We researched the best business insurance options to answer your most common questions about general liability coverage in North Dakota based on our detailed analysis:

Best General Liability Insurance in North Dakota

The Hartford leads North Dakota general liability insurance as both top-rated and most affordable, starting at $72 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in North Dakota: Fast Answers

Which company offers the best general liability insurance in North Dakota?

The Hartford leads as the best general liability insurance company in North Dakota with a 4.59 overall score. It provides affordable coverage at $72 per month and excels in claims handling. ERGO NEXT ranks second with a 4.57 score, offering strong digital tools and customer service for $89 per month.

Who offers the cheapest general liability insurance in North Dakota?

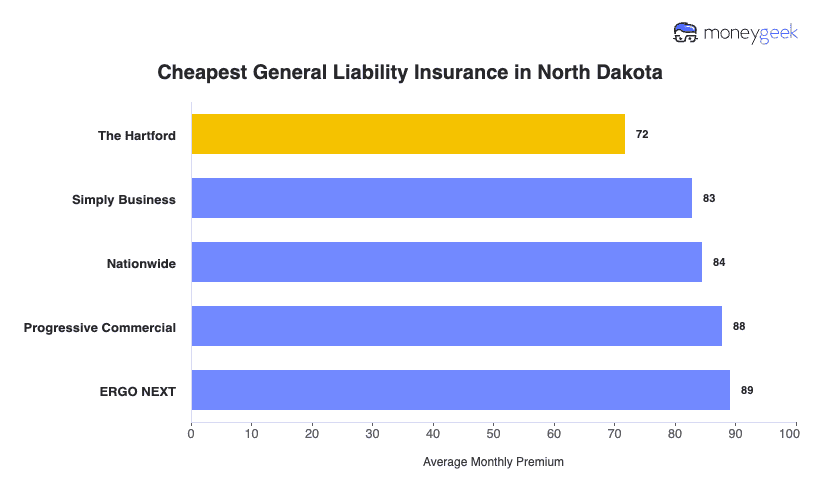

The cheapest general liability insurance companies in North Dakota are:

- The Hartford: $72 per month

- Simply Business: $83 per month

- Nationwide: $84 per month

- Progressive: $88 per month

- ERGO NEXT: $89 per month

Do North Dakota businesses legally need general liability insurance?

North Dakota doesn't legally require most businesses to carry general liability insurance at the state level. However, certain licensed professionals like contractors and electricians may need specific coverage amounts. Local municipalities can set their own requirements, and most landlords and clients demand proof of insurance before signing contracts.

How much does general liability insurance cost in North Dakota?

General liability insurance costs between $15 and $800 per month for small North Dakota businesses with two employees. The drone industry sees the lowest rates at $15 per month, while pressure washing businesses pay the highest costs at $800 per month. Your actual premium depends on your specific industry, business location, coverage limits and company size.

Best General Liability Insurance Companies in North Dakota

The Hartford leads as our top choice for general liability insurance in North Dakota, offering an excellent balance of affordable rates and quality customer service. ERGO NEXT also performs strongly with outstanding customer support and solid coverage options. Nationwide rounds out our recommendations with reliable financial stability and competitive pricing for small business owners.

| The Hartford | 4.59 | $72 |

| ERGO NEXT | 4.57 | $89 |

| Nationwide | 4.52 | $84 |

| Simply Business | 4.48 | $83 |

| Coverdash | 4.38 | $90 |

| Thimble | 4.35 | $93 |

| biBERK | 4.29 | $99 |

| Chubb | 4.27 | $103 |

| Progressive Commercial | 4.26 | $88 |

| Hiscox | 4.19 | $99 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap North Dakota General Liability Insurer

Select your industry and state to get a customized North Dakota general liability insurance quote.

General liability insurance shields North Dakota businesses from customer injury and property damage lawsuits, but most companies need broader financial protection. Explore these additional coverage options for businesses operating in North Dakota:

Best North Dakota General Liability Insurance Reviews

Finding the best general liability insurance in North Dakota requires looking beyond affordable rates to consider coverage quality and customer service. MoneyGeek's research identifies the top business insurers based on comprehensive analysis.

