We researched the best business insurance options to answer your most common questions about general liability coverage in Georgia based on our analysis:

Best General Liability Insurance in Georgia

The Hartford is the best and cheapest general liability insurance provider in Georgia, with rates starting at $83 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: January 29, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Georgia: Fast Answers

Which company offers the best general liability insurance in Georgia?

The Hartford is the best general liability insurance company in Georgia with a 4.63 overall score. It provides the most affordable coverage at $83 per month and delivers reliable claims handling. ERGO NEXT takes second place with a 4.55 score, featuring an excellent digital platform and strong customer support for $105 per month.

Who offers the cheapest general liability insurance in Georgia?

The cheapest general liability insurance companies in Georgia are:

- The Hartford: $83 per month

- Simply Business: $97 per month

- Nationwide: $99 per month

- Progressive: $102 per month

- ERGO NEXT: $105 per month

Do Georgia businesses legally need general liability insurance?

Georgia doesn't legally require general liability insurance for most businesses statewide. However, certain licensed professionals like contractors and electricians must carry minimum coverage amounts. Local municipalities may have their own requirements. Even when not legally mandated, landlords and clients usually demand proof of coverage before signing contracts.

How much does general liability insurance cost in Georgia?

General liability insurance costs between $13 and $934 per month for small Georgia businesses with two employees. The lowest rates start at $13 per month in industries like dental and drone services, while pressure washing businesses land at the highest cost at $934 per month. Your actual premium depends on your industry, location, coverage limits and business size.

Best General Liability Insurance Companies in Georgia

The Hartford is our top choice for general liability insurance in Georgia, offering small businesses an excellent balance of affordability and customer service. ERGO NEXT also performs well, excelling in customer support for business owners. Nationwide rounds out the strong options with reliable stability and competitive pricing for general liability coverage.

| The Hartford | 4.63 | $83 |

| ERGO NEXT | 4.55 | $105 |

| Nationwide | 4.51 | $99 |

| Simply Business | 4.47 | $97 |

| Coverdash | 4.36 | $105 |

| Thimble | 4.35 | $109 |

| biBERK | 4.28 | $116 |

| Progressive Commercial | 4.26 | $102 |

| Chubb | 4.25 | $121 |

| Hiscox | 4.17 | $116 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Georgia General Liability Insurer

Select your industry and state to get a customized Georgia general liability insurance quote.

General liability insurance covers customer injuries and property damage for your Georgia business, but most companies need broader financial protection. Explore these related guides for complete coverage:

Best Georgia General Liability Insurance Reviews

Finding the right general liability insurance in Georgia requires looking beyond just affordable rates. Coverage quality and customer service matter too. Our research identified the top business insurers in the state based on these important factors.

Best Georgia General Liability Insurer

Average Monthly General Liability Premium

$83These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Handles claims quickly and efficiently with top state performance

Provides exceptional customer service with highly responsive support

Maintains A+ AM Best rating indicating strong financial stability

Ranks first overall for customer satisfaction in the state

consOffers limited online tools compared to digital-first competitors

Requires working with agents rather than self-service purchasing options

The Hartford leads Georgia's general liability market with exceptional customer service and strong financial stability, backed by an A+ rating from AM Best. Its comprehensive coverage and efficient claims processing make it suitable for construction, professional services and retail businesses in Georgia. The Hartford excels in serving business owners who value personalized support and reliable claims handling.

Overall Score 4.63 1 Affordability Score 4.59 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 The Hartford offers general liability coverage in Georgia at $83 per month, ranking among the state's most cost-effective providers. It delivers competitive rates for construction, electrical work and professional services, while maintaining strong pricing for retail and cleaning businesses.

Data filtered by:AccountantsAccountants $17 2 The Hartford excels in customer service and claims processing, earning top rankings in Georgia for both categories. Customer feedback consistently highlights the company's efficient claim resolutions and knowledgeable support staff, though digital services show room for improvement.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford provides coverage limits from $300,000 to $2 million per occurrence, with aggregate limits up to double that amount. Businesses can enhance protection with product liability coverage and broad form contractual liability options.

