Our research team compiled answers to common questions about Florida general liability insurance to help you secure the best business insurance for your needs. These insights come from MoneyGeek's detailed analysis of coverage options, costs and requirements:

Best General Liability Insurance in Florida

The Hartford leads Florida general liability insurance as both the top choice and most affordable option at $89 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: January 29, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Florida: Fast Answers

Which company offers the best general liability insurance in Florida?

The Hartford is the best general liability insurance company in Florida with a 4.60 overall score out of 5. It offers affordable coverage at $89 per month along with reliable claims handling. ERGO NEXT ranks second with a 4.55 score, providing excellent digital tools and customer support for $112 per month.

Who offers the cheapest general liability insurance in Florida?

The cheapest general liability insurance companies in Florida are:

- The Hartford: $89 per month

- Simply Business: $104 per month

- Nationwide: $105 per month

- Progressive: $109 per month

- ERGO NEXT: $112 per month

Do Florida businesses legally need general liability insurance?

Florida doesn't legally require most businesses to carry general liability insurance at the state level. However, certain licensed professionals like contractors and electricians must maintain specific coverage amounts to keep their licenses active. Local municipalities may also impose their own insurance requirements. Even when not legally mandated, most landlords and clients demand proof of coverage before signing contracts.

How much does general liability insurance cost in Florida?

General liability insurance costs between $18 and $996 per month for small Florida businesses with two employees. The drone industry has the lowest rates at $18 per month, while pressure washing businesses see the highest at $996 per month. Your actual premium depends on your industry risk level, business location, coverage limits and employee count.

Note: These rates are estimates based on MoneyGeek’s survey methodology and may differ from your actual premium. For accurate pricing, request a personalized quote directly from the insurer.

Best General Liability Insurance Companies in Florida

The Hartford is our top choice for general liability insurance in Florida, offering a great mix of affordability and customer service for small business owners. ERGO NEXT also performs well with outstanding customer service and strong coverage options. Nationwide rounds out our recommendations with solid affordability and reliable financial strength.

| The Hartford | 4.60 | $89 |

| ERGO NEXT | 4.55 | $112 |

| Nationwide | 4.51 | $105 |

| Simply Business | 4.46 | $104 |

| Coverdash | 4.36 | $112 |

| Thimble | 4.35 | $116 |

| biBERK | 4.28 | $123 |

| Progressive Commercial | 4.25 | $109 |

| Chubb | 4.25 | $129 |

| Hiscox | 4.17 | $123 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Florida General Liability Insurer

Select your industry and state to get a customized Florida general liability insurance quote.

General liability insurance covers customer injuries and property damage for your Florida business, but it won't protect against every risk. Explore these related guides for comprehensive coverage in the Sunshine State:

Best Florida General Liability Insurance Reviews

Finding the right general liability insurance provider in Florida means looking beyond just affordable rates. Our research reveals which business insurers offer the best combination of coverage and service in the state.

The Hartford

Best Florida General Liability Insurer

Average Monthly General Liability Premium

$89These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Ranks first in the state for claims process efficiency

Maintains A+ AM Best financial strength rating

Handles customer service inquiries quickly and effectively

Offers competitive rates among major commercial insurers

consDigital platform ranks last among surveyed providers

Most policy purchases require working with an agent

The Hartford leads Florida's general liability market through excellent customer service, financial stability and competitive pricing. With an A+ rating from AM Best, it delivers reliable coverage and ranks first nationally for claims processing.

The Hartford suits Florida businesses seeking personalized agent support and established claims handling expertise, including contractors, professional services and retail operations.

Overall Score 4.60 1 Affordability Score 4.53 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 The Hartford offers general liability coverage in Florida at $89 per month on average. The company shows strong affordability across diverse industries, with competitive rates for construction, professional services and retail businesses.

Its pricing ranks among the most favorable for over 40 business categories, including contractors, cleaning services and healthcare providers.