Best North Dakota General Liability Insurer

Average Monthly General Liability Premium

$72These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Ranks first overall among general liability providers

Handles claims quickly and efficiently with top processing

Maintains A+ AM Best financial stability rating

Delivers exceptional customer service with highest satisfaction scores

consDigital experience ranks last among surveyed providers

Requires agent interaction rather than online-only purchase options

The Hartford leads North Dakota's general liability market with exceptional customer service and strong financial stability, backed by an A+ AM Best rating. Their combination of competitive pricing and efficient claims processing makes them valuable for construction, professional services and retail businesses. The Hartford excels in personalized support, making them ideal for business owners who prefer direct agent interaction over digital-only service.

Overall Score 4.59 1 Affordability Score 4.50 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 The Hartford offers general liability coverage at $72 per month in North Dakota, ranking among the state's most cost-effective providers. They show competitive pricing for construction, cleaning and professional services industries, with strong affordability rankings across 47 different business types.

Data filtered by:AccountantsAccountants $15 2 Customer feedback places The Hartford at the top for claims processing and customer service in North Dakota. Their high satisfaction ratings reflect efficient claim resolutions and knowledgeable support staff, though digital experience scores suggest room for improvement in online services.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford provides coverage limits from $300,000 to $2 million per occurrence, with aggregate limits up to double that amount. Businesses can enhance protection with product liability coverage and broad form contractual liability options. Their business owner's policy allows bundling with data breach protection, offering comprehensive coverage for North Dakota enterprises.

Best North Dakota Commercial General Liability: Runner-Up

Average Monthly General Liability Premium

$89These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first for affordability with competitive commercial liability rates

Offers streamlined digital experience for tech-savvy business owners

Maintains A- AM Best financial strength rating

Excels in policy management with user-friendly online tools

consNewer insurer with limited operating history compared to competitors

Online-only platform lacks local agent support for complex needs

Ranks sixth in financial stability among surveyed providers

ERGO NEXT excels in North Dakota's general liability market through outstanding customer service and comprehensive coverage options. With an A- AM Best rating and strong financial stability, ERGO NEXT delivers reliable protection suited for tech companies, contractors and professional services. North Dakota businesses valuing digital-first solutions and efficient policy management will find ERGO NEXT's modern approach especially beneficial.

Overall Score 4.57 2 Affordability Score 4.31 5 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 At $89 monthly, ERGO NEXT offers competitive general liability coverage in North Dakota. The provider shows particular strength in affordability for tech companies, professional services and contractors, ranking among the most cost-effective options for these industries. Small businesses in hospitality, retail and personal services also benefit from ERGO NEXT's competitive rates.

Data filtered by:AccountantsAccountants $15 3 Customer feedback highlights ERGO NEXT's exceptional digital experience and policy management capabilities in North Dakota. Business owners consistently praise the provider's user-friendly platform and efficient service delivery. The high likelihood of customers to recommend ERGO NEXT and renew their policies demonstrates strong satisfaction with the overall experience.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT provides general liability coverage with limits up to $2 million per claim and $4 million aggregate in North Dakota. The provider includes contractor E&O insurance and offers specialized endorsements like CG2010 for completed operations coverage. These flexible policies benefit construction and contract-based businesses, with options to add professional liability coverage for comprehensive protection.

Cheapest General Liability Insurance Companies in North Dakota

The Hartford offers the cheapest general liability insurance in North Dakota at $72 per month, saving businesses $17 or 19% compared to the state average. Simply Business and Nationwide also provide affordable coverage options for North Dakota companies.

| The Hartford | $72 | $861 |

| Simply Business | $83 | $995 |

| Nationwide | $84 | $1,014 |

| Progressive Commercial | $88 | $1,054 |

| ERGO NEXT | $89 | $1,070 |

| Coverdash | $90 | $1,074 |

| Thimble | $93 | $1,117 |

| Hiscox | $99 | $1,189 |

| biBERK | $99 | $1,190 |

| Chubb | $103 | $1,235 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in North Dakota by Industry

MoneyGeek's research identifies the most affordable general liability insurance providers across industries in North Dakota.

- The Hartford wins affordability in 19 industries, leading in construction, cleaning, transportation and security sectors.

- Simply Business offers the cheapest coverage in 12 industries, excelling with professional services like accountants, lawyers and consulting firms.

- BiBerk ranks as the most affordable provider in 11 industries, performing strongly in catering, engineering, hospitality and veterinary businesses.

- ERGO NEXT leads affordability in 10 industries, showing particular strength in tech/IT, photography, dental and travel sectors.

