Wisconsin business owners seeking the best business insurance coverage can find reliable answers to common general liability insurance questions below, all supported by MoneyGeek's comprehensive research and expert analysis:

Best General Liability Insurance in Wisconsin

ERGO NEXT is Wisconsin's top general liability insurer, while The Hartford offers the lowest rates starting at $80 per month.

Get matched to the best and cheapest general liability insurer for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Commercial General Liability Insurance in Wisconsin: Fast Answers

Which company offers the best general liability insurance in Wisconsin?

ERGO NEXT and The Hartford tie as the best general liability providers in Wisconsin, both earning 4.55 out of 5 overall scores. The Hartford offers the lowest rates at $80 per month and provides dependable claims processing. ERGO NEXT delivers competitive coverage at $101 per month along with a strong digital platform for small businesses.

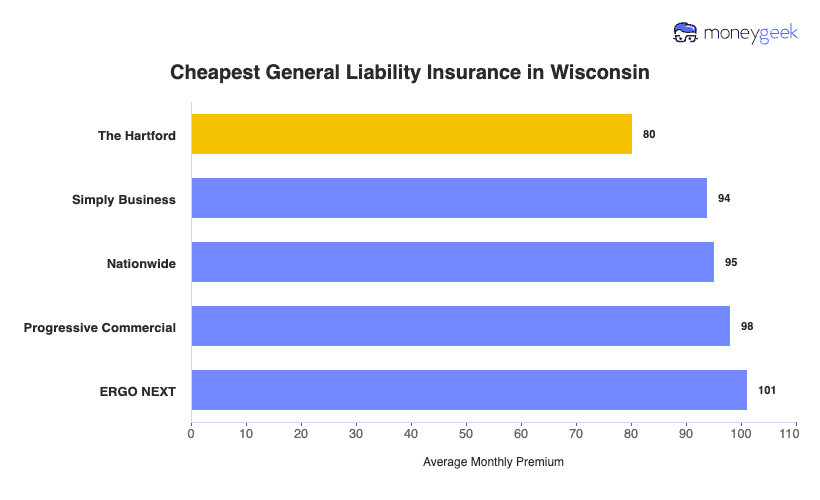

Who offers the cheapest general liability insurance in Wisconsin?

The cheapest general liability insurance companies in Wisconsin are:

- The Hartford: $80 per month

- Simply Business: $94 per month

- Nationwide: $95 per month

- Progressive: $98 per month

- ERGO NEXT: $101 per month

Do Wisconsin businesses legally need general liability insurance?

Wisconsin doesn't legally require general liability insurance for most businesses statewide. However, certain licensed professionals like contractors and electricians must carry minimum coverage to maintain their licenses.

Local municipalities may impose additional requirements. Even without legal mandates, landlords and clients often require proof of coverage before signing contracts or leases.

How much does general liability insurance cost in Wisconsin?

General liability insurance costs between $16 and $903 per month for small Wisconsin businesses with two employees. The drone industry sees the lowest rates at $16 per month, while pressure washing businesses have the highest costs at $903 per month. Your actual premium depends on your industry, location, coverage limits and business size.

Best General Liability Insurance Companies in Wisconsin

ERGO NEXT and The Hartford are our joint top picks for general liability insurance in Wisconsin. ERGO NEXT delivers excellent customer service, while The Hartford offers strong affordability and financial stability. Nationwide is another reliable option with consistent performance across coverage and customer service for small businesses.

| ERGO NEXT | 4.55 | $101 |

| The Hartford | 4.55 | $80 |

| Nationwide | 4.51 | $95 |

| Simply Business | 4.47 | $94 |

| Coverdash | 4.36 | $101 |

| Thimble | 4.35 | $105 |

| biBERK | 4.28 | $112 |

| Progressive Commercial | 4.26 | $98 |

| Chubb | 4.26 | $117 |

| Hiscox | 4.17 | $112 |

How Did We Determine These Rates?

These rates reflect MoneyGeek's analysis of small businesses with two employees across 79 major industries. Actual rates vary based on your business location, industry risk factors, claims history, coverage limits and individual insurer underwriting criteria. Contact insurers directly for personalized quotes.

Get Matched to the Best Cheap Wisconsin General Liability Insurer

Select your industry and state to get a customized Wisconsin general liability insurance quote.

