The Hartford and ERGO NEXT tie for best tech business insurance with MoneyGeek scores of 4.78 out of 5. Both excel in affordability and customer service while offering comprehensive coverage for IT companies. We also recommend comparing quotes from biBERK and Simply Business to find the right fit for your technology company's specific needs.

Best Tech and IT Business Insurance

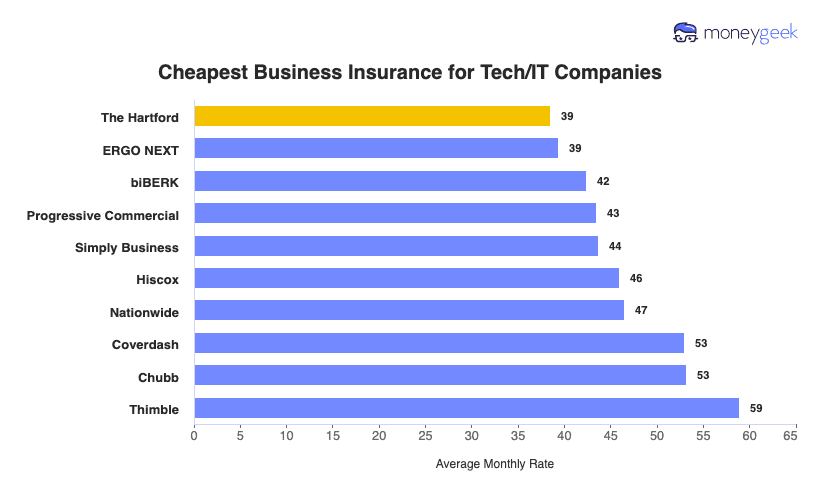

ERGO NEXT, The Hartford and biBerk offer the best cheap business insurance for tech and IT companies, with rates starting at $16 monthly.

Discover the best business insurance provider for IT businesses.

Updated: February 2, 2026

Advertising & Editorial Disclosure

Tech companies need several types of business insurance including professional liability for service errors, cyber coverage for data breaches, general liability for client injuries and workers' compensation for employee protection.

The Hartford and ERGO NEXT are the best business insurance providers for IT businesses, earning a 4.78 MoneyGeek score for their comprehensive coverage options, responsive customer service and competitive rates for technology companies.

The Hartford offers the cheapest business insurance for tech companies at $39 monthly, with general liability coverage starting at just $17 monthly to protect against client injuries and property damage claims.

Best Business Insurance for Tech and IT Companies

| ERGO NEXT | 4.78 | $39 |

| The Hartford | 4.78 | $39 |

| biBERK | 4.60 | $42 |

| Simply Business | 4.50 | $44 |

| Nationwide | 4.50 | $47 |

| Progressive Commercial | 4.40 | $43 |

| Chubb | 4.30 | $53 |

| Hiscox | 4.30 | $46 |

| Thimble | 4.30 | $59 |

| Coverdash | 4.20 | $53 |

Note: We based all scores on a tech/it business with two employees across professional liability, general liability, workers' comp and BOP policies.

To find the right coverage for your tech and IT company, check out the following resources:

Best Tech and IT Business Insurance Providers By Specific Industry

The Hartford and ERGO NEXT remain top choices across tech specializations. The Hartford leads for computer programming and software companies, while ERGO NEXT edges ahead for computer repair businesses. Both offer competitive rates starting around $37 monthly and comprehensive coverage for IT companies facing cyber liability, professional liability and tech errors and omissions risks.

| Computer Programming | The Hartford | $40 |

| Computer Repair | ERGO NEXT | $37 |

| Software | The Hartford | $37 |

Get Matched to the Best Technology and IT Business Insurer for You

Select your industry and state to get matched to the best provider for you and get customized quotes.

1. The Hartford: Cheapest Business Insurance Provider for IT Companies

Cheapest professional liability for tech companies at $88 monthly

First nationally for claims processing and customer service

A+ Superior financial rating from AM Best and S&P

FailSafe program covers breach of contract and tech-specific risks

Digital experience ranks 10th nationally

Fewer policy add-ons than competitors for customization needs

The Hartford offers the cheapest professional liability coverage at $88 monthly and ranks second for general liability and workers' comp. The company has an AM Best's A+ (Superior) rating backing every policy.

The Hartford's FailSafe program covers breach of contract, software glitches causing client data loss and failed technology services.

2. ERGO NEXT: Best Business Insurance Overall for Tech Companies

Highest scores for digital tools and customer satisfaction nationwide

Lowest rates for general liability and workers' comp coverage

A+ Superior financial rating with strong Munich Re backing

Instant 24/7 quotes, purchasing and certificate downloads via app

Claims processing ranks fourth nationally behind top competitors

ERGO NEXT offers general liability at $16 monthly and workers' comp at $26 monthly. Tech founders benefit from ERGO NEXT's 100% digital platform that delivers instant certificates of insurance via mobile app with no paperwork delays.

It holds an A+ (Superior) rating from AM Best. Coverage includes cyber liability protection critical for software developers and IT consultants facing data breach risks.

