Florida homeowners pay rates well below the national average. MoneyGeek analyzed premiums, J.D. Power satisfaction scores and coverage options from major insurers to find the best home insurance companies in Florida.

Best Homeowners Insurance Companies in Florida

State Farm ranks No. 1 in our review of the best home insurance in Florida, followed by Chubb and Nationwide.

See if you're overpaying for home insurance below.

Updated: January 29, 2026

Advertising & Editorial Disclosure

State Farm is the best home insurance provider in Florida with a score of 4.9 out of 5 from our review team.

Chubb, Nationwide, Allstate and Florida Peninsula rank high for homeowners insurance in Florida based on affordable rates, strong customer service and reliable coverage.

The best insurer for your home depends on your coverage needs, budget and preferred features like claims service or discount availability.

What Are the Best Home Insurance Companies in Florida?

State Farm ranks first for Florida homeowners with the state's lowest premiums and above-average customer satisfaction. Chubb, Nationwide, Allstate and Florida Peninsula complete the top five, excelling in areas like military-focused service, premium coverage quality and local agent networks.

State Farm | 4.9 | $3,727 | Most Florida homeowners |

Chubb | 4.7 | $10,821 | Coverage options |

Nationwide | 4.5 | $6,309 | Financial stability |

Allstate | 4.4 | $11,393 | Local agent network |

Florida Peninsula | 4.2 | $6,826 | Hurricane coverage |

*Our ratings consider various combinations of coverage levels, home features and homeowner details to identify the best overall options. Rankings may differ based on your profile.

J.D. Power Customer Satisfaction Score

657/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$3,727Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Strong financial stability with high industry ratings

User-friendly digital tools for easy policy management

Most affordable rates for Florida homeowners

consClaims process slows during high-demand periods

Some customers prefer more direct purchase options

Limited add-on coverage availability in some regions

State Farm offers Florida's most affordable home insurance at $3,727 annually. The company provides hurricane damage coverage, crucial for Florida's storm-prone environment, along with personal property replacement cost coverage that allows homeowners to replace lost items at current prices.

State Farm charges $3,727 annually for home insurance in Florida, 64% less than the state average of $10,384 but above the national average of $3,467. The company offers bundling discounts for combined home and auto insurance policies and security system discounts.

Older Homes $352 $4,223 Newer Homes $149 $1,786 Young Homeowners $311 $3,727 Senior Homeowners $310 $3,722 High-Risk Fire Homes $348 $4,176 Smaller Homes $435 $5,225 Larger Homes $542 $6,502 State Farm earned 657 out of 1,000 points in J.D. Power ratings, above the industry average of 642. The company operates through local independent agents and direct sales, providing flexible service options for Florida homeowners. State Farm provides strong claims support and local expertise for Florida's insurance landscape. Its online tools enable customers who prefer digital interactions to obtain quotes and manage policies.

State Farm provides standard homeowners coverage with optional add-ons:

- Hurricane damage coverage: Protection against Florida's frequent storm activity

- Personal property replacement cost: Covers belongings at current replacement prices rather than depreciated value

- Dwelling coverage: Protects your home's structure against covered perils

- Personal liability: Covers legal costs if someone is injured on your property

- Additional living expenses: Pays temporary housing costs while your home is repaired

- Medical payments: Covers minor injuries to guests regardless of fault

J.D. Power Customer Satisfaction Score

677/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$10,821Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Strong financial stability with high industry ratings

Customer satisfaction scores above industry average

Comprehensive coverage options for diverse homeowner needs

consPremium rates higher than Florida state average

Claims processing slow for complex cases

Limited availability in some Florida regions

Chubb charges $10,821 annually for home insurance in Florida and provides guaranteed replacement cost coverage and water damage protection as endorsements. These options matter when hurricanes and tropical storms bring both wind damage and water intrusion that threatens homes statewide, from the Panhandle to the Keys.

Home insurance from Chubb costs $10,821 annually in Florida, nearly matching the state average of $10,384 but substantially above the national benchmark of $3,467. Bundling policies or adding qualifying security systems can reduce your premium through available discounts.

Older Homes $1,457 $17,480 Newer Homes $736 $8,836 Young Homeowners $902 $10,821 Senior Homeowners $901 $10,814 High-Risk Fire Homes $1,010 $12,124 Smaller Homes $1,255 $15,063 Larger Homes $1,555 $18,660 Local independent agents handle Chubb policies in Florida, bringing knowledge of the state's hurricane seasons, flooding patterns and unique insurance requirements. The insurer earned 677 points in J.D. Power satisfaction ratings compared to the 642-point industry average and offers an accessible online platform for customers who prefer digital policy management.

