We researched general liability insurance to help Arkansas business owners find the best coverage. Here are answers to common questions based on MoneyGeek's analysis:

Best General Liability Insurance in Arkansas

The Hartford leads Arkansas general liability insurance as both the top choice and most affordable option at $78 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Arkansas: Fast Answers

Which company offers the best general liability insurance in Arkansas?

The Hartford ranks as the best general liability insurance company in Arkansas with an overall score of 4.63 out of 5. It provides affordable coverage at $78 per month and excellent claims handling. ERGO NEXT follows closely as runner-up, featuring a user-friendly digital platform and strong customer support for $99 per month.

Who offers the cheapest general liability insurance in Arkansas?

The cheapest general liability insurance companies in Arkansas and their monthly rates are:

- The Hartford: $78

- Simply Business: $92

- Nationwide: $93

- Progressive: $96

- ERGO NEXT: $99

Do Arkansas businesses legally need general liability insurance?

Arkansas doesn't legally require general liability insurance for most businesses statewide. But certain licensed professionals like contractors and electricians may need coverage to maintain their licenses. Local municipalities can set their own requirements, so check city and county regulations. Even without legal requirements, most landlords and clients demand proof of coverage before signing contracts or leases, making it necessary for most business operations.

How much does general liability insurance cost in Arkansas?

General liability insurance costs between $16 and $882 per month for small Arkansas businesses with two employees. Drone businesses often get the lowest rates, while pressure washing companies fall at the higher end. Your actual cost depends on your industry, business location, coverage limits and company size.

Best General Liability Insurance Companies in Arkansas

The Hartford is our top choice for general liability insurance in Arkansas. It combines affordable rates with strong financial strength for small businesses. ERGO NEXT offers excellent customer service for business owners who want responsive support. Nationwide also ranks high with reliable coverage and competitive pricing for Arkansas entrepreneurs.

| The Hartford | 4.63 | $78 |

| ERGO NEXT | 4.57 | $99 |

| Nationwide | 4.52 | $93 |

| Simply Business | 4.48 | $92 |

| Coverdash | 4.37 | $99 |

| Thimble | 4.35 | $103 |

| biBERK | 4.28 | $110 |

| Progressive Commercial | 4.27 | $96 |

| Chubb | 4.25 | $114 |

| Hiscox | 4.18 | $109 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Arkansas General Liability Insurer

Select your industry and state to get a customized Arkansas general liability insurance quote.

General liability insurance covers customer injuries and property damage for Arkansas businesses, but it doesn't cover every risk. Here are additional coverage options for more complete financial protection:

Best Arkansas General Liability Insurance Reviews

The cheapest general liability insurance in Arkansas isn't always the best. Our research identifies which insurers offer the best coverage and service.

Best Arkansas General Liability Insurer

Average Monthly General Liability Premium

$78These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Processes claims quickly and efficiently

Earns highest customer satisfaction ratings

Holds A+ AM Best rating for strong financial stability

Ranks first overall among general liability insurance providers

consRequires agent interaction instead of online-only purchasing

Has limited digital tools and online features

The Hartford leads Arkansas's general liability market with strong affordability and customer service quality, backed by an A+ financial strength rating from AM Best. Its competitive pricing and efficient claims handling work well for construction, professional services and retail businesses. The Hartford fits business owners who value personalized support and proven reliability over digital-first solutions.

Overall Score 4.63 1 Affordability Score 4.60 1 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 The Hartford offers general liability coverage in Arkansas at $78 per month on average, making it the most affordable provider in our analysis. It has competitive rates for construction, cleaning and professional service industries, with strong pricing across 23 business categories in its top affordability tier.

Data filtered by:AccountantsAccountants $16 2 Customer feedback shows The Hartford excels in claims processing, customer service and overall satisfaction, earning top national rankings. The company emphasizes personal attention and efficient claim resolutions, though digital tools don't match some competitors.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford has general liability coverage with limits from $300,000 to $2 million per occurrence, with aggregate limits up to twice that amount. Businesses can add product liability coverage and broad form contractual liability options. The Hartford also allows bundling data breach protection through a business owner's policy for more comprehensive coverage.

