We analyzed business insurance options across Michigan to answer your questions about general liability coverage. Our research gives you the information you need to choose the right policy:

Best General Liability Insurance in Michigan

ERGO NEXT tops Michigan general liability insurance while The Hartford offers the cheapest rates starting at $77 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Michigan: Fast Answers

Which company offers the best general liability insurance in Michigan?

ERGO NEXT leads as the best general liability insurance company in Michigan with a 4.57 overall score, offering strong digital tools and streamlined claims processing at $98 per month. The Hartford follows closely with a 4.56 rating, providing affordable coverage and reliable customer service for $77 per month.

Who offers the cheapest general liability insurance in Michigan?

The cheapest general liability insurance companies in Michigan are:

- The Hartford: $77 per month

- Simply Business: $91 per month

- Nationwide: $92 per month

- Progressive: $95 per month

- ERGO NEXT: $98 per month

Do Michigan businesses legally need general liability insurance?

Michigan doesn't legally require most businesses to carry general liability insurance at the state level. However, certain licensed professionals like contractors and electricians may need coverage to maintain their licenses. Local municipalities can impose their own requirements. Even when not mandated, landlords and clients often require proof of coverage before signing contracts.

How much does general liability insurance cost in Michigan?

General liability insurance costs between $16 and $871 per month for small Michigan businesses with two employees. The drone industry often sees the lowest rates at $16 per month, while pressure washing businesses pay the highest at $871 per month. Your actual premium depends on your industry, location, coverage limits, and business size.

Best General Liability Insurance Companies in Michigan

ERGO NEXT is our top choice for general liability insurance in Michigan, offering strong customer service and coverage options for small businesses. The Hartford and Nationwide also perform well, with The Hartford providing excellent affordability and stability, while Nationwide delivers reliable customer service and financial strength. Together, these providers give Michigan small business owners solid options to protect their operations.

| ERGO NEXT | 4.57 | $98 |

| The Hartford | 4.56 | $77 |

| Nationwide | 4.53 | $92 |

| Simply Business | 4.48 | $91 |

| Coverdash | 4.38 | $98 |

| Thimble | 4.35 | $102 |

| biBERK | 4.31 | $108 |

| Chubb | 4.29 | $113 |

| Progressive Commercial | 4.28 | $95 |

| Hiscox | 4.20 | $108 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Michigan General Liability Insurer

Select your industry and state to get a customized Michigan general liability insurance quote.

General liability insurance shields Michigan businesses from customer injuries and property damage claims, but it won't cover every risk you might encounter. Explore these additional coverage options to protect your business completely:

Best Michigan General Liability Insurance Reviews

Finding the right general liability insurance provider in Michigan requires looking beyond just affordable rates. Coverage quality and customer service matter too. MoneyGeek's research identified the top business insurers in the state.

Best Michigan General Liability Insurer

Average Monthly General Liability Premium

$98These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first for digital tools and online usability

Makes policy management fast and easy

Holds an A- AM Best rating for financial strength

Offers competitive general liability pricing

consClaims handling ranks fourth, which may slow resolutions

Shorter operating history than long-established insurers

Online-only model with no local agent support

ERGO NEXT leads Michigan’s general liability market with a strong digital platform and flexible coverage options. The insurer earns an A- AM Best rating and ranks first for ease of use, making it a good fit for businesses that prefer managing policies online. ERGO NEXT serves tech companies, professional services, and contractors that want straightforward coverage with minimal friction.

Overall Score 4.57 1 Affordability Score 4.31 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 In Michigan, ERGO NEXT charges an average of $98 per month for general liability coverage, placing it among the more affordable providers statewide. The company offers favorable pricing for tech firms, professional services, and home-based businesses. Contractors and retail operations also benefit from competitive rates across standard coverage levels.

Data filtered by:AccountantsAccountants $16 3 Michigan businesses give ERGO NEXT high marks for its online platform and policy tools. The system makes it easy to access documents, manage coverage, and handle routine tasks without delays. Claims handling ranks below other service categories, but customer satisfaction remains strong overall.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT offers general liability limits up to $2 million per occurrence and $4 million aggregate. Coverage includes contractor E&O and endorsements such as CG2010 for completed operations. Businesses can adjust coverage through digital tools, which works well for contract-based operations that need fast policy updates.

Best Michigan Commercial General Liability: Runner-Up

Average Monthly General Liability Premium

$77These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Processes claims quickly with top-ranked handling

Delivers responsive customer support ranked first statewide

Holds an A+ AM Best rating for financial strength

Earns the highest overall customer satisfaction among Michigan providers

consRequires working with an agent for most policy purchases

Offers fewer digital tools than online-first competitors

The Hartford remains one of Michigan’s most established general liability insurers, backed by strong customer service and an A+ AM Best rating. The company performs especially well in claims handling and support, which appeals to business owners who prefer working directly with agents. Its coverage structure suits service-based businesses, contractors, and professional firms that value experience, stability and hands-on guidance.