Data filtered by:AccountantsAccountants $18 2 Florida customers rate The Hartford highest for claims processing and customer service quality, with strong satisfaction in policy management. Customer feedback consistently praises the company's efficient claims resolution and knowledgeable support staff, though digital tools receive lower ratings compared to competitors.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford provides general liability coverage with limits from $300,000 to $2 million per occurrence, offering aggregate limits up to twice that amount. Businesses can enhance financial protection with product liability coverage, broad form contractual liability and data breach protection through a business owner's policy.

The flexible coverage structure allows Florida companies to customize financial protection based on specific industry needs.

ERGO NEXT

Best Florida Commercial General Liability Customer Experience

Average Monthly General Liability Premium

$112These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first in affordability with competitive pricing

Excels in customer service with quick, responsive support

Leading digital experience for seamless online policy management

A- AM Best rating demonstrates solid financial strength

consNewer insurer with limited operating history compared to competitors

Online-only platform lacks local agent support options

ERGO NEXT is a great general liability option for Florida businesses, offering reliable customer service and helpful coverage choices. With an A- rating from AM Best, it provides dependable financial protection that works well for tech companies, contractors and professional service firms.

Florida businesses that prefer a digital-first insurance experience with flexible coverage options will find ERGO NEXT’s platform easy to use and very convenient.

Overall Score 4.55 2 Affordability Score 4.24 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 ERGO NEXT offers general liability coverage at $112 per month, ranking among Florida's most affordable providers. The company shows competitive pricing for dental practices, tech companies and home-based businesses, while also offering cost-effective solutions for automotive, construction and professional service industries.

Data filtered by:AccountantsAccountants $19 3 Customer feedback highlights ERGO NEXT's exceptional digital experience and policy management capabilities in Florida. The company ranks first nationally for customer recommendations and renewal likelihood, demonstrating strong client satisfaction.

While claims processing scores are solid, some customers note room for improvement in response times.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT provides flexible coverage limits up to $2 million per claim and $4 million aggregate for Florida businesses. The company includes contractor E&O insurance and offers specialized endorsements like CG2010 for completed operations coverage.

Businesses can customize their financial protection through various add-ons and policy modifications to match their specific needs.

Cheapest General Liability Insurance Companies in Florida

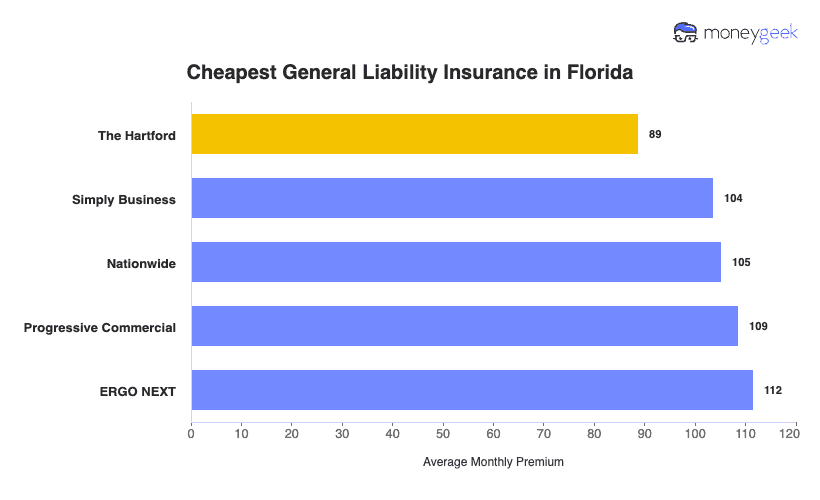

The Hartford provides the cheapest general liability insurance in Florida at $89 per month, saving businesses $22 or 20% compared to the state average. Simply Business and Nationwide also offer affordable coverage options for Florida businesses.