- Thimble secures the cheapest rates in nine industries, dominating home services like HVAC, roofing, pet care and tutoring.

| Accountants | Simply Business | $13 | $150 |

Average Cost of General Liability Insurance in North Dakota

Most small businesses in North Dakota pay around $89 monthly for general liability insurance. The average cost of general liability coverage depends on your industry, business size, location and coverage limits.

Manufacturing companies pay higher premiums due to increased risk exposure, while accounting firms pay less because of lower claim potential. Sole proprietors usually pay less than businesses with employees since they have fewer liability exposures.

Average Cost of General Liability Insurance in North Dakota by Industry

Monthly costs for general liability coverage in North Dakota vary widely by industry. Drone businesses pay as little as $15 per month, while pressure washing companies can expect rates around $800 monthly. Review the table below to find typical costs for your specific business type.

| Accountants | $19 | $231 |

| Ad Agency | $31 | $371 |

| Automotive | $47 | $559 |

| Auto Repair | $133 | $1,593 |

| Bakery | $79 | $947 |

| Barber | $39 | $464 |

| Beauty Salon | $58 | $701 |

| Bounce House | $61 | $736 |

| Candle | $48 | $576 |

| Cannabis | $59 | $703 |

| Catering | $77 | $919 |

| Cleaning | $116 | $1,389 |

| Coffee Shop | $78 | $940 |

| Computer Programming | $25 | $305 |

| Computer Repair | $42 | $500 |

| Construction | $153 | $1,837 |

| Consulting | $19 | $230 |

| Contractor | $223 | $2,672 |

| Courier | $171 | $2,049 |

| Daycare | $29 | $345 |

| Dental | $19 | $225 |

| DJ | $22 | $265 |

| Dog Grooming | $55 | $665 |

| Drone | $15 | $175 |

| Ecommerce | $64 | $767 |

| Electrical | $98 | $1,179 |

| Engineering | $35 | $417 |

| Excavation | $407 | $4,881 |

| Florist | $37 | $449 |

| Food | $94 | $1,129 |

| Food Truck | $124 | $1,486 |

| Funeral Home | $53 | $633 |

| Gardening | $98 | $1,178 |

| Handyman | $213 | $2,558 |

| Home-based | $21 | $249 |

| Home-based | $40 | $477 |

| Hospitality | $57 | $683 |

| HVAC | $214 | $2,572 |

| Janitorial | $120 | $1,437 |

| Jewelry | $35 | $422 |

| Junk Removal | $142 | $1,703 |

| Lawn/Landscaping | $105 | $1,260 |

| Lawyers | $20 | $239 |

| Manufacturing | $56 | $670 |

| Marine | $24 | $294 |

| Massage | $84 | $1,005 |

| Mortgage Broker | $20 | $240 |

| Moving | $108 | $1,300 |

| Nonprofit | $31 | $376 |

| Painting | $126 | $1,507 |

| Party Rental | $69 | $833 |

| Personal Training | $21 | $250 |

| Pest Control | $28 | $338 |

| Pet | $49 | $587 |

| Pharmacy | $54 | $648 |

| Photography | $21 | $253 |

| Physical Therapy | $96 | $1,154 |

| Plumbing | $316 | $3,788 |

| Pressure Washing | $800 | $9,597 |

| Real Estate | $46 | $558 |

| Restaurant | $127 | $1,520 |

| Retail | $57 | $686 |

| Roofing | $339 | $4,068 |

| Security | $122 | $1,458 |

| Snack Bars | $103 | $1,231 |

| Software | $23 | $276 |

| Spa/Wellness | $93 | $1,119 |

| Speech Therapist | $27 | $327 |

| Startup | $25 | $300 |

| Tech/IT | $23 | $276 |

| Transportation | $33 | $394 |

| Travel | $18 | $219 |

| Tree Service | $113 | $1,360 |

| Trucking | $90 | $1,075 |

| Tutoring | $26 | $317 |

| Veterinary | $39 | $470 |

| Wedding Planning | $24 | $290 |

| Welding | $144 | $1,729 |

| Wholesale | $39 | $468 |

| Window Cleaning | $139 | $1,669 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect North Dakota General Liability Insurance Costs?

Many important factors play a role in what North Dakota businesses pay for general liability insurance coverage.