The company offers flexible bundling through business owner's policies, including data breach protection, making it a comprehensive choice for Georgia businesses.

Best Georgia Commercial General Liability Customer Experience

Average Monthly General Liability Premium

$105These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first in affordability, offering competitive rates for businesses

Delivers top digital experience with streamlined online tools and processes

Maintains A- AM Best rating demonstrating strong financial stability

Leads in policy management, making coverage changes simple and efficient

consNewer insurer with limited operating history compared to established competitors

Operates entirely online without local agents for in-person support

Claims processing and customer service rank lower than digital capabilities

ERGO NEXT is a strong choice in Georgia for exceptional customer service and comprehensive coverage options, backed by an A- financial strength rating from AM Best. Its digital-first approach and flexible policies make it ideal for tech-savvy business owners and contractors seeking efficient policy management.

The provider excels in serving industries like tech, construction and professional services with customizable coverage solutions.

Overall Score 4.55 2 Affordability Score 4.26 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 ERGO NEXT offers general liability coverage at $105 per month in Georgia, with competitive rates for dental, tech and trucking industries. The provider ranks among the most affordable options for over 40 business categories, including automotive, construction and professional services sectors.

Data filtered by:AccountantsAccountants $18 3 Georgia customers consistently praise ERGO NEXT's digital experience, policy management capabilities and likelihood of recommending the provider to others. The company's online platform and automated claims process receive high marks for efficiency, though some customers note their preference for more traditional service channels.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT provides general liability coverage with limits up to $2 million per occurrence and $4 million aggregate. Policies include contractor E&O insurance and optional endorsements for completed operations coverage through CG2010 forms. The provider offers flexible terms suited for contract-based businesses, with instant online policy customization and certificate generation.

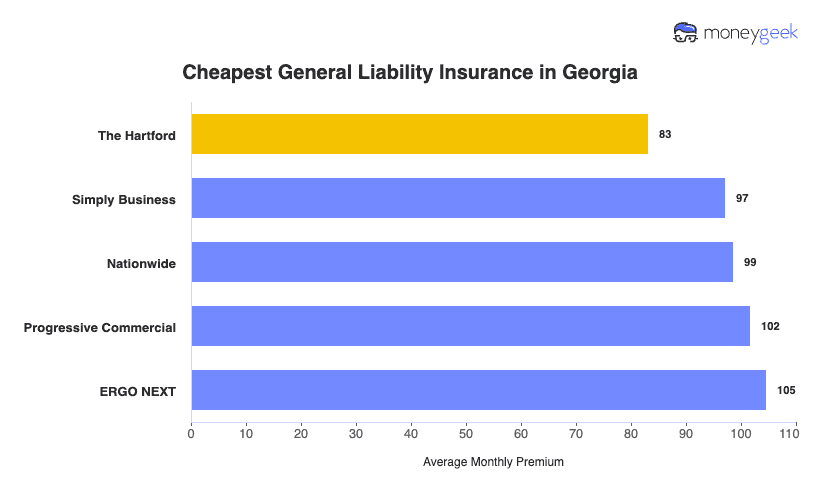

Cheapest General Liability Insurance Companies in Georgia

The Hartford offers the cheapest general liability insurance in Georgia at $83 per month, saving businesses $21 or 20% compared to the state average. Simply Business and Nationwide also provide affordable coverage options for Georgia businesses.

| The Hartford | $83 | $997 |

| Simply Business | $97 | $1,167 |

| Nationwide | $99 | $1,183 |

| Progressive Commercial | $102 | $1,220 |

| ERGO NEXT | $105 | $1,256 |

| Coverdash | $105 | $1,260 |

| Thimble | $109 | $1,306 |

| Hiscox | $116 | $1,390 |

| biBERK | $116 | $1,391 |

| Chubb | $121 | $1,449 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Georgia by Industry

MoneyGeek's research identifies the cheapest general liability insurance providers across industries in Georgia.

