We researched Pennsylvania's best business insurance options and compiled answers to your most common questions about general liability coverage. Here's what you need to know to protect your business:

Best General Liability Insurance in Pennsylvania

The Hartford tops Pennsylvania as the best and cheapest general liability insurer, with coverage starting at $95 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Pennsylvania: Fast Answers

Which company offers the best general liability insurance in Pennsylvania?

The Hartford ranks as the best general liability insurance company in Pennsylvania with a 4.64 overall score out of 5. It provides affordable coverage at $95 per month with excellent claims handling. ERGO NEXT follows closely in second place, scoring 4.54 with strong digital tools and customer service for $119 per month.

Who offers the cheapest general liability insurance in Pennsylvania?

The cheapest general liability insurance companies in Pennsylvania are:

- The Hartford: $95 per month

- Simply Business: $111 per month

- Nationwide: $113 per month

- Progressive: $116 per month

- ERGO NEXT: $119 per month

Do Pennsylvania businesses legally need general liability insurance?

Pennsylvania doesn't legally require general liability insurance for most businesses statewide. However, certain licensed professionals like contractors and electricians must carry minimum coverage to maintain their licenses. Local municipalities may also impose their own insurance requirements. Even when not legally mandated, most landlords and clients demand proof of coverage before signing contracts.

How much does general liability insurance cost in Pennsylvania?

General liability insurance costs between $19 and $1,061 per month for small Pennsylvania businesses with two employees. Drone companies pay the lowest rates, while pressure washing businesses pay the highest premiums. Your actual cost depends on your industry, location, coverage limits and business size.

Best General Liability Insurance Companies in Pennsylvania

The Hartford leads our rankings for general liability insurance in Pennsylvania with affordable rates and strong financial stability. ERGO NEXT and Nationwide also rank high as alternatives. ERGO NEXT excels in customer service, while Nationwide offers strong overall value for small businesses across Pennsylvania.

| The Hartford | 4.64 | $95 |

| ERGO NEXT | 4.54 | $119 |

| Nationwide | 4.52 | $113 |

| Simply Business | 4.48 | $111 |

| Thimble | 4.40 | $122 |

| Coverdash | 4.37 | $120 |

| biBERK | 4.30 | $130 |

| Progressive Commercial | 4.27 | $116 |

| Chubb | 4.25 | $138 |

| Hiscox | 4.19 | $130 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Pennsylvania General Liability Insurer

Select your industry and state to get a customized Pennsylvania general liability insurance quote.

General liability insurance shields Pennsylvania businesses from customer injury and property damage claims, but comprehensive financial protection requires additional coverage types. Explore these related business insurance guides for complete coverage:

Best Pennsylvania General Liability Insurance Reviews

Finding the right general liability insurance in Pennsylvania requires looking beyond price alone. Our research identifies the top business insurers based on coverage quality, service and value.

The Hartford

Best Pennsylvania General Liability Insurer

Average Monthly General Liability Premium

$95These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Quick, well-run claims process

Strong customer support ratings

A+ AM Best financial strength

Lowest average pricing in Pennsylvania

consAgent involvement required to buy a policy

Online tools feel dated

The Hartford holds a strong position in Pennsylvania thanks to dependable claims handling, steady pricing, and long-standing financial backing. Businesses that prefer real human support over a fully self-serve platform tend to value its agent-based approach.

This insurer works well for contractors, service businesses, and retail operations that want coverage from a carrier with deep industry experience and a proven track record.

Overall Score 4.64 1 Affordability Score 4.62 1 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 General liability pricing from The Hartford averages $95 per month in Pennsylvania, making it the lowest-cost option in our review. Rates stay competitive for service-based businesses such as construction, cleaning, and professional consulting, with consistent pricing across 78 business categories.

Data filtered by:AccountantsAccountants $19 2 Policyholders in Pennsylvania rate The Hartford highly for both claims handling and customer support. Feedback often highlights clear communication and quick progress once a claim starts. Satisfaction scores remain strong across service and claims categories, though online account features lag behind more tech-forward insurers.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 Coverage limits range from $300,000 to $2 million per occurrence, with aggregate limits reaching twice the per-occurrence amount. Businesses can add product liability, broad form contractual liability, or data breach protection, often through a bundled business owner’s policy.

These options suit service providers and contractors who need layered protection without piecing together multiple standalone policies.

