ERGO NEXT leads our rankings for food truck business insurance with a score of 4.82 out of 5. The company earned top marks for coverage options, competitive rates and quality service. The Hartford and Simply Business also offer strong options for food truck owners seeking comprehensive protection for their mobile food business.

Best Food Truck Business Insurance

ERGO NEXT, The Hartford and Simply Business offer the best cheap business insurance for food trucks, with rates starting at $43 monthly.

Get matched to the best business insurance provider for food truck owners.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Food truck operators need commercial auto, general liability, workers' comp and inland marine, among other coverage types, to protect mobile operations.

ERGO NEXT is the best business insurance for food trucks (4.82 MoneyGeek score) with top marks for coverage, competitive rates and customer service quality.

ERGO NEXT offers the cheapest business insurance at $71 monthly for food truck vendors, with workers' comp coverage starting at just $43 per month.

Best Business Insurance for Food Truck Vendors

| ERGO NEXT | 4.82 | $71 |

| Simply Business | 4.70 | $74 |

| Thimble | 4.50 | $78 |

| The Hartford | 4.70 | $92 |

| biBERK | 4.50 | $115 |

| Progressive Commercial | 4.40 | $117 |

| Coverdash | 4.50 | $120 |

| Hiscox | 4.40 | $126 |

| Chubb | 4.50 | $143 |

| Nationwide | 4.30 | $220 |

Note: We based all scores on a food truck business with two employees across professional liability, general liability, workers' comp and BOP policies.

Get Matched to the Best Food Truck Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

To find the right coverage for food truck vendors, check out the following resources:

1. ERGO NEXT: Best and Cheapest Provider for Food Trucks

Tops customer satisfaction rankings

Cheapest rates for general liability, BOP and workers' comp

Get quotes and buy coverage online in 10 minutes

Bundle multiple policies and save up to 10%

Instant proof of insurance through mobile app anytime

Some food truck owners report slower claims processing

Digital-only platform with no physical branch locations

Phone support unavailable during initial quote process

ERGO NEXT offers the most competitive rates for general liability, BOP, and workers' compensation costs, with general liability starting at $73 per month and workers' compensation at $43 per month. ERGO NEXT also topped customer satisfaction nationally with a 4.45 score.

It includes foodborne illness coverage in its general liability policies and offers up to 10% for bundling discounts. ERGO NEXT has an A+ AM Best rating,

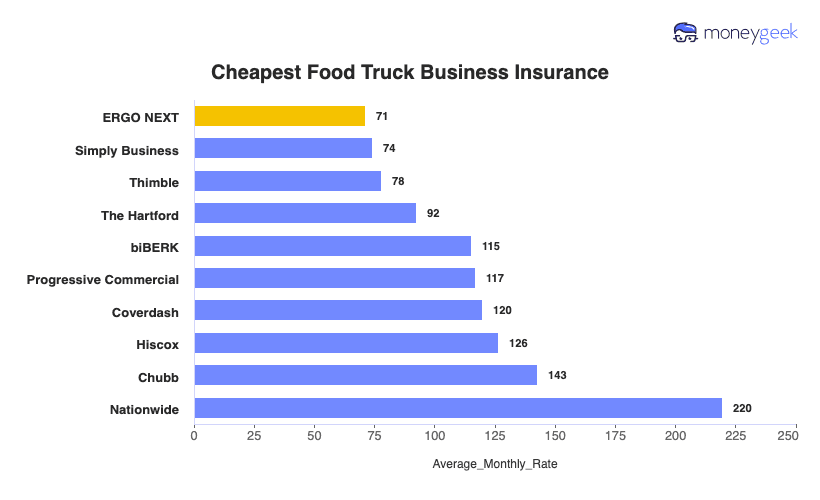

Cheapest Business Insurance for Food Truck Owners

ERGO NEXT offers the most affordable food truck business insurance at $71 monthly or $854 annually. The company ranks first for general liability, workers' compensation and business owner's policies. For professional liability coverage, food truck owners should consider The Hartford, which offers cheaper rates at $52 monthly compared to ERGO NEXT's $55.

