Choosing business insurance coverage means knowing which options protect your Alaska operation. Our research team compiled answers to common questions about general liability insurance:

Best General Liability Insurance in Alaska

ERGO NEXT leads Alaska general liability insurance, while The Hartford provides the most affordable rates starting at $75 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: January 30, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Alaska: Fast Answers

Which company offers the best general liability insurance in Alaska?

ERGO NEXT ranks as the best general liability insurance company in Alaska with a 4.58 overall score out of 5. The provider excels in digital experience and reliable claims handling at $94 per month. Simply Business follows closely as runner-up with competitive rates at $88 per month and strong customer service.

Who offers the cheapest general liability insurance in Alaska?

The cheapest general liability insurance companies in Alaska are:

- The Hartford: $75 per month

- Simply Business: $88 per month

- Nationwide: $89 per month

- Progressive: $92 per month

- ERGO NEXT: $94 per month

Do Alaska businesses legally need general liability insurance?

Alaska doesn't legally require most businesses to carry general liability insurance at the state level. However, certain licensed professionals like contractors and electricians may need specific coverage amounts for licensing. Local municipalities can impose their own requirements, and most landlords and clients demand proof of insurance before signing contracts.

How much does general liability insurance cost in Alaska?

General liability insurance costs between $15 and $809 per month for small Alaska businesses with two employees. The drone industry often sees the lowest rates at $15 per month, while pressure washing businesses land at the higher end at $809 per month. Your actual premium depends on your industry risk level, business location, coverage limits, and employee count.

Best General Liability Insurance Companies in Alaska

ERGO NEXT is our top choice for general liability insurance in Alaska because of its strong customer service and solid pricing for small businesses. Simply Business and Thimble are also good options. Simply Business performs well in both affordability and coverage variety, while Thimble offers some of the lowest rates available to Alaska business owners.

| ERGO NEXT | 4.58 | $94 |

| Simply Business | 4.49 | $88 |

| Thimble | 4.40 | $98 |

| Coverdash | 4.38 | $95 |

| biBERK | 4.29 | $105 |

| Progressive Commercial | 4.28 | $92 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Alaska General Liability Insurer

Select your industry and state to get a customized Alaska general liability insurance quote.

General liability insurance covers customer injuries and property damage for Alaska businesses, but it does not cover every type of risk. Explore these additional coverage options to build comprehensive financial protection:

Best Alaska General Liability Insurance Reviews

Finding the right general liability insurance provider in Alaska involves more than comparing prices. Our research reveals which business insurers offer the best combination of coverage and service.

Best Alaska General Liability Insurer

Average Monthly General Liability Premium

$94These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Leads Alaska providers for overall digital experience and online usability

Holds an A- AM Best financial strength rating

Ranks first for policy management and account controls

Shows high customer retention with strong renewal and referral rates

consClaims handling places fourth, which may slow resolution times

Shorter operating history compared with established insurers

Provides online-only service without local agent access

ERGO NEXT ranks first for general liability insurance in Alaska, supported by high customer satisfaction and strong digital performance. It pairs an A- AM Best rating with an online-first platform that simplifies policy setup and ongoing management.

The company suits service-based businesses such as cleaning, tech services, and consulting firms that prefer managing coverage without agent involvement. Its focus on usability and consistency places it at the top of statewide rankings.

Overall Score 4.58 1 Affordability Score 4.32 4 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 4 In Alaska, ERGO NEXT’s general liability coverage averages $94 per month, placing it among the lowest-cost providers statewide. The insurer offers especially competitive rates for service-based businesses like cleaning services, computer repair, and professional consulting. Pricing also remains reasonable for contractors and retail businesses when compared with coverage limits and policy terms.

Data filtered by:AccountantsAccountants $16 2 Alaska business owners often cite ERGO NEXT’s online platform and simple policy controls as standout features. Easy renewals and quick access to account details come up frequently in customer feedback. While claims handling ranks lower than other service areas, overall sentiment stays positive, supported by strong renewal and recommendation activity.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT offers general liability coverage for third-party bodily injury, property damage, and advertising injury claims. Businesses can adjust coverage limits and bundle policies directly through the online platform. While standard liability coverage is well supported, some specialized risks or independent contractor needs may require separate policies.