ERGO NEXT

Best Pennsylvania Commercial General Liability Customer Experience

Average Monthly General Liability Premium

$119These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Competitive pricing across many industries

Smooth, fully online policy and account management

A- AM Best financial strength rating

Simple, efficient policy updates and renewals

consShort operating history compared to legacy insurers

No local agents or in-person support

Customer service scores fall mid-pack overall

ERGO NEXT performs well in Pennsylvania by pairing stable financial backing with a modern, digital-first approach. The company supports tech firms, contractors, and professional service businesses that prefer managing coverage online without agent involvement.

Its platform prioritizes speed and simplicity, which appeals to owners who want clear pricing, fast changes, and minimal paperwork.

Overall Score 4.54 2 Affordability Score 4.23 7 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 Average general liability pricing from ERGO NEXT runs about $119 per month in Pennsylvania. Rates work well for dental practices, food trucks, tech companies, and home-based businesses, with coverage that also fits larger sectors like automotive and professional services.

Data filtered by:AccountantsAccountants $20 3 Pennsylvania policyholders frequently point to ERGO NEXT’s digital platform as a key strength. Businesses value the clean interface, quick policy updates, and straightforward renewal process. Claims handling and service support earn solid but not top-tier scores, with most interactions handled entirely online.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT offers coverage limits up to $2 million per claim and $4 million in aggregate within Pennsylvania. The insurer includes contractor E&O coverage and supports endorsements such as CG2010 for completed operations.

Additional options for ongoing operations allow contractors and service-based businesses to shape coverage around active job risks.

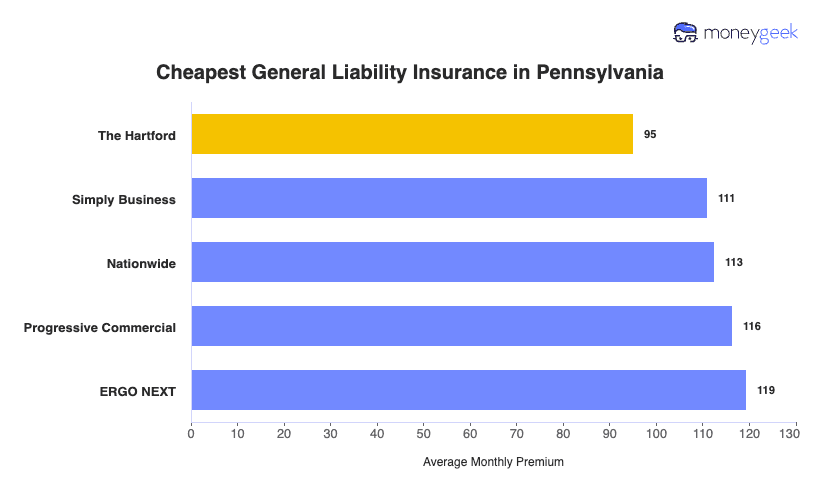

Cheapest General Liability Insurance Companies in Pennsylvania

The Hartford provides the cheapest general liability insurance in Pennsylvania at $95 per month, saving businesses $24 or 20% compared to the state average. Simply Business and Nationwide also offer affordable coverage options for small businesses.

| The Hartford | $95 | $1,140 |

| Simply Business | $111 | $1,331 |

| Nationwide | $113 | $1,351 |

| Progressive Commercial | $116 | $1,395 |

| ERGO NEXT | $119 | $1,433 |

| Coverdash | $120 | $1,438 |

| Thimble | $122 | $1,468 |

| biBERK | $130 | $1,557 |

| Hiscox | $130 | $1,559 |

| Chubb | $138 | $1,652 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus only on general liability policies. Your premium depends on your business location, industry, coverage amount and other factors insurers consider. Available options vary by state.

Cheapest General Liability Insurance in Pennsylvania by Industry

Based on MoneyGeek’s research, these five insurers deliver the lowest general liability pricing across a wide range of Pennsylvania industries:

- The Hartford: Leads affordability in 18 of the 72 industries reviewed. Pricing stays competitive across hands-on and small-business sectors such as electrical work, trucking, welding, and home-based operations.

- Nationwide and Thimble: Each take the top affordability spot in 12 industries. Nationwide works well for established businesses like construction, manufacturing and restaurants, while Thimble focuses on newer sectors including software development, cannabis and HVAC services.

- Simply Business: Posts the lowest rates in 11 industries, with pricing that favors professional services such as accounting, legal practices and consulting firms.

