Arizona homeowners pay rates well below the national average. MoneyGeek analyzed premiums, J.D. Power satisfaction scores and coverage options from major insurers to find the best home insurance companies in Arizona.

Best Homeowners Insurance Companies in Arizona

American Family ranks No. 1 in our review of the best home insurance in Arizona, followed by State Farm and Auto-Owners.

See if you're overpaying for home insurance below.

Updated: January 29, 2026

Advertising & Editorial Disclosure

American Family is the best home insurance provider in Arizona with a score of 4.6 out of 5 from our review team.

State Farm, Auto-Owners, Farmers and Nationwide rank high for homeowners insurance in Arizona based on affordable rates, strong customer service and reliable coverage.

The best insurer for your home depends on your coverage needs, budget and preferred features like claims service or discount availability.

What Are the Best Home Insurance Companies in Arizona?

American Family ranks first for Arizona homeowners with the state's lowest premiums and above-average customer satisfaction. State Farm, Auto-Owners, Farmers and Nationwide complete the top five, excelling in areas like military-focused service, premium coverage quality and local agent networks.

American Family | 4.6 | $1,938 | Most Arizona homeowners |

State Farm | 4.6 | $1,334 | Affordable rates |

Auto-Owners | 4.6 | $2,540 | Customer experience |

Farmers | 4.4 | $2,023 | Monsoon protection |

Nationwide | 4.3 | $2,089 | High value item protection |

*Our ratings consider various combinations of coverage levels, home features and homeowner details to identify the best overall options. Rankings may differ based on your profile.

J.D. Power Customer Satisfaction Score

643/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,938Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Strong agent network with personalized service

J.D. Power score above industry average

User-friendly digital tools for policy management

consClaims processing slower than expected

Rates slightly higher than some competitors

Fewer unique coverage add-ons available

Arizona's monsoon season brings flash floods and water damage risks from June through September. American Family offers water backup protection and replacement cost coverage for personal property as endorsements to address these seasonal threats. The insurer charges $1,938 annually for a base policy, making it a competitively priced option for Arizona homeowners.

At 26% below Arizona's state average, American Family offers meaningful savings on home insurance. Annual premiums run $1,938, compared to the $2,602 state average and $3,467 national average. The insurer provides bundling discounts and home security discounts to reduce costs further.

Older Homes $165 $1,980 Newer Homes $108 $1,300 Young Homeowners $165 $1,977 Senior Homeowners $161 $1,932 High-Risk Fire Homes $181 $2,171 Smaller Homes $148 $1,781 Larger Homes $167 $2,002 American Family combines local agent support with digital convenience. The company operates through independent agents who maintain strong community ties across Arizona while offering a user-friendly online platform for policy management. American Family earned 643 points in J.D. Power's satisfaction study, edging past the 642 industry average.

American Family provides standard homeowners coverage with optional add-ons:

- Equipment breakdown: Covers damage to appliances, home systems and smart home devices from mechanical or electrical failures

- Flash flood: Provides inland flood coverage for flash flood damage

- Hidden water damage: Covers leaks within walls, floors, ceilings and cabinets

- Home renovation: Protects against foundation collapse and construction material damage or theft during renovations

- Matching undamaged siding: Reimburses costs to replace undamaged siding for a consistent appearance

- Roof damage: Bridges the gap between your current roof's depreciated value and replacement cost

- Service line: Covers repair or replacement of underground piping or wiring

- Sewer and septic backup: Covers repairs from backed-up drains or overflowing sumps

- Scheduled personal property: Increases coverage limits for jewelry, gemstones, watches and furs

J.D. Power Customer Satisfaction Score

657/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,334Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Comprehensive coverage options for diverse homeowner needs

Strong financial stability with high industry ratings

J.D. Power score above industry average

consClaims processing slows during peak periods

Limited availability in some Arizona areas

Some add-on coverage options unavailable

State Farm offers Arizona's most affordable home insurance at $1,334 annually. It provides essential coverage for personal property against theft and damage, particularly valuable in urban areas. The company also includes protection against natural disasters, which proves crucial given Arizona's climate risks, including monsoons and extreme heat.

State Farm charges $1,334 annually for home insurance in Arizona, 49% less than the state average of $2,602 and 25% below the national average of $3,467. The company offers valuable discounts for bundling multiple policies and installing home security systems.

