Getting the best business insurance means having the right information at your fingertips, so we've compiled answers to common questions about general liability insurance in Tennessee based on MoneyGeek's research:

Best General Liability Insurance in Tennessee

The Hartford leads Tennessee general liability insurance as both the top-rated and most affordable option at $80 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Tennessee: Fast Answers

Which company offers the best general liability insurance in Tennessee?

The Hartford ranks as the best general liability insurance company in Tennessee with an overall score of 4.64 out of 5. It provides affordable coverage at $80 per month and excels in claims handling. ERGO NEXT takes second place with a 4.55 score, featuring excellent digital tools and customer service for $100 per month.

Who offers the cheapest general liability insurance in Tennessee?

The cheapest general liability insurance companies in Tennessee are:

- The Hartford: $80 per month

- Simply Business: $93 per month

- Nationwide: $95 per month

- Progressive: $98 per month

- ERGO NEXT: $100 per month

Do Tennessee businesses legally need general liability insurance?

Tennessee doesn't legally require most businesses to carry general liability insurance at the state level. However, certain licensed professionals like contractors and electricians may need specific coverage amounts. Local municipalities can set their own requirements, and most landlords and clients demand proof of insurance before signing contracts.

How much does general liability insurance cost in Tennessee?

General liability insurance costs between $16 and $897 per month for small Tennessee businesses with two employees. Drone businesses tend to get the lowest rates, while pressure washing companies see the highest premiums. Your actual cost depends on your industry, business location, coverage limits and company size.

Best General Liability Insurance Companies in Tennessee

The Hartford is our top choice for general liability insurance in Tennessee, offering reliable affordability and strong financial stability for small businesses. ERGO NEXT also performs well, providing great customer service and comprehensive coverage options. Nationwide rounds out our recommendations with steady stability ratings and competitive pricing across Tennessee.

| The Hartford | 4.64 | $80 |

| ERGO NEXT | 4.55 | $100 |

| Nationwide | 4.53 | $95 |

| Simply Business | 4.49 | $93 |

| Thimble | 4.40 | $105 |

| Coverdash | 4.37 | $101 |

| biBERK | 4.28 | $111 |

| Progressive Commercial | 4.27 | $98 |

| Chubb | 4.25 | $116 |

| Hiscox | 4.17 | $111 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Tennessee General Liability Insurer

Select your industry and state to get a customized Tennessee general liability insurance quote.

General liability insurance covers customer injuries and property damage for Tennessee businesses, but it won’t protect against every risk. Explore these additional coverage options to build comprehensive financial protection:

Best Tennessee General Liability Insurance Reviews

Finding the best general liability insurance in Tennessee requires looking beyond affordable rates to coverage quality and customer service. Our research identifies the top business insurers based on comprehensive analysis.

The Hartford

Best Tennessee General Liability Insurer

Average Monthly General Liability Premium

$80These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

4.5/5Our Survey: Likely to Be Recommended to Others

4.5/5

- pros

Handles claims quickly and efficiently with top-tier processing

Provides exceptional customer service with knowledgeable representatives

Maintains A+ AM Best rating indicating strong financial stability

Ranks first overall among general liability providers statewide

consRequires working with agents rather than online purchasing options

Digital platform experience lags behind other major insurers

The Hartford leads Tennessee's general liability market with exceptional customer service and strong financial stability, backed by an A+ AM Best rating. Its combination of competitive pricing and reliable claims processing makes it valuable for construction, professional services and retail businesses.

The Hartford excels in personalized support, making it ideal for business owners who prefer direct agent interaction over digital-only service.

Overall Score 4.64 1 Affordability Score 4.64 2 Customer Service Score 4.55 2 Coverage Score 4.70 3 Stability Score 4.98 1 The Hartford offers general liability coverage at $80 monthly, ranking among Tennessee's most cost-effective providers. It demonstrates competitive pricing for construction, cleaning and professional services, with strong affordability rankings across 21 different industry categories including home-based businesses and contractors.

Data filtered by:AccountantsAccountants $16 2 Tennessee customers consistently praise The Hartford's claims processing and customer service, ranking it first nationally in both categories. Customer feedback highlights efficient claim resolutions and knowledgeable support staff, though digital tools receive lower ratings compared to competitors.