| The Hartford | $89 | $1,064 |

| Simply Business | $104 | $1,244 |

| Nationwide | $105 | $1,262 |

| Progressive Commercial | $109 | $1,302 |

| ERGO NEXT | $112 | $1,339 |

| Coverdash | $112 | $1,343 |

| Thimble | $116 | $1,390 |

| Hiscox | $123 | $1,479 |

| biBERK | $123 | $1,480 |

| Chubb | $129 | $1,544 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Florida by Industry

Based on MoneyGeek's research, these five providers offer the cheapest general liability insurance across Florida industries:

- The Hartford: Ranks as the most affordable provider in 18 industries, leading in diverse sectors like cannabis, electrical work, trucking and pest control.

- Simply Business: Offers the cheapest coverage in 14 industries, excelling with professional services like accountants, lawyers and consultants.

- Thimble: Ties for third place with affordable rates in 12 industries, performing strongest in tech sectors like software, computer programming and creative businesses.

- biBerk: Also covers 12 industries with competitive pricing, focusing on service trades including contractors, veterinary practices and beauty salons.

- Nationwide: Provides cheap coverage across 10 industries, showing particular strength in construction, manufacturing and restaurant businesses.

| Accountants | Simply Business | $16 | $187 |

Average Cost of General Liability Insurance in Florida

Most small businesses in Florida pay around $111 monthly for general liability insurance. The average cost of general liability coverage depends on your industry risk level, company size, location and policy limits.

Manufacturing companies tend to have higher premiums because of greater liability exposure, while accounting firms usually pay less due to lower risk. Sole proprietors generally pay lower rates compared to businesses with employees since they have fewer liability concerns.

Average Cost of General Liability Insurance in Florida by Industry

General liability insurance costs in Florida vary widely by industry, ranging from $18 monthly for drone businesses to $996 for pressure washing companies. Review this table to find typical general liability coverage costs for your specific business type.

