Get quick answers about general liability insurance in Alabama and explore best business insurance options backed by MoneyGeek's comprehensive research. Our FAQ section addresses common questions Alabama business owners have about coverage requirements and costs:

Best General Liability Insurance in Alabama

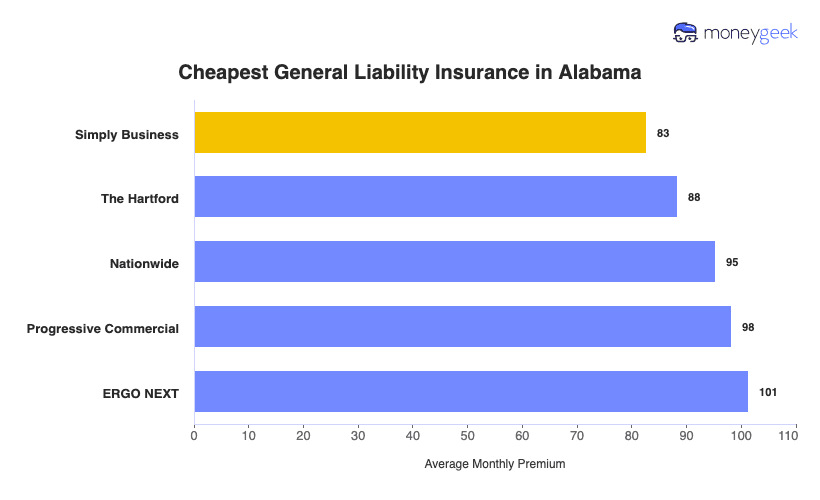

The Hartford leads Alabama general liability insurance, while Simply Business offers the lowest rates at $83 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: January 29, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Alabama: Fast Answers

Which company offers the best general liability insurance in Alabama?

The Hartford ranks as the best general liability insurance company in Alabama with an overall score of 4.61 out of 5. It provides affordable coverage at $88 per month and excels in claims handling. ERGO NEXT follows closely as runner-up, offering excellent digital tools and customer service for $101 per month.

Who offers the cheapest general liability insurance in Alabama?

The cheapest general liability insurance companies in Alabama are:

- Simply Business: $83 per month

- The Hartford: $88 per month

- Nationwide: $95 per month

- Progressive: $98 per month

- ERGO NEXT: $101 per month

Do Alabama businesses legally need general liability insurance?

Alabama doesn't legally require most businesses to carry general liability insurance at the state level. However, certain licensed professionals like contractors and electricians may need specific coverage amounts to maintain their licenses. Local cities and counties can also set their own insurance requirements. Even without legal mandates, most landlords and clients require proof of coverage before signing contracts or leases.

How much does general liability insurance cost in Alabama?

General liability insurance in Alabama ranges from $16 to $904 per month for small businesses with two employees. Drone businesses usually have the lowest rates at $16 per month, while pressure washing companies fall at the higher end at $904. Your exact premium depends on your industry, location, coverage limits and business size.

Best General Liability Insurance Companies in Alabama

The Hartford is our top pick for general liability coverage in Alabama thanks to its mix of affordable rates and dependable service. ERGO NEXT is another solid option, especially for customer support, while Nationwide offers strong financial stability and competitive pricing for small businesses that want reliable financial protection.

| The Hartford | 4.61 | $88 |

| ERGO NEXT | 4.57 | $101 |

| Nationwide | 4.53 | $95 |

| Simply Business | 4.49 | $83 |

| Thimble | 4.40 | $105 |

| Coverdash | 4.37 | $102 |

| biBERK | 4.29 | $112 |

| Progressive Commercial | 4.28 | $98 |

| Chubb | 4.26 | $117 |

| Hiscox | 4.18 | $112 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Alabama General Liability Insurer

Select your industry and state to get a customized Alabama general liability insurance quote.

General liability insurance covers customer injuries and property damage claims for Alabama businesses, but it doesn't protect against every type of risk. Explore these additional coverage options to build comprehensive financial protection:

Best Alabama General Liability Insurance Reviews

Finding the right general liability insurance provider in Alabama requires looking beyond affordable rates to consider coverage quality and customer service. Our research identified the top business insurers based on comprehensive analysis.

Best Alabama General Liability Insurer

Average Monthly General Liability Premium

$88These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Ranks first overall

Ranks second for affordability and customer service

Backed by A+ Superior AM Best financial strength rating

Established since 1810

consCustomer satisfaction scores below industry average per J.D. Power

May involve more complexity than newer digital-first providers

The Hartford combines excellent customer service with competitive pricing and strong financial stability.

