We researched general liability insurance options to help you find the best business insurance for your New York company. Below are answers to common questions based on our analysis:

Best General Liability Insurance in New York

The Hartford leads New York general liability insurance as both the top choice and most affordable option at $97 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in New York: Fast Answers

Which company offers the best general liability insurance in New York?

The Hartford ranks as the best general liability insurance company in New York with a 4.59 overall score out of 5. The provider offers competitive rates at $97 per month alongside strong claims handling and reliable service. ERGO NEXT takes second place with a 4.56 score, providing an excellent digital platform and responsive customer support for $120 per month.

Who offers the cheapest general liability insurance in New York?

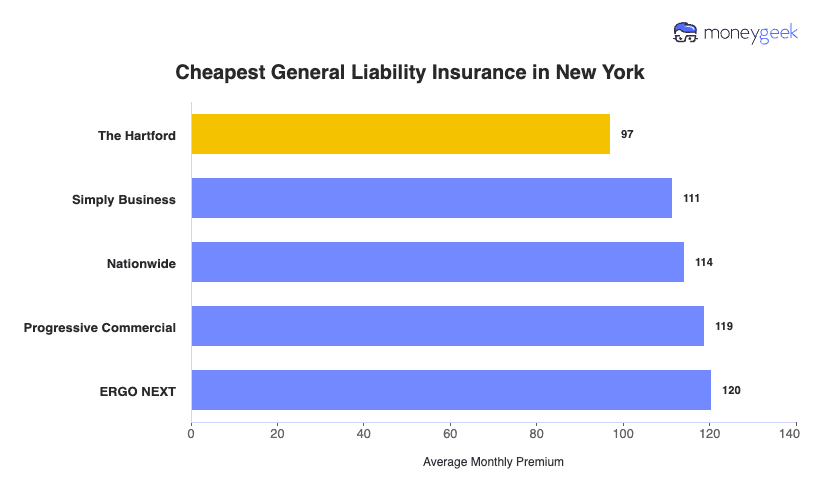

The cheapest general liability insurance companies in New York are:

- The Hartford: $97 per month

- Simply Business: $111 per month

- Nationwide: $114 per month

- Progressive: $119 per month

- ERGO NEXT: $120 per month

Do New York businesses legally need general liability insurance?

New York doesn't legally require most businesses to carry general liability insurance at the state level. However, certain licensed professionals like contractors and electricians must maintain specific coverage limits. Local municipalities may have their own requirements, and most landlords and clients demand proof of insurance before signing contracts.

How much does general liability insurance cost in New York?

General liability insurance costs between $19 and $1,071 per month for small New York businesses with two employees. Drone operations see the lowest rates, while pressure washing businesses pay the highest premiums. Your actual cost depends on your industry risk level, business location, coverage limits and employee count.

Best General Liability Insurance Companies in New York

The Hartford ranks as our top choice for general liability insurance in New York, offering an excellent mix of affordable rates and financial stability. ERGO NEXT also performs strongly with outstanding customer service and comprehensive coverage options for small businesses. Nationwide rounds out our recommendations with solid stability ratings and balanced affordability across its general liability policies.

| The Hartford | 4.59 | $97 |

| ERGO NEXT | 4.56 | $120 |

| Nationwide | 4.52 | $114 |

| Simply Business | 4.49 | $111 |

| Thimble | 4.40 | $122 |

| Coverdash | 4.38 | $121 |

| biBERK | 4.33 | $130 |

| Chubb | 4.28 | $139 |

| Progressive Commercial | 4.26 | $119 |

| Hiscox | 4.22 | $130 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap New York General Liability Insurer

Select your industry and state to get a customized New York general liability insurance quote.

General liability insurance covers customer injuries and property damage for New York businesses, but it won't protect against every risk you encounter. Explore these additional coverage options:

Best New York General Liability Insurance Reviews

Finding the best general liability insurance in New York requires looking beyond just affordable rates. Our analysis of top business insurers considers coverage quality and customer service to help you make the right choice.