- biBerk: Offers low-cost coverage across 10 industries, performing best for service-driven businesses like bakeries, beauty salons and veterinary practices.

| Accountants | Simply Business | $17 | $200 |

Average Cost of General Liability Insurance in Pennsylvania

Most small businesses in Pennsylvania pay around $119 monthly for general liability insurance. The average general liability insurance cost for your business depends on your industry, business size, location and coverage limits.

Manufacturing companies often pay higher premiums because of increased risk exposure, while accounting firms usually pay less due to lower liability risks. Sole proprietors generally pay lower rates compared to businesses with employees since they have fewer liability exposures.

Average Cost of General Liability Insurance in Pennsylvania by Industry

Pennsylvania businesses pay between $19 and $1,061 per month for general liability coverage, with drone companies seeing the most affordable rates and pressure washing businesses paying the highest costs. Review this table to find typical monthly rates for your specific industry.

| Accountants | $26 | $306 |

| Ad Agency | $41 | $491 |

| Automotive | $62 | $742 |

| Auto Repair | $176 | $2,110 |

| Bakery | $105 | $1,257 |

| Barber | $51 | $614 |

| Beauty Salon | $77 | $929 |

| Bounce House | $81 | $977 |

| Candle | $64 | $764 |

| Cannabis | $78 | $932 |

| Catering | $101 | $1,214 |

| Cleaning | $153 | $1,841 |

| Coffee Shop | $104 | $1,247 |

| Computer Programming | $34 | $403 |

| Computer Repair | $55 | $663 |

| Construction | $203 | $2,440 |

| Consulting | $25 | $305 |

| Contractor | $296 | $3,547 |

| Courier | $227 | $2,718 |

| Daycare | $38 | $457 |

| Dental | $25 | $299 |

| DJ | $29 | $351 |

| Dog Grooming | $74 | $883 |

| Drone | $19 | $232 |

| Ecommerce | $85 | $1,018 |

| Electrical | $130 | $1,562 |

| Engineering | $46 | $554 |

| Excavation | $540 | $6,479 |

| Florist | $50 | $595 |

| Food | $125 | $1,496 |

| Food Truck | $164 | $1,973 |

| Funeral Home | $70 | $839 |

| Gardening | $130 | $1,560 |

| Handyman | $283 | $3,398 |

| Home-based | $28 | $331 |

| Home-based | $53 | $639 |

| Hospitality | $75 | $905 |

| HVAC | $284 | $3,413 |

| Janitorial | $159 | $1,905 |

| Jewelry | $47 | $558 |

| Junk Removal | $188 | $2,259 |

| Lawn/Landscaping | $139 | $1,670 |

| Lawyers | $26 | $317 |

| Manufacturing | $74 | $884 |

| Marine | $32 | $390 |

| Massage | $111 | $1,331 |

| Mortgage Broker | $27 | $318 |

| Moving | $144 | $1,724 |

| Nonprofit | $42 | $499 |

| Painting | $167 | $2,001 |

| Party Rental | $92 | $1,106 |

| Personal Training | $28 | $332 |

| Pest Control | $37 | $448 |

| Pet | $65 | $780 |

| Pharmacy | $72 | $858 |

| Photography | $28 | $335 |

| Physical Therapy | $127 | $1,521 |

| Plumbing | $419 | $5,031 |

| Pressure Washing | $1,061 | $12,738 |

| Real Estate | $62 | $741 |

| Restaurant | $168 | $2,015 |

| Retail | $76 | $910 |

| Roofing | $450 | $5,395 |

| Security | $162 | $1,938 |

| Snack Bars | $136 | $1,633 |

| Software | $30 | $365 |

| Spa/Wellness | $124 | $1,482 |

| Speech Therapist | $36 | $434 |

| Startup | $33 | $398 |

| Tech/IT | $31 | $366 |

| Transportation | $44 | $523 |

| Travel | $24 | $290 |

| Tree Service | $151 | $1,807 |

| Trucking | $119 | $1,427 |

| Tutoring | $35 | $420 |

| Veterinary | $52 | $624 |

| Wedding Planning | $32 | $384 |

| Welding | $191 | $2,294 |

| Wholesale | $52 | $621 |

| Window Cleaning | $185 | $2,216 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Pennsylvania General Liability Insurance Costs?

Several important factors influence what Pennsylvania businesses pay for general liability insurance.

Pennsylvania Legal and Litigation Environment

Pennsylvania ranks third nationally for nuclear verdicts totaling $3.4 billion in 2024 and topped the American Tort Reform Foundation's Judicial Hellholes ranking. Supreme Court rulings expanded premises liability and venue rules, pushing cases into plaintiff-friendly Philadelphia courts. Juries award $10 million or more for liability claims, and insurers must pay these verdicts, often beyond standard policy limits.

