Yes, several major insurers offer car insurance for $50 or less per month, though these plans usually meet only your state’s minimum legal requirements.

- USAA: $28 per month (military members and families only)

- GEICO: $43 per month

- National General: $48 per month

- Travelers: up to $50 per month

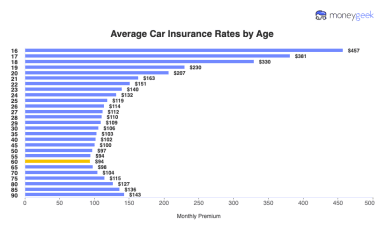

These averages are based on a 40-year-old male driver with a clean record and minimum coverage requirements.