Chubb provides standard homeowners coverage with optional add-ons:

- Extended replacement cost: Repairs or rebuilds your home to its original condition even when costs exceed your policy limit

- Temporary living arrangements: Helps you find comfortable accommodations while your house is rebuilt

- Risk consulting: Complimentary home appraisals with trained risk consultants who visit your home and provide security and fire prevention advice

- Cash settlement: Offers cash settlement up to your policy limit for covered total losses if you choose not to rebuild

- Replacement cost coverage: Replaces upgraded appliances, custom cabinets, flooring and carpentry without depreciation deductions

- HomeScan: Uses infrared technology to detect problems like leaks, missing insulation and faulty electrical connections before damage occurs

J.D. Power Customer Satisfaction Score

641/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$6,309Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Strong financial stability with high industry ratings

Most affordable rates for Florida homeowners

User-friendly digital tools for policy management

consClaims process slow and complex

Direct purchase lacks personalized guidance

Limited add-on coverage availability

Nationwide offers Florida homeowners competitive insurance at $6,309 annually. The company provides water damage coverage, crucial for Florida's flood-prone areas, plus optional hurricane protection for severe storm seasons.

Nationwide charges $6,309 annually for home insurance in Florida, 39% less than the state average of $10,384 but above the national average of $3,467. The company offers bundling discounts for multiple policies and home security system discounts.

Older Homes $822 $9,858 Newer Homes $257 $3,081 Young Homeowners $526 $6,309 Senior Homeowners $497 $5,959 High-Risk Fire Homes $589 $7,069 Smaller Homes $738 $8,860 Larger Homes $920 $11,035 Nationwide earned 641 out of 1,000 points in J.D. Power ratings, just below the industry average of 642. The company operates through local independent agents who provide personalized service and understand regional coverage needs. Nationwide offers coverage options for Florida homeowners and provides a user-friendly online platform for policy management.

Nationwide provides standard homeowners coverage with optional add-ons:

- Water damage coverage: Protects against water-related losses common in Florida's humid climate

- Optional hurricane coverage: Protection from severe storms and wind damage

- Dwelling coverage: Rebuilds or repairs your home's structure after covered losses

- Personal property protection: Covers belongings damaged by covered perils

- Liability coverage: Protects against lawsuits from injuries on your property

- Additional living expenses: Pays temporary housing costs during home repairs

J.D. Power Customer Satisfaction Score

633/1,000From the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$11,393Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Strong financial stability with high industry ratings

Extensive agent network with personalized service and local support

User-friendly digital tools for policy management and claims

consRates above Florida state average

Limited add-on coverage availability for homeowners

Geographic restrictions limit availability in some Florida areas

Allstate offers homeowners insurance in Florida for $11,393 annually. The company excels in hurricane protection with extensive wind and hail damage coverage, essential for the state's storm-prone climate. Its personal property replacement cost coverage allows you to replace lost belongings without depreciation.

Allstate charges $11,393 annually for home insurance in Florida, 10% above the state average of $10,384 and 3%above the national average of $3,467. The company offers bundling discounts for multiple policies and home security system discounts.

Older Homes $1,464 $17,572 Newer Homes $688 $8,260 Young Homeowners $949 $11,393 Senior Homeowners $937 $11,243 High-Risk Fire Homes $1,064 $12,765 Smaller Homes $1,323 $15,879 Larger Homes $1,640 $19,684 Allstate scored 633 out of 1,000 points in J.D. Power's customer satisfaction study, slightly below the industry average of 642. The company operates through local independent agents and direct sales, providing flexible service options. Allstate's strength is personalized service through local agents who understand Florida's unique insurance challenges and weather risks. It offers online tools for quotes and policy management, though its mobile app features remain limited compared to digital-first competitors.

Allstate provides comprehensive homeowners coverage with specialized add-ons for Florida residents:

- Wind and hail coverage: Extensive protection against hurricane and storm damage

- Personal property replacement cost: Full replacement value for belongings without depreciation

- Dwelling coverage: Protection for your home's structure and attached features

- Personal liability: Coverage for accidents occurring on your property

- Additional living expenses: Temporary housing costs during home repairs

- Medical payments: Coverage for guest injuries on your property

J.D. Power Customer Satisfaction Score

N/AFrom the J.D. Power 2025 U.S. Home Insurance Study, which examines customer satisfaction based on responses from 14,511 homeowners and renters. The average score is 642/1,000.Average Annual Premium

$6,826Based on our methodology's base profile of a policy with $250K in dwelling coverage, $125K in personal property coverage and $200K in liability coverage with a $1,000 deductible

- pros

Comprehensive coverage options for Florida homeowners

Most affordable rates for Florida homeowners statewide

User-friendly digital tools for policy management and claims

consLimited agent network affects accessibility in some areas

Some unique features not well-known to customers

Limited availability in some Florida regions

Hurricane damage coverage makes Florida Peninsula a relevant option for homeowners across the state, from coastal communities to inland areas vulnerable to tropical systems. The insurer charges $6,826 annually and offers personal property replacement cost coverage as an endorsement, ensuring you can replace belongings at current prices rather than depreciated values.

