Coverdash earned our top rating for food vendor business insurance with a MoneyGeek score of 4.70 out of 5. It stands out for competitive rates and broad coverage options that protect mobile food vendors from foodborne illness claims to equipment damage. The Hartford and Simply Business round out our top picks, offering strong protection whether you run a food cart or concession stand.

Best Food Business Insurance

Coverdash, The Hartford and Simply Business offer the best cheap business insurance for food vendors, with rates starting at $26 monthly.

Discover affordable coverage for your food business below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Food vendors need several types of business insurance: general liability, property, workers' comp and product liability for complete protection.

Coverdash is the best business insurance for food vendor businesses, earning a 4.70 score for competitive rates and coverage options.

Coverdash offers the cheapest business insurance at $64 monthly, while ERGO ERGO NEXT has the lowest professional liability rate at $26 monthly.

Best Business Insurance for Food Businesses

| Coverdash | 4.70 | $64 |

| Thimble | 4.40 | $72 |

| The Hartford | 4.62 | $89 |

| Simply Business | 4.50 | $91 |

| Progressive Commercial | 4.30 | $109 |

| Hiscox | 4.30 | $116 |

| ERGO NEXT | 4.37 | $122 |

| Nationwide | 4.40 | $122 |

| Chubb | 4.30 | $133 |

| biBERK | 4.20 | $144 |

Note: We based all scores on a food business with two employees across professional liability, general liability, workers' comp and BOP policies.

To find the right coverage for food vendors, check out the following resources:

Best Food Business Insurance Providers by Specific Industry

The food industry includes diverse businesses like food trucks, coffee shops, bakeries and restaurants, each with unique insurance needs. Food truck operators will find specialized protection through ERGO ERGO NEXT, while mobile food vendors running bakeries or snack bars can turn to The Hartford for comprehensive coverage options. Coffee shop and restaurant owners benefit from Nationwide's strong financial stability, while Coverdash offers balanced coverage across multiple food vendor operations.

| Bakery | The Hartford | $66 |

| Catering | ERGO NEXT | $66 |

| Coffee Shop | Coverdash | $62 |

| Coffee Shop | Nationwide | $73 |

| Food Truck | ERGO NEXT | $71 |

| Restaurant | Nationwide | $92 |

| Snack Bars | The Hartford | $76 |

Get Matched to the Best Food Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

1. Coverdash: Best and Cheapest Overall for Food Vendors

Cheapest general liability and BOP rates for food vendors

Fast online quotes from 30+ carriers in minutes

Strong coverage variety including spoilage and equipment protection

Top-rated digital platform for easy policy management

Claims processing ranks last among competitors

Customer service lags behind other insurers

Professional liability costs more than most competitors

Coverdash offers the cheapest general liability and BOP coverage we studied for food vendor businesses at $34 and $49 monthly. It ranks first for overall affordability and third for coverage options that protect food carts and concession stands from equipment damage, spoilage and product liability claims.

Coverdash ranks tenth for claims processing and customer service. Mobile food vendors who need responsive support during foodborne illness or equipment damage claims should consider insurers with stronger service records.

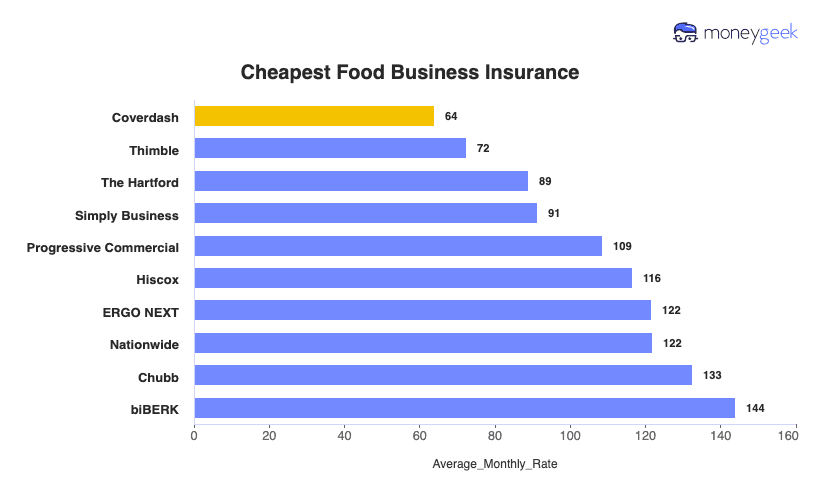

Cheapest Business Insurance for Food Businesses

Coverdash offers food vendor businesses the most affordable insurance at $64 monthly ($768 annually), ranking first for general liability at $34 and BOP at $49. ERGO ERGO NEXT leads for workers' compensation at $40 monthly and professional liability at $26 monthly.