| Accountants | $24 | $288 |

| Ad Agency | $38 | $461 |

| Automotive | $58 | $696 |

| Auto Repair | $165 | $1,983 |

| Bakery | $98 | $1,179 |

| Barber | $48 | $578 |

| Beauty Salon | $73 | $872 |

| Bounce House | $76 | $917 |

| Candle | $60 | $717 |

| Cannabis | $73 | $875 |

| Catering | $95 | $1,144 |

| Cleaning | $144 | $1,729 |

| Coffee Shop | $98 | $1,171 |

| Computer Programming | $32 | $379 |

| Computer Repair | $52 | $622 |

| Construction | $191 | $2,289 |

| Consulting | $24 | $286 |

| Contractor | $277 | $3,327 |

| Courier | $213 | $2,551 |

| Daycare | $36 | $429 |

| Dental | $23 | $281 |

| DJ | $28 | $330 |

| Dog Grooming | $69 | $828 |

| Drone | $18 | $218 |

| Ecommerce | $80 | $955 |

| Electrical | $122 | $1,467 |

| Engineering | $43 | $520 |

| Excavation | $507 | $6,078 |

| Florist | $47 | $559 |

| Food | $117 | $1,405 |

| Food Truck | $154 | $1,850 |

| Funeral Home | $66 | $788 |

| Gardening | $122 | $1,466 |

| Handyman | $266 | $3,187 |

| Home-based | $26 | $310 |

| Home-based | $50 | $598 |

| Hospitality | $71 | $851 |

| HVAC | $267 | $3,202 |

| Janitorial | $149 | $1,790 |

| Jewelry | $44 | $525 |

| Junk Removal | $177 | $2,121 |

| Lawn/Landscaping | $131 | $1,569 |

| Lawyers | $25 | $298 |

| Manufacturing | $69 | $834 |

| Marine | $30 | $366 |

| Massage | $104 | $1,251 |

| Mortgage Broker | $25 | $299 |

| Moving | $135 | $1,619 |

| Nonprofit | $39 | $468 |

| Painting | $156 | $1,877 |

| Party Rental | $86 | $1,038 |

| Personal Training | $26 | $312 |

| Pest Control | $35 | $421 |

| Pet | $61 | $732 |

| Pharmacy | $67 | $806 |

| Photography | $26 | $315 |

| Physical Therapy | $120 | $1,437 |

| Plumbing | $393 | $4,719 |

| Pressure Washing | $996 | $11,950 |

| Real Estate | $58 | $694 |

| Restaurant | $158 | $1,892 |

| Retail | $71 | $854 |

| Roofing | $422 | $5,065 |

| Security | $151 | $1,816 |

| Snack Bars | $128 | $1,533 |

| Software | $29 | $343 |

| Spa/Wellness | $116 | $1,393 |

| Speech Therapist | $34 | $408 |

| Startup | $31 | $373 |

| Tech/IT | $29 | $344 |

| Transportation | $41 | $491 |

| Travel | $23 | $272 |

| Tree Service | $141 | $1,694 |

| Trucking | $112 | $1,339 |

| Tutoring | $33 | $395 |

| Veterinary | $49 | $585 |

| Wedding Planning | $30 | $361 |

| Welding | $179 | $2,152 |

| Wholesale | $49 | $583 |

| Window Cleaning | $173 | $2,079 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Florida General Liability Insurance Costs?

Multiple factors determine how much Florida businesses pay for general liability coverage.

Florida's Legal and Regulatory Environment

Florida’s 2023 tort reform law changed how negligence lawsuits are handled for small business owners. House Bill 837 shortened the statute of limitations from four years to two and removed one-way attorney fees that previously encouraged more filings.

Since then, litigation has declined in several sectors and insurers have adjusted some rates in response. These changes can help lower premiums by reducing legal and defense costs.

Florida's Population Density and Urban Concentration

Where you operate your Florida business matters for your general liability rates. Nearly 90% of Floridians live in urban areas, with three-quarters residing within 10 miles of the coast. If you run a Miami storefront, you'll pay more than a similar business in Ocala because urban locations mean more foot traffic, higher slip-and-fall risk and increased crime exposure. More people walking through your door equals more liability exposure in insurers' calculations.

Florida's Rapid Population Growth

Florida's population boom directly impacts your liability exposure. The Orlando, Tampa, and Miami metro areas added over 150,000 new residents between 2022 and 2023 alone. More people moving to your area means more potential customers visiting your business daily. Areas like Polk County and Pasco County are transforming farmland into bustling communities, creating construction activity and infrastructure strain that increases premises liability risks for businesses operating in high-growth zones.

Florida's Construction and Labor Costs

Rising construction costs hit your general liability premiums even if you've never filed a claim. Florida's reconstruction costs jumped 12% from January 2022 to January 2023 due to inflation and supply chain disruptions. Your policy covers property damage you cause to others, so when lumber, drywall, and contractor labor cost more, insurers pay more to settle claims. Higher repair costs mean higher premiums across all industries, not just construction businesses.

How Much General Liability Insurance Do I Need in Florida?

Most Florida businesses aren't legally required to carry general liability insurance, but contractors are the exception. If you hold a contractor's license, the state sets specific requirements for commercial general liability coverage. Even without a legal mandate, you'll likely need a $1 million per occurrence limit with a $2 million aggregate. Your clients and landlord will ask for proof before signing contracts or lease agreements.

$300,000 in public liability coverage and $50,000 in property damage coverage

Your minimums are lower at $100,000 in public liability coverage and $25,000 in property damage coverage

Florida contractors submit a signed affidavit when applying for or renewing their license, confirming they carry the required coverage. The Construction Industry Licensing Board randomly audits contractors by ZIP code to verify compliance, so keeping your policy active matters for your license status.

Note: State insurance requirements update regularly. Check with the Florida Department of Financial Services or a licensed agent to confirm the latest requirements before purchasing coverage.