Best Alaska Commercial General Liability Customer Experience

Average Monthly General Liability Premium

$88These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.7/5Our Survey: Likely to Be Recommended to Others

4.2/5

- pros

Offers the widest range of coverage options among Alaska providers

Ranks second statewide for overall affordability

Provides a clean, easy-to-use online platform for policy management

Receives strong customer satisfaction scores

consClaims handling ranks lowest, which may lead to longer processing times

Limited access to local agents for in-person support

Simply Business delivers broad coverage options paired with competitive pricing for Alaska businesses. The provider ranks first for coverage variety and second for affordability, helping small businesses balance protection and cost.

It suits contractors, professional service firms, and retail businesses that want flexible coverage without paying higher rates. For Alaska entrepreneurs focused on value and choice, Simply Business remains a practical option.

Overall Score 4.49 2 Affordability Score 4.45 2 Customer Service Score 4.15 3 Coverage Score 4.90 1 Stability Score 4.83 3 With monthly rates starting at $88 in Alaska, Simply Business prices general liability coverage at $1,053 per year. The company ranks as the cheapest option for 14 business types across the state, covering accountants, lawyers, home-based businesses and consultants.

Data filtered by:AccountantsAccountants $13 1 Customer reviews point to Simply Business’s easy-to-use digital tools and competitive pricing. Many Alaska business owners appreciate the ability to compare policies and manage coverage online. Although claims processing ranks lower than other service categories, overall satisfaction remains solid among customers who prioritize digital access and cost control.

Overall Customer Score 4.14 7 Claims Process 3.70 8 Customer Service 4.00 6 Digital Experience 4.50 3 Overall Satisfaction 4.10 7 Policy Management 4.10 7 Recommend to Others 4.20 8 Renewal Likelihood 4.10 7 Simply Business connects Alaska companies with general liability coverage from top-rated carriers. Businesses can compare multiple quotes through its online marketplace and choose policies matching their industry requirements.

Cheapest General Liability Insurance Companies in Alaska

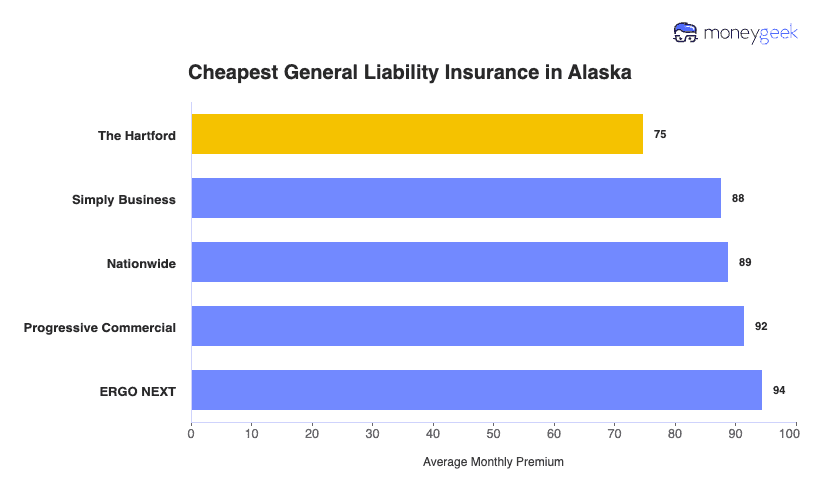

The Hartford offers the cheapest general liability insurance in Alaska at $75 per month, saving businesses $20 or 21% compared to the state average. Simply Business and Nationwide also provide affordable coverage options for Alaska businesses.

| The Hartford | $75 | $898 |

| Simply Business | $88 | $1,053 |

| Nationwide | $89 | $1,066 |

| Progressive Commercial | $92 | $1,099 |

| ERGO NEXT | $94 | $1,133 |

| Coverdash | $95 | $1,137 |

| Thimble | $98 | $1,181 |

| Hiscox | $105 | $1,257 |

| biBERK | $105 | $1,258 |

| Chubb | $109 | $1,307 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Alaska by Industry

Based on MoneyGeek's research, these five providers offer the most affordable general liability insurance across different industries in Alaska:

- ERGO NEXT dominates affordability in 28 out of 66 industries statewide. The provider performs especially well for diverse sectors including manufacturing, tech/IT, real estate and construction-related businesses.