- The Hartford wins affordability in 21 of 81 industries statewide. The company performs strongest in construction, electrical work, pest control and food truck businesses.

- Thimble offers the most affordable coverage in 15 industries for Georgia companies. This provider excels in service-based sectors including cleaning, HVAC, roofing and software development.

- Simply Business and biBerk each lead 10 industries for cheap general liability plans. Simply Business dominates professional services like accounting, legal and consulting, while biBerk specializes in contractors, engineering and hospitality businesses.

- ERGO NEXT and Nationwide tie with affordability wins in seven Georgia industries each. ERGO NEXT shows strong results for tech, photography and dental practices, while Nationwide leads in manufacturing, restaurants and tree service companies.

- Coverdash rounds out the top five with the cheapest rates in four industries, including auto repair and wholesale businesses.

| Accountants | Simply Business | $15 | $176 |

Average Cost of General Liability Insurance in Georgia

Small businesses in Georgia often pay $104 monthly for general liability insurance. The average cost of general liability coverage depends on your industry, business size, location and coverage limits. Manufacturing companies tend to see higher premiums because of increased risk exposure, while accounting firms pay less given their lower claim potential. Sole proprietors generally see lower costs compared to businesses with employees since they have reduced liability exposure.

Average Cost of General Liability Insurance in Georgia by Industry

General liability insurance costs in Georgia vary widely by industry, ranging from $17 monthly for drone businesses to $934 for pressure washing companies. These rates reflect the different risk levels across business types. Review this table to find typical general liability coverage costs for your specific industry.