Cheapest Business Insurance for Tech and IT Firms

The Hartford offers the cheapest tech/IT business insurance at $39 monthly ($462 annually) and leads for professional liability coverage at $88 monthly. For IT companies looking for the lowest rates, ERGO NEXT beats The Hartford on general liability and workers' comp, while biBERK offers the cheapest business owner's policy at $22 monthly.

| The Hartford | $39 | $462 |

| ERGO NEXT | $39 | $472 |

| biBERK | $42 | $508 |

| Progressive Commercial | $43 | $522 |

| Simply Business | $44 | $524 |

| Hiscox | $46 | $551 |

| Nationwide | $47 | $558 |

| Coverdash | $53 | $635 |

| Chubb | $53 | $638 |

| Thimble | $59 | $707 |

Cheapest General Liability Insurance for Tech and IT Businesses

ERGO NEXT offers the cheapest general liability insurance for tech companies at $16 monthly ($188 annually), saving IT businesses $11 monthly compared to the $27 industry average. That's 41% lower, adding up to $132 in annual savings.

| ERGO NEXT | $16 | $188 |

| The Hartford | $17 | $199 |

| biBERK | $17 | $201 |

| Nationwide | $20 | $237 |

| Simply Business | $20 | $243 |

Cheapest Workers' Comp Insurance for Tech and IT Businesses

Tech companies with employees can secure the cheapest workers' comp insurance through ERGO NEXT at $26 monthly ($307 annually). That saves IT businesses $21 yearly compared to the $328 industry average. The Hartford, Thimble and Simply Business offer competitive alternatives for technology companies seeking affordable workers' compensation coverage.

| ERGO NEXT | $26 | $307 |

| The Hartford | $26 | $312 |

| Thimble | $26 | $315 |

| Simply Business | $26 | $316 |

| Progressive Commercial | $26 | $317 |

Cheapest Professional Liability Insurance for Tech and IT Businesses

The Hartford offers the cheapest professional liability insurance for tech companies at $88 monthly ($1,051 annually), saving IT businesses $128 yearly versus the $1,179 industry average. ERGO NEXT ranks second at $91 monthly, while Progressive Commercial offers another budget-friendly option for software developers and IT consultants.

| The Hartford | $88 | $1,051 |

| ERGO NEXT | $91 | $1,095 |

| Progressive Commercial | $93 | $1,119 |

| Simply Business | $96 | $1,157 |

| Thimble | $97 | $1,162 |

Cheapest BOP Insurance for Tech and IT Businesses

Tech companies seeking business owner's policy coverage will find biBERK offers the most affordable option at $263 annually. This saves businesses $12 yearly compared to The Hartford's $275 rate.

| biBERK | $22 | $263 |

| The Hartford | $23 | $275 |

| ERGO NEXT | $24 | $286 |

| Nationwide | $29 | $353 |

| Simply Business | $30 | $362 |

What Does Tech and IT Business Insurance Cost?

Tech/IT business insurance costs are the following for the four most popular coverage types:

- General Liability: $27 on average per month, ranging from $23 to $32 , depending on the state

- Workers' Comp: $27 on average per month, ranging from $24 to $32, depending on the state

- Professional Liability (E&O): $98 on average per month, ranging from $85 to $115, depending on the state

- BOP Insurance: $32 on average per month, ranging from $28 to $38, depending on the state

| Professional Liability (E&O) | $98 | $1,179 |

| BOP | $32 | $386 |

| Workers' Comp | $27 | $328 |

| General Liability | $27 | $320 |

What Type of Insurance Is Best for a Tech and IT Company?

Required coverage for technology companies varies by state and business structure, while others are highly recommended based on common industry risks. Depending on your specific operations, like consulting work, software development or managing client data, you may need additional protection beyond the basics.

Mandated

- Workers' Compensation Insurance: Tech companies with employees must carry this in almost every state. It covers medical bills and lost wages when employees get injured, from carpal tunnel developed by programmers to back injuries sustained during hardware installation at client sites. Most states require coverage from your first hire, though a few states set thresholds at three to five employees. Remote workers need coverage too, since work-related injuries can happen anywhere.

- Professional Liability Insurance (Errors & Omissions): A coding error crashes your client's e-commerce site during a major sale, costing them revenue. Now they're suing your firm. This covers legal costs, settlements and judgments when your tech services or advice fail to meet client expectations. Most tech companies carry $1 million per occurrence and $1 million aggregate limits, though clients with larger projects often require $2 million to $5 million. Software developers, IT consultants and managed service providers especially need this protection.

- Cyber Liability Insurance: Hackers breach your client's customer database through a vulnerability you missed, or ransomware locks down your own systems right before a critical project deadline. Cyber insurance covers client notification costs, legal fees, data recovery expenses and regulatory fines from privacy violations. Most small businesses purchase policies with a $1 million per occurrence limit, a $1 million aggregate limit and a $2,500 deductible. IT consultants and companies managing sensitive data need $2 million to $5 million in coverage to meet client contract requirements.