- Simply Business ranks as the cheapest option in 14 industries, focusing primarily on professional services. The company excels in coverage for accountants, lawyers, consulting firms and software businesses.

- Thimble offers the lowest rates in 12 industries, with strong performance in service-based sectors. The provider leads affordability for construction, HVAC, roofing and tutoring businesses.

- biBerk also covers 12 industries as the most affordable option, specializing in contractor and technical services. The company performs best for engineering, excavation, hospitality and veterinary practices.

- Coverdash and Progressive each lead in 7 industries. Coverdash focuses on automotive and transportation sectors, while Progressive dominates food service, retail and wellness businesses.

| Accountants | Simply Business | $13 | $158 |

Average Cost of General Liability Insurance in Alaska

General liability insurance costs Alaska small businesses an average of $95 per month. The average cost of general liability coverage changes based on your industry, business size, location and coverage limits.

Manufacturing companies often have higher premiums because of increased risk exposure, while accounting firms usually pay less due to lower liability concerns. Sole proprietors usually see cheaper rates compared to businesses with several employees.

Average Cost of General Liability Insurance in Alaska by Industry

General liability insurance costs in Alaska vary widely by industry, ranging from $15 monthly for drone businesses to $809 for pressure washing companies. This difference reflects how business risk levels affect your general liability coverage rates. Review this table to find typical costs for your specific business type.