Best Arkansas Commercial General Liability Customer Experience

Average Monthly General Liability Premium

$99These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Offers competitive rates across multiple industries

Easy-to-use digital platform simplifies policy management

A- AM Best financial stability rating

Customers consistently recommend to other business owners

consNewer company with limited operating history compared to competitors

Online-only model lacks local agent support for complex issues

ERGO NEXT has strong customer service in Arkansas and multiple coverage options, backed by an A- financial strength rating from AM Best. Its digital-first approach fits tech-savvy business owners who want efficient online policy management and fast service.

The company also covers professional services, retail operations and contractors with industry-specific policies.

Overall Score 4.57 2 Affordability Score 4.30 5 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 ERGO NEXT offers general liability coverage starting at $99 monthly in Arkansas, with competitive rates for professional services, retail and contracting businesses. It shows strong affordability rankings across multiple industries, including tech services, photography and home-based businesses, making it an economical choice for small business owners.

Data filtered by:AccountantsAccountants $17 3 Customer feedback highlights ERGO NEXT's strong digital experience and easy policy management. The online platform gets top marks for ease of use, and customers praise the likelihood of renewal and willingness to recommend the service.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT offers general liability coverage with limits up to $2 million per claim and $4 million aggregate. Policies include contractor E&O insurance and optional endorsements for completed work protection through CG2010 coverage. Businesses can customize coverage limits and add specialized protection, making ERGO NEXT a good fit for contract-based businesses in Arkansas.

Cheapest General Liability Insurance Companies in Arkansas

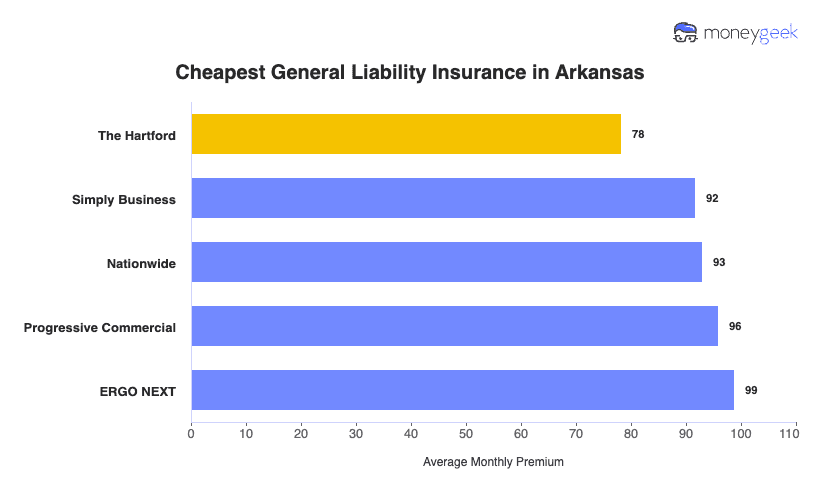

The Hartford offers the cheapest general liability insurance in Arkansas at $78 per month, saving businesses $21 or 21% compared to the state average. Simply Business and Nationwide also provide affordable coverage options.

| The Hartford | $78 | $940 |

| Simply Business | $92 | $1,102 |

| Nationwide | $93 | $1,116 |

| Progressive Commercial | $96 | $1,151 |

| ERGO NEXT | $99 | $1,186 |

| Coverdash | $99 | $1,190 |

| Thimble | $103 | $1,235 |

| Hiscox | $109 | $1,314 |

| biBERK | $110 | $1,315 |

| Chubb | $114 | $1,368 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on your business location, industry, coverage amount and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Arkansas by Industry

Based on MoneyGeek's research, these five providers have the most affordable general liability insurance across industries in Arkansas.

- The Hartford: Cheapest option in 23 industries, leading in construction, cleaning, transportation and home-based businesses

- Simply Business: Wins affordability in 11 industries, strongest with professional services like accountants, lawyers and consulting firms

- Thimble: Lowest rates in nine industries, best for service businesses including HVAC, roofing and pet care companies

- biBerk: Ties for third place with cheap coverage across nine industries, focusing on contractor, engineering and hospitality sectors

- ERGO NEXT and Progressive: Each leads in eight industries. ERGO NEXT has the strongest presence in tech and photography, while Progressive performs best with retail, beauty salons and food service companies.

| Accountants | Simply Business | $14 | $166 |

Average Cost of General Liability Insurance in Arkansas

Most small businesses in Arkansas pay about $99 monthly for general liability insurance. The average cost of general liability coverage changes based on your industry type, business size, location and policy limits.