Overall Score 4.61 1 Affordability Score 4.55 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 The Hartford offers competitively priced general liability coverage in Alabama, with premiums averaging $88 monthly or $1,060 annually.

The Hartford provides the lowest rates for several key industries in Alabama, including electricians, food service businesses and food truck operators.

Data filtered by:AccountantsAccountants $18 3 The Hartford has a good support team and claims handling. Customers report high satisfaction with the claims process.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford offers comprehensive general liability coverage. Its coverage includes standard financial protections against third-party bodily injury and property damage claims. You can bundle general liability with other coverages through a business owner's policy (BOP).

Best Alabama Commercial General Liability Customer Experience

Average Monthly General Liability Premium

$101These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first for customer service

Ranks second for coverage options

Instant certificates and digital policy management tools

Backed by Munich Re's A- financial strength rating

consHigher premiums

Service delays

Newer company with limited operating history

ERGO NEXT is good for businesses that want quick digital service and flexible coverage options.

Overall Score 4.57 2 Affordability Score 4.30 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 ERGO NEXT offers general liability coverage at $101 per month in Alabama, ranking among the most cost-effective providers statewide. They show particularly competitive pricing for accountants and consultants, while also offering affordable rates for retail businesses and contractors.

Data filtered by:AccountantsAccountants $17 2 Customer feedback highlights ERGO NEXT's superior digital experience and policy management capabilities.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT provides flexible coverage limits up to $2 million per claim and $4 million aggregate, with specialized options including contractor E&O insurance. Its policies feature endorsements for completed work protection through CG2010 coverage.

Cheapest General Liability Insurance Companies in Alabama

Simply Business offers the most affordable general liability insurance in Alabama at $83 per month, saving businesses $18 or 18% compared to the state average. The Hartford and Nationwide also provide low-cost coverage options.

| Simply Business | $83 | $993 |

| The Hartford | $88 | $1,060 |

| Nationwide | $95 | $1,144 |

| Progressive Commercial | $98 | $1,179 |

| ERGO NEXT | $101 | $1,215 |

| Coverdash | $102 | $1,219 |

| Thimble | $105 | $1,264 |

| Hiscox | $112 | $1,345 |

| biBERK | $112 | $1,346 |

| Chubb | $117 | $1,401 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Alabama by Industry

MoneyGeek's research identifies the five cheapest general liability insurance providers across Alabama industries based on comprehensive data analysis.

- ERGO NEXT offers the most affordable coverage in 17 industries, excelling in tech, dental, photography and security sectors.

- Simply Business ranks as the cheapest provider for 16 industries, particularly strong in professional services like accounting, consulting and legal practices.

- biBerk leads affordability in 12 industries, specializing in contractor work, engineering and trucking businesses.

- Thimble provides the lowest rates across 11 industries, with particular strength in construction, HVAC and roofing companies.

- Three providers tie for fifth place with six industries each: Nationwide dominates manufacturing and real estate, Progressive leads in retail and landscaping, while The Hartford offers competitive rates for electrical and food service businesses.

| Accountants | Simply Business | $12 | $150 |

Average Cost of General Liability Insurance in Alabama

General liability insurance costs Alabama small businesses an average of $101 per month. The average cost of general liability coverage depends on your industry, company size, location and policy limits.

Manufacturing companies pay higher premiums due to increased liability risks. Accounting firms usually see lower costs because they deal with fewer physical hazards. Sole proprietors generally pay less than businesses with employees since they have smaller operations and fewer exposures.

Average Cost of General Liability Insurance in Alabama by Industry

General liability insurance in Alabama ranges from $16 monthly for drone businesses to $904 for pressure washing companies. This wide range shows how your industry affects your general liability coverage costs. Review this table to find typical rates for your specific business type.