How to Choose the Best General Liability Insurance in Florida

Getting business insurance in Florida means finding coverage that meets both your contract requirements and your actual liability exposure. The right policy protects you from third-party claims without paying for coverage you don't need.

- 1Determine Coverage Needs

Most Florida businesses don’t have state-mandated general liability requirements, but your clients and landlord likely do. Standard policies run from $500,000 to $2 million per occurrence, though some Florida cities set their own minimums for occupational licenses. Check your contracts and call your local city or county offices to understand what coverage you actually need before shopping.

- 2Prepare Business Information

Florida insurers calculate your premium based on your industry classification, revenue, employee count and physical location. Urban businesses in Miami or Tampa pay more than rural operations due to higher claim frequency. Have your EIN, business registration and recent tax returns ready when requesting quotes to get accurate pricing from the start.

- 3Compare Multiple Quotes

Request at least three quotes from Florida-licensed insurers since business insurance costs can vary by hundreds of dollars annually for identical coverage. Pay attention to whether defense costs eat into your policy limit or sit outside it. The cost of your coverage depends heavily on your location within Florida and your specific industry risk profile.

- 4Look Beyond Price

Cheap business insurance is a good thing, but you can’t make it the only basis for choosing a policy. Read the exclusions section carefully since standard policies won't cover professional errors, pollution or employee injuries. Understanding what's not covered prevents expensive surprises when you actually need to use your policy.

- 5Verify Insurer Credentials

Check any insurer's license status through the Florida Department of Financial Services online database at MyFloridaCFO.com before buying. Review AM Best financial ratings and complaint ratios since you want an insurer with strong reserves when large claims hit.

These steps help you find the best insurance for your business, especially since Florida’s market has seen multiple insolvencies in recent years, making financial stability checks essential.

- 6Ask About Discounts

Florida insurers cut premiums by 10% to 25% when you bundle general liability with commercial property or auto coverage. Installing safety systems, maintaining claims-free records or paying annually instead of monthly can reduce your costs. Ask specifically about bundling options since combining policies almost always saves money in Florida's competitive insurance market.

- 7Obtain Certificate of Insurance

Most Florida clients and landlords require a certificate of insurance before you start work or sign a lease. Some insurers provide digital certificates instantly through online portals, while others take up to 48 hours. Keep your agent's contact information accessible for urgent certificate requests that could otherwise delay your projects.

- 8Review Coverage Annually

Florida businesses should reassess coverage 60 to 90 days before renewal, especially after adding employees or expanding services. Compare new quotes annually since Florida's improving insurance market means rates dropped for many businesses in 2024 and 2025. Adjusting your coverage limits as your business grows prevents both overpaying and dangerous coverage gaps.

Top General Liability Insurance in Florida: Bottom Line

Finding quality general liability insurance in Florida starts with understanding your specific business needs and thoroughly researching available options. The Hartford, ERGO NEXT and Nationwide represent strong choices in the market, but your ideal provider depends on your industry, business size, and budget constraints. Compare quotes from multiple insurers and verify their licensing credentials before making your final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Actuarial Review Magazine. "The Verdict on Florida's Tort Reforms." Accessed February 13, 2026.

- Executive Office of the Governor. "Governor Ron DeSantis Signs Comprehensive Legal Reforms into Law." Accessed February 13, 2026.

- Florida Office of Insurance Regulation. "Florida Office of Insurance Regulation Announces Lower Auto Insurance Rates Thanks to Florida's Insurance Reforms." Accessed February 13, 2026.

- Milliman. "How Recent Tort Reforms are Shaping Insurance Claims." Accessed February 13, 2026.

- The Florida Senate. "House Bill 837 (2023)." Accessed February 13, 2026.

- U.S. Census Bureau. "Sunshine State Home to Metro Areas Among Top 10 U.S. Population Gainers From 2022 to 2023." Accessed February 13, 2026.

- University of Florida, Bureau of Economic and Business Research. "Florida Estimates of Population 2024." Accessed February 13, 2026.