Manufacturing companies often pay higher premiums because of higher liability risks, while accounting firms usually pay less because they have lower risk. Sole proprietors generally pay less than businesses with employees since they have fewer liability concerns.

Average Cost of General Liability Insurance in Arkansas by Industry

General liability insurance in Arkansas ranges from $16 monthly for drone businesses to $882 for pressure washing companies. Review the table below to find affordable general liability coverage rates for your specific industry.

| Accountants | $21 | $255 |

| Ad Agency | $34 | $409 |

| Automotive | $51 | $617 |

| Auto Repair | $146 | $1,757 |

| Bakery | $87 | $1,045 |

| Barber | $43 | $513 |

| Beauty Salon | $64 | $773 |

| Bounce House | $68 | $813 |

| Candle | $53 | $635 |

| Cannabis | $65 | $775 |

| Catering | $85 | $1,014 |

| Cleaning | $128 | $1,532 |

| Coffee Shop | $86 | $1,038 |

| Computer Programming | $28 | $336 |

| Computer Repair | $46 | $551 |

| Construction | $169 | $2,028 |

| Consulting | $21 | $254 |

| Contractor | $246 | $2,948 |

| Courier | $188 | $2,260 |

| Daycare | $32 | $380 |

| Dental | $21 | $249 |

| DJ | $24 | $293 |

| Dog Grooming | $61 | $734 |

| Drone | $16 | $193 |

| Ecommerce | $71 | $846 |

| Electrical | $108 | $1,300 |

| Engineering | $38 | $461 |

| Excavation | $449 | $5,385 |

| Florist | $41 | $495 |

| Food | $104 | $1,245 |

| Food Truck | $137 | $1,639 |

| Funeral Home | $58 | $698 |

| Gardening | $108 | $1,300 |

| Handyman | $235 | $2,823 |

| Home-based | $23 | $275 |

| Home-based | $44 | $529 |

| Hospitality | $63 | $754 |

| HVAC | $236 | $2,837 |

| Janitorial | $132 | $1,586 |

| Jewelry | $39 | $466 |

| Junk Removal | $157 | $1,879 |

| Lawn/Landscaping | $116 | $1,390 |

| Lawyers | $22 | $264 |

| Manufacturing | $62 | $740 |

| Marine | $27 | $324 |

| Massage | $92 | $1,108 |

| Mortgage Broker | $22 | $265 |

| Moving | $120 | $1,435 |

| Nonprofit | $35 | $415 |

| Painting | $139 | $1,663 |

| Party Rental | $77 | $919 |

| Personal Training | $23 | $276 |

| Pest Control | $31 | $373 |

| Pet | $54 | $648 |

| Pharmacy | $60 | $715 |

| Photography | $23 | $279 |

| Physical Therapy | $106 | $1,275 |

| Plumbing | $348 | $4,181 |

| Pressure Washing | $882 | $10,587 |

| Real Estate | $51 | $615 |

| Restaurant | $140 | $1,677 |

| Retail | $63 | $756 |

| Roofing | $374 | $4,488 |

| Security | $134 | $1,609 |

| Snack Bars | $113 | $1,358 |

| Software | $25 | $304 |

| Spa/Wellness | $103 | $1,234 |

| Speech Therapist | $30 | $361 |

| Startup | $28 | $331 |

| Tech/IT | $25 | $305 |

| Transportation | $36 | $435 |

| Travel | $20 | $241 |

| Tree Service | $125 | $1,501 |

| Trucking | $99 | $1,187 |

| Tutoring | $29 | $350 |

| Veterinary | $43 | $518 |

| Wedding Planning | $27 | $321 |

| Welding | $159 | $1,907 |

| Wholesale | $43 | $517 |

| Window Cleaning | $153 | $1,842 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on your business location, industry, coverage amount and other factors insurers consider. Available options differ by state.