General liability insurance covers customer injuries and property damage for Wisconsin businesses, but it won’t protect against every risk. Explore these additional coverage options:

Best Wisconsin General Liability Insurance Reviews

Finding the best general liability insurance in Wisconsin requires looking beyond affordable rates to consider coverage quality and customer service. Our research identified the top business insurers based on comprehensive analysis.

ERGO NEXT

Best Wisconsin General Liability Insurer

Average Monthly General Liability Premium

$101These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.8/5

- pros

Ranks first for digital experience with streamlined online tools

Handles claims quickly with efficient processing systems

Holds A- AM Best rating indicating strong financial stability

Offers competitive pricing for general liability coverage

consNewer insurer with shorter track record than established competitors

No local agents available; all interactions happen online

ERGO NEXT leads Wisconsin's general liability market with exceptional customer service and comprehensive coverage options. Their A- AM Best rating and top rankings in digital experience and policy management make them ideal for tech-savvy business owners. ERGO NEXT serves contractors, professional services and retail businesses seeking streamlined online insurance management.

Overall Score 4.55 1 Affordability Score 4.26 6 Customer Service Score 4.70 1 Coverage Score 4.80 2 Stability Score 4.78 6 ERGO NEXT offers general liability coverage at $101 per month, providing competitive rates for construction, professional services and retail businesses. They show strongest affordability rankings for tech companies, home-based businesses and professional service providers.

Data filtered by:AccountantsAccountants $17 3 Wisconsin customers rate ERGO NEXT highest for digital experience, policy management and likelihood to recommend. Their online platform receives praise for ease of use and efficient claims processing, though some customers note their claims handling could be more consistent.

Overall Customer Score 4.45 1 Claims Process 3.90 4 Customer Service 4.20 4 Digital Experience 4.80 1 Overall Satisfaction 4.40 2 Policy Management 4.30 1 Recommend to Others 4.80 1 Renewal Likelihood 4.60 1 ERGO NEXT provides liability coverage up to $2 million per claim with $4 million aggregate limits. Their policies include contractor errors and omissions insurance and optional endorsements for completed operations coverage. Small businesses can customize protection through add-ons like the CG2010 endorsement for ongoing operations.

Nationwide

Best Wisconsin Commercial General Liability: Runner-Up

Average Monthly General Liability Premium

$95These rates are for small businesses with two employees across 79 major industries or business types and focus solely on general liability policies.Our Survey: Claims Process

3.9/5Our Survey: Likely to Be Recommended to Others

4.3/5

- pros

Ranks first in financial stability among state providers

Ranks second in customer service with responsive support

Strong policy management capabilities for easy administration

Over 90 years of insurance industry experience

consDigital experience ranks lower than most competitors

Affordability ranks fourth among surveyed providers

Nationwide ranks as a leading general liability insurance provider in Wisconsin, distinguished by its exceptional stability ranking and customer service. With strong financial backing and consistent performance across service metrics, it offers reliable financial protection suited for electrical contractors, manufacturing firms and professional service businesses.

Wisconsin business owners who value personalized service and established stability will find Nationwide's comprehensive coverage approach especially beneficial.

Overall Score 4.51 2 Affordability Score 4.36 4 Customer Service Score 4.55 2 Coverage Score 4.61 4 Stability Score 4.98 1 At $95 per month on average, Nationwide offers competitive rates for Wisconsin businesses, with strong pricing for electrical, manufacturing and janitorial services. The company demonstrates exceptional affordability rankings across professional services and trades, making it a cost-effective choice for diverse business types.

Data filtered by:AccountantsAccountants $20 4 Wisconsin customers consistently praise Nationwide's policy management and customer service capabilities, ranking these aspects among the provider's strongest features. The company excels in renewal experiences and policyholder recommendations, reflecting high satisfaction levels across key service metrics.

Overall Customer Score 4.16 6 Claims Process 3.90 5 Customer Service 4.30 3 Digital Experience 4.00 8 Overall Satisfaction 4.20 5 Policy Management 4.30 2 Recommend to Others 4.30 4 Renewal Likelihood 4.20 5 Nationwide provides general liability coverage with limits ranging from $300,000 to $2 million per occurrence, offering aggregate limits up to $4 million. Businesses can enhance protection through additional options like product liability coverage and data breach protection. The company offers flexible policy customization, allowing Wisconsin businesses to tailor coverage to their specific industry needs.

