Washington homeowners pay rates well below the national average. MoneyGeek analyzed premiums, J.D. Power satisfaction scores and coverage options from major insurers to find the best home insurance companies in Washington.

Best Homeowners Insurance Companies in Washington

Chubb ranks No. 1 in our review of the best home insurance in Washington, followed by USAA and State Farm.

See if you're overpaying for home insurance below.

Updated: January 27, 2026

Advertising & Editorial Disclosure

Chubb is the best home insurance provider in Washington with a score of 4.5 out of 5 from our review team.

USAA, State Farm, Allstate and Capital Insurance Group rank high for homeowners insurance in Washington based on affordable rates, strong customer service and reliable coverage.

The best insurer for your home depends on your coverage needs, budget and preferred features like claims service or discount availability.

What Are the Best Home Insurance Companies in Washington?

Chubb ranks first for Washington homeowners with the state's lowest premiums and above-average customer satisfaction. USAA, State Farm, Allstate and Capital Insurance Group complete the top five, excelling in areas like military-focused service, premium coverage quality and local agent networks.

Chubb | 4.5 | $1,794 | Most Washington homeowners |

USAA | 4.8 | $1,592 | Military families |

State Farm | 4.5 | $1,369 | Urban homeowners |

Allstate | 4.3 | $1,137 | Local agent network |

Capital Insurance Group | 4.2 | $1,000 | Affordable rates |

*Our ratings consider various combinations of coverage levels, home features and homeowner details to identify the best overall options. Rankings may differ based on your profile.

**Although USAA earned the highest score, we didn't rank it No. 1 due to its eligibility requirements.

J.D. Power Customer Satisfaction Score

677/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,794Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Digital tools for policy management and claims tracking

Strong financial stability with high AM Best ratings

Reliable financial strength protects policyholder claims

consLimited direct purchase options for some customers

Limited availability in some Washington areas

Chubb charges Washington homeowners $1,794 annually. The company provides guaranteed replacement cost coverage, ensuring full home rebuilding costs without depreciation deductions. Its extensive personal property coverage includes high-value items, which proves essential for protecting against the state's diverse climate risks.

Chubb charges $1,794 annually for home insurance in Washington, 22% higher than the state average of $1,474 and below the national average of $3,467. You can lower your premium by bundling home and auto policies or installing monitored security systems.

Older Homes $138 $1,653 Newer Homes $127 $1,521 Young Homeowners $150 $1,804 Senior Homeowners $149 $1,793 High-Risk Fire Homes $167 $2,010 Smaller Homes $159 $1,907 Larger Homes $183 $2,192 Chubb earned 677 out of 1,000 points in J.D. Power customer satisfaction ratings, surpassing the industry average of 642. The company operates through local independent agents who provide personalized service and tailored coverage options addressing Washington's unique regional needs. Chubb complements this traditional approach with a user-friendly online platform for convenient policy management and streamlined claims processing.

Chubb provides standard homeowners coverage with optional add-ons:

- Extended replacement cost: Rebuilds your home even if construction costs exceed your policy limit

- Temporary living arrangements: Covers hotel stays and meals while your house is being repaired

- Risk consulting: Free home inspection identifies security and fire prevention improvements

- Cash settlement: Pays your policy limit in cash if you choose not to rebuild after a total loss

- Replacement cost coverage: Replaces damaged items at today's prices without depreciation deductions

- HomeScan: Infrared technology detects hidden problems like leaks, missing insulation and electrical issues before they cause damage

J.D. Power Customer Satisfaction Score

737/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,592Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Strong financial stability with high AM Best ratings

Digital tools for easy policy management

Comprehensive coverage options tailored for military families

consRates run above state average

Only available to military members, veterans and their families

Not available in all Washington ZIP codes

USAA offers Washington homeowners competitive insurance at $1,592 annually, making it accessible for military families seeking quality coverage. The insurer provides replacement cost coverage for personal belongings, ensuring full value replacement without depreciation when you file claims. It offers flood insurance options, crucial for homeowners in Washington's flood-prone areas. USAA's military-focused approach delivers specialized benefits that standard insurers often overlook.

USAA charges $1,592 annually for home insurance in Washington, 8% more than the state average of $1,474 but 57% below the national average of $3,467. Lower premiums by bundling home and auto policies or installing monitored security systems.

