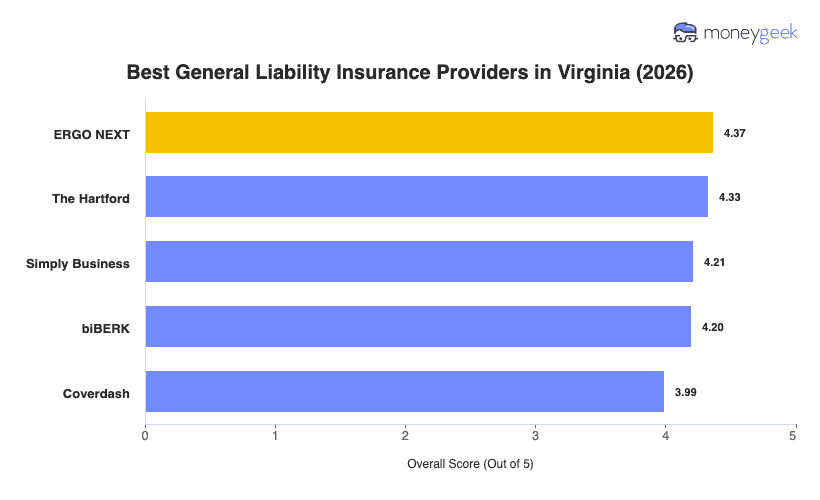

The best general liability insurers for Virginia small businesses balance competitive pricing with reliable claims handling and flexible coverage. These five companies rank highest for 25 general industries operating across the Commonwealth, from urban centers to smaller markets.

- ERGO NEXT: Best Overall, Best for Higher-Risk Service Businesses

- The Hartford: Best Cheap General Liability Insurance

- Simply Business: Best for Comparing Multiple Carriers

- biBERK: Best for Service-Oriented Businesses

- Thimble: Best for Gig Workers and Freelancers

Each of these providers performs well on cost, service quality, and policy flexibility for Virginia businesses. The detailed profiles below show how their strengths match different operations, whether you're running a Norfolk storefront, managing a Fairfax consulting firm or operating a Charlottesville food truck.