ERGO NEXT ranks first for beauty salons with perfect scores in coverage and affordability, offering comprehensive protection at competitive rates. Even so, we recommend comparing quotes from The Hartford, Coverdash, Nationwide, and Simply Business, our other top picks.

Best Beauty Salon Business Insurance

Coverdash, Simply Business and The Hartford offer the best cheap business insurance for beauty salon companies, with rates starting at $14 monthly.

Get matched with the best salon business insurer for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

General liability, professional liability, property insurance, and workers' comp (if you have employees) are the essential four types of commercial insurance for beauty and hair salons.

ERGO NEXT stands out as the best business insurance company for beauty salons because it delivers excellent coverage and affordability.

Coverdash provides the cheapest overall commercial insurance for beauty salon businesses and their stylists at just $42 monthly for comprehensive business protection.

Best Business Insurance for Beauty Salon Companies

| ERGO NEXT | 4.73 | $49 |

| The Hartford | 4.72 | $46 |

| Coverdash | 4.70 | $42 |

| Nationwide | 4.70 | $48 |

| Simply Business | 4.70 | $46 |

| biBERK | 4.40 | $64 |

| Chubb | 4.40 | $71 |

| Thimble | 4.30 | $62 |

| Hiscox | 4.30 | $68 |

| Progressive Commercial | 4.10 | $87 |

*We based all scores on a beauty salon business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Salon Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your beauty salon business, check out the following resources:

1. ERGO NEXT: Best Overall for Salons

Great discounts offered of up to 25% on beauty and hair salon insurance

Simplified purchasing process to offer tailored plans for salons

Affordable rates for workers comp policies

Younger company with a little over 10 years of experience

Fifth in affordability overall for salons

ERGO NEXT uses AI and machine learning technology to simplify the purchasing process and customize affordable coverage and offers tailored insurance plans for more than 350 beauty and wellness industries. The process is quick and under 10 minutes and can be completed completely online.

2. The Hartford: Best Professional Liability Insurance for Beauty Salons

Cheapest professional liability insurance rates for salons and hair stylists

Over 200+ years of experience with tailored, industry specific agents

Most highly rated claims and agent service by customers

Not offered in Alaska or Hawaii

Ranks last for digital experience

Unique for beauty professionals, The Hartford offers a BOP policy combining general liability and professional liability insurance for a discount and additional riders to protect you further. Even with a lackluster digital experience, they win out for agent service in our industry survey, with a tailored division for beauty and wellness industry professionals to make sure your needs are met.

3. Coverdash: Cheapest Business Insurance for Salons

Cheapest overall rates for salons

Great coverage selection due to their aggregator model

Buying can be completed completely online

Customer service is mixed and coverage is not directly provided

With average overall business insurance rates of $509 per year for salons, Coverdash is affordable. In addition to this, the company has extensive coverage offerings, making it an ideal provider if you are looking for the most tailored plans possible.

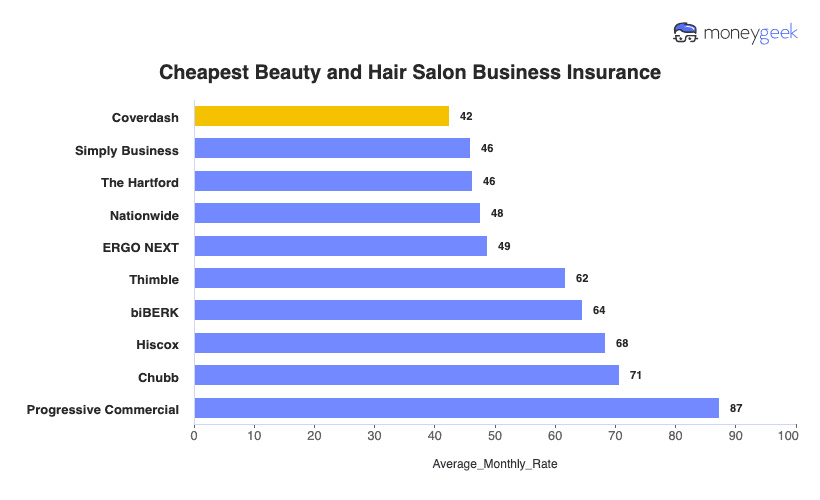

Cheapest Business Insurance for Beauty Salons

Coverdash leads as the most affordable business insurance for beauty salons at $42 monthly, especially for general liability coverage. However, salon owners seeking workers comp, professional liability, and BOP insurance will find better rates with ERGO NEXT and The Hartford for these protection needs.

| Coverdash | $42 | $509 |

| Simply Business | $46 | $551 |

| The Hartford | $46 | $555 |

| Nationwide | $48 | $571 |

| ERGO NEXT | $49 | $586 |

| Thimble | $62 | $741 |

| biBERK | $64 | $774 |

| Hiscox | $68 | $820 |

| Chubb | $71 | $849 |

| Progressive Commercial | $87 | $1,048 |

What Does Beauty and Hair Salon Business Insurance Cost?