Older Homes $128 $1,534 Newer Homes $97 $1,167 Young Homeowners $145 $1,744 Senior Homeowners $136 $1,630 High-Risk Fire Homes $149 $1,783 Smaller Homes $116 $1,392 Larger Homes $145 $1,738 USAA earned 737 out of 1,000 points in J.D. Power ratings, above the industry average of 642 points. The company operates through a direct-to-consumer model with a digital-first approach that streamlines policy management and claims processing. USAA offers tailored coverage options specifically designed for military families in Washington. Its strong mobile app includes comprehensive claims management features for convenient self-service options.

USAA provides standard homeowners coverage with optional add-ons:

- Dwelling coverage: Rebuilds your home after fires, storms or other covered damage

- Personal property coverage: Replaces belongings at current prices without depreciation

- Liability protection: Pays legal costs and settlements if someone gets injured on your property

- Additional living expenses: Covers hotel and meal costs while your home is being repaired

- Flood insurance: Protects against water damage in areas near Puget Sound, Lake Washington and major rivers

- Personal umbrella policy: Adds $1 million to $5 million in liability coverage beyond your home policy limits

J.D. Power Customer Satisfaction Score

657/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,369Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

J.D. Power score exceeds industry average for customer satisfaction

Digital tools simplify policy management tasks

Strong agent network provides personalized service and support

consNot available in all Washington ZIP codes

Fewer coverage customization options

Some customers report longer claims processing times

Washington's rainy climate makes water damage protection a must, and State Farm delivers with optional water damage coverage alongside its $1,369 annual premium. Personal property replacement cost coverage comes standard, ensuring you receive today's prices for damaged items rather than depreciated values. State Farm offers additional endorsements to address Washington's weather-related risks.

You'll save $105 annually compared to Washington's average homeowner by choosing State Farm's $1,369 rate. The premium sits 60% below the national average of $3,467, and you can reduce costs further through policy bundling or monitored security system installation.

Older Homes $115 $1,382 Newer Homes $88 $1,053 Young Homeowners $115 $1,375 Senior Homeowners $114 $1,369 High-Risk Fire Homes $128 $1,534 Smaller Homes $121 $1,456 Larger Homes $139 $1,674 State Farm earned 657 out of 1,000 points in J.D. Power's satisfaction ratings, surpassing the 642 industry average. Local agents handle your complex claims and coverage questions, while the company's digital platforms let you manage routine tasks independently. You can get quotes, pay bills and file claims through State Farm's website or mobile app without contacting your agent.

State Farm provides standard homeowners coverage with optional add-ons:

- Water damage coverage: Covers roof leaks, burst pipes and water seepage, critical protection given Washington's 150+ annual rain days

- Personal property replacement cost: Replaces damaged items at today's prices without depreciation deductions

- Dwelling coverage: Rebuilds your home after fires, windstorms or other covered damage

- Personal liability protection: Pays legal costs and settlements if someone gets injured on your property

- Additional living expenses: Covers hotel and meal costs while your home is uninhabitable

- Medical payments: Pays medical bills for guests injured on your property, regardless of fault

J.D. Power Customer Satisfaction Score

633/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$1,137Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Strong financial stability with high ratings from industry analysts

Digital tools make policy management simple and convenient

Most affordable rates available for Washington homeowners

consCustomer satisfaction score falls below industry average

Limited flexibility when customizing policy options

Slower claims process for some policyholders

Allstate charges Washington homeowners $1,137 annually while offering endorsements that suit local risks. For homes in popular cities like Seattle with aging infrastructures, Allstate offers optional coverage for water backup from sewer and drain failures, along with the option to replace damaged belongings at current prices without depreciation.

Washington homeowners save $337 annually by choosing Allstate's $1,137 premium over the state's $1,474 average. The rate sits 67% below the national average of $3,467. Bundling home and auto policies or installing monitored alarm systems reduces your premium further.

Older Homes $103 $1,234 Newer Homes $118 $1,414 Young Homeowners $102 $1,218 Senior Homeowners $81 $971 High-Risk Fire Homes $106 $1,274 Smaller Homes $92 $1,104 Larger Homes $127 $1,528 Local agents and online purchasing give Washington homeowners flexibility with Allstate, though the company's 633-point J.D. Power score trails the 642 industry average. You can handle quotes, policy adjustments and claims through Allstate's website, but the mobile app misses features like photo claims submission that competing insurers provide.