| Accountants | $20 | $246 |

| Ad Agency | $38 | $455 |

| Automotive | $49 | $592 |

| Auto Repair | $151 | $1,809 |

| Bakery | $85 | $1,015 |

| Barber | $47 | $562 |

| Beauty Salon | $62 | $749 |

| Bounce House | $63 | $756 |

| Candle | $50 | $599 |

| Cannabis | $60 | $720 |

| Catering | $96 | $1,147 |

| Cleaning | $114 | $1,368 |

| Coffee Shop | $85 | $1,017 |

| Computer Programming | $32 | $379 |

| Computer Repair | $41 | $492 |

| Construction | $184 | $2,209 |

| Consulting | $21 | $252 |

| Contractor | $225 | $2,699 |

| Courier | $173 | $2,079 |

| Daycare | $30 | $354 |

| Dental | $20 | $241 |

| DJ | $27 | $322 |

| Dog Grooming | $57 | $679 |

| Drone | $15 | $179 |

| Ecommerce | $65 | $779 |

| Electrical | $83 | $994 |

| Engineering | $41 | $486 |

| Excavation | $428 | $5,134 |

| Florist | $39 | $464 |

| Food | $97 | $1,165 |

| Food Truck | $104 | $1,244 |

| Funeral Home | $56 | $677 |

| Gardening | $89 | $1,070 |

| Handyman | $230 | $2,762 |

| Home-based | $23 | $272 |

| Home-based | $42 | $505 |

| Hospitality | $66 | $790 |

| HVAC | $219 | $2,634 |

| Janitorial | $111 | $1,326 |

| Jewelry | $46 | $554 |

| Junk Removal | $147 | $1,767 |

| Lawn/Landscaping | $108 | $1,291 |

| Lawyers | $21 | $254 |

| Manufacturing | $83 | $996 |

| Marine | $25 | $298 |

| Massage | $97 | $1,162 |

| Mortgage Broker | $21 | $257 |

| Moving | $119 | $1,422 |

| Nonprofit | $32 | $389 |

| Painting | $128 | $1,536 |

| Party Rental | $71 | $857 |

| Personal Training | $23 | $281 |

| Pest Control | $29 | $347 |

| Pet | $52 | $622 |

| Pharmacy | $59 | $705 |

| Photography | $24 | $288 |

| Physical Therapy | $153 | $1,839 |

| Plumbing | $344 | $4,131 |

| Pressure Washing | $809 | $9,710 |

| Real Estate | $41 | $490 |

| Restaurant | $141 | $1,695 |

| Retail | $61 | $733 |

| Roofing | $341 | $4,087 |

| Security | $141 | $1,691 |

| Snack Bars | $107 | $1,289 |

| Software | $28 | $338 |

| Spa/Wellness | $88 | $1,059 |

| Speech Therapist | $30 | $355 |

| Startup | $29 | $344 |

| Tech/IT | $28 | $330 |

| Transportation | $33 | $397 |

| Travel | $20 | $234 |

| Tree Service | $124 | $1,483 |

| Trucking | $90 | $1,079 |

| Tutoring | $32 | $385 |

| Veterinary | $39 | $468 |

| Wedding Planning | $30 | $356 |

| Welding | $151 | $1,812 |

| Wholesale | $41 | $488 |

| Window Cleaning | $147 | $1,758 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Alaska General Liability Insurance Costs?

General liability insurance pricing for Alaska businesses changes depending on industry type, location and coverage choices.

Alaska's Remote Geography and Limited Service Access

Investigating claims in Alaska costs four times what it does elsewhere. That $500 slip-and-fall investigation in Seattle? It's $2,000 in rural Alaska once you factor in travel. Shipping materials and finding qualified contractors drives settlement costs higher. Your premiums reflect these realities.

Alaska's Seismic Activity and Earthquake Risk

More than 12,000 earthquakes shake Alaska every year. Tremors knock shelves through shared walls or drop signs onto parked cars below. After quakes, cracked sidewalks and unstable building elements create new liability exposures. Insurers price coverage knowing this happens regularly, not occasionally.

Alaska's Extreme Weather and Climate Conditions

Six to eight months of brutal winter means half your year involves slip-and-fall risk. Snow piles up daily. Ice builds on roofs and crashes down on people or vehicles. General liability covers the injuries and damage, but insurers pay out claims all winter long. Extended exposure drives up what you pay.

Alaska's Elevated Medical and Healthcare Costs

Emergency room visits after falls cost $3,000 in Alaska versus $1,200 in most states. Healthcare premiums jumped 16% from 2023 to 2025 alone. Remote patients get airlifted to Anchorage or sent to the Lower 48, adding thousands more. Medical expenses inflate every claim, so premiums follow.

Alaska's Legal and Regulatory Environment

Data breaches trigger mandatory reporting to affected residents and resolution costs pile up fast. Contractors must carry commercial general liability plus a $25,000 surety bond. Remote regulatory oversight stretches dispute timelines, raising legal expenses insurers eventually cover. Claims take longer and cost more to close.

How Much General Liability Insurance Do I Need in Alaska?

Alaska law doesn't mandate general liability insurance for most businesses, but operating without it proves difficult. Landlords write coverage requirements into lease agreements. Clients demand proof before signing contracts.

Licensed electricians, HVAC contractors and safety companies must carry coverage under state law. Most Alaska businesses buy $1 million per occurrence and $2 million aggregate limits to meet contract requirements.**

Alaska requires the same general liability insurance minimums for electricians, electrical sign contractors, HVAC contractors and safety companies.

All licensed contractors must carry at least $20,000 property damage coverage, $50,000 bodily injury per person and $100,000 bodily injury per accident. These minimums apply regardless of specialty trade, though commercial projects and larger contracts often require higher coverage limits.

Note: Alaska insurance requirements change regularly. Check current rules with the Alaska Division of Insurance or call a licensed agent for updated requirements.

How to Choose the Best General Liability Insurance in Alaska

Getting business insurance in Alaska means finding coverage that protects your operations while fitting your budget and meeting client contract requirements.