Overall Customer Score 4.38 2 Claims Process 4.50 1 Customer Service 4.70 1 Digital Experience 3.80 10 Overall Satisfaction 4.50 1 Policy Management 4.20 4 Recommend to Others 4.50 2 Renewal Likelihood 4.40 2 The Hartford provides general liability coverage with limits from $300,000 to $2 million per occurrence and double aggregate limits. Businesses can enhance protection with product liability coverage and broad form contractual liability options.

Additional features include data breach protection through business owner's policy bundling, offering comprehensive coverage for Tennessee enterprises.

ERGO NEXT

Best Tennessee Commercial General Liability: Runner-Up

Average Monthly General Liability Premium

$100These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first in customer service and second for coverage among Tennessee providers

Provides instant quotes and coverage in 10 minutes

Has an A- AM Best rating with backing from Munich Re

Covers 1,300+ business types with AI-driven customization

consCosts more than five other Tennessee providers

Newer insurer with less history than competitors

No local agents; everything's online

ERGO NEXT is a strong player in Tennessee’s general liability market, offering exceptional customer service and well-rounded coverage options. With an A- AM Best rating and high marks for policy management, ERGO NEXT provides reliable protection suited for tech companies, contractors and professional services.

It works especially well for businesses that prefer digital-first operations and streamlined policy management.

Overall Score 4.55 2 Affordability Score 4.24 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 At $100 monthly, ERGO NEXT offers competitive general liability coverage in Tennessee, with strong pricing for tech businesses, home-based services and professional contractors. The provider shows exceptional affordability rankings across 22 industries including automotive, cleaning and electrical services, making it a cost-effective choice for diverse business types.

Data filtered by:AccountantsAccountants $17 3 Tennessee customers rate ERGO NEXT highly for digital experience, policy management and likelihood to recommend the service to others. Customer feedback emphasizes the provider's efficient online platform and straightforward policy administration, though claims processing scores indicate room for improvement.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT provides general liability coverage with limits up to $2 million per claim and $4 million aggregate in Tennessee. The provider includes contractor E&O insurance and offers specialized endorsements like CG2010 for completed operations coverage. Their flexible policy structure allows businesses to customize protection levels and add specific endorsements based on industry needs.

Cheapest General Liability Insurance Companies in Tennessee

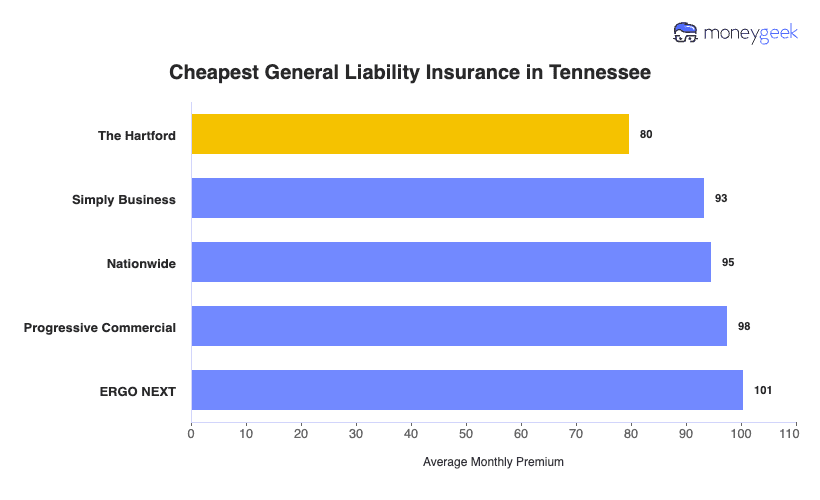

The Hartford offers the cheapest general liability insurance in Tennessee at $80 per month, saving businesses $20 or 20% compared to the state average. Simply Business and Nationwide also provide affordable coverage options for Tennessee companies.

| The Hartford | $80 | $957 |

| Simply Business | $93 | $1,120 |

| Nationwide | $95 | $1,135 |

| Progressive Commercial | $98 | $1,171 |

| ERGO NEXT | $101 | $1,206 |

| Coverdash | $101 | $1,210 |

| Thimble | $105 | $1,255 |

| Hiscox | $111 | $1,335 |

| biBERK | $111 | $1,336 |

| Chubb | $116 | $1,391 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Tennessee by Industry

MoneyGeek's research identifies the most affordable general liability insurance providers by industry in Tennessee.

- The Hartford: Offers the cheapest coverage across 21 industries, leading in construction, cleaning, transportation and home-based businesses.