| Coverdash | $64 | $768 |

| Thimble | $72 | $870 |

| The Hartford | $89 | $1,067 |

| Simply Business | $91 | $1,094 |

| Progressive Commercial | $109 | $1,304 |

| Hiscox | $116 | $1,398 |

| ERGO NEXT | $122 | $1,459 |

| Nationwide | $122 | $1,463 |

| Chubb | $133 | $1,590 |

| biBERK | $144 | $1,727 |

Cheapest General Liability Insurance for Food Vendors

Coverdash charges $34 monthly ($406 annually) for cheapest general liability insurance for food vendor businesses, saving you $74 monthly compared to the $108 industry average. Mobile food vendors and food cart operators pay 69% less with Coverdash, protecting against customer injuries and property damage claims at festivals, farmers markets and street vending locations.

| Coverdash | $34 | $406 |

| Simply Business | $76 | $917 |

| Thimble | $82 | $984 |

| The Hartford | $83 | $997 |

| Progressive Commercial | $106 | $1,275 |

Cheapest Workers' Comp Insurance for Food Vendors

Food vendor businesses pay just $40 monthly ($477 annually) with ERGO ERGO NEXT for most affordable workers' compensation, saving $2 compared to the $42 industry average. Mobile food vendors and concession stand operators find The Hartford, Thimble and Progressive Commercial close behind.

| ERGO NEXT | $40 | $477 |

| The Hartford | $40 | $481 |

| Thimble | $40 | $485 |

| Progressive Commercial | $41 | $490 |

| Hiscox | $41 | $494 |

Cheapest Professional Liability Insurance for Food Vendors

At $26 monthly ($315 annually), ERGO ERGO NEXT offers the cheapest professional liability insurance for food vendor businesses, saving you $84 monthly compared to the $110 industry average. That's 76% less than what most mobile food vendors pay. Thimble ranks second at $38 monthly.

| ERGO NEXT | $26 | $315 |

| Thimble | $38 | $454 |

| The Hartford | $115 | $1,375 |

| Progressive Commercial | $122 | $1,470 |

| Hiscox | $127 | $1,522 |

Cheapest BOP Insurance for Food Vendors

Food vendor businesses save $109 monthly with Coverdash's most affordable BOP insurance at $49 ($586 annually), 69% below the $158 industry average. The Hartford offers the second-best rate at $114 monthly for concession stands needing comprehensive coverage.

| Coverdash | $49 | $586 |

| The Hartford | $114 | $1,367 |

| Simply Business | $115 | $1,384 |

| Thimble | $127 | $1,525 |

| Progressive Commercial | $159 | $1,914 |

What Does Food Business Insurance Cost?

In general, food business insurance costs are the following for the four most popular coverage types:

- General Liability: $108 on average per month, ranging from $94 to $126, depending on the state

- Workers' Comp: $42 on average per month, ranging from $36 to $49, depending on the state

- Professional Liability (E&O): $110 on average per month, ranging from $88 to $128, depending on the state

- BOP Insurance: $158 on average per month, ranging from $135 to $184, depending on the state

| BOP | $158 | $1,898 |

| Professional Liability (E&O) | $110 | $1,321 |

| General Liability | $108 | $1,296 |

| Workers' Comp | $42 | $507 |

What Type of Insurance Is Best for a Food Business?

Event organizers and commissary kitchens require required coverage for food vendors like general liability before letting you serve. Beyond mandates, food business's insurance needs depend on whether you're running a solo food cart at farmers markets or managing a concession stand crew at festivals.

- Workers' Compensation Insurance: Required in most states once you hire employees to help run your food booth or prep ingredients. Covers medical bills when your assistant burns their hand pulling fresh empanadas from the fryer or needs stitches after slicing jalapeños. California requires coverage with one employee, while Texas makes it optional. Standard limits run $100,000 to $500,000 based on payroll.