Older Homes $113 $1,351 Newer Homes $83 $991 Young Homeowners $112 $1,339 Senior Homeowners $111 $1,330 High-Risk Fire Homes $125 $1,495 Smaller Homes $108 $1,298 Larger Homes $124 $1,485 State Farm earned 657 out of 1,000 points in J.D. Power customer satisfaction ratings, above the industry average of 642. The company operates through local independent agents and direct sales, providing personalized service through agents familiar with Arizona's specific homeowner needs. Its digital platform offers easy policy management, though it lacks some advanced features found with tech-focused competitors.

State Farm provides standard homeowners coverage with optional add-ons:

- Personal property protection: Covers belongings against theft and damage

- Natural disaster coverage: Protects against Arizona's monsoons and extreme weather

- Dwelling coverage: Covers your home's structure and attached buildings

- Liability protection: Pays for injuries or property damage you're legally responsible for

- Additional living expenses: Covers temporary housing during covered repairs

- Medical payments: Pays for guest injuries regardless of fault

J.D. Power Customer Satisfaction Score

621/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$2,540Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Flexible policy options with various add-on coverage

Strong financial stability with high ratings

Strong agent network with personalized service

consCustomer satisfaction score below industry average

Claims process slower than some competitors

Limited digital tools for online policy management

Arizona's desert environment creates distinct challenges for homeowners — wildfires threaten properties statewide while extreme temperature swings stress plumbing systems. Auto-Owners addresses both concerns with wildfire damage coverage and water damage protection for plumbing issues. The insurer charges $2,540 annually, positioning it as a practical option for residents navigating the state's climate risks.

Bundling discounts and home security system discounts help Arizona homeowners lower their Auto-Owners premiums. The company charges $2,540 annually, which falls 2% below the $2,602 state average and 25% under the national benchmark.

Older Homes $203 $2,437 Newer Homes $183 $2,191 Young Homeowners $219 $2,626 Senior Homeowners $194 $2,328 High-Risk Fire Homes $237 $2,846 Smaller Homes $205 $2,462 Larger Homes $235 $2,817 Auto-Owners operates through local independent agents rather than a digital-first model. Arizona homeowners get personalized service from agents who understand local risks, though online policy management options remain limited. The company earned 621 out of 1,000 points in J.D. Power's satisfaction study, below the 642 industry average.

Auto-Owners provides standard homeowners coverage with optional add-ons:

- Wildfire damage coverage: Protects against fire damage in Arizona's fire-prone areas

- Water damage protection: Covers plumbing issues common in desert climates

- Dwelling coverage: Covers your home's structure and attached features

- Personal property coverage: Protects belongings inside your home

- Liability protection: Covers legal expenses if someone gets injured on your property

- Additional living expenses: Pays temporary housing costs during repairs

- Medical payments: Covers minor guest injuries regardless of fault

J.D. Power Customer Satisfaction Score

631/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$2,023Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Strong financial stability with high industry ratings

User-friendly digital policy management tools

Competitive rates near Arizona state average

consCustomer satisfaction scores below industry standards

Fewer coverage add-on options than competitors

Limited service availability in some Arizona regions

Farmers offers Arizona homeowners affordable coverage at $2,023 annually. The insurer provides specialized monsoon damage protection, important for desert residents facing seasonal storms. Farmers' customizable policies let homeowners tailor coverage for desert climate risks, from extreme heat to flash flooding.

Farmers charges $2,023 annually for home insurance in Arizona, 22% less than the state average of $2,602 and below the national average of $3,467. The company offers bundling discounts when you combine multiple policies and discounts for security system installations.

Older Homes $171 $2,051 Newer Homes $100 $1,196 Young Homeowners $169 $2,030 Senior Homeowners $163 $1,960 High-Risk Fire Homes $189 $2,267 Smaller Homes $163 $1,960 Larger Homes $175 $2,094 Farmers earned 631 out of 1,000 points in J.D. Power customer satisfaction ratings, slightly below the industry average of 642. The company operates through local independent agents who provide personalized service tailored to Arizona homeowners' specific needs. Farmers also offers a user-friendly online platform for policy management, combining traditional agent support with modern digital convenience for customers who prefer self-service options.