Overall Score 4.56 2 Affordability Score 4.44 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 Average general liability pricing runs $77 per month, placing the provider among Michigan’s more affordable options. Construction businesses, cleaning services, and professional firms see favorable rates. Retail, manufacturing and healthcare operations also benefit from competitive pricing.

Data filtered by:AccountantsAccountants $16 2 Michigan businesses consistently rate The Hartford highly for claims handling and customer support. Feedback points to efficient claims resolution and knowledgeable representatives who guide policyholders through the process. While the digital experience lags behind newer insurers, the traditional service model continues to deliver dependable support.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford offers general liability limits ranging from $300,000 to $2 million per occurrence, with aggregate limits up to double that amount. Businesses can add product liability and broad form contractual liability coverage. The insurer also allows bundling with business owner policies that include data breach protection, giving Michigan companies flexible ways to build broader coverage.

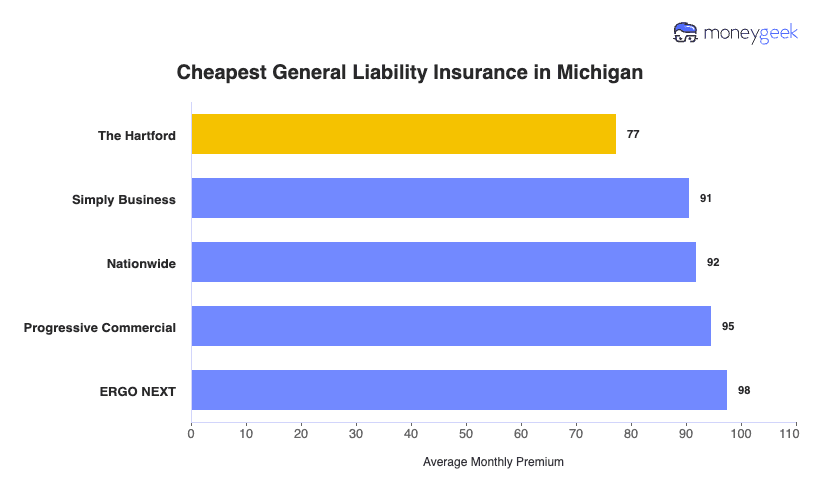

Cheapest General Liability Insurance Companies in Michigan

The Hartford offers the cheapest general liability insurance in Michigan at $77 per month, saving businesses $20 or 20% compared to the state average. Simply Business and Nationwide also provide affordable coverage options for Michigan businesses.

| The Hartford | $77 | $928 |

| Simply Business | $91 | $1,088 |

| Nationwide | $92 | $1,102 |

| Progressive Commercial | $95 | $1,136 |

| ERGO NEXT | $98 | $1,171 |

| Coverdash | $98 | $1,175 |

| Thimble | $102 | $1,219 |

| Hiscox | $108 | $1,297 |

| biBERK | $108 | $1,299 |

| Chubb | $113 | $1,350 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Michigan by Industry

MoneyGeek's research identifies the most affordable general liability insurance providers across industries in Michigan.

- The Hartford dominates with the cheapest rates in 23 industries, excelling in construction, cleaning, food trucks and transportation sectors.

- Simply Business offers affordable coverage in 11 industries and performs well for professional services like accounting, consulting, legal and software companies.

- Thimble ranks as the cheapest provider for 10 industries, focusing on service businesses including barbers, coffee shops, HVAC and tutoring.

- biBerk leads affordability in nine industries, performing well for contractors, engineering firms, catering and handyman services.

- ERGO NEXT and Progressive each win seven industries for cheap rates. ERGO NEXT excels in dental, photography and tech sectors, while Progressive leads in retail, beauty salons and food businesses.

| Accountants | Simply Business | $14 | $164 |

Average Cost of General Liability Insurance in Michigan

Most small businesses in Michigan pay around $97 monthly for general liability insurance. Average general liability coverage costs change based on your industry risk level, business size, location and policy limits.

Businesses in manufacturing or roofing often pay higher premiums due to increased injury risks. Meanwhile, accounting firms and other professional services usually pay less because they have lower claim exposure. Sole proprietors generally pay less than companies with multiple employees since they have fewer liability exposures.

