau offers Mississippi's cheapest full coverage car insurance at $1,078 a year, breaking down to $90 a month. That's 27% lower than what most drivers in the state pay. Travelers follows at $1,232 a year, with Progressive next at $1,368. Safeway rounds out the top four at $1,407 annually. The $290 difference between Farm Bureau and Progressive equals more than three months of coverage.

Cheapest Car Insurance in Mississippi

Farm Bureau leads with Mississippi's cheapest state minimum at $368 yearly and most affordable full coverage at $1,078 annually.

Find low-cost Mississippi car insurance for you below.

Updated: February 3, 2026

Advertising & Editorial Disclosure

Full coverage: Farm Bureau, $90

Liability only: Farm Bureau, $31

Teens: Southern Farm Bureau, $98

Young adults: Southern Farm Bureau, $55

Seniors: Southern Farm Bureau, $39

DUI: Farm Bureau, $59

SR-22: Direct General Insurance, $61

Non-owner: Progressive, $68

Bad credit: Farm Bureau, $77

Why You Can Trust MoneyGeek

We analyzed car insurance rates from major insurers across all Mississippi ZIP codes for various driver profiles, including clean records, violations and age groups. Rates show averages for a 40-year-old driver with good credit and a clean record unless otherwise noted. Your actual rate may differ based on your circumstances, location, driving history and coverage options. Read more about MoneyGeek's methodology.

Cheapest Full Coverage Car Insurance in Mississippi

| Farm Bureau | $90 | $1,078 | 27% |

| Travelers | $103 | $1,232 | 16% |

| Progressive | $114 | $1,368 | 7% |

| Safeway Insurance | $117 | $1,407 | 5% |

Cheapest Minimum Coverage Car Insurance in Mississippi

Farm Bureau offers Mississippi's cheapest minimum coverage car insurance at $31 a month, totaling $368 a year. That price is 46% lower than the state average.

Progressive charges $523 a year for the same required coverage, while GEICO costs $621 annually. Safeway Insurance charges $659 a year for minimum coverage, and Travelers comes in at $650. Choosing Farm Bureau instead of Safeway saves $291 a year, or roughly $24 each month.

For drivers whose budgets guide coverage decisions, pairing minimum coverage comparisons with affordable car insurance for drivers with low income in Mississippi can reveal lower-priced insurers.

| Farm Bureau | $31 | $368 | 46% |

| Progressive | $44 | $523 | 24% |

| Geico | $52 | $621 | 10% |

| Travelers | $54 | $650 | 5% |

| Safeway Insurance | $55 | $659 | 4% |

Cheapest Car Insurance in Mississippi by City

Allstate has the cheapest minimum coverage in 19 of Mississippi's 20 largest cities. Monthly rates run from $31 in Columbus to $48 in Pearl. Farm Bureau wins in both Biloxi and Pearl. Jackson drivers pay the most across Mississippi at $44 monthly for minimum coverage through Allstate, due to denser traffic and more frequent accidents.