Farmers provides standard homeowners coverage with optional add-ons:

- Monsoon damage protection: Covers property damage from Arizona's seasonal storms and high winds

- Desert climate customization: Tailored coverage for extreme heat and climate-related risks

- Dwelling coverage: Covers your home's structure against covered perils

- Personal property protection: Covers belongings inside your home

- Liability coverage: Protects against lawsuits for injuries or property damage

- Additional living expenses: Pays temporary housing costs during covered repairs

- Medical payments: Covers guest injuries regardless of fault

J.D. Power Customer Satisfaction Score

641/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$2,089Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Wide range of customizable coverage options

Strong financial stability with high ratings

Strong agent network for personalized service

consSome add-on coverages unavailable in certain regions

Rates slightly higher than some competitors

Claims process can be slow and cumbersome

Nationwide offers Arizona's most affordable home insurance at $2,089 annually. The company provides coverage for water backup, protecting against sewer and drain issues common in Arizona's desert climate. Its policy includes coverage for personal property loss due to theft, crucial in urban areas throughout the state.

Nationwide charges $2,089 annually for home insurance in Arizona, 20% less than the state average of $2,602. Homeowners can reduce costs further through bundling discounts for multiple policies and home security system installation discounts.

Older Homes $182 $2,183 Newer Homes $99 $1,194 Young Homeowners $177 $2,121 Senior Homeowners $173 $2,070 High-Risk Fire Homes $195 $2,341 Smaller Homes $169 $2,030 Larger Homes $194 $2,323 Nationwide earned 641 out of 1,000 points in the J.D. Power study, just below the industry average of 642. The company operates through local independent agents who understand Arizona's unique insurance landscape. Nationwide offers personalized service tailored to Arizona homeowners' specific needs, complemented by a user-friendly online platform for policy management.

Nationwide provides standard homeowners coverage with optional add-ons:

- Identity theft: Helps keep personal data secure amid a growing number of risks and cybercrime.

- Dwelling replacement cost: Can pay up to two times your dwelling coverage limit if your home needs to be rebuilt after a loss

- Water backup: Provides coverage if water backs up through your sewer, drains or your sump pump overflows

- Earthquake: Provides coverage for earthquake damage with a separate deductible

- Valuables Plus: Provides additional coverage for high-value items such as jewelry, watches, antiques and fine art

- Service line: Protection against damage to exterior, underground service lines that bring water, gas, electric to your residence

- Equipment breakdown: Provides repair or replacement coverage in the event of an electrical, mechanical or pressure system breakdown

- Umbrella insurance: Helps pay for medical expenses and legal fees in the event an accident occurs on your property

- Roof replacement: Additional coverage to ensure your roof is completely covered if you need to replace it

Best Arizona Home Insurance by City

Arizona home insurance rates vary by location. State Farm leads in six cities: Buckeye, Gilbert, Glendale, Peoria, Prescott Valley and Surprise, with annual premiums ranging from $1,322 to $1,339. American Family ranks best in seven cities, including Chandler, Mesa, Phoenix, Scottsdale and Tempe. Auto-Owners Insurance offers the lowest rate in Tucson at $1,919 annually.

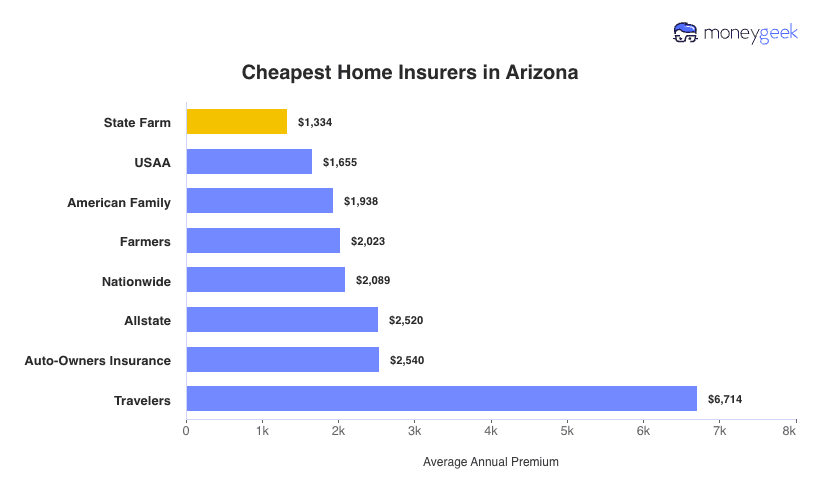

Cheapest Arizona Home Insurance Companies

Arizona homeowners pay $2,602 annually for home insurance, 25% less than the national average of $3,467. State Farm offers the state's most affordable home insurance at $1,334 annually, 49% below the state average. USAA ranks second at $1,655 per year, but restricts coverage to military members, veterans and their families. Premiums vary among insurers. Travelers represents the expensive end, charging 94% above the national benchmark.