Average Cost of General Liability Insurance in Michigan by Industry

General liability insurance in Michigan costs between $16 monthly for drone businesses and $871 for pressure washing companies. This wide range reflects different risk levels across industries. Review this table to find typical general liability coverage costs for your specific business type.

| Accountants | $21 | $252 |

| Ad Agency | $34 | $404 |

| Automotive | $51 | $609 |

| Auto Repair | $145 | $1,735 |

| Bakery | $86 | $1,032 |

| Barber | $42 | $506 |

| Beauty Salon | $64 | $763 |

| Bounce House | $67 | $802 |

| Candle | $52 | $627 |

| Cannabis | $64 | $765 |

| Catering | $83 | $1,001 |

| Cleaning | $126 | $1,513 |

| Coffee Shop | $85 | $1,025 |

| Computer Programming | $28 | $332 |

| Computer Repair | $45 | $544 |

| Construction | $167 | $2,002 |

| Consulting | $21 | $250 |

| Contractor | $243 | $2,910 |

| Courier | $186 | $2,232 |

| Daycare | $31 | $376 |

| Dental | $20 | $245 |

| DJ | $24 | $289 |

| Dog Grooming | $60 | $725 |

| Drone | $16 | $190 |

| Ecommerce | $70 | $836 |

| Electrical | $107 | $1,284 |

| Engineering | $38 | $455 |

| Excavation | $443 | $5,317 |

| Florist | $41 | $489 |

| Food | $102 | $1,229 |

| Food Truck | $135 | $1,619 |

| Funeral Home | $57 | $689 |

| Gardening | $107 | $1,283 |

| Handyman | $232 | $2,788 |

| Home-based | $23 | $272 |

| Home-based | $44 | $523 |

| Hospitality | $62 | $745 |

| HVAC | $233 | $2,801 |

| Janitorial | $131 | $1,566 |

| Jewelry | $38 | $460 |

| Junk Removal | $155 | $1,855 |

| Lawn/Landscaping | $114 | $1,373 |

| Lawyers | $22 | $260 |

| Manufacturing | $61 | $730 |

| Marine | $27 | $320 |

| Massage | $91 | $1,094 |

| Mortgage Broker | $22 | $261 |

| Moving | $118 | $1,417 |

| Nonprofit | $34 | $410 |

| Painting | $137 | $1,642 |

| Party Rental | $76 | $908 |

| Personal Training | $23 | $273 |

| Pest Control | $31 | $368 |

| Pet | $53 | $640 |

| Pharmacy | $59 | $706 |

| Photography | $23 | $276 |

| Physical Therapy | $105 | $1,260 |

| Plumbing | $344 | $4,128 |

| Pressure Washing | $871 | $10,453 |

| Real Estate | $51 | $607 |

| Restaurant | $138 | $1,656 |

| Retail | $62 | $747 |

| Roofing | $369 | $4,431 |

| Security | $132 | $1,588 |

| Snack Bars | $112 | $1,341 |

| Software | $25 | $301 |

| Spa/Wellness | $102 | $1,219 |

| Speech Therapist | $30 | $356 |

| Startup | $27 | $327 |

| Tech/IT | $25 | $301 |

| Transportation | $36 | $430 |

| Travel | $20 | $238 |

| Tree Service | $124 | $1,482 |

| Trucking | $98 | $1,171 |

| Tutoring | $29 | $346 |

| Veterinary | $43 | $512 |

| Wedding Planning | $26 | $317 |

| Welding | $157 | $1,883 |

| Wholesale | $43 | $510 |

| Window Cleaning | $152 | $1,819 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Michigan General Liability Insurance Costs?

Many factors affect general liability insurance costs for Michigan businesses.

Michigan's Weather and Geographic Risks

Michigan's severe winter weather creates constant slip-and-fall exposure from November through March, when ice and snow blanket your sidewalks and parking lots. Storms bring 60 to 80 mph winds that topple trees onto customer vehicles and hurl debris across business property. Lakefront operations near the Great Lakes deal with coastal flooding and erosion risks. Detroit and Grand Rapids businesses pay more because medical treatment and legal settlements cost more in urban counties than rural Michigan communities.

Michigan's Legal and Regulatory Landscape

Michigan courts eliminated the "open and obvious" defense in 2023, stripping away your ability to dismiss slip-and-fall claims by arguing hazards were visible. General liability insurers now settle cases they previously won in court, pushing your premiums higher. State law also sets mandatory coverage floors for certain trades. Licensed electricians must carry $500,000 per occurrence with completed operations protection, while cannabis businesses need $100,000 product liability minimums to operate legally. These requirements prevent bare-bones coverage that would leave your business exposed.

Michigan's Fraud and Medical Cost Pressures

Michigan logged 3,789 insurance fraud reports last year, including staged falls and inflated injury claims that drive up everyone's premiums. Medical costs hit general liability rates even harder. Michigan health plans jumped 20% to 26% in 2025, and your policy pays those bills when customers get injured. Emergency room visits and specialist care cost substantially more now. When insurers pay 20% more per claim, they pass increases directly to your business through higher premiums.