What Factors Affect Arkansas General Liability Insurance Costs?

Several factors influence what Arkansas businesses pay for general liability insurance.

Arkansas Legal and Regulatory Environment

Arkansas small business owners saw major changes in 2025 when Governor Sanders signed House Bill 1204, capping medical expense recovery in injury lawsuits at actual paid costs instead of billed amounts. Insurance industry supporters expect this tort reform to reduce your general liability premiums over time, though legal challenges may delay any rate decreases.

Arkansas also shields government entities from most liability claims beyond their insurance coverage, which affects your exposure when you contract with state or local agencies.

Arkansas Weather and Geographic Risks

Your Arkansas business may see higher general liability premiums because of the state's weather patterns. Arkansas averages 37 tornadoes annually along with destructive hailstorms, flash flooding, and damaging ice storms. Recent years brought multiple federal disaster declarations affecting dozens of counties statewide.

Your specific location plays a major role in what you pay for coverage. Little Rock businesses and companies in tornado-prone regions pay more for coverage than businesses in calmer, rural areas where severe weather strikes less frequently.

Arkansas Economic Growth and Industry Expansion

Arkansas construction employment jumped 31% since 2020, giving the state a #2 national ranking for industry strength with over 67,000 workers. You'll see this growth throughout Arkansas, from Northwest Arkansas gaining 35 new residents daily to massive steel manufacturing projects in Mississippi County and emerging lithium operations drawing worldwide investment.

This rapid expansion increases property values and business activity across the state, increasing liability exposure that affects your premiums for commercial spaces and customer interactions.

Rising Medical and Healthcare Costs in Arkansas

Medical expenses directly impact what you pay for general liability insurance in Arkansas. Employer health coverage costs hit $8,951 per employee for single coverage and $25,572 for family coverage in 2024, up 6% to 7% from the previous year.

Arkansas businesses may see healthcare costs rise by 6% to 10% in 2025, driven by expensive prescription drugs, cancer treatments and higher labor costs. When customers or visitors suffer injuries at your business, these escalating medical bills lead to larger bodily injury claims that push your premiums higher.

Arkansas Industry-Specific Risk Profiles

Your business type has a major impact on general liability costs in Arkansas. High-risk operations like pressure washing, construction, hospitality and retail often see much higher premiums than low-risk professional services such as consulting or office-based work.

Insurers assess how often customers visit your location, what equipment you use, and your typical injury claim frequency when calculating your rates. Industries with frequent customer interactions and physical work environments pay more for coverage than businesses with minimal public contact.

How Much General Liability Insurance Do I Need in Arkansas?

Arkansas doesn't require most businesses to carry general liability insurance by state law. HVAC contractors with Class A through E licenses need at least $250,000 in coverage, and fire protection companies need $1 million.

Even without state mandates, most small business owners need general liability insurance because clients and lenders demand it. We recommend $1 million per occurrence and $2 million aggregate coverage to meet typical requirements for commercial general liability in Arkansas.

Arkansas requires Class A, B, C, D and E HVAC license holders to carry general liability insurance with minimum coverage of $250,000. This requirement applies to most HVAC contractors in the state.

Fire sprinkler and fire protection companies in Arkansas must maintain general liability insurance with a minimum of $1,000,000. This requirement applies to companies installing, inspecting and servicing fire suppression systems throughout the state.

*State insurance requirements update regularly. Check with the Arkansas Insurance Department or a licensed agent to confirm current regulations before purchasing coverage.

How to Choose the Best General Liability Insurance in Arkansas

Arkansas small business owners should balance coverage needs with costs when getting business insurance. General liability insurance covers customer injury claims and property damage lawsuits. Combining multiple policies provides broader financial protection for your business beyond basic liability coverage.

- 1Determine Your Coverage Needs

Arkansas requires general liability insurance only for specific trades: HVAC contractors must carry at least $250,000 in coverage, and fire protection companies need $1 million.

Most other Arkansas companies don't need business insurance by law, but clients and landlords often expect $1 million per occurrence and $2 million aggregate limits before signing contracts. Your industry requirements and existing agreements determine how much coverage you need.