Cheapest General Liability Insurance Companies in Wisconsin

The Hartford offers the cheapest general liability insurance in Wisconsin at $80 per month, saving businesses $21 or 21% compared to the state average. Simply Business and Nationwide also provide affordable coverage options for Wisconsin small businesses.

| The Hartford | $80 | $963 |

| Simply Business | $94 | $1,127 |

| Nationwide | $95 | $1,142 |

| Progressive Commercial | $98 | $1,178 |

| ERGO NEXT | $101 | $1,213 |

| Coverdash | $101 | $1,218 |

| Thimble | $105 | $1,263 |

| Hiscox | $112 | $1,344 |

| biBERK | $112 | $1,345 |

| Chubb | $117 | $1,399 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

Cheapest General Liability Insurance in Wisconsin by Industry

MoneyGeek's research identifies the cheapest general liability insurance providers by industry across Wisconsin.

- The Hartford: Offers the most affordable coverage in 22 industries, leading in construction, cleaning, security and welding sectors.

- Simply Business and Thimble: Each provides cheap rates for 11 industries. Simply Business excels with professional services like accountants, lawyers and software companies, while Thimble dominates trades including HVAC, roofing and barber services.

- biBerk: Ranks as the most affordable option in 10 industries, performing strongly for contractors, engineering firms and trucking companies.

- Nationwide: Delivers competitive rates across eight industries, excelling in electrical, manufacturing and real estate sectors.

- ERGO NEXT: Secures affordability leadership in seven Wisconsin industries, showing strong performance for tech, photography and dental practices.

| Accountants | Simply Business | $14 | $170 |

Average Cost of General Liability Insurance in Wisconsin

Most small businesses in Wisconsin pay about $101 monthly for general liability insurance. The average cost of general liability coverage depends on your industry, business size, location and coverage limits.

Manufacturing companies often pay higher premiums due to greater risk exposure, while accounting firms tend to pay less because of lower claim potential. Sole proprietors generally pay less than businesses with employees since they have fewer liability exposures.

Average Cost of General Liability Insurance in Wisconsin by Industry

Wisconsin businesses pay between $16 and $903 monthly for general liability coverage, depending on their industry. Drone businesses see the most affordable rates at $16 per month, while pressure washing companies have the highest costs at $903 monthly. Review this table to find typical rates for your specific business type.