| Biloxi | Farm Bureau | $39 | $105 | 25% |

| Clinton | Allstate | $38 | $70 | 43% |

| Columbus | Allstate | $31 | $58 | 43% |

| Gautier | Allstate | $37 | $69 | 40% |

| Greenville | Allstate | $35 | $66 | 41% |

| Gulfport | Allstate | $40 | $75 | 39% |

| Hattiesburg | Allstate | $36 | $67 | 41% |

| Horn Lake | Allstate | $38 | $71 | 39% |

| Jackson | Allstate | $44 | $83 | 35% |

| Long Beach | Allstate | $38 | $71 | 41% |

| Madison | Allstate | $37 | $68 | 40% |

| Meridian | Allstate | $36 | $67 | 39% |

| Natchez | Allstate | $38 | $72 | 45% |

| Olive Branch | Allstate | $38 | $70 | 39% |

| Oxford | Allstate | $35 | $65 | 38% |

| Pearl | Farm Bureau | $48 | $106 | 28% |

| Southaven | Allstate | $38 | $71 | 39% |

| Starkville | Allstate | $34 | $64 | 33% |

| Tupelo | Allstate | $33 | $63 | 37% |

| Vicksburg | Allstate | $39 | $73 | 38% |

Cheapest Car Insurance in Mississippi for Teens and Young Adults

Southern Farm Bureau has Mississippi's cheapest full coverage for teens and young adults. Sixteen-year-olds pay $127 monthly. Rates fall to $110 at age 17 and $98 at age 18. The company keeps its low prices through the early 20s.At 19, Southern Farm Bureau charges $87 a month, and by age 20 the rate falls to $79. The trend continues into the mid-20s, with 25-year-olds paying $55 a month for full coverage.

Drivers under 18 need a parent or guardian to cosign because they can't legally purchase auto insurance on their own. Requirements for teen drivers differ by state, so it helps to speak with a licensed agent to understand coverage rules and legal guidelines in Mississippi.

Cheapest Car Insurance for Seniors in Mississippi

Direct General Insurance offers Mississippi's cheapest minimum coverage car insurance for seniors at age 65, charging $56 a month for minimum coverage and $66 for full coverage. Southern Farm Bureau becomes the cheaper choice at age 70 with $39 a month for minimum coverage and $95 for full coverage. Both providers offer rates 35% to 37% below Mississippi's state average across senior age groups.

| 65 | Direct General Insurance | $56 | $66 | 35% |

| 70 | Southern Farm Bureau | $39 | $95 | 37% |

| 80 | Southern Farm Bureau | $61 | $128 | 35% |

Cheapest DUI Insurance in Mississippi

Farm Bureau offers Mississippi's cheapest minimum coverage car insurance for drivers with a DUI at $59 a month, with full coverage at $145 monthly. Progressive comes next at $64 a month for minimum coverage, with full coverage rising to $156. Safeway charges $74 a month for minimum coverage and keeps full coverage competitive at $155.

| Farm Bureau | $59 | $145 | 36% |

| Progressive | $64 | $156 | 31% |

| Safeway Insurance | $74 | $155 | 28% |

| Travelers | $76 | $156 | 27% |

| Shelter Insurance | $79 | $169 | 22% |

Cheapest SR-22 Insurance in Mississippi

Direct General Insurance offers Mississippi's cheapest SR-22 insurance for minimum coverage at $61 a month, sitting 41% below the state average. Southern Farm Bureau follows at $67 a month, which is 21% below the state average.

Direct General Insurance has the lowest full coverage with an SR-22 filing at $109 monthly. This price covers both the SR-22 certificate and full coverage, giving high-risk drivers good value as they rebuild their records.

| Direct General Insurance | $61 | $109 | 41% |

| Southern Farm Bureau | $67 | $159 | 21% |

| Travelers | $84 | $155 | 17% |

| GEICO | $81 | $190 | 6% |

| Nationwide | $99 | $187 | 1% |

Cheapest Non-Owner Car Insurance in Mississippi

Progressive has Mississippi's cheapest non-owner car insurance at $68 monthly for minimum coverage, about 18% below the state average. This policy works well for drivers who need to reinstate their license after a suspension, need an SR-22 filing without owning a car or rent vehicles often.

Non-owner coverage costs less than a standard auto policy because it provides liability protection only. It doesn't include coverage for any specific vehicle you drive.

| Progressive | $68 | 18% |

| State Farm | $74 | 6% |

| Nationwide | $83 | 2% |

Cheapest Car Insurance After an Accident in Mississippi

Farm Bureau offers Mississippi's cheapest minimum coverage car insurance after an at-fault accident at $44 a month, with full coverage at $119. These prices sit 42% below the state average, giving drivers some of the most affordable coverage after an accident in Mississippi.