| ERGO NEXT | $71 | $854 |

| Simply Business | $74 | $888 |

| Thimble | $78 | $934 |

| The Hartford | $92 | $1,109 |

| biBERK | $115 | $1,382 |

| Progressive Commercial | $117 | $1,405 |

| Coverdash | $120 | $1,437 |

| Hiscox | $126 | $1,516 |

| Chubb | $143 | $1,713 |

| Nationwide | $220 | $2,634 |

Cheapest General Liability Insurance for Food Trucks

ERGO NEXT offers the cheapest general liability insurance for food truck owners at $73 monthly or $874 annually. This saves mobile food vendors $68 per month compared to the $141 industry average, cutting costs by nearly 50%. Food truck businesses can redirect these savings toward equipment upgrades, inventory or marketing while maintaining essential liability protection.

| ERGO NEXT | $73 | $874 |

| Simply Business | $76 | $917 |

| Thimble | $82 | $984 |

| The Hartford | $113 | $1,354 |

| Progressive Commercial | $144 | $1,730 |

Cheapest Workers' Comp Insurance for Food Trucks

Food truck operators find the most affordable workers' compensation through ERGO NEXT at $43 monthly or $514 annually. ERGO NEXT undercuts the $46 industry average by $3 per month, saving mobile food businesses $34 yearly. The Hartford, Thimble and Progressive Commercial offer competitive alternatives with rates starting at $44 monthly for food truck owners with employees.

| ERGO NEXT | $43 | $514 |

| The Hartford | $44 | $522 |

| Thimble | $44 | $523 |

| Progressive Commercial | $44 | $525 |

| Simply Business | $44 | $529 |

Cheapest Professional Liability Insurance for Food Trucks

Professional liability rates average $59 monthly across providers, but The Hartford cuts that cost to just $52 per month or $629 annually for food truck owners. That makes The Hartford the cheapest professional liability insurance option, saving mobile food vendors $84 yearly. ERGO NEXT offers competitive alternative coverage at $55 monthly for food truck businesses seeking errors and omissions protection.

| The Hartford | $52 | $629 |

| ERGO NEXT | $55 | $662 |

| Progressive Commercial | $56 | $677 |

| Thimble | $57 | $689 |

| Hiscox | $58 | $700 |

Cheapest BOP Insurance for Food Trucks

Business owner's policies for food trucks average $207 monthly, but ERGO NEXT has the most affordable BOP insurance at $112 monthly or $1,339 annually. That's a 46% reduction from industry averages. Simply Business offering the next-best option for food truck operators at $115 monthly.

| ERGO NEXT | $112 | $1,339 |

| Simply Business | $115 | $1,376 |

| Thimble | $126 | $1,508 |

| The Hartford | $157 | $1,881 |

| biBERK | $197 | $2,359 |

What Does Food Truck Business Insurance Cost?

Food truck business insurance costs are as follows for the four most popular coverage types:

- General Liability: $141 on average per month, ranging from $104 to $166, depending on the state

- Workers' Comp: $46 on average per month, ranging from $40 to $53, depending on the state

- Professional Liability (E&O): $59 on average per month, ranging from $51 to $69, depending on the state

- BOP Insurance: $207 on average per month, ranging from $150 to $244, depending on the state

| BOP | $207 | $2,485 |

| General Liability | $141 | $1,693 |

| Professional Liability (E&O) | $59 | $708 |

| Workers' Comp | $46 | $548 |

What Type of Insurance Is Best for a Food Truck Business?

Commercial auto and general liability insurance form the core required coverage for food truck vendors, with workers' compensation mandated in most states if you have employees. Additional policies like commercial property, inland marine and business interruption insurance protect against equipment damage, spoilage and income loss during unexpected closures.

- Commercial Auto Insurance: Required by law when your truck hits public roads between farmers markets, festivals and catering gigs. Covers collision damage when you misjudge clearance under low awnings, liability when you accidentally back into vendor tents and comprehensive protection if someone breaks in overnight to steal equipment.

- Workers' Compensation Insurance: Mandated in almost every state if you hire prep cooks or service staff. Pays medical bills and lost wages when employees suffer grease burns at the fryer, slice fingers while prepping ingredients or slip on wet floors during cleanup.