Guide to Finding the Best Arizona Home Insurance Company

Compare multiple providers based on your coverage needs, budget and service preferences.

Annual premiums among Arizona's leading insurers range from $1,334 to $2,540, so you'll want to gather quotes from at least three to five companies. Don't just shop by price. The cheapest policy might leave coverage gaps when you file a claim after severe weather or other covered losses.

Examine complaint ratios through the Arizona Department of Insurance and Financial Institutions and review J.D. Power satisfaction scores, which range from 621 to 737 among top Arizona providers versus the 642 industry average. Focus on customer reviews about claims handling during Arizona's monsoon season rather than just policy purchase experiences.

Consider extended or guaranteed replacement cost options since construction costs often surge after Arizona's monsoon storms and flooding events. Base your coverage on replacement cost rather than market value, and review optional protections like wind/hail coverage and flood insurance that address your home's specific risk exposure.

Digital-first insurers like Lemonade, Hippo and Root work well if you prefer online policy management, while State Farm, Farmers and Allstate offer strong local agent networks for face-to-face support. Align your service preferences to avoid paying premium prices for features you won't actually use.

Arizona faces monsoon flooding risk, with the state experiencing over 1,000 flood events annually during monsoon season, according to the National Weather Service. Flooding is a leading cause of weather-related damage. Standard homeowners insurance covers monsoon flooding damage, but it doesn't cover regular flood damage. You'll need separate flood insurance coverage through your insurer or the National Flood Insurance Program for comprehensive protection.

Get the best rate for your insurance. Compare quotes from the top insurance companies.

Top-Rated Home Insurance Companies in Arizona: FAQ

Explore our FAQ section for answers to common questions about selecting the right Arizona home insurance provider for your needs.

Does standard homeowners insurance in Arizona cover monsoon flooding damage?

Yes, standard homeowners insurance in Arizona covers monsoon flooding damage caused by wind-driven rain entering your home. However, it doesn't cover regular flood damage from rising water, so you'll need separate flood insurance through your insurer or the National Flood Insurance Program for comprehensive protection.

What's the difference between replacement cost and actual cash value coverage?

Replacement cost coverage pays the full amount to rebuild your home or replace belongings at current market prices, while actual cash value coverage deducts depreciation based on your property's age and condition. Though actual cash value policies have lower premiums, you'll receive smaller claim payouts and cover more repair or replacement costs yourself after a loss.

How much do Arizona homeowners pay for home insurance compared to the national average?

Arizona homeowners pay $2,602 annually for home insurance, which is 25% less than the national average of $3,467. State Farm offers the state's most affordable option at $1,334 per year, while rates among top providers range from $1,334 to $2,540 annually.

Can I get home insurance if I have a trampoline or swimming pool?

Arizona insurers view trampolines and swimming pools as liability risks that increase your chances of injury claims. Insurers often require higher premiums or additional liability coverage. Some companies exclude trampoline coverage entirely or require safety features like nets and padding. Swimming pools require fencing, self-closing gates and liability coverage of at least $300,000.

Our Methodology: Determining the Best Arizona Home Insurers

Arizona homeowners deal with tornado risks, hurricane exposure and fluctuating construction costs. Our ranking system weighs affordable premiums, quality coverage and reliable claims handling.

We scored insurers across three factors:

Affordability (55%): We compared rates for identical coverage across major providers and evaluated discount availability.

Customer satisfaction (30%): J.D. Power ratings, Trustpilot reviews and app feedback reveal how insurers handle claims after storms damage your home.

Coverage options (15%): We assessed add-on availability, including water backup protection and inland flood options for Arizona's risks.

Our Sample Profile

Rates reflect a homeowner aged 41-60 with good credit and no prior claims insuring a 2,500-square-foot home built in 2000. Coverage includes $250,000 dwelling coverage, $125,000 personal property coverage, $200,000 personal liability coverage and a $1,000 deductible.

Your rates will vary based on your home's age, location, claims history and credit score.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- National Weather Service. "Monsoon." Accessed February 7, 2026.