| Accountants | $22 | $261 |

| Ad Agency | $35 | $419 |

| Automotive | $52 | $629 |

| Auto Repair | $149 | $1,793 |

| Bakery | $89 | $1,066 |

| Barber | $44 | $524 |

| Beauty Salon | $66 | $791 |

| Bounce House | $69 | $829 |

| Candle | $53 | $642 |

| Cannabis | $66 | $791 |

| Catering | $86 | $1,037 |

| Cleaning | $130 | $1,566 |

| Coffee Shop | $88 | $1,060 |

| Computer Programming | $29 | $343 |

| Computer Repair | $47 | $562 |

| Construction | $172 | $2,069 |

| Consulting | $22 | $260 |

| Contractor | $251 | $3,010 |

| Courier | $192 | $2,308 |

| Daycare | $32 | $388 |

| Dental | $21 | $253 |

| DJ | $25 | $300 |

| Dog Grooming | $62 | $747 |

| Drone | $16 | $196 |

| Ecommerce | $72 | $860 |

| Electrical | $111 | $1,335 |

| Engineering | $39 | $468 |

| Excavation | $456 | $5,474 |

| Florist | $42 | $507 |

| Food | $106 | $1,274 |

| Food Truck | $140 | $1,681 |

| Funeral Home | $59 | $712 |

| Gardening | $111 | $1,330 |

| Handyman | $240 | $2,883 |

| Home-based | $23 | $281 |

| Home-based | $45 | $542 |

| Hospitality | $64 | $769 |

| HVAC | $241 | $2,898 |

| Janitorial | $135 | $1,620 |

| Jewelry | $40 | $477 |

| Junk Removal | $160 | $1,916 |

| Lawn/Landscaping | $119 | $1,424 |

| Lawyers | $23 | $270 |

| Manufacturing | $63 | $756 |

| Marine | $28 | $331 |

| Massage | $94 | $1,133 |

| Mortgage Broker | $23 | $270 |

| Moving | $122 | $1,464 |

| Nonprofit | $35 | $423 |

| Painting | $141 | $1,693 |

| Party Rental | $78 | $936 |

| Personal Training | $24 | $282 |

| Pest Control | $32 | $380 |

| Pet | $55 | $658 |

| Pharmacy | $61 | $729 |

| Photography | $24 | $286 |

| Physical Therapy | $109 | $1,305 |

| Plumbing | $356 | $4,277 |

| Pressure Washing | $904 | $10,843 |

| Real Estate | $52 | $627 |

| Restaurant | $143 | $1,711 |

| Retail | $64 | $770 |

| Roofing | $382 | $4,588 |

| Security | $135 | $1,625 |

| Snack Bars | $115 | $1,385 |

| Software | $26 | $312 |

| Spa/Wellness | $106 | $1,271 |

| Speech Therapist | $31 | $370 |

| Startup | $28 | $340 |

| Tech/IT | $26 | $312 |

| Transportation | $37 | $444 |

| Travel | $21 | $246 |

| Tree Service | $126 | $1,513 |

| Trucking | $101 | $1,210 |

| Tutoring | $30 | $358 |

| Veterinary | $44 | $528 |

| Wedding Planning | $27 | $328 |

| Welding | $162 | $1,944 |

| Wholesale | $44 | $527 |

| Window Cleaning | $157 | $1,883 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Alabama General Liability Insurance Costs?

Several key factors determine general liability insurance costs for Alabama businesses.

Alabama Weather and Natural Disaster Risks

Alabama's volatile weather directly affects what you'll pay for general liability coverage. The state has recorded 116 billion-dollar disasters since 1980, averaging 6.4 major events per year over the past five years. Tornadoes occur about 40 times a year, while hurricanes along the Gulf Coast cost insurers roughly $1 million annually.

When storms damage your business property, they create hazardous conditions, such as loose debris, compromised walkways, falling objects, that trigger customer injury claims. Premium increases of 38% since 2022 reflect insurers rebuilding reserves after paying widespread storm-related claims.

Alabama Tourism Industry Impact

Your business likely serves some of Alabama's 29 million annual visitors who spent $23.9 billion across the state in 2024. Higher foot traffic means more slip-and-fall accidents, food poisoning claims, and premises liability incidents. Tourists unfamiliar with your location are more prone to accidents than regular customers.

Restaurants and hotels employ 74% of Alabama's tourism workforce, facing constant bodily injury exposure. Insurers calculate your premiums based on gross sales, so higher tourist-driven revenue automatically increases your base rate, even without filing claims.

Alabama Industry-Specific Insurance Requirements

If you're a contractor in Alabama, you can't legally operate without meeting state-mandated liability minimums. Electricians must carry $100,000 per occurrence and $300,000 aggregate coverage, while HVAC residential contractors need $50,000 per occurrence and $150,000 aggregate.