- General Liability Insurance: Protects when customers trip over your generator cords, claim food poisoning from your tacos or spill hot coffee and blame your service window height. Festival organizers and parking lot owners require $1 million per occurrence and $2 million aggregate before issuing permits.

- Inland Marine Insurance: Covers portable equipment like generators, propane tanks, prep tables and non-attached cooking tools that move between locations. Your commercial auto policy only protects equipment bolted to the truck, leaving portable items vulnerable to theft or damage during transport and setup.

- Business Interruption Insurance: Replaces lost income when your refrigerator dies mid-festival, propane leaks force you to close or your generator quits during your busiest lunch rush. Covers daily revenue losses plus ongoing expenses like truck payments and commissary kitchen fees.

- Commercial Property Insurance: Protects inventory, ingredients and supplies stored at your commissary kitchen or warehouse location. Covers losses from fire, theft or water damage at your fixed business locations separate from the mobile truck.

- Food Spoilage Coverage: Reimburses you when power failures spoil your prepped ingredients, refrigeration breakdowns ruin your inventory or equipment malfunctions destroy tomorrow's specialty items. A single weekend festival spoilage can cost $1,000 to $3,000 in lost product.

- Liquor Liability Insurance: Required if you sell beer at craft festivals, wine pairings at food events or specialty cocktails from your mobile bar. Protects your business when intoxicated customers start fights, damage property or cause accidents after leaving your service window.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Food Truck

Follow this step-by-step method for getting business insurance that balances affordability with comprehensive protection for your food truck.

- 1Decide on Coverage Needs Before Buying

Taco trucks have different exposures than coffee carts or BBQ smokers. If you're parked at breweries serving late-night crowds, you need different liability limits than daytime farmers market vendors. Match coverage to your menu, locations and equipment.

- 2Research Costs

Check what other mobile food vendors pay at your commissary kitchen or in local food truck associations. Knowing realistic prices for your specific operation stops insurers from quoting you rates meant for sit-down restaurants.

- 3Look Into Company Reputations and Coverage Options

Ask vendors at your regular festival spots which insurers actually paid out when their generators died mid-event or refrigerators quit overnight.

- 4Compare Multiple Quotes Through Different Means

Get quotes from food truck specialty insurers, general business agents and direct online platforms. Some insurers won't touch mobile vendors, while others specialize in street food risks.

- 5Reassess Annually

Revisit coverage when you upgrade to a larger truck, add a trailer, start booking weddings or begin serving beer at events.

Best Insurance for Food Truck Business: Bottom Line

Food truck owners need commercial auto, general liability, workers' compensation and inland marine coverage to protect their mobile food businesses from daily risks. ERGO NEXT leads our rankings with a 4.82 MoneyGeek score, offering the most affordable rates at $71 monthly while delivering top marks for coverage options and customer service. Compare quotes from multiple providers to find the right balance of protection and cost for your operation.

Food Truck Business Insurance: FAQ

We answer frequently asked questions about food truck business insurance:

Who offers the best food truck business insurance overall?

ERGO NEXT leads food truck business insurance with a MoneyGeek score of 4.82 out of 5. The Hartford follows closely as second place, delivering excellent value through competitive pricing, reliable customer support and comprehensive protection options.

Who has the cheapest business insurance for food trucks?

Here are the cheapest business insurance companies for food trucks by coverage type:

- Cheapest general liability insurance: ERGO NEXT at $73 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $43 monthly

- Cheapest professional liability insurance: The Hartford at $52 monthly

- Cheapest BOP insurance: ERGO NEXT at $112 monthly

What business insurance is required for food truck owners?

Food truck businesses must carry workers' compensation insurance for employees and commercial auto insurance for business vehicles, though requirements vary by state. General liability coverage is also essential for securing permits and client contracts.

How much does food truck business insurance cost?

Food Truck business insurance costs by coverage type are as follows:

- General Liability: $141/mo

- Workers' Comp: $46/mo

- Professional Liability: $59/mo

- BOP Insurance: $207/mo

How We Chose the Best Food Truck Business Insurance

We selected the best business insurer for food truck businesses based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- ERGO NEXT. "ERGO NEXT Earns A+ (Superior) Financial Strength Rating from AM Best, Approaches 750,000 Small Business Customers." Accessed February 8, 2026.