Best New York General Liability Insurer

Average Monthly General Liability Premium

$97These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Processes claims quickly, with strong results across turnaround and resolution quality

Holds an A+ AM Best rating, reflecting long-term financial strength

Known for responsive support teams with clear, practical guidance

Places first overall among general liability insurance providers

consPolicies are purchased through agents rather than fully online

Self-service and digital tools trail some competitors

The Hartford has built a strong presence in New York through consistent performance, solid financial backing and hands-on service. With an A+ rating from AM Best, the company offers dependable claims handling and support for businesses that prefer personal assistance over a fully digital setup. It suits contractors, professional service firms and retail businesses seeking stable coverage and informed guidance.

Overall Score 4.59 1 Affordability Score 4.49 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 In New York, The Hartford offers general liability policies starting around $97 per month, with pricing that stays competitive across a wide range of industries. The company ranks as the lowest-cost option in 16 business categories, including construction, electrical services, cleaning businesses and professional services. Its pricing structure works well for businesses that want stable costs without sacrificing coverage depth.

Data filtered by:AccountantsAccountants $20 2 Policyholders rate The Hartford highly for claims handling and customer support at the national level. Feedback often highlights fast claim resolution and representatives who understand business needs rather than relying on scripted responses. While customers give its online tools more modest reviews, renewal data points to strong loyalty among those who prioritize service quality over digital convenience.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford offers per-occurrence limits ranging from $300,000 up to $2 million, with aggregate limits that can reach double that amount. Businesses can add protections such as product liability and broad form contractual liability to tailor coverage to their operations. Its business owner's policy option allows bundling general liability with data breach protection, giving New York businesses a more complete coverage setup under one policy.

Best New York Commercial General Liability: Runner Up

Average Monthly General Liability Premium

$120These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Strong affordability results across several industries

Easy-to-use digital platform for policy management

A- AM Best rating reflects solid financial backing

consShorter operating history than established insurers

Online-only model with no local agent support

Claims handling scores trail top-ranked providers

ERGO NEXT appeals to New York businesses that prioritize digital convenience and straightforward coverage management. Supported by an A- AM Best rating, the company provides dependable financial protection for tech firms, contractors and professional service businesses. Its platform-first approach works well for owners who prefer fast policy changes and online service rather than in-person support.

Overall Score 4.56 2 Affordability Score 4.28 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 ERGO NEXT offers New York general liability policies starting around $120 per month, with pricing that remains competitive across several business types. It posts its strongest affordability results among professional service industries such as mortgage brokers and IT consultants, while still offering solid pricing for construction, retail, dental practices, food trucks and tech companies.

Data filtered by:AccountantsAccountants $20 3 New York policyholders often point to ERGO NEXT’s digital tools as a key strength, especially for policy management and renewals. Customer feedback shows strong satisfaction and a high willingness to recommend the provider. While users value the online experience, some note that claims handling could improve compared to higher-ranked competitors.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT offers general liability limits up to $2 million per claim and $4 million in total coverage. The company includes contractor E&O insurance and supports completed operations coverage through its CG2010 endorsement. Additional endorsements allow businesses to tailor coverage for ongoing operations, making the policy structure a good match for construction firms and contract-based businesses across New York.

Cheapest General Liability Insurance Companies in New York

The Hartford offers the cheapest general liability insurance in New York at $97 per month, saving businesses $22 or 18.4% compared to the state average. Simply Business and Nationwide also provide affordable coverage options for New York companies.

| The Hartford | $97 | $1,165 |

| Simply Business | $111 | $1,338 |

| Nationwide | $114 | $1,371 |

| Progressive Commercial | $119 | $1,426 |

| ERGO NEXT | $120 | $1,445 |

| Coverdash | $121 | $1,447 |

| Thimble | $122 | $1,468 |

| biBERK | $130 | $1,557 |

| Hiscox | $130 | $1,559 |

| Chubb | $139 | $1,662 |

How Did We Determine These Rates?