- 1Determine Coverage Needs

Alaska doesn't legally require general liability insurance, but most commercial leases in Anchorage, Fairbanks, and other cities require proof of coverage before signing. Lease agreements commonly set minimum limits between $1 million and $2 million per occurrence, with aggregate limits that match or exceed per-occurrence amounts. Review your lease terms, client contracts and industry standards to confirm the coverage limits needed to operate your business in Alaska.

- 2Prepare Business Information

Insurers require specific details to generate accurate Alaska quotes, including your business classification, annual revenue, employee count, and operating location. General liability premiums in Alaska average $48 per month, though rates vary by industry risk and whether you operate in urban centers like Anchorage or remote areas. Gather your EIN, Alaska business license and tax records ahead of time to speed up applications and reduce pricing errors.

- 3Compare Multiple Quotes

Request quotes from at least three insurers licensed to operate in Alaska, as pricing and policy terms differ by carrier. Review how each policy treats defense costs, whether they reduce your coverage limit or remain outside it, along with deductibles and coverage limits. Comparing business insurance costs across multiple insurers helps balance price with coverage strength for Alaska operations.

- 4Look Beyond Price

Avoid choosing coverage based only on affordable business insurance rates. Many Alaska policies exclude professional errors, pollution exposure, and employee injuries, which require separate coverage. Review exclusions carefully and confirm whether legal defense costs sit inside or outside your policy limits, as this affects real-world protection.

- 5Verify Insurer Credentials

Confirm insurer licensing through the Alaska Division of Insurance and review AM Best financial strength ratings before purchasing coverage. File complaints with the Alaska Division of Insurance at (800) 467-8725 and check complaint ratios to spot patterns tied to claims handling issues. Choosing the best insurance for your business means working with insurers that show financial stability and consistent claims performance.

- 6Ask About Discounts

Many Alaska insurers offer savings for bundling policies, maintaining a claims-free record, implementing safety programs, or paying premiums annually. Packaging general liability with commercial property coverage through a business owner’s policy often lowers premiums by 10% to 25%. Security systems, employee safety training and Alaska industry memberships may also qualify your business for reduced rates.

- 7Get Certificate of Insurance

Commercial landlords and clients across Alaska require certificates of insurance before contracts begin, especially in cities like Anchorage and Juneau. Some insurers issue digital certificates instantly, while others take up to 48 hours. Keep insurer or agent contact details accessible, as delays in providing proof of coverage can postpone projects or lease approvals.

- 8Review Coverage Annually

Revisit your general liability policy each year, particularly after hiring staff, expanding services, or increasing revenue. Compare quotes 60 to 90 days before renewal to adjust limits or identify better pricing based on current operations. Regular reviews help prevent compliance gaps tied to leases and reduce the risk of audit-related premium increases.

Top General Liability Insurance in Alaska: Bottom Line

Compare multiple insurers before buying general liability coverage in Alaska. ERGO NEXT, Simply Business and Thimble offer solid options depending on your industry, business size and budget. Get quotes from at least three carriers and verify their credentials before choosing.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Alaska Department of Labor and Workforce Development. "Construction Contractor Licensing." Accessed February 7, 2026.

- Alaska Division of Geological & Geophysical Surveys. "Earthquakes & Tsunamis." Accessed February 7, 2026.

- Alaska Division of Insurance. "2024 Annual Report." Accessed February 7, 2026.

- Alaska Public Media. "Monthly Premiums for Health Insurance on the Federal Marketplace Will Rise 16% in Alaska Next Year." Accessed February 7, 2026.

- U.S. Bureau of Labor Statistics. "Census of Fatal Occupational Injuries." Accessed February 7, 2026.

- U.S. Geological Survey. "Alaska Earthquake and Tsunami Hazards." Accessed February 7, 2026.

- U.S. Geological Survey. "Earthquakes." Accessed February 7, 2026.

- U.S. Climate Resilience Toolkit. "Arctic Weather and Extreme Events." Accessed February 7, 2026.

- VolcanoDiscovery. "Latest Earthquakes in Alaska and the Aleutian Islands." Accessed February 7, 2026.