Allstate provides standard homeowners coverage with optional add-ons:

- Water backup coverage: Covers damage from sewer and drain backups, common in older Seattle and Tacoma neighborhoods with aging infrastructure

- Replacement cost personal property: Replaces damaged items at today's prices without depreciation deductions

- Dwelling coverage: Rebuilds your home after fires, windstorms or other covered damage

- Personal liability: Pays legal costs and settlements if someone gets injured on your property

- Additional living expenses: Covers hotel and meal costs while your home is being repaired

- Medical payments: Pays medical bills for guests injured on your property up to your policy limit

J.D. Power Customer Satisfaction Score

1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

N/ABased on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Digital tools simplify policy management and customer service

Most affordable rates available for Washington homeowners

Flexible policy options with add-on coverage choices

consNot available in all Washington counties

Must purchase through agents—no direct online buying

Claims processing slower than some competitor companies

Capital Insurance Group offers Washington's most affordable home insurance at $1,000 annually. The company offers optional water damage coverage for homes near Puget Sound and major rivers, plus earthquake coverage for properties in high-risk zones like Seattle and Tacoma.

Capital Insurance Group charges $1,000 annually for home insurance in Washington, 32% less than the state average of $1,474 and 71% below the national average of $3,467. Lower your premium by bundling home and auto policies or installing monitored security systems.

Older Homes $90 $1,079 Newer Homes $52 $626 Young Homeowners $86 $1,033 Senior Homeowners $77 $921 High-Risk Fire Homes $93 $1,120 Smaller Homes $80 $963 Larger Homes $92 $1,100 Capital Insurance Group has no J.D. Power customer satisfaction rating, so we can't compare it to the 642 industry average. The company sells only through independent agents, not directly online. Capital Insurance Group lacks mobile apps and online claims filing. You must call your agent or visit their office to file claims or make policy changes.

Capital Insurance Group provides standard homeowners coverage with optional add-ons:

- Water damage coverage: Covers flooding from heavy rainfall and storm surge—important for homes in King, Pierce and Snohomish counties' flood zones

- Earthquake damage protection: Covers structural damage and rebuilding costs after earthquakes—critical given Washington's position on the Cascadia Subduction Zone

- Dwelling coverage: Rebuilds your home after fires, windstorms or other covered damage

- Personal property protection: Replaces belongings damaged by covered perils

- Liability coverage: Pays legal costs and settlements if someone gets injured on your property

- Additional living expenses: Covers hotel and meal costs while your home is uninhabitable

Best Washington Home Insurance by City

Chubb leads Washington's home insurance market as the top provider in seven cities: Brewster, Everett, Snohomish, Spokane, Tacoma, Vancouver and Kent. State Farm ranks best in four cities: Bellevue, Bothell, Renton and Seattle. Annual premiums range from $1,210 in Seattle to $1,976 in Tacoma across the 11 cities analyzed.

| Bellevue | State Farm | $1,292 |

| Bothell | State Farm | $1,248 |

| Brewster | Chubb | $1,870 |

| Everett | Chubb | $1,694 |

| Kent | State Farm | $1,428 |

| Renton | State Farm | $1,266 |

| Seattle | State Farm | $1,210 |

| Snohomish | Chubb | $1,694 |

| Spokane | Chubb | $1,344 |

| Tacoma | Chubb | $1,976 |

| Vancouver | Chubb | $1,222 |

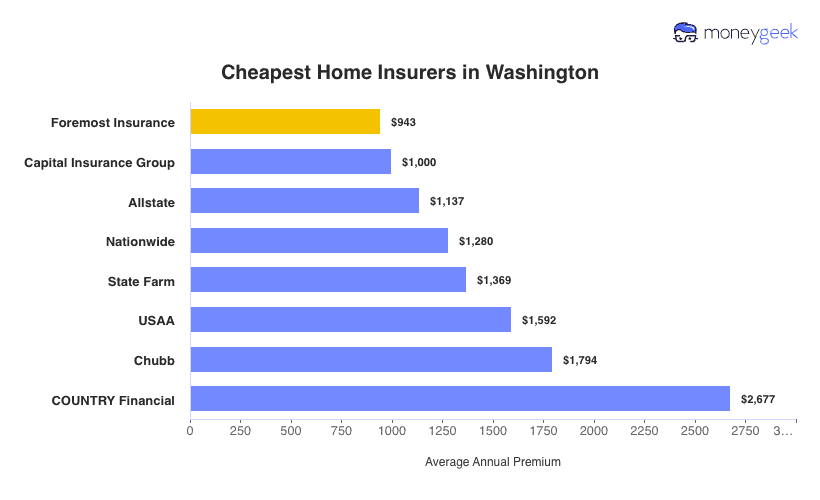

Cheapest Washington Home Insurance Companies

Washington homeowners pay $1,474 annually for home insurance, 57% less than the national average of $3,467. Foremost offers the state's most affordable home insurance at $943 annually, 36% below the state average. Capital Insurance Group ranks second at $1,000 per year. Premiums vary among insurers, with COUNTRY Financial charging 23% above the national benchmark.