Your premium varies based on location, industry type, coverage amount and other rating factors. These rates show general liability policies for small businesses with two employees across 79 major industries. Coverage options differ by state.

Cheapest General Liability Insurance in New York by Industry

MoneyGeek analyzed general liability pricing across New York industries to identify the lowest-cost providers based on detailed rate comparisons.

- The Hartford records the lowest pricing in 16 industries, performing well in skilled trades like electrical work, welding and trucking, as well as service businesses such as pest control and security.

- Simply Business posts the best rates in 13 industries, offering strong value for professional services including accountants, lawyers and consultants, as well as many home-based businesses.

- Thimble ranks as the lowest-cost option in 12 industries, with its strongest pricing in tech-focused fields like software and computer programming, plus niche services such as cannabis and HVAC.

- Nationwide offers the most affordable coverage in 11 industries, performing well in established sectors including construction, manufacturing, restaurants and auto repair.

- biBerk rounds out the list with the lowest rates in 10 industries, concentrating on contractors, engineering firms, veterinary practices and handyman services.

| Accountants | Simply Business | $17 | $201 |

Average Cost of General Liability Insurance in New York

Most small businesses in New York pay around $119 monthly for general liability insurance. The average cost of general liability insurance coverage depends on your industry, business size, location and coverage limits.

Manufacturing companies pay higher premiums due to increased risk exposure, while accounting firms pay less because of lower liability concerns. Sole proprietors generally pay lower rates compared to businesses with employees since they have fewer risk factors.

Average Cost of General Liability Insurance in New York by Industry

New York businesses pay between $19 and $1,071 monthly for general liability coverage, depending on their industry. Drone businesses see the most affordable rates at $19 per month, while pressure washing companies pay the highest costs at $1,071 monthly. Review this table for rates specific to your business type.