| Accountants | $22 | $270 |

| Ad Agency | $36 | $433 |

| Automotive | $54 | $653 |

| Auto Repair | $155 | $1,861 |

| Bakery | $92 | $1,107 |

| Barber | $45 | $543 |

| Beauty Salon | $68 | $818 |

| Bounce House | $72 | $860 |

| Candle | $56 | $673 |

| Cannabis | $68 | $821 |

| Catering | $89 | $1,074 |

| Cleaning | $135 | $1,622 |

| Coffee Shop | $92 | $1,099 |

| Computer Programming | $30 | $356 |

| Computer Repair | $49 | $583 |

| Construction | $179 | $2,148 |

| Consulting | $22 | $269 |

| Contractor | $260 | $3,122 |

| Courier | $199 | $2,394 |

| Daycare | $34 | $403 |

| Dental | $22 | $263 |

| DJ | $26 | $310 |

| Dog Grooming | $65 | $777 |

| Drone | $17 | $204 |

| Ecommerce | $75 | $896 |

| Electrical | $115 | $1,377 |

| Engineering | $41 | $488 |

| Excavation | $475 | $5,704 |

| Florist | $44 | $524 |

| Food | $110 | $1,319 |

| Food Truck | $145 | $1,736 |

| Funeral Home | $62 | $739 |

| Gardening | $115 | $1,376 |

| Handyman | $249 | $2,990 |

| Home-based | $24 | $291 |

| Home-based | $47 | $561 |

| Hospitality | $67 | $798 |

| HVAC | $250 | $3,005 |

| Janitorial | $140 | $1,679 |

| Jewelry | $41 | $493 |

| Junk Removal | $166 | $1,990 |

| Lawn/Landscaping | $123 | $1,472 |

| Lawyers | $23 | $279 |

| Manufacturing | $65 | $783 |

| Marine | $29 | $343 |

| Massage | $98 | $1,174 |

| Mortgage Broker | $23 | $280 |

| Moving | $127 | $1,520 |

| Nonprofit | $37 | $440 |

| Painting | $147 | $1,761 |

| Party Rental | $81 | $973 |

| Personal Training | $24 | $292 |

| Pest Control | $33 | $395 |

| Pet | $57 | $687 |

| Pharmacy | $63 | $757 |

| Photography | $25 | $296 |

| Physical Therapy | $112 | $1,350 |

| Plumbing | $369 | $4,428 |

| Pressure Washing | $934 | $11,213 |

| Real Estate | $54 | $651 |

| Restaurant | $148 | $1,776 |

| Retail | $67 | $801 |

| Roofing | $396 | $4,753 |

| Security | $142 | $1,704 |

| Snack Bars | $120 | $1,438 |

| Software | $27 | $322 |

| Spa/Wellness | $109 | $1,307 |

| Speech Therapist | $32 | $383 |

| Startup | $29 | $350 |

| Tech/IT | $27 | $323 |

| Transportation | $38 | $461 |

| Travel | $21 | $256 |

| Tree Service | $132 | $1,590 |

| Trucking | $105 | $1,257 |

| Tutoring | $31 | $371 |

| Veterinary | $46 | $549 |

| Wedding Planning | $28 | $339 |

| Welding | $168 | $2,020 |

| Wholesale | $46 | $547 |

| Window Cleaning | $163 | $1,951 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Georgia General Liability Insurance Costs?

Many factors affect how much Georgia businesses pay for general liability insurance coverage.

Georgia's Legal Climate and Verdict Trends

Georgia earned the "#1 Judicial Hellhole" ranking in 2022 due to massive jury awards exceeding $10 million. Premises liability cases account for 26% of these verdicts. A CVS store received a $43 million verdict after a parking lot shooting, while a trucking company was ordered to pay $280 million following a 45-minute jury deliberation.

These enormous payouts drain general liability policy limits and drive up costs for all Georgia businesses. Small business owners collectively shoulder about $1,370 annually in added insurance expenses.

Georgia's Tort Reform Legislation

Governor Kemp signed major tort reform legislation in April 2025 to address skyrocketing insurance costs. The new laws restrict tactics that inflate jury awards, split trials into liability and damages phases, and tighten standards for negligent security claims.

Georgia's Insurance Commissioner expects rates to drop 3% to 5% as litigation costs decline. While insurers haven't guaranteed lower premiums, the reforms aim to stabilize the market and make coverage more predictable for small businesses across the state.

Metro Atlanta's Business Environment

Metro Atlanta's 5.6 million residents create concentrated liability exposure that directly impacts your premiums. Businesses in high-crime neighborhoods pay substantially more due to premises liability lawsuits and property crimes.

One apartment complex saw costs jump from $50 to over $1,500 per unit, with assault and battery coverage becoming unavailable. Major retailers avoid investing in certain areas, and insurers decline coverage or add hefty surcharges when you lack proper security measures like lighting and surveillance cameras.

Georgia's Premises Liability Standards

A 2023 Georgia Supreme Court decision expanded when property owners can be held liable for crimes on their premises. Courts now use a "totality of circumstances" approach rather than requiring proof of similar past incidents.

Your business carries risk simply by operating in a high-crime area. Insurers carefully evaluate your specific location's crime statistics, nearby incident history, and your security investments when calculating your general liability premium. Businesses with customer parking lots or public gathering spaces receive closer scrutiny from insurers.

How Much General Liability Insurance Do I Need in Georgia?

Most Georgia businesses aren't legally required to carry general liability insurance. The state mandates coverage only for specific licensed professionals. That said, you'll likely need it anyway. Landlords won't approve your commercial lease without proof of coverage, and clients usually demand certificates of insurance before signing contracts or awarding projects.

Here are the requirements for commercial general liability insurance by profession:

- Class I contractors need $100,000 per occurrence and $300,000 annual aggregate

- Class II contractors must maintain $300,000 per occurrence with $600,000 annual aggregate

- Residential Basic contractors need $500,000 per occurrence

- Residential Light Commercial contractors must maintain $300,000 per occurrence

- General Contractor licenses require $500,000 per occurrence with no project value limits

- General Contractor Limited Tier licenses require $500,000 per occurrence for projects under $1 million

Licensed electricians and electrical sign contractors must both carry $300,000 per occurrence with $600,000 annual aggregate

Coverage requirements vary by license classification

Must have $500,000 per occurrence and $1 million annual aggregate to maintain Georgia registration

Coverage requirements vary by license classification:

Most small businesses in Georgia opt for $1 million per occurrence and $2 million aggregate limits. This coverage level meets typical contractual demands while providing solid financial protection if someone files a claim against your business. Cities and counties can set their own insurance requirements beyond state mandates, so contact your local government offices to confirm what your specific location requires before you start operations.