| Accountants | $22 | $261 |

| Ad Agency | $35 | $419 |

| Automotive | $53 | $631 |

| Auto Repair | $150 | $1,798 |

| Bakery | $89 | $1,069 |

| Barber | $44 | $525 |

| Beauty Salon | $66 | $791 |

| Bounce House | $69 | $831 |

| Candle | $54 | $650 |

| Cannabis | $66 | $793 |

| Catering | $86 | $1,037 |

| Cleaning | $131 | $1,568 |

| Coffee Shop | $88 | $1,061 |

| Computer Programming | $29 | $344 |

| Computer Repair | $47 | $564 |

| Construction | $173 | $2,076 |

| Consulting | $22 | $260 |

| Contractor | $251 | $3,016 |

| Courier | $193 | $2,313 |

| Daycare | $32 | $389 |

| Dental | $21 | $254 |

| DJ | $25 | $299 |

| Dog Grooming | $63 | $751 |

| Drone | $16 | $197 |

| Ecommerce | $72 | $866 |

| Electrical | $111 | $1,331 |

| Engineering | $39 | $471 |

| Excavation | $459 | $5,511 |

| Florist | $42 | $507 |

| Food | $106 | $1,274 |

| Food Truck | $140 | $1,677 |

| Funeral Home | $60 | $714 |

| Gardening | $111 | $1,330 |

| Handyman | $241 | $2,889 |

| Home-based | $23 | $281 |

| Home-based | $45 | $542 |

| Hospitality | $64 | $772 |

| HVAC | $242 | $2,903 |

| Janitorial | $135 | $1,623 |

| Jewelry | $40 | $477 |

| Junk Removal | $160 | $1,923 |

| Lawn/Landscaping | $119 | $1,423 |

| Lawyers | $22 | $270 |

| Manufacturing | $63 | $757 |

| Marine | $28 | $332 |

| Massage | $95 | $1,134 |

| Mortgage Broker | $23 | $271 |

| Moving | $122 | $1,468 |

| Nonprofit | $35 | $425 |

| Painting | $142 | $1,702 |

| Party Rental | $78 | $941 |

| Personal Training | $24 | $282 |

| Pest Control | $32 | $382 |

| Pet | $55 | $663 |

| Pharmacy | $61 | $731 |

| Photography | $24 | $286 |

| Physical Therapy | $109 | $1,305 |

| Plumbing | $357 | $4,278 |

| Pressure Washing | $903 | $10,833 |

| Real Estate | $52 | $629 |

| Restaurant | $143 | $1,716 |

| Retail | $64 | $774 |

| Roofing | $383 | $4,592 |

| Security | $137 | $1,646 |

| Snack Bars | $116 | $1,389 |

| Software | $26 | $312 |

| Spa/Wellness | $105 | $1,263 |

| Speech Therapist | $31 | $369 |

| Startup | $28 | $339 |

| Tech/IT | $26 | $312 |

| Transportation | $37 | $445 |

| Travel | $21 | $247 |

| Tree Service | $128 | $1,536 |

| Trucking | $101 | $1,214 |

| Tutoring | $30 | $358 |

| Veterinary | $44 | $530 |

| Wedding Planning | $27 | $328 |

| Welding | $163 | $1,951 |

| Wholesale | $44 | $529 |

| Window Cleaning | $157 | $1,885 |

How Did We Determine These Rates?

These rates reflect small businesses with two employees across 79 major industries and focus solely on general liability policies. Your premium depends on where your business is located, what industry you're in, how much coverage you choose and other factors insurers consider. Available options differ by state.

What Factors Affect Wisconsin General Liability Insurance Costs?

Several important factors influence what Wisconsin businesses pay for general liability insurance.

Wisconsin's Legal and Regulatory Environment

Wisconsin's 2011 tort reforms cap punitive damages at $200,000 or twice compensatory damages and adopted Daubert standards for expert testimony. These caps create predictable maximum payouts, helping insurers price policies more accurately. Fewer lawsuits and capped damages reduce loss ratios, which stabilizes or lowers premiums.

The reforms cut frivolous claims and limited product liability exposure, making Wisconsin more attractive to insurers and increasing competition that can drive rates down for small business owners.

Wisconsin's Healthcare and Medical Costs

Medical expenses drive bodily injury claim costs, and Wisconsin has the fourth highest hospital prices nationwide at 307% of Medicare rates. Hospital costs jumped 11% since 2022, while uncompensated care climbed 30.5% to $1.77 billion in 2024.

When a customer slips at your business and needs emergency care, you’ll encounter substantially higher claim costs than in most states. Insurers pass these elevated medical expenses directly to policyholders through higher premiums.

Wisconsin's Weather and Environmental Risks

From 1980-2024, Wisconsin experienced 63 billion-dollar disasters, including 44 severe storms and 5 major floods. Harsh winters bring months of snow, ice, and freezing rain that create slip-and-fall hazards in parking lots and entryways.

Businesses manage icy conditions and water damage for extended periods yearly. Urban areas like Milwaukee and Madison pay more than rural locations due to higher foot traffic exposure. More weather-related accidents mean more claims, pushing your premiums higher.

Wisconsin's Economic and Industry Landscape

Wisconsin ranks first or second nationwide for manufacturing jobs as a percentage of employment. Key industries include advanced manufacturing, biohealth, water technology, and food processing. Manufacturing has elevated liability risks from heavy equipment and hazardous materials, which raises baseline rates for all businesses statewide.

Inflation at 3.7% increases claim costs for medical care, wage replacement and property repairs. You'll pay more as insurers adjust premiums to cover rising settlement values across Wisconsin's high-risk industrial economy.

How Much General Liability Insurance Do I Need in Wisconsin?

Wisconsin requires general liability insurance for one profession only: dwelling contractors need $250,000 minimum coverage to maintain their licenses. The general liability insurance requirements don't extend to other businesses at the state level. Most Wisconsin small business owners still carry coverage because landlords and clients won't work with you without proof of insurance before signing leases or contracts.

Note: State insurance rules change regularly. Check with the Wisconsin Office of the Commissioner of Insurance or a licensed agent to confirm the latest requirements before purchasing coverage.

How to Choose the Best General Liability Insurance in Wisconsin

Getting business insurance in Wisconsin starts with comparing general liability quotes from multiple insurers to find coverage that fits your budget and risk level. Bundle general liability with property or workers' compensation insurance to save money while protecting your business from accidents, lawsuits and financial losses.

- 1Determine Coverage Needs

Dwelling contractors in Wisconsin must carry at least $250,000 in general liability coverage, while other businesses have no state-mandated minimums. Most small Wisconsin businesses choose $1 million per occurrence and $2 million aggregate limits as part of their business insurance coverage to meet commercial lease and client contract requirements.