| Accountants | $26 | $309 |

| Ad Agency | $41 | $494 |

| Automotive | $62 | $748 |

| Auto Repair | $177 | $2,125 |

| Bakery | $106 | $1,267 |

| Barber | $52 | $618 |

| Beauty Salon | $78 | $937 |

| Bounce House | $82 | $985 |

| Candle | $64 | $771 |

| Cannabis | $78 | $940 |

| Catering | $102 | $1,221 |

| Cleaning | $155 | $1,855 |

| Coffee Shop | $105 | $1,257 |

| Computer Programming | $34 | $406 |

| Computer Repair | $56 | $669 |

| Construction | $205 | $2,459 |

| Consulting | $26 | $307 |

| Contractor | $298 | $3,577 |

| Courier | $228 | $2,741 |

| Daycare | $38 | $461 |

| Dental | $25 | $301 |

| DJ | $29 | $353 |

| Dog Grooming | $74 | $890 |

| Drone | $19 | $234 |

| Ecommerce | $85 | $1,025 |

| Electrical | $131 | $1,573 |

| Engineering | $47 | $558 |

| Excavation | $544 | $6,532 |

| Florist | $50 | $600 |

| Food | $126 | $1,508 |

| Food Truck | $166 | $1,991 |

| Funeral Home | $70 | $845 |

| Gardening | $131 | $1,572 |

| Handyman | $286 | $3,427 |

| Home-based | $28 | $333 |

| Home-based | $54 | $644 |

| Hospitality | $76 | $911 |

| HVAC | $287 | $3,442 |

| Janitorial | $160 | $1,919 |

| Jewelry | $47 | $561 |

| Junk Removal | $190 | $2,278 |

| Lawn/Landscaping | $140 | $1,682 |

| Lawyers | $27 | $320 |

| Manufacturing | $74 | $886 |

| Marine | $33 | $393 |

| Massage | $112 | $1,340 |

| Mortgage Broker | $27 | $320 |

| Moving | $145 | $1,737 |

| Nonprofit | $42 | $504 |

| Painting | $168 | $2,017 |

| Party Rental | $93 | $1,115 |

| Personal Training | $28 | $335 |

| Pest Control | $38 | $452 |

| Pet | $66 | $787 |

| Pharmacy | $72 | $864 |

| Photography | $28 | $338 |

| Physical Therapy | $127 | $1,524 |

| Plumbing | $423 | $5,072 |

| Pressure Washing | $1,071 | $12,848 |

| Real Estate | $62 | $748 |

| Restaurant | $169 | $2,030 |

| Retail | $76 | $917 |

| Roofing | $453 | $5,440 |

| Security | $163 | $1,955 |

| Snack Bars | $137 | $1,647 |

| Software | $31 | $367 |

| Spa/Wellness | $125 | $1,495 |

| Speech Therapist | $36 | $438 |

| Startup | $33 | $401 |

| Tech/IT | $31 | $369 |

| Transportation | $44 | $528 |

| Travel | $24 | $293 |

| Tree Service | $152 | $1,822 |

| Trucking | $120 | $1,439 |

| Tutoring | $35 | $423 |

| Veterinary | $52 | $629 |

| Wedding Planning | $32 | $387 |

| Welding | $193 | $2,313 |

| Wholesale | $52 | $626 |

| Window Cleaning | $186 | $2,235 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect New York General Liability Insurance Costs?

Many factors determine how much New York businesses pay for general liability insurance coverage.

New York's Scaffold Law and Absolute Liability Standard

New York is the only state with absolute liability under the Scaffold Law. Contractors and property owners pay for all elevation-related injuries, even when workers share fault. No comparative negligence defense exists. Every construction fall becomes an automatic payout. Insurers assume worst-case outcomes for each incident. Construction contractors pay two to five times more for general liability coverage than businesses in other states.

Litigation Frequency and Nuclear Verdict Environment

New York courts award settlements and judgments that routinely hit millions. General liability rates run about 300% higher than New Jersey. The average nuclear verdict jumped from $21.5 million in 2020 to $41.1 million in 2022. Juries deliver unpredictable awards. Insurers maintain larger reserves and build these costs into premiums. New York's legal fees add to defense costs that businesses ultimately pay.

Medical Costs and Claim Severity

Medical care in New York costs more than most of the nation. Insurers cover these bills when someone gets injured on business premises. One reinsurer's claim costs jumped from $3.15 million in 2018 to $18.4 million in 2023, a 484% increase. Juries multiply medical expenses to calculate pain and suffering awards. High treatment costs become massive verdicts.

Insurance Market Competition and Urban Density

Berkshire Hathaway and State Farm have pulled back from New York. Fewer insurers means less competition on price. New York City's crowded streets create liability risks: limited space, heavy pedestrian traffic, high-rise construction. Dense populations and constant commercial activity mean more chances for third-party injuries and property damage. Businesses now see rate increases of 20% or more as routine.

How Much General Liability Insurance Do I Need in New York?

New York requires licensed contractors and trades professionals to carry specific levels of general liability coverage. Coverage rules vary by profession and location, with New York City applying higher standards than many other municipalities.

In most cases, licensed trades must carry at least $1 million per occurrence to keep credentials active and obtain permits. The following outlines general liability requirements for selected professions in New York:

Statewide requirements include $1 million per occurrence and $2 million aggregate coverage. Policies must cover completed operations for work after project completion.

New York mandates $1 million per occurrence and $2 million aggregate limits for these professionals. Completed operations coverage is required.

Operating legally requires $1 million per occurrence and $2 million aggregate coverage. Sprinkler installation and fire protection system work fall under this requirement.

Coverage requirements differ by municipality. NYC, Buffalo and Syracuse mandate insurance for heating contractor licenses.

Major projects require $2 million per occurrence and $4 million aggregate coverage. The largest commercial sites often demand higher limits.

City licensing starts at $1 million per occurrence. Workers' compensation insurance becomes mandatory when hiring employees.

Building one-, two- or three-family homes requires at least $1 million per occurrence coverage. Registration with the city requires insurance verification before work begins.

