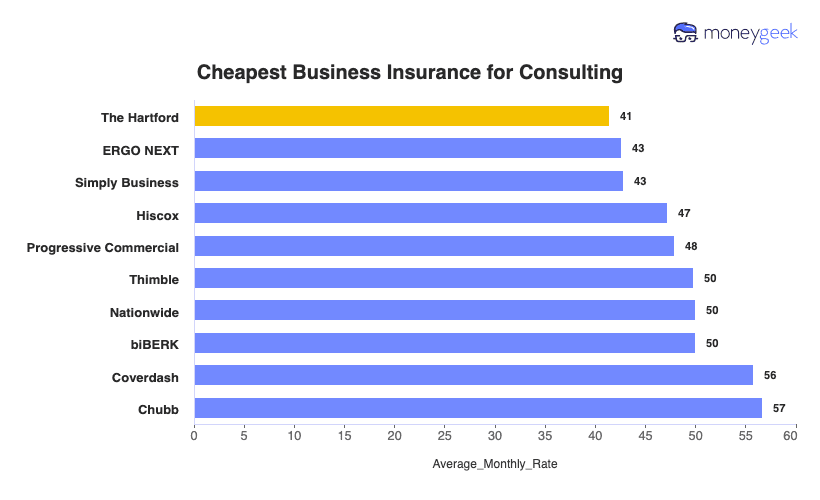

The Hartford is the ideal business insurer for consultants due to its great balance of affordability, service and coverage. The company offers the cheapest rates for professional liability insurance, which is the most needed coverage for the industry. It also offers special policies for the service industry and has a great customer service and claims reputation.

We recommend that you also compare commercial liability policies from ERGO NEXT, Simply Business, Nationwide and biBerk to ensure you're getting the best deal