Guide to Finding the Best Washington Home Insurance Company

Compare multiple providers based on your coverage needs, budget and service preferences.

Get quotes from at least three to five insurers. Premiums among top Washington providers range from $1,000 to $1,794 annually. Don't just shop by price. The cheapest policy might leave coverage gaps when you file a claim after severe weather or other covered losses.

Check complaint ratios through Washington State Office of the Insurance Commissioner, then review J.D. Power scores ranging from 633 to 737 among leading insurers compared to the 642 industry average. Focus on recent customer reviews about claims handling during Washington's flooding season rather than just policy purchase experiences.

Base your coverage on replacement cost rather than market value, especially important in Washington, where construction costs spike after flooding and windstorms. Review extended or guaranteed replacement cost options alongside additional coverages like flood insurance and wind/hail protection that address your home's specific risk profile.

Choose insurers with local agent networks like State Farm if you want face-to-face support or digital-first insurers like USAA if you prefer online policy management. Don't pay premium prices for services you won't use.

Washington faces flooding risk, with the state experiencing over $1 billion in flood damage during 2021 according to FEMA. Flooding remains a leading cause of property damage throughout the state. Standard homeowners insurance covers many types of damage like fire and wind, but it doesn't cover flood damage. You'll need separate flood insurance coverage, available through your insurer or the National Flood Insurance Program.

Get the best rate for your insurance. Compare quotes from the top insurance companies.

Top-Rated Home Insurance Companies in Washington: FAQ

Explore our FAQ section for answers to common questions about selecting the right Washington home insurance provider for your needs.

How do Washington's home insurance rates compare to the national average?

Washington homeowners pay $1,474 annually for home insurance, 57% less than the national average of $3,467. Premiums vary significantly by insurer and location, ranging from $943 to over $4,000 annually depending on the provider and your home's specific risk factors.

Does standard homeowners insurance in Washington cover earthquake damage?

No, standard homeowners insurance doesn't cover earthquake damage in Washington, despite the state's position on the Cascadia Subduction Zone. You'll need to purchase separate earthquake coverage, which some insurers like Capital Insurance Group offer as an optional add-on for properties in high-risk zones like Seattle and Tacoma.

What's the difference between replacement cost and actual cash value coverage?

Replacement cost coverage pays to rebuild your home or replace belongings at current prices without deducting for depreciation. Actual cash value coverage subtracts depreciation from claim payments. You receive less money based on your property's age and condition. Actual cash value policies cost less up front but leave you covering more expenses out of pocket after a loss.

Can I get home insurance if I have a trampoline or swimming pool?

You can get home insurance with a trampoline or swimming pool, though Washington insurers consider these features liability risks. Most companies require higher premiums or additional liability coverage of at least $300,000. Safety measures are mandatory: trampolines need nets and padding, while pools require fencing and self-closing gates. Some insurers may exclude coverage for these features entirely, so compare policies carefully.

Our Methodology: Determining the Best Washington Home Insurers

Washington homeowners deal with tornado risks, hurricane exposure and fluctuating construction costs. Our ranking system weighs affordable premiums, quality coverage and reliable claims handling.

We scored insurers across three factors:

Affordability (55%): We compared rates for identical coverage across major providers and evaluated discount availability.

Customer satisfaction (30%): J.D. Power ratings, Trustpilot reviews and app feedback reveal how insurers handle claims after storms damage your home.

Coverage options (15%): We assessed add-on availability, including water backup protection and inland flood options for Washington's risks.

Our Sample Profile

Rates reflect a homeowner aged 41-60 with good credit and no prior claims insuring a 2,500-square-foot home built in 2000. Coverage includes $250,000 dwelling coverage, $125,000 personal property coverage, $200,000 personal liability coverage and a $1,000 deductible.

Your rates will vary based on your home's age, location, claims history and credit score.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- FEMA. "Washington Severe Storms, Straight-line Winds, Flooding, Landslides and Mudslides." Accessed February 7, 2026.