North Dakota Legal and Tort Environment

North Dakota's modified comparative negligence rule (50% bar) reduces claim frequency by preventing recovery when claimants share equal or greater fault, lowering premiums compared to pure comparative negligence states. The state's six-year statute of limitations for personal injury claims, which is double most states' two to three years, extends insurers' exposure periods and increases premiums to account for claims surfacing years later.

Recent large tort awards, including a $345 million judgment, demonstrate substantial damages in North Dakota courts, prompting insurers to build larger reserves and charge higher premiums for potential catastrophic losses.

North Dakota Medical and Healthcare Costs

General liability insurance pays medical expenses when customers suffer bodily injuries at your business. North Dakota's healthcare costs rank among the nation's highest, with health insurance rates jumping 6% to 15% in 2025. Medical treatment expenses grow faster than insurers can adjust rates, with carriers retaining only one to two cents per premium dollar.

Slip-and-fall claims requiring emergency care, surgery, and ongoing treatment cost a lot more in North Dakota's expensive healthcare market. Your general liability rates directly reflect these inflated medical costs, as insurers must price policies to cover increasingly expensive bodily injury claims.

North Dakota Climate and Weather Hazards

North Dakota's harsh climate creates predictable premises liability exposures that impact general liability rates. The state experiences three to four severe winter storms annually from late November through late March, with 26 to 38 inches of snowfall creating continuous slip-and-fall hazards for four to five months.

Businesses must maintain safe premises despite frozen walkways, icy parking lots and snow accumulation. Extreme temperatures from -60°F to 121°F create year-round liability risks. Insurers price coverage higher for North Dakota businesses because weather-related premises liability claims are both more frequent and predictable in this harsh environment.

North Dakota Economic and Industry Landscape

North Dakota's economy centers on oil and gas (third largest U.S. producer, 30% of state GDP) and agriculture ($41.3 billion annually), industries with elevated general liability exposures from heavy machinery, hazardous materials, and high-risk operations. This concentration affects rates statewide as insurers assess the overall risk environment.

Recent economic volatility (0.7% GDP decline in 2024) increases claim frequency, as financial pressures prompt more injury lawsuits and business failures leave injured parties seeking insurer compensation. Energy sector boom-and-bust cycles create unpredictable claim patterns, prompting insurers to charge higher premiums for economic uncertainty and inherent industry risks.

North Dakota Geographic and Population Factors

Your business location within North Dakota influences general liability rates because of population density and local risk patterns. Urban centers such as Fargo, Bismarck, Grand Forks and Minot see more customer traffic and more slip-and-fall incidents, which leads to higher premiums than in rural areas.

Insurers also price policies using ZIP code–level data. Northeastern regions deal with harsher winters and more weather-related claims, while western areas with strong energy activity have more construction work and contractor-related risks. Your exact location shapes the mix of risks that apply to your business, with urban areas generally seeing higher premiums due to more frequent claims.

How Much General Liability Insurance Do I Need in North Dakota?

North Dakota small businesses usually need $1 million per occurrence and $2 million aggregate coverage, though specific amounts depend on industry and contractual obligations. The state sets requirements for commercial general liability only for licensed contractors.

Retailers, restaurants and service businesses often follow coverage requirements set by landlords and clients rather than state law. Lease agreements and client contracts determine minimum coverage amounts for most North Dakota businesses.

- Class A for contracts over $250,000

- Class B up to $250,000

- Class C up to $120,000

- Class D up to $50,000

Landlords in Bismarck, Fargo, Grand Forks and across North Dakota often require tenants to carry general liability insurance as a lease condition. Most commercial leases specify $1 million per occurrence coverage and name the landlord as an additional insured on the policy.

Many clients require proof of general liability insurance before signing service agreements, especially in B2B relationships. Contract requirements often specify $1 million to $2 million in coverage, depending on project size and potential risks.

Handymen performing projects valued over $4,000 need a contractor license in North Dakota, which requires general liability coverage. The state doesn't mandate specific coverage limits, though handymen commonly carry $100,000 to $1 million based on project size and client requirements.

North Dakota requires contractors performing work valued over $4,000 to carry general liability insurance for state licensing. The state offers four license classes based on project value:

All contractors must submit proof of liability coverage naming the North Dakota Secretary of State as certificate holder, though the state doesn't specify minimum dollar amounts.