These requirements create pricing floors because you can't shop for cheaper, lower limits. Cannabis businesses have even higher requirements, with liability coverage starting at $2 million. Alabama's licensing boards enforce these minimums strictly, and insurers maintain higher base rates knowing contractors cannot reduce coverage to save money.

Alabama Geographic Cost Variations

Where you operate dramatically affects your premium. Alabama small businesses pay anywhere from $27 to $3,124 monthly for general liability coverage. Coastal businesses near Gulf Shores and Mobile deal with hurricane winds, storm surge, and beach-related injuries, which lead to far more claims than inland operations.

A Birmingham storefront with heavy customer traffic pays a lot more than a home-based consulting business in Dothan. Insurers analyze historical loss data by ZIP code and adjust rates accordingly. Your location matters as much as your industry when calculating premiums.

How Much General Liability Insurance Do I Need in Alabama?

Alabama law mandates general liability insurance only for licensed contractors like electricians, HVAC technicians and safety companies. Most businesses have no state requirement, but clients and landlords often ask for proof of coverage before signing contracts or leases.

Most Alabama businesses carry $1 million per occurrence and $2 million aggregate to satisfy these common contractual expectations. Requirements for commercial general liability vary by industry and client, so verify specific coverage needs with partners before purchasing a policy.

- Residential HVAC contractors often carry $50,000 per occurrence and $150,000 annual aggregate general liability coverage

- Commercial HVAC contractors usually maintain $100,000 per occurrence and $300,000 annual aggregate coverage

While Alabama doesn't mandate insurance for electrical licensing, electricians carrying general liability coverage need $100,000 per occurrence and $300,000 annual aggregate to meet client and contract requirements.

Electrical sign contractors in Alabama carry $100,000 per occurrence and $300,000 annual aggregate general liability coverage, including completed operations protection.

Alabama HVAC contractor insurance requirements depend on your license classification:

Note: All active Alabama HVAC contractors must secure a $20,000 performance bond to obtain and maintain licensure

Fire safety businesses in Alabama carry $500,000 per occurrence and $1,000,000 annual aggregate general liability coverage to meet local jurisdiction and commercial contract requirements.

Note: State insurance rules change often. Check current requirements with the Alabama Department of Insurance or talk with a licensed agent before selecting coverage.

How to Choose the Best General Liability Insurance in Alabama

Getting business insurance in Alabama starts with understanding your liability exposure and coverage needs. General liability insurance covers bodily injury claims, property damage and legal defense costs. Balance financial protection levels with your budget to find coverage that safeguards your Alabama business.

- 1Determine Coverage Needs

Alabama doesn't legally require general liability insurance. Certain licensed professions, like electricians, need $100,000 per occurrence and $300,000 annual aggregate, while fire safety companies usually carry $500,000 per occurrence and $1,000,000 annual aggregate.

- 2Prepare Business Information

Collect your business details before requesting quotes, including annual revenue, employee count, Alabama location and industry classification.

- 3Compare Multiple Quotes

Request quotes from at least three insurers licensed in Alabama since business insurance costs can vary by hundreds of dollars annually between carriers.

- 4Look Beyond Price

Cheap business insurance isn't always the best choice if it leaves coverage gaps during claims.

- 5Verify Insurer Credibility

Check insurer and agent licenses through the Alabama Department of Insurance and review AM Best financial strength ratings before choosing the best insurance for your business.

- 6Ask About Discounts

Alabama insurers offer discounts for bundling multiple policies, maintaining claims-free histories, implementing safety programs and paying premiums annually.

- 7Obtain Certificate of Insurance

Certificates of insurance prove your coverage to Alabama clients, landlords and contractors who require COIs before doing business with you.

- 8Review Coverage Annually

Reassess your general liability coverage each year.

Top General Liability Insurance in Alabama: Bottom Line

Finding the right general liability insurance in Alabama starts with understanding your specific business needs and comparing providers carefully. The Hartford, ERGO NEXT and Nationwide lead our analysis, but your ideal choice depends on your industry, business size and budget. Compare multiple quotes from different insurers and verify their credentials before making your final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Alabama Licensing Board for General Contractors. "2025 Prime Contractors License Renewal." Accessed February 7, 2026.

- Alabama Tourism Department. "Alabama Tourism Department." Accessed February 7, 2026.

- NOAA National Centers for Environmental Information. "Billion-Dollar Weather and Climate Disasters | State Summary - Alabama." Accessed February 7, 2026.