Insurers raise premiums across all Pennsylvania businesses to cover these payouts, even for companies with clean records. Venue shopping lets plaintiffs sue your business in Philadelphia's plaintiff-friendly courts regardless of where you operate. Insurers price your policy assuming Philadelphia's highest litigation risk.

Pennsylvania Winter Weather Conditions

Pennsylvania gets freezing temperatures from November through March. Municipal ordinances require snow removal within six hours, and courts apply the "hills and ridges doctrine" for liability. Your business deals with potential slip-and-fall claims for five months each year, nearly half the calendar.

Fail to clear snow within six hours, and courts automatically consider you negligent. This makes it easier for injured customers to win settlements. Even when you follow snow removal rules, insurers investigate and defend the high volume of winter slip-and-fall claims filed annually. You pay for these defense costs through higher premiums.

Pennsylvania Economic and Medical Cost Factors

Medical payments per claim rose 14% in Pennsylvania in 2023. The state's sixth-largest U.S. economy runs on professional services, construction and legacy manufacturing. A 14% jump in medical costs means every slip-and-fall or customer injury claim costs insurers more to settle. You pay higher premiums to cover these increased medical bills.

Pennsylvania's concentration of manufacturing and construction businesses creates more third-party injury claims from heavy machinery and job sites. Even if you run a low-risk service business, you pay elevated premiums because insurers price for the overall state risk profile dominated by higher-risk industries.

Pennsylvania Insurance Regulatory and Market Dynamics

The Pennsylvania Insurance Department blocked $180.3 million in premium increases in 2024, while the state's product liability cases show a $25 million median nuclear verdict. When regulators block rate increases, insurers can't immediately raise your premiums to match rising claim costs. Instead, they absorb losses temporarily and then file for larger rate increases later to catch up, which means you eventually see bigger premium jumps than if insurers could adjust rates gradually.

Pennsylvania's $25 million median product liability verdict far exceeds the standard $1-2 million policy limits most businesses carry. This forces insurers to charge higher premiums to all businesses that sell, manufacture or distribute products, since one verdict could wipe out premiums collected from hundreds of policyholders.

Pennsylvania Urban-Rural Geographic Disparities

General liability insurance in Pennsylvania averages $119 monthly ($1,423 annually), with Philadelphia and Pittsburgh businesses paying higher premiums than smaller towns due to increased foot traffic, higher property values and more frequent claims. Your location directly affects your premium.

Philadelphia businesses deal with heavier customer traffic that creates more slip-and-fall risks, higher property values that lead to larger damage claims when accidents happen and juries that often award bigger verdicts to injured plaintiffs.

If you operate in Philadelphia, you'll pay 40-60% more than an identical business in rural Pennsylvania. Even rural businesses pay above-national-average rates because insurers price for the statewide risk of being sued in Philadelphia courts.

How Much General Liability Insurance Do I Need in Pennsylvania?

Your general liability insurance needs depend on your profession and where you operate in Pennsylvania. The requirements for commercial general liability insurance vary across cities, counties, and industries throughout the state. Pennsylvania doesn't mandate coverage at the state level for most businesses.

Home improvement contractors must carry minimum insurance to register with the Attorney General's Office. Philadelphia and Pittsburgh set their own requirements for contractors and specific trades.

- General Contractors: The city mandates $500,000 per-occurrence limits for general contractors. Philadelphia requires all contractors listed on construction permits to maintain current coverage with the Department of Licenses and Inspections.

- Electricians: Licensed electrical contractors in Philadelphia carry $500,000 in general liability coverage. Philadelphia applies the $500,000 requirement to all electrical work within city limits.

- General Contractors: Pittsburgh general contractors need $1 million per occurrence and $2 million aggregate coverage. Your policy must list Pittsburgh as certificate holder and additionally insured.

- Electricians: Pittsburgh sets a $300,000 minimum for electricians. Licensed electricians must maintain coverage regardless of project size or scope.

Contractors performing residential improvement work worth $5,000 or more annually must register under HICPA with general liability coverage of $50,000 for bodily injury and $50,000 for property damage. HICPA registration includes carpenters, plumbers, painters, electricians, roofers, and HVAC contractors working on residential projects.

Pennsylvania daycares must maintain $1 million per occurrence and $3 million general aggregate. Daycare coverage limits account for the unique risks of caring for children.