- General Liability Insurance: A delivery person trips over server cables in your office and breaks their wrist, or you accidentally use a competitor's trademarked phrase in your marketing campaign. General liability covers bodily injuries, property damage and advertising injuries at your office or client sites. Most technology business owners choose policies with a $1 million per-occurrence limit and a $2 million aggregate limit. Commercial leases and client contracts frequently require proof of this coverage before you can start work or sign agreements.

- Commercial Property Insurance: Protects your computers, servers and office equipment from theft, fire or natural disasters. Tech companies with expensive hardware or office spaces can bundle this with general liability in a business owner's policy, which costs less than buying each policy separately and covers daily operating costs if property damage forces you to close temporarily.

- Commercial Auto Insurance: Required in most states if your IT business owns vehicles for client site visits. Covers accident costs, theft and damage when your technicians drive to install equipment, troubleshoot systems or provide onsite support.

To learn more about whether you need different types of business insurance coverage:

How to Get the Best Cheap Business Insurance for Your Tech and IT Firm?

Finding the best and cheapest business insurance for your tech company starts with getting business insurance quotes from multiple carriers and comparing coverage options that match your specific risks.

- 1Decide on Coverage Needs Before Buying

Your software development firm has different risks than a managed service provider or cybersecurity consultant. Consider scenarios like a data breach exposing client information, a coding error that crashes customer systems or equipment theft from your office.

- 2Research Costs

Know premium ranges before shopping so you can spot overpriced quotes. A solo IT consultant pays far less than a software company with 20 developers.

- 3Look Into Company Reputations and Coverage Options

Check how insurers handle tech-specific claims like intellectual property disputes, software failure lawsuits or cyberattack recovery.

- 4Compare Multiple Quotes Through Different Means

Get quotes from at least three sources since rates vary widely for tech companies. Independent agents sometimes access specialty tech insurers unavailable online.

- 5Reassess Annually

Review your policy yearly to adjust coverage as your technology business grows and shop competitors to ensure you're still getting competitive rates.

Best Insurance for Tech and IT Business: Bottom Line

Tech companies need professional liability, cyber insurance, general liability and workers' compensation to protect against service errors, data breaches and client injuries. The Hartford and ERGO NEXT offer the best overall coverage for IT businesses at competitive rates, with The Hartford providing the most affordable options starting at $39 monthly. Compare quotes from multiple carriers to find business insurance that matches your technology company's specific risks and budget.

Tech and IT Business Insurance: FAQ

We answer frequently asked questions about technology and IT business insurance:

Who offers the best tech & IT business insurance overall?

ERGO NEXT and The Hartford both lead tech & IT business insurance with perfect MoneyGeek scores of 4.78 out of 5. biBERK follows closely behind with a solid 4.60 rating, offering strong coverage and competitive pricing for technology companies.

Who has the cheapest business insurance for tech & IT firms?

Here are the cheapest business insurance for tech & IT companies by coverage type:

- Cheapest general liability insurance: ERGO NEXT at $16 monthly

- Cheapest workers' comp insurance: ERGO NEXT at $26 monthly

- Cheapest professional liability insurance: The Hartford at $88 monthly

- Cheapest BOP insurance: biBerk at $22 monthly

What business insurance is required for tech & IT companies?

Tech and IT businesses must carry workers' compensation insurance with employees and commercial auto insurance for company vehicles, though requirements vary by state. Most clients and leases also require general liability coverage.

How much does tech & IT business insurance cost?

Tech and IT business insurance costs by coverage type are as follows:

- General Liability: $27/mo

- Workers' Comp: $27/mo

- Professional Liability: $98/mo

- BOP Insurance: $32/mo

How We Chose the Best Tech and IT Business Insurance

We selected the best business insurer for tech & IT companies based on the following criteria:

- Affordability (50% of score): The lower a company's costs compared to the competition based on our base profile for four core coverage types, the better the company performs.

- Customer service (30% of score): We scored providers on overall customer satisfaction using industry studies, customer review forum ratings and public forum sentiment analysis from sites like Reddit.

- Coverage (15% of score): We scored business insurance providers for this category based on the flexibility, payment and actual coverage options.

- Financial stability (5% of score): Using financial stability industry ratings from companies like AM Best and Moody's, we created an overall rating to judge how likely companies are to pay out claims compared to the competition.

All pricing in this article is based on the following base profile to represent the vast majority of small businesses in all states:

- Three-person business with two employees

- Coverage: $1 million per occurrence and $2 million total per year for all but BOP, which includes the same coverage plus $5,000 of business property coverage

- $150,000 in payroll

- $300,000 annual revenue

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- AM Best. "AM Best Upgrades Issuer Credit Ratings of The Hartford Insurance Group, Inc. and Its Subsidiaries." Accessed February 7, 2026.

- ERGO NEXT. "ERGO NEXT Earns A+ (Superior) Financial Strength Rating from AM Best, Approaches 750,000 Small Business Customers." Accessed February 7, 2026.