Obtaining and maintaining a master plumber license requires general liability insurance. Required limits vary based on plumbing work type.

Note: Insurance requirements in New York can change over time. Confirm current coverage rules through the New York State Department of Financial Services or a licensed insurance agent.

How to Choose the Best General Liability Insurance in New York

Choosing general liability coverage in New York starts with assessing your business risks and budget constraints. Getting business insurance requires comparing policies from multiple carriers to find coverage that protects against accidents, property damage and lawsuits without overpaying.

- 1Determine Your Coverage Needs

New York does not require general liability insurance for most businesses, but some licensed trades must carry minimum business insurance coverage to keep credentials active. Coverage limits often range from $500,000 to $2 million per occurrence, with licensed electricians commonly carrying $1 million per occurrence and $2 million in aggregate.

New York City applies stricter rules for construction work, with coverage levels tied to permit type and building height. Tower crane projects require $80 million in coverage regardless of project size.

- 2Prepare Business Information

Insurers base quotes on details such as revenue, employee count, business location, and industry classification. In New York, pricing also reflects years in operation and claims history. Gather your EIN, business registration, and tax permits in advance to keep applications moving and reduce pricing errors.

- 3Compare Multiple Quotes

Request quotes from at least three insurers licensed in New York, since business insurance costs can vary by hundreds of dollars each year for the same coverage. Compare deductibles, policy limits, and whether legal defense expenses reduce your coverage amount or apply separately. Pricing differences between insurers make side-by-side comparisons key to finding the best value.

- 4Look Beyond Premium Cost

Lower premiums do not always mean better coverage. Review exclusions closely and confirm how defense expenses apply within the policy. Some risks, including professional errors, pollution exposure, and employee injuries, require separate policies, so identifying gaps early helps avoid costly surprises later.

- 5Verify Insurer Credentials

Confirm that the insurer operates legally in New York through the Department of Financial Services. Review AM Best ratings to assess financial strength, with A-VII often viewed as the minimum acceptable rating for liability coverage. Strong financial backing improves the likelihood that claims are paid without delays.

- 6Ask About Available Discounts

Many New York insurers offer savings through bundled policies, with Business Owner’s Policies often costing 10% to 20% less than separate liability and property coverage. Additional discounts may apply for annual payments, clean claims histories, safety programs and professional certifications. Industry training and OSHA credentials often reduce premiums by 5% to 15%.

- 7Get Certificate of Insurance

Clients, landlords and contractors often require proof of coverage before approving contracts or leases. Many insurers issue certificates digitally within minutes, while others take up to two business days. Keeping your agent’s contact details handy helps prevent delays when certificates are needed quickly.

- 8Review Coverage Annually

Revisit your policy annually, especially after changes in staffing, services, or revenue. New York businesses often pay higher rates in their first year due to limited risk history, but premiums often improve after several years of stable operations. Reviewing options 60 to 90 days before renewal allows time to adjust limits or secure better pricing.

Top General Liability Insurance in New York: Bottom Line

Finding the right general liability insurance in New York starts with understanding your specific business needs and budget. The Hartford, ERGO NEXT and Nationwide represent strong options in the market. Your ideal provider depends on factors like industry type, company size and coverage requirements. Compare quotes from multiple insurers and verify their credentials before making your final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Marathon Strategies. "Nuclear Verdicts Report 2025." Accessed February 7, 2026.

- National Association of Insurance Commissioners. "2024 Market Share Reports For Property/Casualty Groups." Accessed February 7, 2026.

- New York State Assembly. "Bill Search and Legislative Information - A03737." Accessed February 7, 2026.

- New York State Senate. "N.Y. Lab. Law § 240." Accessed February 7, 2026.

- Swiss Re. "New York Labor Law Sections 240 and 241 and priority of coverage." Accessed February 7, 2026.

- U.S. Chamber Institute for Legal Reform. "Nuclear Verdicts: An Update on Trends, Causes, and Solutions." Accessed February 7, 2026.