Commercial landlords ask for proof of general liability insurance before they'll sign a lease. Clients want to see certificates of insurance before they award contracts. You need coverage to get local business licenses and permits.

Note: State insurance requirements change. Verify current requirements with the Pennsylvania Insurance Department or a licensed agent before you buy coverage.

How to Choose the Best General Liability Insurance in Pennsylvania

Pennsylvania business owners need coverage that meets local requirements while protecting against lawsuit costs. Getting business insurance starts with understanding your specific risks, comparing quotes from multiple insurers, and selecting limits that satisfy both clients and municipal regulations.

- 1Determine Coverage Needs

Most Pennsylvania businesses don't need general liability insurance under state law, but local governments often set their own requirements for licenses, permits or registrations. Contractors and licensed trades in cities like Philadelphia and Pittsburgh often see minimum limits spelled out at the city level.

Many businesses choose coverage between $500,000 and $2 million per occurrence to meet contract expectations. Check local rules and industry standards to confirm the level of business insurance coverage that fits your work.

- 2Prepare Business Information

Insurers in Pennsylvania base quotes on details such as annual revenue, employee count, business location, and industry classification. Pricing also reflects the type of work you perform, the buildings you work in, and regional risk factors.

Have your EIN, Pennsylvania Department of State registration, and HICPA number ready if you operate as a home improvement contractor before requesting quotes.

- 3Compare Multiple Quotes

Pennsylvania rates change based on business location, industry risk, claims history, coverage limits and insurer underwriting rules. Request quotes from at least three insurers licensed in the state, then compare the cost of your coverage alongside what each policy includes.

Review deductibles closely and confirm whether legal defense costs reduce your limits or receive separate coverage.

- 4Look Beyond Price

Finding affordable business insurance in Pennsylvania means looking beyond the monthly premium. Review policy exclusions and confirm how each insurer handles legal defense costs, whether they sit outside your limits or reduce them.

General liability policies exclude areas like professional errors, pollution liability and employee injuries, which require separate coverage. Check that your policy matches the day-to-day risks your business handles.

- 5Verify Insurer Credentials

Confirm insurer and agent licenses through the Pennsylvania Insurance Department. Review AM Best financial ratings and complaint records to gauge claims handling reliability. Strong financial backing matters when large claims arise or disputes last longer than expected.

- 6Ask About Discounts

Many Pennsylvania insurers reduce costs when you bundle general liability with property or other commercial coverage, often lowering premiums by 15% or more. Safety certifications and professional licenses also help reduce rates.

Contractors with OSHA training often qualify for 5% to 10% savings. Ask about discounts for clean claims histories, annual payments, and formal safety programs.

- 7Obtain Certificate Documentation

Landlords and clients in Pennsylvania usually require a certificate of insurance before approving leases or contracts. Some insurers issue certificates instantly online, while others need several business days.

Keep your agent’s contact information handy since you may need updated certificates after renewals or coverage changes.

- 8Review Coverage Annually

Revisit your coverage each year, especially after hiring employees, expanding into new municipalities, or increasing revenue beyond HICPA’s $5,000 threshold. Winter weather adds slip-and-fall exposure, so proper training and documentation matter. Compare quotes 60 to 90 days before renewal to adjust limits or find better pricing based on current operations.

Top General Liability Insurance in Pennsylvania: Bottom Line

Finding quality general liability insurance in Pennsylvania starts with understanding your business needs and comparing providers thoroughly. The Hartford, ERGO NEXT and Nationwide lead the market, but your best option depends on your industry, company size and budget. Get quotes from multiple insurers and verify their credentials before making your final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- American Tort Reform Foundation. "2024-2025 Judicial Hellholes." Accessed February 11, 2026.

- Insurance Journal. "Corporate Nuclear Verdicts Surged to New Record High in 2024, Report Says." Accessed February 11, 2026.

- Insurance Journal. "Workers' Compensation Medical Claims Costs Rising Across Most States: WCRI." Accessed February 11, 2026.

- Marathon Strategies. "Corporate Verdicts Go Thermonuclear 2025 Edition." Accessed February 11, 2026.

- Pennsylvania Insurance Department. "Getting Stuff Done: Shapiro Administration Blocks over $180 Million in Annual Property and Casualty Insurance Premium Increases." Accessed February 11, 2026.

- Workers Compensation Research Institute. "CompScope™ Benchmarks for Pennsylvania, 2025 Edition." Accessed February 11, 2026.