In our study of catering business insurance across four key coverage types, ERGO NEXT is the top provider due to its exceptional affordability and digital coverage matching system. Other companies are not too far behind, and we recommend getting quotes from The Hartford, Nationwide, Thimble and Simply Business.

Best Catering Business Insurance

The best cheap business insurance for catering and caterers starts at $48 per month and is offered by ERGO NEXT, The Hartford and Nationwide.

Get matched to the best catering business insurer for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

The business insurance coverage types caterers need include general liability insurance, commercial property insurance, workers' compensation, commercial auto insurance for delivery vehicles, and professional liability insurance to cover food-related illness claims.

In our study, ERGO NEXT has the best business insurance for catering firms, earning perfect coverage and affordability ratings.

ERGO NEXT provides the cheapest small business insurance for catering companies, with workers' comp coverage starting at $69 monthly.

Best Business Insurance for Catering Companies

| ERGO NEXT | 4.73 | $66 |

| The Hartford | 4.67 | $68 |

| Nationwide | 4.60 | $72 |

| Thimble | 4.60 | $101 |

| Simply Business | 4.60 | $73 |

| Chubb | 4.50 | $92 |

| Coverdash | 4.50 | $77 |

| Progressive Commercial | 4.40 | $80 |

| Hiscox | 4.40 | $86 |

| biBERK | 4.20 | $138 |

*We based all scores on a catering business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Catering Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for your catering business, check out the following resources:

ERGO NEXT: Best Catering Business Insurance

Best coverage matching process with 100% digital buying

Quotes take less than 10 minutes, saving you time

Cheapest rates overall for caterers

Most likely to be recommended to others in our study

Less experience in the industry with just under 10 years in business

Some coverage plans are not offered directly

If you are looking for the most balanced business insurance experience, ERGO NEXT is our top pick for your company. They are the most affordable insurer across four core business insurance types and the lowest rates for general liability and workers comp policies.

This insurer also had the best rating for digital experience and likelihood to be recommended to other businesses in our customer survey. It also has testimonials to back up its online experience with individuals describing the process as fast and easy to use.

The Hartford: Best Professional Liability Insurance for Caterers

Most affordable professional liability insurance for caterers

Best claims and agent service experience according to customers

Personalized policy options and bundles for professional services

Over 200+ years of experience in the industry and a dedicated professional food service team

Not available for Hawaii and Alaska firms

The Hartford is our pick for professional liability insurance for catering businesses and second overall for caterers. Its options available to choose from are also especially helpful for catering firms.

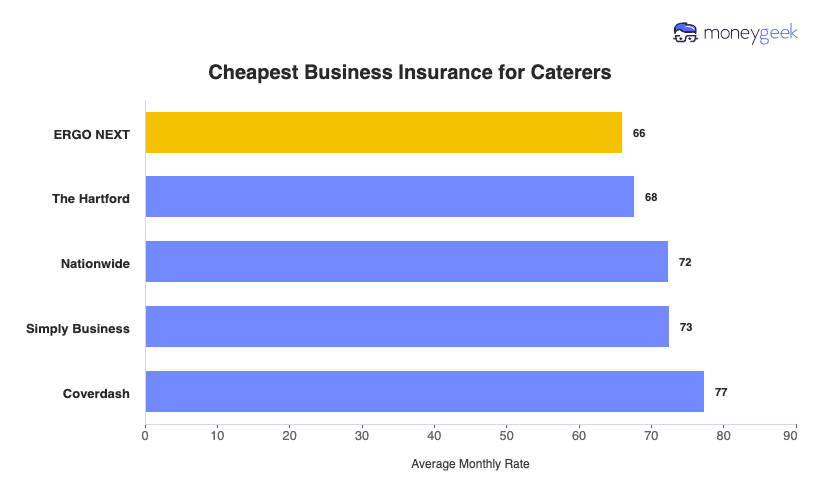

Cheapest Business Insurance for Catering Firms

Based on our analysis, ERGO NEXT delivers the most competitive overall pricing for catering insurance at $66 per month, with particularly strong value in general liability and workers' compensation coverage. Caterers prioritizing professional liability protection will find better rates with The Hartford, while those seeking a budget-friendly Business Owner's Policies should explore Simply Business.

| ERGO NEXT | $66 |

| The Hartford | $68 |

| Nationwide | $72 |

| Simply Business | $73 |

| Coverdash | $77 |

| Progressive Commercial | $80 |

| Hiscox | $86 |

| Chubb | $92 |

| Thimble | $101 |

| biBERK | $138 |

What Does Catering Business Insurance Cost?

