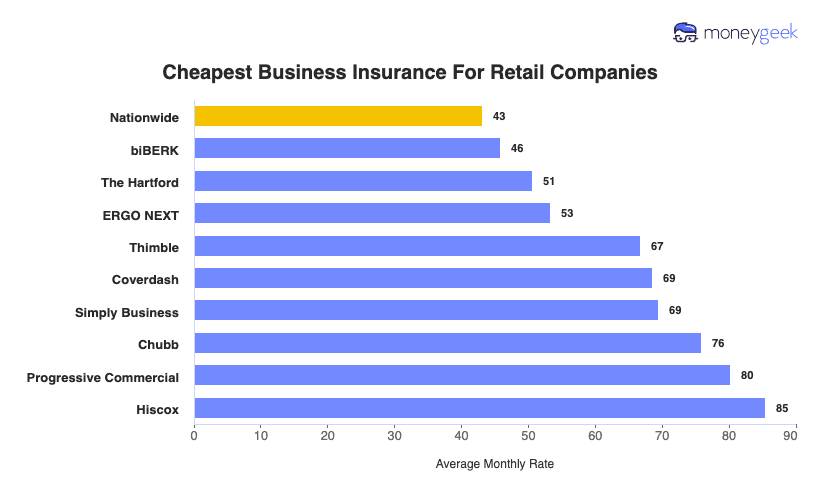

Nationwide is the best retail business insurance provider with a MoneyGeek score of 4.80 out of 5. It earned top marks for competitive rates and quality customer service, making it an excellent choice for retail stores seeking comprehensive coverage.

We also recommend comparing quotes from biBerk and ERGO NEXT to find the right fit for your retail shop's specific needs.