- 2Prepare Business Information

You'll need your annual revenue, employee count, physical location and business classification when requesting quotes from Arkansas insurers. Construction, hospitality and healthcare businesses pay higher premiums than professional services or retail shops because of greater claim risks. Keep your EIN, business registration and tax documents handy for the application.

- 3Compare Multiple Quotes

Get quotes from at least three Arkansas-licensed insurers to compare business insurance costs. General liability coverage in Arkansas averages $42 monthly, but rates swing by hundreds of dollars annually based on your limits and deductibles.

Ask whether each policy counts legal defense costs toward your coverage limit or covers them separately. This distinction affects how much coverage you actually get.

- 4Look Beyond Price

Choosing coverage based only on price can leave dangerous gaps when you need protection. Policy exclusions matter. Professional errors, pollution liability and employee injuries require separate Arkansas policies. Check whether legal defense expenses fall inside or outside your policy limits. Outside coverage gives you stronger financial protection during lawsuits.

- 5Verify Insurer Credentials

Confirm each insurer's license status through the Arkansas Insurance Department's online verification system and review AM Best financial strength ratings. Look up complaint ratios and claims-handling reviews to find companies with proven Arkansas track records.

Financial strength matters most during major claims. Choose established carriers over unknown discount insurers.

- 6Ask About Discounts

Bundling general liability with commercial property or auto insurance can cut your Arkansas premiums by 10% to 25% compared to buying separate policies. Contractors with OSHA safety certifications often get premium discounts up to 15%, and claims-free histories and annual payment options bring additional savings. Ask about discounts for professional association memberships and employee safety training programs.

- 7Get Certificate of Insurance

Your certificate of insurance proves coverage to Arkansas clients, landlords and contractors who need documentation before starting work. Most insurers provide digital certificates instantly through online portals, though some take up to 48 hours. Keep your agent's contact information handy for urgent certificate requests when signing new contracts or leases.

- 8Review Coverage Annually

Review your Arkansas coverage each year after hiring employees, expanding services or increasing revenue. These changes increase your risk. Get new quotes 60 to 90 days before renewal. Established businesses with clean claim records can see premiums drop 10% to 25% after three years. Keeping adequate coverage prevents compliance gaps and surprise audit adjustments that spike costs later.

Top General Liability Insurance in Arkansas: Bottom Line

Getting quality general liability insurance in Arkansas means understanding your business needs and researching providers. The Hartford, ERGO NEXT and Nationwide are strong options. Your industry type, business size and budget determine the right choice. Compare quotes from multiple insurers and check their credentials before deciding.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- American Tort Reform Association. "Arkansas Debuts on ATRA's 2025 Legislative HeatCheck Report as 'Tort Reform Trailblazer.'." Accessed February 7, 2026.

- Arkansas Advocate. "Bill Limiting Personal Injury Claims Heads to Arkansas Governor After Contentious Debates." Accessed February 7, 2026.

- Arkansas Advocate. "New Federal Disaster Declaration Covers 39 Arkansas Counties Affected by April Storms." Accessed February 7, 2026.

- Arkansas Advocate. "Proposed Tort Reform Advances Out of Arkansas Legislative Committee." Accessed February 7, 2026.

- FEMA. "Assistance Available for Vehicles Damaged by Severe Storms and Tornadoes in Arkansas." Accessed February 7, 2026.

- Justia. "Arkansas Code § 21-9-301 (2024) - Tort Liability - Immunity Declared." Accessed February 7, 2026.

- KFF. "2024 Employer Health Benefits Survey." Accessed February 7, 2026.

- National Weather Service Little Rock. "Severe Weather in Arkansas - Tornado FAQ." Accessed February 7, 2026.

- Talk Business & Politics. "'Remarkable Growth' Noted in Arkansas' Construction Sector to Begin 2024." Accessed February 7, 2026.

- Talk Business & Politics. "The Compass Report: Arkansas Economy Sees 'Balanced Growth' in Q3." Accessed February 7, 2026.

- U.S. Bureau of Labor Statistics. "Arkansas Economy at a Glance." Accessed February 7, 2026.