In general, salon business insurance costs are the following for the four most popular coverage types:

- General Liability Insurance Cost: $67 on average per month, ranging from $58 to $78, depending on the state

- Workers' Compensation Insurance Cost: $15 on average per month, ranging from $13 to $17, depending on the state

- Professional Liability Insurance Cost (E&O): $49 on average per month, ranging from $42 to $57, depending on the state

- BOP Insurance Cost: $99 on average per month, ranging from $85 to $116, depending on the state

| BOP | $99 | $1,188 |

| General Liability | $67 | $806 |

| Professional Liability (E&O) | $49 | $589 |

| Workers' Comp | $15 | $175 |

What Type of Insurance Is Best for a Beauty and Hair Salon Company?

Beauty salons need several types of insurance to protect their business. General liability insurance covers customer injuries and property damage, while professional liability (errors & omissions) protects against claims of negligence or service mistakes. Workers' compensation is required by law in most states if you have employees, covering medical expenses and lost wages for work-related injuries. Additional recommended coverage includes commercial property insurance to protect your building, equipment, and inventory from damage or theft and business income or interruption coverage if operations are forced to be stopped.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Beauty Salon

Here's a step-by-step method for finding the best and most affordable business insurance for your beauty salon.

- 1Decide on Coverage Needs Before Buying

Consider the unique risks your salon faces daily, from chemical exposure and styling tool injuries to client slip-and-falls and product damage.

- 2Research Costs

Understand typical costs for salons similar to yours before requesting commercial insurance quotes.

- 3Look Into Company Reputations and Coverage Options

Review customer feedback from fellow salon owners to understand how insurers handle claims and service requests.

- 4Compare Multiple Quotes Through Different Means

Request quotes from at least three to five insurers through different channels to maximize your options.

- 5Reassess Annually

Reevaluate your insurance needs each year as your salon evolves.

Best Insurance for Beauty Salon Business: Bottom Line

ERGO NEXT is the top overall insurer for beauty salon business insurance due to its comprehensive coverage, competitive pricing and excellent customer service. Coverdash provides the most affordable rates.

Salon Insurance: FAQ

We answer common questions about beauty salon business insurance:

Who offers the best beauty salon business insurance overall?

ERGO NEXT leads beauty salon business insurance rankings with a MoneyGeek score of 4.73 out of 5.

Who has the cheapest business insurance for beauty salon firms?

Here are the cheapest business insurance companies for beauty salon businesses by coverage type:

- Cheapest general liability insurance: Coverdash at $42 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $14 monthly

- Cheapest professional liability insurance: The Hartford at $44 monthly

- Cheapest BOP insurance: biBERK at $107 monthly

What business insurance is required for beauty salon organizations?

Beauty salon businesses must carry workers' compensation insurance if they employ staff and commercial auto insurance for business-owned vehicles.

How much does beauty salon business insurance cost?

Beauty salon company insurance costs by coverage type are as follows:

- General Liability: $67/mo

- Workers' Comp: $15/mo

- Professional Liability: $49/mo

- BOP Insurance: $99/mo

How We Chose the Best Beauty Salon Business Insurance

We selected the best business insurers for beauty salon companies based on the following criteria:

- Affordability (50% of score): We compared each company's premiums against competitors using our standard profile across four essential coverage types—general liability, professional liability, workers' compensation, and business owner's policy. Lower costs relative to the market earned higher scores.

- Customer service (30% of score): We evaluated overall customer satisfaction through industry studies from organizations like J.D. Power, customer reviews on platforms such as Trustpilot and Google, and sentiment analysis from public forums including Reddit to gauge real-world experiences.

- Coverage (15% of score): We assessed each provider's policy flexibility, payment options, coverage breadth, and salon-specific endorsements to determine how well they meet the diverse needs of beauty salon businesses.

- Financial stability (5% of score): Using ratings from AM Best, Moody's, and other industry evaluators, we measured each insurer's financial strength and reliability in paying claims when salon owners need it most.

All pricing in this article is based on the following profile representing a typical small beauty salon:

- Three-person business with two employees

- Coverage limits: $1 million per occurrence and $2 million aggregate annually for general liability, professional liability, and workers' comp; BOP includes the same liability limits plus $5,000 in business property coverage

- $150,000 in annual payroll

- $300,000 in annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "Hartford Fire Insurance Company." Accessed October 30, 2025.

- ERGO NEXT. "Customer Reviews." Accessed October 30, 2025.

- Trustpilot. "Thimble." Accessed October 30, 2025.