- General Liability Insurance: Protects when someone slips on spilled sauce near your taco cart or claims your street vendor chili caused food poisoning. Festival organizers require $1 million per occurrence and $2 million aggregate limits before approving your booth application. Covers your legal defense even when claims lack merit.

- Commercial Property Insurance: Covers stolen equipment and spoiled inventory when your food cart gets broken into overnight or your portable refrigerator fails during a summer festival. Essential protection for mobile food vendors whose $8,000 generator, propane equipment and inventory travel to different locations weekly. Match coverage to your total equipment value, $10,000 to $50,000.

- Business Owner's Policy (BOP): Bundles general liability with property coverage at 15% to 30% less than buying separately. Smart choice for concession stand operators with significant equipment investments. Protects both when customers get injured and when your deep fryers or griddles get damaged. Standard packages include $1 million liability limits with $500 deductibles.

- Commercial Auto Insurance: State-mandated for food truck owners and mobile food vendors using vehicles to transport carts and equipment to events. Covers collision damage when another driver hits your truck en route to a wedding catering job, plus theft when someone breaks into your vehicle overnight. Required whenever you own business vehicles.

- Product Liability Insurance: Shields you from lawsuits when customers claim allergic reactions to unlabeled ingredients or foodborne illness from undercooked meat at your food booth. Often included in general liability policies but available separately for street food vendors serving higher-risk items like raw oysters, unpasteurized cheeses or homemade sauces.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Food Business

Getting business insurance for your food vendor business means comparing quotes, understanding coverage limits and choosing policies that protect your mobile operation without breaking your budget.

- 1Decide on Coverage Needs Before Buying

Consider real risks food vendors experience: customers claiming food poisoning from your street tacos, equipment theft at overnight markets or someone tripping over your food cart's power cord.

- 2Research Costs

Check what other food cart and concession stand operators pay for similar coverage before shopping. Knowing that mobile food vendors spend $64 monthly helps you spot fair deals and avoid overpaying.

- 3Look Into Company Reputations and Coverage Options

Read reviews from actual food vendors about claims processing speed and whether insurers understand mobile food operations.

- 4Compare Multiple Quotes Through Different Means

Get quotes from at least three insurers using online platforms, independent agents and direct calls. Independent agents often find specialized food vendor policies, while calling directly may reveal discounts for food safety certifications or commissary kitchen memberships.

- 5Reassess Annually

Review coverage yearly before peak season to ensure your cart's upgraded generator and new inventory are protected at competitive rates matching your current operation.

Best Insurance for Food Business: Bottom Line

Food vendors need several types of business insurance for complete protection: general liability, property coverage, workers' compensation and product liability. Coverdash earns the top spot with a 4.70 score, offering competitive rates and comprehensive coverage options. At $64 monthly, Coverdash makes quality business insurance accessible for food cart owners and mobile food vendors.

Food Business Insurance: FAQ

We answer frequently asked questions about food business insurance:

Who offers the best food business insurance overall?

Coverdash leads food business insurance with a MoneyGeek score of 4.7 out of 5, offering excellent affordability and coverage. The Hartford follows closely at 4.62, delivering outstanding customer service alongside competitive rates and comprehensive protection.

Who has the cheapest business insurance for food vendors?

Here are the cheapest business insurance companies for food vendors by coverage type:

- Cheapest general liability insurance: Coverdash at $34 monthly

- Cheapest workers' comp insurance: ERGO ERGO NEXT at $40 monthly

- Cheapest professional liability insurance: ERGO ERGO NEXT at $26 monthly

- Cheapest BOP insurance: Coverdash at $49 monthly

What business insurance is required for food businesses?

Food businesses must carry workers' compensation insurance with employees and commercial auto insurance for company vehicles, though requirements differ by state.

How much does food business insurance cost?

Food business insurance costs by coverage type are as follows:

- General Liability: $108/mo

- Workers' Comp: $42/mo

- Professional Liability: $110/mo

- BOP Insurance: $158/mo

How We Chose the Best Food Business Insurance

We selected the best business insurer for food vendors based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.