- Simply Business and Thimble: Each provide affordable rates for 11 industries. Simply Business excels with professional services like consulting, accounting and software companies. Thimble focuses on personal service businesses including barbers, HVAC and wedding planning.

- biBerk: Ranks as the most affordable option for nine industries and performs especially well in contracting, engineering and veterinary services.

- Nationwide: Leads affordability in eight industries, showing competitive rates for electrical, manufacturing, moving and real estate businesses.

| Accountants | Simply Business | $14 | $169 |

Average Cost of General Liability Insurance in Tennessee

Most small businesses in Tennessee pay about $100 monthly for general liability insurance. The average cost of general liability insurance coverage depends on your industry, business size, location and coverage limits.

Manufacturing companies often pay higher premiums due to increased risk exposure, while accounting firms usually pay less because of lower liability concerns. Sole proprietors generally pay less than businesses with employees since they have fewer risk factors.

Average Cost of General Liability Insurance in Tennessee by Industry

Monthly costs for general liability coverage in Tennessee vary widely by industry. Drone businesses pay the least at $16 per month, while pressure washing companies reach the highest rates at $897 monthly. Review this table to find typical costs for your specific business type.

| Accountants | $22 | $259 |

| Ad Agency | $35 | $416 |

| Automotive | $52 | $627 |

| Auto Repair | $149 | $1,787 |

| Bakery | $89 | $1,062 |

| Barber | $43 | $521 |

| Beauty Salon | $65 | $786 |

| Bounce House | $69 | $826 |

| Candle | $54 | $646 |

| Cannabis | $66 | $788 |

| Catering | $86 | $1,031 |

| Cleaning | $130 | $1,558 |

| Coffee Shop | $88 | $1,055 |

| Computer Programming | $28 | $342 |

| Computer Repair | $47 | $560 |

| Construction | $172 | $2,062 |

| Consulting | $22 | $258 |

| Contractor | $250 | $2,997 |

| Courier | $192 | $2,298 |

| Daycare | $32 | $387 |

| Dental | $21 | $253 |

| DJ | $25 | $298 |

| Dog Grooming | $62 | $746 |

| Drone | $16 | $196 |

| Ecommerce | $72 | $861 |

| Electrical | $110 | $1,322 |

| Engineering | $39 | $469 |

| Excavation | $456 | $5,476 |

| Florist | $42 | $504 |

| Food | $106 | $1,266 |

| Food Truck | $139 | $1,667 |

| Funeral Home | $59 | $710 |

| Gardening | $110 | $1,322 |

| Handyman | $239 | $2,871 |

| Home-based | $23 | $279 |

| Home-based | $45 | $538 |

| Hospitality | $64 | $767 |

| HVAC | $240 | $2,885 |

| Janitorial | $134 | $1,613 |

| Jewelry | $39 | $474 |

| Junk Removal | $159 | $1,911 |

| Lawn/Landscaping | $118 | $1,414 |

| Lawyers | $22 | $268 |

| Manufacturing | $63 | $752 |

| Marine | $27 | $330 |

| Massage | $94 | $1,127 |

| Mortgage Broker | $22 | $269 |

| Moving | $122 | $1,459 |

| Nonprofit | $35 | $422 |

| Painting | $141 | $1,691 |

| Party Rental | $78 | $935 |

| Personal Training | $23 | $281 |

| Pest Control | $32 | $379 |

| Pet | $55 | $659 |

| Pharmacy | $61 | $727 |

| Photography | $24 | $284 |

| Physical Therapy | $108 | $1,297 |

| Plumbing | $354 | $4,252 |

| Pressure Washing | $897 | $10,766 |

| Real Estate | $52 | $625 |

| Restaurant | $142 | $1,705 |

| Retail | $64 | $769 |

| Roofing | $380 | $4,563 |

| Security | $136 | $1,636 |

| Snack Bars | $115 | $1,381 |

| Software | $26 | $310 |

| Spa/Wellness | $105 | $1,255 |

| Speech Therapist | $31 | $367 |

| Startup | $28 | $337 |

| Tech/IT | $26 | $311 |

| Transportation | $37 | $442 |

| Travel | $20 | $245 |

| Tree Service | $127 | $1,526 |

| Trucking | $101 | $1,207 |

| Tutoring | $30 | $356 |

| Veterinary | $44 | $527 |

| Wedding Planning | $27 | $326 |

| Welding | $162 | $1,939 |

| Wholesale | $44 | $526 |

| Window Cleaning | $156 | $1,873 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Tennessee General Liability Insurance Costs?