Annual premiums of $6,826 place Florida Peninsula 34% below what most Florida homeowners pay ($10,384 state average). The company provides bundling and home security discounts, though rates remain higher than the $3,467 national average due to Florida's elevated insurance costs.

Older Homes $626 $7,516 Newer Homes $376 $4,515 Young Homeowners $569 $6,826 Senior Homeowners $568 $6,822 High-Risk Fire Homes $637 $7,648 Smaller Homes $791 $9,493 Larger Homes $979 $11,752 Local independent agents form the core of Florida Peninsula's service model, providing face-to-face support for homeowners who value personal relationships. The company offers online quoting but maintains limited mobile app features, and it has no J.D. Power satisfaction score to compare against the 642-point industry average.

Florida Peninsula provides standard homeowners coverage with specialized options for Florida residents:

- Hurricane damage coverage: Protection against wind and storm damage from tropical systems

- Personal property replacement cost: Covers belongings at current replacement value rather than depreciated worth

- Dwelling coverage: Protects your home's structure and attached features

- Personal liability: Covers legal costs if someone is injured on your property

- Additional living expenses: Pays temporary housing costs during covered repairs

Best Florida Home Insurance by City

Farm leads in 17 Florida cities with annual premiums of $4,160 to $4,292, covering markets from Jacksonville and Tampa to Miami-area cities like Hialeah and Miami Gardens. Chubb ranks as the top provider in 13 cities, with premiums ranging from $6,023 in Pensacola to $22,941 in Coral Springs and Pompano Beach. Nationwide offers the best rates in two cities: Boca Raton ($5,782) and Hollywood ($5,779).

