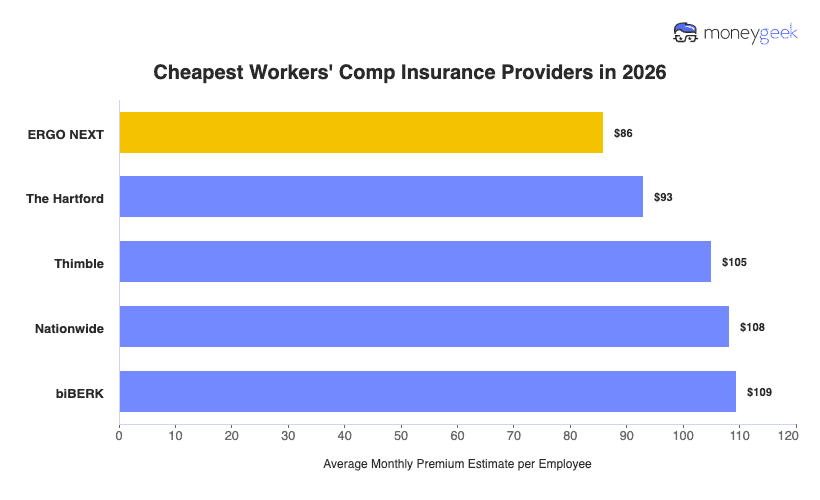

These five insurers offer the lowest worker's comp rates most often across our dataset:

- ERGO NEXT: ERGO NEXT has the most affordable workers' comp insurance overall at rates that are 24% below average nationally at $86/mo per employee. They are often cheapest for hands-on service businesses, retail operations and food establishments (cleaning services, beauty salons, retail shops, restaurants).

- The Hartford: As the second cheapest workers' comp insurer, The Hartford boasted the largest possible savings at the general industry level up to 41%. The company is most affordable for office-based professional services, technology companies and healthcare practices (financial services, consulting, tech startups, medical offices).

- Thimble: While not an overall category winner in our study, Thimble performs well for pricing for workers' comp, usually being the cheapest for construction contractors, installation services and outdoor workers (welding, carpentry, fence installation, tree surgeons).

- biBERK: biBERK is typically cheapest workers' compensation provider for fitness venues, recreation businesses and specialty food operations (CrossFit gyms, amusement parks, coffee shops, butcher shops).

- Nationwide: Nationwide is the workers' comp cost leader for agriculture, being the cheapest for farming operations and is affordable for select types of light manufacturing and community organizations (dairy farms, bakery manufacturing, community centers, homeless shelters).

>> [Click on Each Provider to Learn More]

The cheapest workers’ compensation insurance option for your business depends on what you do, where you operate and the number of employees you have (if any). Use these five companies as your workers' comp insurance cost starting point for any comparisons.