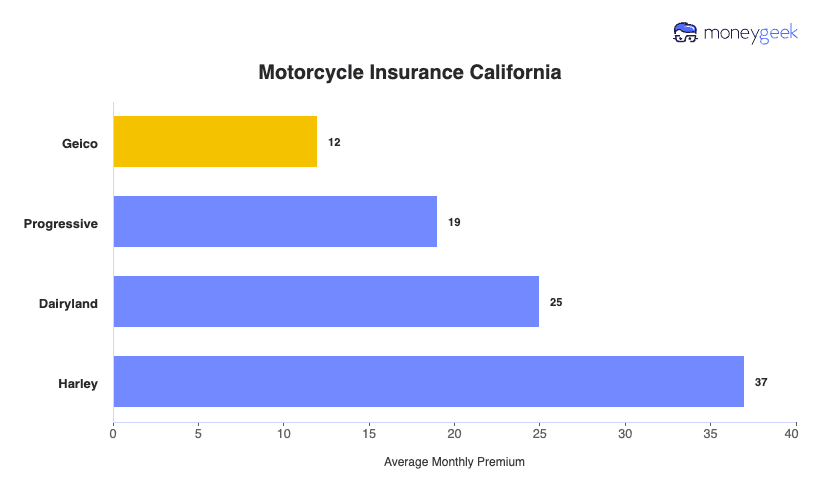

California's cheapest motorcycle insurance comes from GEICO at $12 per month or $145 yearly, dominating both minimum and full coverage categories. Rates undercut competitors across all coverage levels, saving riders an average of $80 to $150 annually compared to other budget options.

Progressive is second place at $19 monthly. Dairyland costs $25 monthly. Both provide solid alternatives for riders qualifying for specialized discounts.