| Boca Raton | Nationwide | $5,782 |

| Brooksville | State Farm | $4,292 |

| Cape Coral | State Farm | $4,160 |

| Clearwater | Chubb | $12,239 |

| Clearwater Beach | Chubb | $12,239 |

| Coral Springs | Chubb | $22,941 |

| Fort Lauderdale | Chubb | $17,490 |

| Fort Myers | State Farm | $4,160 |

| Gainesville | State Farm | $4,292 |

| Hialeah | Chubb | $14,563 |

| Hollywood | Nationwide | $5,779 |

| Jacksonville | State Farm | $4,271 |

| Lakeland | State Farm | $4,292 |

| Lehigh Acres | State Farm | $4,160 |

| Miami | Chubb | $18,922 |

| Miami Gardens | Chubb | $14,654 |

| Naples | Chubb | $12,473 |

| Ocala | State Farm | $4,292 |

| Ocoee | State Farm | $4,292 |

| Okeechobee | State Farm | $4,160 |

| Orlando | State Farm | $4,292 |

| Oxford | State Farm | $4,292 |

| Palm Bay | State Farm | $4,160 |

| Pembroke Pines | Chubb | $9,313 |

| Pensacola | Chubb | $6,023 |

| Pompano Beach | Chubb | $22,941 |

| Port Saint Lucie | Chubb | $15,511 |

| Saint Petersburg | Chubb | $12,239 |

| Spring Hill | State Farm | $4,292 |

| Tallahassee | State Farm | $4,271 |

| Tampa | State Farm | $4,292 |

| Valrico | State Farm | $4,292 |

| West Palm Beach | Chubb | $13,220 |

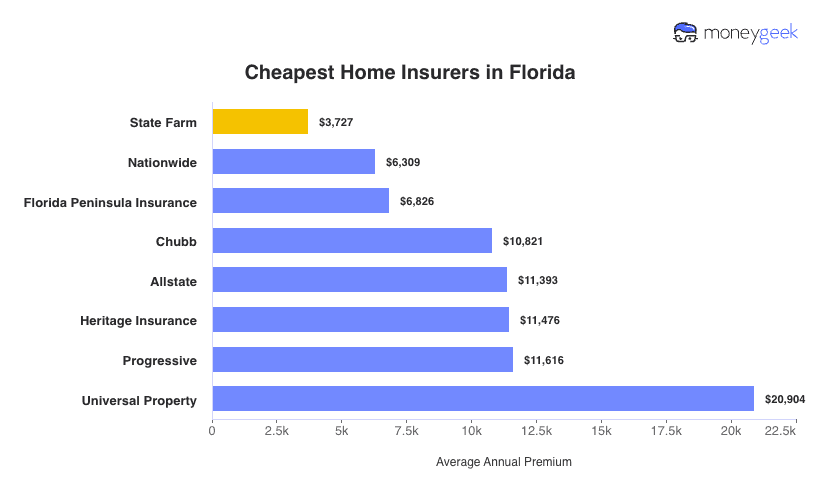

Cheapest Florida Home Insurance Companies

Florida homeowners pay $10,384 annually for home insurance, 200% higher than the national average of $3,467. State Farm offers the state's most affordable home insurance at $3,727 annually, 64% below the state average. Nationwide offers the second-best rates at $6,309. Costs vary among insurers. Universal Property represents the expensive end, charging 503% more than the national benchmark.

Guide to Finding the Best Florida Home Insurance Company

Choosing quality home insurance in the Sunshine State involves evaluating multiple providers based on your budget, coverage requirements and service expectations.

Get quotes from at least three to five insurers. Premiums among top Florida providers range from $3,727 to $11,393 annually. Don't just shop by price. The cheapest policy might leave coverage gaps when you file a claim after severe weather or other covered losses.

Review J.D. Power scores, which range from 633 to 677 among Florida's top providers compared to the 642 industry average. Check complaint ratios through the Florida Insurance and Safety Fire Commissioner's office. Read recent customer reviews focusing on claims experiences during Florida's severe weather season, not just policy shopping.

Consider extended or guaranteed replacement cost options since Florida's construction costs surge after hurricanes and flooding. Base your coverage on replacement cost rather than market value and review optional protections like wind/hail coverage, flood insurance and extended replacement cost that address your home's specific risks.

Choose insurers with local agent networks like State Farm if you want face-to-face support or digital-first insurers like USAA if you prefer online policy management. Don't pay premium prices for services you won't use.

Florida is the most hurricane-prone state in the U.S., averaging 1.5 hurricanes per year between 2018 and 2023, according to the National Hurricane Center. State law allows insurers to include hurricane deductibles in homeowners policies, calculated as 2% to 10% of your home's insured value.

Standard homeowners insurance covers hurricane wind damage but excludes flooding. You'll need separate flood coverage through your insurer or the National Flood Insurance Program.

Get the best rate for your insurance. Compare quotes from the top insurance companies.

Top-Rated Home Insurance Companies in Florida: FAQ

Explore our FAQ section for answers to common questions about selecting the right Florida home insurance provider for your needs.

Does Florida require separate hurricane deductibles for homeowners insurance?

Yes, Florida law allows insurers to include hurricane deductibles calculated as 2% to 10% of your home's insured value, separate from your standard deductible. These hurricane-specific deductibles apply when the National Hurricane Center declares a hurricane, making your out-of-pocket costs higher during named storms.

Does home insurance cover damage from fallen trees in Florida?

Home insurance covers damage to your house from fallen trees when wind, lightning, or other covered perils cause the tree to fall. Coverage excludes trees that fell due to rot or neglect, and your policy won't cover tree removal unless the tree damaged a structure. Most policies limit tree removal coverage to $500 to $1,000 per tree.

What's the difference between replacement cost and actual cash value coverage?

Replacement cost coverage pays to rebuild your home or replace belongings at current prices without deducting for depreciation. Actual cash value coverage subtracts depreciation from claim payments. You receive less money based on your property's age and condition. Actual cash value policies cost less up front but leave you covering more expenses out of pocket after a loss.

Do Florida homeowners insurance policies cover flood damage from hurricanes?

No, standard Florida homeowners insurance covers hurricane wind damage but excludes flooding from storm surge or heavy rains. You need separate flood coverage through your insurer or the National Flood Insurance Program.

Our Methodology: Determining the Best Florida Home Insurers

Florida homeowners deal with tornado risks, hurricane exposure and fluctuating construction costs. Our ranking system weighs affordable premiums, quality coverage and reliable claims handling.

We scored insurers across three factors:

Affordability (55%): We compared rates for identical coverage across major providers and evaluated discount availability.

Customer satisfaction (30%): J.D. Power ratings, Trustpilot reviews and app feedback reveal how insurers handle claims after storms damage your home.

Coverage options (15%): We assessed add-on availability, including water backup protection and inland flood options for Florida's risks.

Our Sample Profile

Rates reflect a homeowner aged 41-60 with good credit and no prior claims insuring a 2,500-square-foot home built in 2000. Coverage includes $250,000 dwelling coverage, $125,000 personal property coverage, $200,000 personal liability coverage and a $1,000 deductible.

Your rates will vary based on your home's age, location, claims history and credit score.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- NOAA. "National Hurricane Center and Central Pacific Hurricane Center." Accessed February 7, 2026.