In general, catering business insurance costs are the following for the four most popular coverage types:

- General Liability: $89 on average per month, ranging from $76 to $111, depending on the state

- Workers' Comp: $74 on average per month, ranging from $64 to $86, depending on the state

- Professional Liability (E&O): $79 on average per month, ranging from $68 to $92, depending on the state

- BOP Insurance: $99 on average per month, ranging from $84 to $115, depending on the state

| BOP | $99 | $1,192 |

| General Liability | $89 | $1,064 |

| Professional Liability (E&O) | $79 | $950 |

| Workers Comp | $74 | $885 |

What Type of Insurance Is Best for a Catering Company?

The most essential coverages for caterers and catering businesses typically include general liability, commercial property, and product liability insurance, while workers' compensation becomes mandatory in most states if you employ staff.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Catering Company

Here's a practical approach for securing the best value on business insurance for your catering company.

- 1Decide on Coverage Needs Before Buying

Consider the specific risks your food service operation faces, including foodborne illness claims, equipment damage, and accidents at event venues. Connect with fellow caterers and culinary professionals to learn from their insurance experiences and seek advice from agents who specialize in the food and hospitality industry. Understanding the available coverage types will help you make informed decisions and build appropriate protection for your catering company.

- 2Research Costs

Understanding typical catering business insurance costs before you begin shopping gives you a baseline for comparison. Look into what event catering services similar to yours in size and scope typically pay for coverage. This knowledge strengthens your position during negotiations and helps you identify competitive pricing when you encounter it.

- 3Look Into Company Reputations and Coverage Options

Pay attention to feedback from actual customers, particularly other food service businesses and event caterers that have filed claims. Check reviews on platforms like Google and Better Business Bureau to understand how insurers handle claims and customer service. Examine each company's coverage options carefully to ensure they offer the specific protections your catering operation requires.

- 4Compare Multiple Quotes Through Different Means

Obtain quotes from at least three different insurance providers for your catering service business using various approaches to ensure you're finding the best value. Working with an independent agent can uncover pricing that may not appear on company websites. While online comparison tools offer convenience and speed, directly contacting insurers sometimes reveals exclusive discounts.

- 5Reassess Annually

Your catering enterprise evolves over time, which impacts both your premium costs and coverage requirements. Review your policy annually and repeat these evaluation steps to confirm you're still getting optimal value. Expanding your food service operation or introducing new offerings like bar services or wedding catering may necessitate different protection than what you initially purchased.

Best Insurance for Catering Business: Bottom Line

Through our comprehensive research, we found ERGO NEXT, The Hartford, Nationwide and Thimble are our top business insurance options for caterers. For the best deal possible, consult agents and similar businesses, research costs and companies, and compare multiple quotes.

Catering Insurance: FAQ

We answer frequently asked questions about catering business insurance:

Who offers the best catering business insurance overall?

ERGO NEXT leads with a MoneyGeek score of 4.73 out of 5. The Hartford follows closely as runner-up with 4.67, delivering excellent affordability and comprehensive coverage options.

Who has the cheapest business insurance for catering firms?

Here are the cheapest business insurance companies for catering companies by coverage type:

- Cheapest general liability insurance: ERGO NEXT at $48 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $69 monthly

- Cheapest professional liability insurance: The Hartford at $71 monthly

- Cheapest BOP insurance: Simply Business at $84 monthly

What business insurance is required for catering organizations?

Catering companies must carry workers' compensation insurance for employees and commercial auto insurance for business vehicles, though requirements vary by state.

How much does catering business insurance cost?

Catering company insurance costs per month by coverage type are as follows:

- General Liability: $89/mo

- Workers' Comp: $74/mo

- Professional Liability: $79/mo

- BOP Insurance: $99/mo

How We Chose the Best Catering Business Insurance

We selected the best business insurer for catering companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "Hartford Fire Insurance Company." Accessed February 7, 2026.

- ERGO NEXT. "Customer Reviews." Accessed February 7, 2026.

- Trustpilot. "Thimble." Accessed February 7, 2026.