Shelter Insurance follows at $61 for minimum coverage and $135 for full coverage. Premiums rise 20% to 40% after an at-fault accident and usually stay higher for three to five years.

| Farm Bureau | $44 | $119 | 42% |

| Shelter Insurance | $61 | $135 | 31% |

| Safeway Insurance | $70 | $144 | 25% |

| Travelers | $71 | $144 | 24% |

| Progressive | $82 | $199 | 1% |

Cheapest Car Insurance With a Speeding Ticket

Farm Bureau posts the lowest minimum coverage rates in Mississippi for drivers with a speeding ticket, coming in at $37 per month or $438 annually. It also leads for full coverage at $101 a month. Safeway ranks next at $130 monthly, followed by Progressive at $161 for comparable coverage.

Picking Farm Bureau over Progressive saves about $720 each year, which is close to eight months of Farm Bureau premiums.

| Farm Bureau | $37 | $101 | 40% |

| Shelter Insurance | $61 | $135 | 15% |

| Progressive | $61 | $161 | 3% |

| Safeway Insurance | $64 | $130 | 15% |

| Travelers | $67 | $138 | 11% |

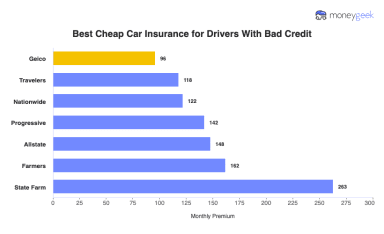

Cheapest Bad Credit Car Insurance in Mississippi

Farm Bureau offers Mississippi's cheapest minimum coverage car insurance for drivers with bad credit at $77 a month, or $919 a year. For full coverage, Safe Auto Insurance comes in at $158 monthly, which is $28 less than Safeway's $186 rate.

That difference adds up to $336 in yearly savings. Bad credit raises costs across all providers. GEICO charges $84 a month for minimum coverage and $201 for full coverage.

| Farm Bureau | $77 | $204 | 16% |

| Safe Auto Insurance | $83 | $158 | 28% |

| Geico | $84 | $201 | 15% |

| Shelter Insurance | $92 | $217 | 8% |

| Safeway Insurance | $96 | $186 | 16% |

How to Get the Cheapest Car Insurance in Mississippi

Car insurance rates in Mississippi depend on your location, driving history, age and credit score. Farm Bureau Insurance offers the lowest full coverage at $1,078 per year, and their minimum coverage starts at $368 annually. You save hundreds of dollars each year by comparing providers and using available discounts.

- 1Compare Multiple Carriers

Collect quotes from three to five car insurance companies, including a mix of national and regional companies. Regional carriers such as Southern Farm Bureau and MAPFRE often price more competitively in certain Mississippi metro areas, which can make a noticeable difference depending on where you live.

You can also use MoneyGeek’s Mississippi car insurance calculator to get an estimate based on your location and driver profile. The tool is free, does not ask for personal details, and does not trigger follow-up emails.

- 2Maximize Available Discounts

Bundle home and auto policies to save 5% to 25%, then add multi-car discounts for another 10% to 25%. Defensive driver courses often reduce rates, with added value for seniors, while good student discounts commonly fall between 10% and 15%. Drivers with lower annual mileage may also see savings of 15% to 30%.

- 3Strategic Deductible Management

Increasing your deductible from $500 to $1,000 often trims premiums by about 10% to 15%. While this lowers your monthly bill, it also means covering a larger amount yourself if you file a claim. Weigh monthly savings against potential out-of-pocket costs when deciding how much car insurance you actually need.

- 4Meet Mississippi Requirements

Mississippi requires $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $25,000 for property damage, commonly written as 25/50/25. These state minimum requirements may fall short in serious crashes, with average vehicle repairs around $4,500 and total loss replacements exceeding $20,000.

- 5Shop After Life Changes

Major changes like getting married, relocating within Mississippi, or adding a vehicle often shift insurance pricing. Moving from Jackson to Gulfport, for instance, can lower costs by roughly $200 per month. These moments create opportunities to revisit quotes and find better pricing with certain carriers.

- 6AIPSO High-Risk Coverage

Mississippi participates in the Automobile Insurance Plan Service Office, known as AIPSO, for drivers who cannot obtain coverage through standard insurers. This state-backed option allows drivers to meet legal requirements, although pricing runs higher than most traditional policies.