Note: State insurance requirements change regularly. Check current requirements with the Georgia Office of Insurance and Safety Fire Commissioner or contact a licensed insurance agent for updated information.

How to Choose the Best General Liability Insurance in Georgia

Balance coverage requirements and budget when choosing general liability insurance in Georgia. Getting business insurance starts with understanding your risk exposure, then combining general liability with other policies for complete financial protection against accidents and property damage claims.

- 1Assess Coverage Needs

Georgia doesn't legally require general liability insurance for most businesses, though licensed electricians, HVAC contractors, fire safety companies and general contractors must meet state-mandated minimums for business insurance coverage.

Standard coverage limits range between $500,000 and $2 million per occurrence. Review your contracts and check with local Atlanta, Savannah or Columbus government offices, as cities and counties can set their own insurance requirements beyond state mandates.

- 2Prepare Business Information

Gather your revenue figures, employee count, physical location and business classification before requesting quotes. Georgia insurers calculate premiums based on industry risk, region and scale of operations. Prepare your EIN, business registration with the Georgia Secretary of State and tax permits to streamline the application process.

- 3Compare Multiple Quotes

Get quotes from at least three insurers licensed in Georgia since business insurance costs can vary by hundreds of dollars annually between carriers. Compare deductibles, coverage limits and whether legal defense costs count toward or sit outside your policy limits. Georgia businesses average $42 to $121 monthly for general liability coverage depending on industry and company size.

- 4Evaluate Policy Details

Cheap business insurance often excludes critical coverage that Georgia businesses need most. Verify that legal defense costs sit outside your policy limits rather than depleting your coverage, and identify gaps like professional liability or pollution coverage that require separate Georgia-licensed policies.

- 5Verify Insurer Credentials

Check insurer legitimacy through the Georgia Office of Insurance and Safety Fire Commissioner's company search portal and review AM Best ratings for financial stability. Georgia complaint ratios reveal insurers with poor claims-handling reputations. Strong financial backing matters when large claims arise.

- 6Explore Available Discounts

Georgia insurers offer discounts for bundled policies, safety programs, claims-free histories and annual payments instead of monthly installments. Combining general liability with commercial property insurance can lower your cost of coverage by 10% to 25%. Implementing workplace safety training and maintaining clean claim records reduce risk and premiums.

- 7Obtain Coverage Certificate

Georgia clients, landlords and commercial contractors demand certificates of insurance before finalizing contracts or lease agreements. Most insurers email digital certificates within minutes to a few business days, so maintain your agent's contact details for time-sensitive requests.

- 8Schedule Annual Reviews

Reassess coverage yearly, especially after hiring employees, expanding services or increasing revenue in Georgia's growing business climate. Compare quotes 60 to 90 days before renewal to find better rates or adjust limits. Maintaining up-to-date coverage helps avoid compliance gaps with Georgia licensing requirements.

Top General Liability Insurance in Georgia: Bottom Line

Finding the right general liability insurance in Georgia starts with understanding your specific business needs and budget. The Hartford, ERGO NEXT, and Nationwide lead the market, but your best choice depends on your industry, company size and coverage requirements. Compare quotes from multiple insurers and verify their credentials before making your final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- American Tort Reform Foundation. "Judicial Hellholes 2024-2025." Accessed February 7, 2026.

- Georgia General Assembly. "Senate Bill 68." Accessed February 7, 2026.

- Georgia Office of the Commissioner of Insurance and Safety Fire. "HB 1114 - Data Analysis for Tort Reform Act Report." Accessed February 7, 2026.

- Supreme Court of Georgia. "Georgia CVS Pharmacy, LLC v. Carmichael, No. S22G0527." Accessed February 7, 2026.

- U.S. Chamber of Commerce Institute for Legal Reform. "Nuclear Verdicts Trends, Causes, and Solutions." Accessed February 7, 2026.