Michigan's High-Risk Industry Concentration

Michigan's 103,531 construction businesses create a high-risk general liability insurance market that affects your rates regardless of industry. Construction work produces frequent third-party injuries from falling materials, equipment accidents, property damage to neighboring buildings, and debris-related claims.

Contractors also carry completed operations exposure where defective work triggers claims years after job completion. Professional and technical service firms add 108,656 more businesses with specialized risks. This concentration pulls Michigan's overall market pricing upward, even when your specific business operates safely.

How Much General Liability Insurance Do I Need in Michigan?

Most Michigan businesses do not need general liability insurance under state law. Specialty sign contractors must show proof that they meet the requirements for commercial general liability to keep their licenses active. Other insurance and licensing rules vary by city and industry.

Many businesses carry $1 million per occurrence and $2 million aggregate coverage. Clients and property owners often require proof of insurance before approving contracts, and landlords commonly include coverage requirements in lease agreements. Choose limits that satisfy contract terms and protect against liability claims.

Note: Insurance requirements change regularly. Check current rules with the Michigan Department of Insurance or speak with a licensed insurance agent for the latest information.

How to Choose the Best General Liability Insurance in Michigan

Michigan small businesses balance coverage requirements with budget constraints when getting business insurance. Compare general liability policies by reviewing coverage limits, exclusions and costs specific to your industry.

- 1Determine Coverage Needs

Specialty sign contractors in Michigan must provide proof of public liability insurance to maintain their licenses, though most businesses have no state-level requirements. Many Michigan business owners choose $1 million per occurrence and $2 million aggregate limits for their business insurance coverage. Review your client contracts and any industry licensing rules to determine the limits that fit your needs.

- 2Prepare Business Information

You'll need your annual revenue, employee count, business location and classification code when requesting Michigan quotes. Urban businesses in Detroit or Grand Rapids pay higher premiums than rural operations due to increased risk exposure. Have your EIN, business registration and tax permits ready to streamline the quoting process.

- 3Compare Multiple Quotes

Request quotes from at least three Michigan-licensed insurers, as annual premiums can differ by hundreds of dollars between providers. Review how each policy handles defense costs since some count them toward your limits while others cover them separately. Comparing business insurance costs across multiple insurers helps you find the best value for your coverage needs.

- 4Look Beyond Price

Affordable business insurance isn't always the best choice if it leaves gaps in your coverage. Read the exclusions carefully since professional errors, pollution and employee injuries need separate policies beyond general liability. Check whether defense costs reduce your policy limits or come as additional coverage, since this affects how much protection you're actually getting.

- 5Verify Insurer Credibility

Confirm your insurer's license through Michigan's Department of Insurance and Financial Services website and check their AM Best financial strength rating. Review DIFS complaint ratios to spot companies with poor claims-handling records. You'll want an insurer with solid finances and few complaints when you're facing a large claim.

- 6Ask About Discounts

Michigan insurers usually offer 10% to 15% savings when you bundle general liability with commercial property or auto coverage. You can also reduce premiums through claims-free histories, annual payments and documented safety programs. Ask every insurer about multi-policy discounts during the quote process.

- 7Obtain Certificate of Insurance

Get your certificate of insurance immediately after buying coverage—Michigan clients, landlords and contractors won't start work without proof. Digital platforms issue certificates instantly, while traditional insurers need up to 48 hours. Keep your agent's contact details handy for urgent certificate requests.

- 8Review Coverage Annually

Compare renewal quotes 60 to 90 days early, especially after you've hired employees, expanded services or increased revenue. Your risk profile changes as your business grows, and annual reviews prevent compliance gaps. Outdated coverage can trigger audit adjustments that increase your costs unexpectedly.

Top General Liability Insurance in Michigan: Bottom Line

Finding the right general liability insurance in Michigan starts with knowing your business needs and comparing providers carefully. ERGO NEXT, The Hartford and Nationwide lead the market, but your best option depends on your industry, business size and budget. Get multiple quotes and check each insurer's credentials before making your final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Bridge Michigan. "Five Reasons Health Insurance Rates Are Rising So Much in Michigan." Accessed February 7, 2026.

- Bridge Michigan. "Michigan Open Enrollment: Here's How Much Health Insurance Rates Are Rising." Accessed February 7, 2026.

- Michigan Courts. "Kandil-Elsayed v F & E Oil, Inc and Pinsky v Kroger Co of Mich." Accessed February 7, 2026.

- Michigan Department of Insurance and Financial Services. "Insurance Fraud Statistics." Accessed February 7, 2026.

- National Weather Service. "June 25, 2024 Severe Weather." Accessed February 7, 2026.

- U.S. Small Business Administration Office of Advocacy. "2023 Small Business Profiles for the States, Territories, and Nation." Accessed February 7, 2026.

- U.S. Small Business Administration Office of Advocacy. "2024 Small Business Profiles for the States, Territories, and Nation." Accessed February 7, 2026.