Many important factors influence what Tennessee businesses pay for general liability insurance coverage.

Tennessee Legal and Regulatory Environment

Tennessee follows a modified comparative negligence system with a 50% bar rule. Plaintiffs can recover damages only if their fault is less than 50%, which limits insurer exposure in shared-fault situations. The state's trial rate for personal injury cases dropped to 2.44% in FY 2023-24 from 3.8% in FY 2014-15, reducing expensive litigation costs for insurers.

The average personal injury jury verdict in Tennessee is $273,821, but the median is $17,536, with most judgments falling under $100,000. These factors create predictable claim outcomes, helping keep Tennessee premiums lower and more stable than states with pure comparative negligence or higher litigation rates.

Tennessee Geographic and Environmental Risks

Tennessee experienced 116 confirmed billion-dollar disaster events from 1980 to 2024, with the annual average increasing from 2.6 events to 7.8 events in the most recent five years. The state set a record with 11 billion-dollar disasters in 2023 and has one of the highest rates of nocturnal tornadoes in the country.

Severe weather creates hazardous premises conditions such as storm damage, fallen debris, damaged walkways and power outages, all of which increase slip-and-fall claims and customer injuries. As disaster frequency continues to rise, insurers raise rates to cover growing weather-related premises liability claims, which pushes Tennessee premiums higher.

Tennessee Geographic and Urban Factors

Tennessee's urban centers drive higher claim costs through increased customer traffic, more frequent litigation, and larger jury awards. Small businesses in Nashville, Memphis, Knoxville, and Chattanooga often pay higher premiums than those in rural areas of Tennessee.

Urban areas generate more slip-and-fall accidents, premises liability claims and higher settlement costs. Commercial premiums are expected to increase 8 to 15% in industrial and manufacturing risks in Jackson, Memphis, and Chattanooga. Insurers adjust rates upward by ZIP code to reflect geographic differences in claim frequency and severity between urban and rural locations.

Tennessee Industry and Economic Composition

Tennessee's economy is dominated by manufacturing (2,600+ establishments), healthcare (2,300+ establishments), and distribution/logistics (15,200 establishments), creating a higher-risk business environment. Manufacturing, construction and logistics businesses carry greater liability exposures from equipment injuries and on-site accidents.

The state's major tourism industry adds substantial premises liability exposure through hotels, restaurants and entertainment venues with constant customer interaction. High claims in these concentrated industries drive up insurers' overall Tennessee loss ratios, pushing base rates higher for all businesses including small retail and service companies.

How Much General Liability Insurance Do I Need in Tennessee?

Tennessee's general liability insurance requirements for businesses depend on your industry and license type. While most small businesses aren't legally required to carry coverage, the state mandates specific minimums for licensed contractors. Understanding these requirements helps you stay compliant and protects your business from costly lawsuits. Below are Tennessee's mandatory coverage requirements by profession.

- Projects up to $500,000 need $100,000 minimum coverage.

- Mid-sized projects between $500,001 and $1,500,000 require $500,000 in coverage.

- Major projects exceeding $1,500,001 demand $1 million minimum.You'll need to submit a certificate of insurance listing the Board for Licensing Contractors as the certificate holder regardless of project size.

Tennessee contractors must carry general liability insurance to obtain and maintain their license through the Board for Licensing Contractors. Coverage minimums are tied to your project's monetary limit:

Licensed electricians in Tennessee need general liability insurance matching their project limits, with minimums starting at $100,000. Both full contractor licenses and Limited License Electrician (LLE) classifications require proof of coverage.

Tennessee requires plumbers to carry general liability insurance based on their monetary limit, following the same tiered structure as general contractors. Limited License Plumbers (LLP) working on projects under $25,000 need $100,000 minimum coverage, while larger projects require higher limits matching the project-based tiers.

Heating, ventilation and air conditioning contractors must maintain general liability insurance as part of their mechanical contractor license. Coverage amounts follow the same project-based minimums as general contractors, ranging from $100,000 to $1 million depending on the monetary limit.

Tennessee requires home improvement contractors to carry a minimum of $100,000 in general liability insurance for residential remodeling projects valued between $3,000 and $24,999. This flat minimum protects homeowners and ensures contractors can cover potential property damage or injuries during residential work.

State insurance requirements change often. Check current requirements with the Tennessee Department of Commerce and Insurance or talk with a licensed insurance agent for the latest information.

