We studied 79 industries, all 50 states, companies with 0 to 49 employees and the largest business insurers in the U.S. to give you the best recommendations for cheap business insurance.

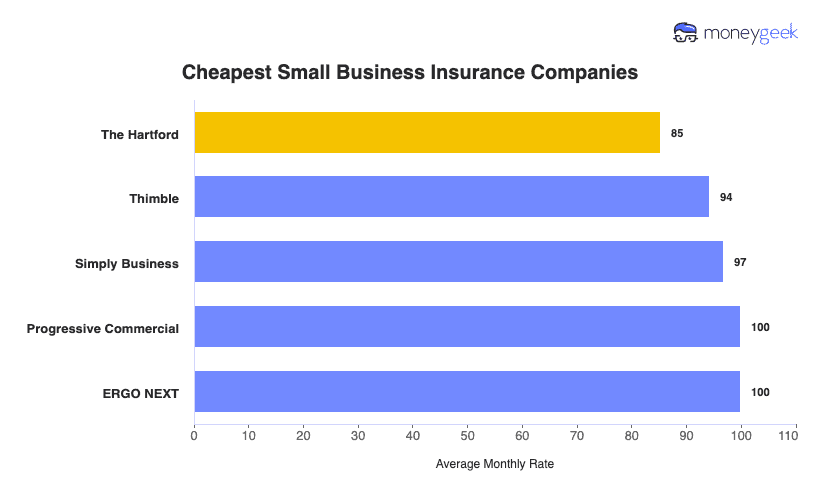

We've summarized the cheapest small business insurers and their low prices by commonly needed coverage types below to get you started

- Cheapest General Liability Insurance: The Hartford ($83 per month)

- Cheapest Workers Comp Insurance: ERGO NEXT ($69 monthly)

- Cheapest Professional Liability Insurance: The Hartford ($72 a month)

- Cheapest BOP Insurance: The Hartford ($115 per month)

- Cheapest Commercial Auto Insurance: ERGO NEXT ($137 a month)