Review your vendor agreements and check whether landlords in Milwaukee or Madison specify coverage amounts before selecting your policy limits.

- 2Prepare Business Information

Wisconsin insurers calculate premiums based on your business location, industry classification, annual revenue and employee headcount. Milwaukee businesses pay higher premiums than those in Green Bay or Appleton due to concentrated liability exposure. Gather your EIN, Wisconsin business registration documents and recent tax returns before requesting quotes to ensure accurate pricing for your operation.

- 3Compare Multiple Quotes

Wisconsin small businesses pay around $101 monthly for general liability insurance, with rates ranging from $16 for drone operators to $903 for pressure washing companies depending on industry risk.

Compare at least three quotes since the cost of your coverage varies between insurers even for identical limits and business types. Review whether defense costs count against your policy limits or sit outside them, as this distinction affects your financial protection during claims.

- 4Look Beyond Price

Cheap business insurance excludes critical coverages Wisconsin businesses need—products liability for restaurants or completed operations coverage for contractors. Read policy exclusions carefully since standard general liability won't cover professional errors, pollution claims or employee injuries requiring separate coverage.

Wisconsin's harsh winters create more slip-and-fall claims, so confirm your policy includes adequate premises liability protection for snow and ice incidents.

- 5Verify Insurer Credentials

Check insurer licensing through the Wisconsin Office of the Commissioner of Insurance and review AM Best ratings to confirm financial stability before purchasing coverage. The state insurance department handles over 18,000 consumer complaints annually, making complaint ratios a valuable indicator of insurer performance.

Choose carriers with at least an A- AM Best rating to ensure claims payment capability during Wisconsin's peak loss seasons.

- 6Ask About Discounts

Bundle general liability with commercial property or workers' compensation in a business owner's policy to save 10% to 25% on premiums. Claims-free businesses qualify for additional savings. Documented safety programs, employee training, annual payment plans and Wisconsin business association memberships can lower costs further.

- 7Obtain Certificate of Insurance

Wisconsin landlords and clients require certificates of insurance before signing leases or contracts, and most insurers provide digital certificates instantly through online portals. Keep your insurance agent's contact information accessible since general contractors in Wisconsin need same-day certificates to avoid project delays.

Your certificate proves you meet the $250,000 dwelling contractor requirement or other contractually required coverage amounts.

- 8Review Coverage Annually

Reassess coverage 60 to 90 days before renewal, especially after hiring employees or expanding into new service areas across Wisconsin. Your liability exposure increases when you add locations in Milwaukee versus smaller markets, and your rates should reflect current operations. Annual quote comparisons help you adjust limits and identify coverage gaps before claims arise.

Top General Liability Insurance in Wisconsin: Bottom Line

Finding the right general liability insurance in Wisconsin starts with understanding your specific business needs and thoroughly researching available providers. ERGO NEXT, The Hartford and Nationwide consistently rank among top insurers, but your ideal choice depends on your industry, business size, and budget. Compare quotes from multiple providers and verify each insurer's credentials before making your final decision.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- NOAA National Centers for Environmental Information. "Billion-Dollar Weather and Climate Disasters | Wisconsin." Accessed March 7, 2026.

- Wisconsin Department of Revenue. "Wisconsin Economic Forecast – August 2025." Accessed March 7, 2026.

- Wisconsin Department of Safety and Professional Services. "SPS 305.315 – Dwelling Contractor Certification." Accessed March 7, 2026.

- Wisconsin Department of Workforce Development. "New Job Growth Estimates: A Positive Outlook for Wisconsin's Workforce and Economy." Accessed March 7, 2026.

- Wisconsin Economic Development Corporation. "Wisconsin Major Industries." Accessed March 7, 2026.

- Wisconsin Hospital Association. "Guide to Wisconsin Hospitals for FY2024." Accessed March 7, 2026.

- Wisconsin Legislature. "2011 Wisconsin Act 2: LC Act Memo." Accessed March 7, 2026.

- Wisconsin Manufacturers & Commerce. "Reforms Needed to Bring Down Wisconsin's 4th Highest Hospital Prices in the Country." Accessed March 7, 2026.

- Wisconsin Public Radio. "Fewer Than Half of Wisconsin Manufacturers Say Business Climate Heading in Right Direction." Accessed March 7, 2026.

- Wisconsin Public Radio. "Wisconsin Hospital Finances Stabilized Slightly in 2024, but It Might Not Last." Accessed March 7, 2026.