How to Choose the Best General Liability Insurance in Tennessee

Getting business insurance in Tennessee starts with understanding your coverage needs and budget. General liability insurance covers accidents and property damage claims, but most small businesses need additional policies like commercial property and professional liability for complete financial protection.

- 1Determine Coverage Needs

Tennessee doesn't mandate general liability insurance for most businesses, but many commercial landlords require $1 million per occurrence with $2 million aggregate limits in lease agreements.

Licensed contractors must carry coverage that matches their project size, ranging from $100,000 to $1 million. Review your industry risks, client contracts and lease requirements to determine the right business insurance coverage limits for your operations.

- 2Prepare Business Information

Tennessee insurers calculate premiums based on your business classification, annual revenue, employee count and physical location within the state. Nashville and Memphis businesses often pay higher rates due to increased claim frequency in urban areas. Gather your EIN, business registration with the Tennessee Secretary of State and recent tax returns before requesting quotes to ensure accurate pricing.

- 3Compare Multiple Quotes

Request quotes from at least three insurers licensed in Tennessee, as business insurance costs vary significantly by industry: drone businesses average $16 monthly while pressure washing companies pay around $897 monthly per MoneyGeek analysis. Compare whether defense costs count against your policy limit or come as additional coverage beyond your liability cap. Most Tennessee small businesses pay approximately $100 per month for general liability insurance, though your actual rate depends on your industry risk profile and coverage limits.

- 4Look Beyond Price

Cheap business insurance often includes restrictive exclusions that leave coverage gaps during claims. Review policy exclusions carefully since Tennessee businesses commonly need separate coverage for professional errors, pollution liability and employee injuries through workers' compensation. Defense cost provisions matter significantly since legal fees in Tennessee civil courts often exceed settlement amounts.

- 5Verify Insurer Credentials

Check insurer legitimacy through the Tennessee Department of Commerce and Insurance’s online database. Review AM Best financial strength ratings, since Tennessee regulators recommend carriers with A- or higher to help confirm claim payment capability. You can also look at complaint ratios filed with state regulators to identify companies with weaker claims-handling records in Tennessee.

- 6Ask About Discounts

Tennessee insurers offer discounts for bundling general liability with commercial auto or property coverage, reducing premiums by 10% to 25%. Businesses with claims-free histories for three or more years qualify for preferred rates in Tennessee's competitive insurance market. Installing safety systems or completing employee training programs through Tennessee Department of Labor resources can lower premiums by documenting reduced risk.

- 7Obtain Certificate of Insurance

Tennessee commercial landlords and project owners require certificates of insurance before signing leases or contracts. Most insurers issue digital certificates instantly through online portals, though some carriers take 24 to 48 hours for manual processing. Keep your agent's contact information accessible for urgent certificate requests (Tennessee contractors often need same day certificates) when bidding on projects.

- 8Review Coverage Annually

Reassess your coverage each renewal period, especially after hiring employees that push you past Tennessee's five-employee threshold requiring workers' compensation insurance. Compare quotes 60 to 90 days before renewal since Tennessee's insurance market fluctuates and carriers adjust rates annually. Updating coverage prevents compliance gaps with the Tennessee Board for Licensing Contractors if you're in construction trades.

Top General Liability Insurance in Tennessee: Bottom Line

Finding the right general liability insurance in Tennessee starts with understanding your specific business needs and researching providers thoroughly. The Hartford, ERGO NEXT and Nationwide are leading options, but your best choice depends on your industry, company size and budget. Compare quotes from multiple insurers and verify their credentials before making your final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Bureau of Economic Analysis. "Real Gross Domestic Product by State and Industry [Interactive Data]." Accessed February 18, 2026.

- National Oceanic and Atmospheric Administration (NOAA) National Centers for Environmental Information. "Billion-Dollar Weather and Climate Disasters: Tennessee Summary." Accessed February 18, 2026.

- National Weather Service Nashville. "Tornadoes and Severe Storms." Accessed February 18, 2026.

- Tennessee Administrative Office of the Courts. "Annual Statistical Report of the Tennessee Judiciary 2023-2024." Accessed February 18, 2026.

- Tennessee Bar Association. "Examining 2023-2024 Tennessee Tort Case Stats." Accessed February 18, 2026.

- Tennessee Bar Legal Education. "TORTS: Comparative Fault." Accessed February 18, 2026.

- WPLN News. "Tennessee Has Seen 100+ 'Billion-Dollar Disasters' Since 1980." Accessed February 18, 2026.