Note: State insurance requirements in North Dakota change often. Check current rules with the North Dakota Insurance and Securities Department or contact a licensed agent for updated information.

How to Choose the Best General Liability Insurance in North Dakota

Choosing general liability insurance in North Dakota requires matching coverage limits to contractor license classes, lease requirements and client contracts. Getting business insurance starts with identifying mandatory coverage needs, then comparing quotes from multiple insurers to find affordable rates that protect against liability claims.

- 1Assess Coverage Needs

North Dakota requires general liability insurance only for licensed contractors, while many commercial leases and client contracts still call for at least $1 million per occurrence. Most businesses choose business insurance coverage between $500,000 and $2 million per occurrence depending on their risk level.

Contractors should review their license class requirements (Class A through D), along with any lease terms and client contracts, to decide the level of protection that fits their operations.

- 2Prepare Business Information

Business owners should gather revenue data, employee count, physical location and industry classification before requesting quotes. Industry risk affects premiums significantly, with higher-risk businesses like construction paying more than lower-risk operations like consulting. Prepare EIN documentation, state business registration and contractor license records if applicable to streamline the quoting process.

- 3Compare Multiple Quotes

Business owners should request quotes from at least three insurers licensed in North Dakota to evaluate business insurance costs across providers. General liability insurance in North Dakota averages around $89 monthly for small businesses, though rates vary by industry and coverage limits. Compare deductibles, coverage limits and whether defense costs count toward policy limits to identify the best value.

- 4Evaluate Beyond Price

Business owners shouldn't select coverage based solely on affordable business insurance premiums without reviewing coverage exclusions. Policies in North Dakota exclude professional errors, pollution and employee injuries, requiring separate coverage. Defense costs may apply toward policy limits or sit outside them, affecting actual protection when claims arise.

- 5Verify Insurer Credentials

Business owners should verify insurer licensing through the North Dakota Insurance and Securities Department's company search tool. You can also check AM Best financial strength ratings.

Review complaint ratios through the state insurance department to identify companies with poor claims-handling records. Choose insurers with A- or better ratings from AM Best to confirm adequate financial backing when large claims arise.

- 6Explore Available Discounts

Insurers in North Dakota offer discounts for bundling general liability with commercial property or auto insurance, potentially reducing costs by 10% to 25%. Business owner's policies bundle general liability and property coverage at lower combined rates. Claims-free histories, safety programs and annual premium payments can also reduce general liability costs for North Dakota businesses.

- 7Obtain Certificate Documentation

Business owners should request certificates of insurance naming specific parties as certificate holders for contractor licensing or lease compliance. North Dakota contractors must list the Secretary of State at 600 E Boulevard Ave, Dept 108, Bismarck, ND 58505 as certificate holder for license applications. Most insurers provide digital certificates instantly, though some require 48 hours for processing.

- 8Schedule Annual Reviews

Business owners should reassess coverage annually before March 1 contractor license renewals or when adding employees, expanding services or increasing revenue. Compare quotes 60 to 90 days before renewal to find better rates or adjust coverage limits. Maintaining current coverage helps contractors avoid license lapses and unexpected audit adjustments that increase premiums.

Top General Liability Insurance in North Dakota: Bottom Line

Finding quality general liability insurance in North Dakota starts with understanding your specific business needs and researching providers thoroughly. The Hartford, ERGO NEXT, and Nationwide represent strong options in the market. The best provider depends on your industry type, business size, and budget constraints. Compare multiple quotes and verify each insurer's licensing and credentials before making your final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Godfread, Jon. "Godfread Announces 2025 ACA Plan Rates, Citing Increasing Prices for Healthcare Services as Lead Factor." Accessed February 7, 2026.

- National Oceanic and Atmospheric Administration. "Billion-Dollar Weather and Climate Disasters: North Dakota." Accessed February 7, 2026.

- North Dakota Century Code. "Section 28-01-16: Time for Commencing Actions." Accessed February 7, 2026.

- North Dakota Century Code. "Section 32-03.2-02: Comparative Fault." Accessed February 7, 2026.

- North Dakota Office of the Governor. "New Report Highlights Agriculture's $41.3 Billion Impact on North Dakota's Economy." Accessed February 7, 2026.

- U.S. Bureau of Economic Analysis. "Gross Domestic Product by State and Personal Income by State, 4th Quarter 2024 and Preliminary 2024." Accessed February 7, 2026.