Cheap Car Insurance in Mississippi: FAQ

Mississippi car insurance comes with a lot of choices. This section highlights some of the most important points so you can pick the best coverage.

How much does car insurance cost in Mississippi?

Mississippi drivers usually spend $40 to $65 each month for minimum coverage and $85 to $140 for full coverage. Prices shift based on where you live, your driving history and the company you choose.

Jackson residents pay the highest rates in the state, while smaller cities like Tupelo and Hattiesburg tend to offer lower prices. See our Mississippi car insurance costs analysis for a full breakdown of city-by-city rates.

Should you buy the cheapest car insurance in Mississippi?

The cheapest policy isn’t always the best choice if it leaves you underinsured after a major accident. It’s better to compare rates and choose a plan that still offers solid financial protection, even if it costs slightly more.

Is state minimum coverage enough in Mississippi?

Mississippi requires all drivers to carry auto insurance for legal vehicle operation. The state operates under an at-fault system, meaning the driver who causes an accident is responsible for damages.

It mandates minimum liability coverage of $25,000 per person and $50,000 per accident for bodily injury, plus $25,000 for property damage. While meeting these minimums keeps you legal, many drivers choose higher limits for enhanced financial protection against costly accidents.

Is Mississippi a no-fault state?

Mississippi follows an at-fault system, not no-fault. When you cause an accident in Mississippi, your liability insurance pays for the other driver's medical bills and property damage.

The at-fault driver bears financial responsibility for all resulting damages. Mississippi drivers can sue for pain and suffering without meeting injury thresholds, unlike no-fault states that restrict lawsuit rights.

Does Mississippi allow gender-based insurance pricing?

Mississippi allows insurance companies to consider gender when setting car insurance rates, so young male drivers often end up with higher premiums than young female drivers with similar coverage and driving histories. Still, some Mississippi providers choose not to use gender as a rating factor.

Note: State insurance rules can change over time. Check with the Mississippi Insurance Department for the most up-to-date information.

Most Affordable Car Insurance in Mississippi: Related Articles

How We Found the Most Affordable Car Insurance in Mississippi

Our Research Approach

Mississippi drivers deal with some of the nation's highest insurance rates, and costs swing dramatically between Jackson, the Gulf Coast and rural areas. The state's minimum liability requirements are higher than many neighboring states, but they still leave gaps in serious accidents. Our research identifies which insurers offer competitive rates across Mississippi's diverse markets, from the Delta to the Pine Belt.

We collected auto insurance data from the Mississippi Department of Insurance and Quadrant Information Services, analyzing quotes from 12 major insurers and reviewing more than 200 million rate comparisons across every residential ZIP code in Mississippi.

Sample Driver Profile

Our baseline rates use a 40-year-old driver with good credit and a clean driving record. This profile represents typical Mississippi drivers without violations or poor credit that increase premiums. Your personal quote will adjust based on your specific driving history, credit and location.

Coverage Levels We Compared

We analyzed two coverage scenarios:

Minimum coverage: Mississippi's required liability limits of $25,000 per person for bodily injury, $50,000 per accident for bodily injury and $25,000 per accident for property damage (25/50/25). This meets legal requirements but often falls short in serious accidents.

Full coverage: Liability limits of $100,000/$300,000/$100,000 plus comprehensive and collision coverage with a $1,000 deductible. You're covered for damage you cause to others and repairs to your own vehicle.

Location Affects Your Rate

Mississippi rates vary by city. Drivers in Jackson often pay more than those in Tupelo or Hattiesburg for identical coverage. Our ZIP code analysis reveals where drivers overpay because of geography and local claim patterns.

For more information, see the detailed methodology here.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Insurance Information Institute. "Facts + Statistics: Auto insurance." Accessed February 7, 2026.

- Insurance Information Institute. "Facts + Statistics: Uninsured motorists." Accessed February 7, 2026.

- National Insurance Crime Bureau. "Vehicle Thefts Surge Nationwide in 2023 ." Accessed February 7, 2026.

- National Centers for Environmental Information . "Climate at a Glance ." Accessed February 7, 2026.