California pet owners often have questions about coverage costs, providers and policy details before buying insurance.

Best Pet Insurance in California

The best and cheapest pet insurance companies in California are Lemonade, Spot, AKC and Pumpkin, with monthly rates starting at $14.

Get quotes from the best pet insurance provider in California below.

Updated: December 29, 2025

Advertising & Editorial Disclosure

Best Pet Insurance in California: FAQ

Who offers the best pet insurance in California?

California's best pet insurance companies are Lemonade for overall coverage, Spot for wellness plans, Pumpkin for cheap cat insurance, Rainwalk for customer experience and Pets Best for direct vet payments.

Who offers the cheapest pet insurance in California?

Lemonade offers the cheapest pet insurance in California at $40 monthly (based on overall average rates), Pumpkin and ASPCA offer $42 monthly, and Hartville and Spot offer $44 monthly.

By species, ASPCA is the cheapest insurer for dogs at $65 monthly, while Pumpkin provides the lowest rates for cats at $27.

How much does pet insurance cost in California?

Pet insurance in California costs an average of $114 per month for dogs and $58 for cats. Your price depends on your pet's age, breed, location and coverage choices.

Is pet insurance worth it in California?

Pet insurance is worth it due to high vet costs in California, which rank third highest nationwide. If you have a high-risk breed for certain conditions or own a large breed, getting coverage is usually worth the cost.

What does pet insurance cover in California?

California pet insurance coverage includes accidents, illnesses and optional routine care. Coverage varies by the policy type and terms you select.

Coverage for accidents and diseases applies only to eligible conditions after mandatory waiting periods (typically 14 days for illnesses, immediate to 3 days for accidents and up to 6 months for orthopedic conditions). Pre-existing conditions are generally excluded.

How do I choose the best pet insurance company in California?

Comparing multiple plans, clearly defining your coverage needs and thoroughly researching provider reputation and pricing options will help you find the best deal when buying pet insurance.

Best Pet Insurance Companies in California

With a score of 4.38 out of 5, Lemonade earns our top spot as the best pet insurance company in California for most cats and dogs. The provider has the cheapest rates overall, a great customer experience and the most customizable plan options so you can choose what you need. Even so, look into our other top options, including Spot, Pumpkin, Rainwalk and Pets Best, for great California pet health coverage at reasonable prices.

How We Decided the Best Pet Insurance Providers in California

We calculated the scores based on our methodology across all dog and cat breeds for customer experiences and coverage scores. Affordability scores and rates are based on a middle-aged dog and cat with a $5,000 annual limit, $500 deductible and 80% reimbursement policy.

Learn more about the best pet insurance companies in California for your pet:

Best California Pet Insurance by Pet Type and Age

At the pet type and age level, Lemonade is California's top pet insurance provider, winning five out of eight of our judged categories. Rainwalk is the best insurer for senior dogs and cats. Owners of middle-aged cats will find better coverage with Spot.

| Puppies | Lemonade | $30 | 3 | 6 |

| Kittens | Lemonade | $15 | 3 | 6 |

| Young Dogs | Lemonade | $35 | 3 | 6 |

| Young Cats | Lemonade | $19 | 3 | 6 |

| Middle Aged Dogs | Lemonade | $60 | 3 | 6 |

| Middle Aged Cats | Spot | $31 | 2 | 8 |

| Senior Dogs | Rainwalk | $92 | 1 | 4 |

| Senior Cats | Rainwalk | $60 | 1 | 4 |

How We Determined the Best Pet Insurance in California by Category

Our picks represent the following profiles for pet age, and we based all rates on a policy with a $5,000 limit, $500 deductible and 80% reimbursement:

- Kittens or puppies: Under 1 year old

- Younger dogs: 1 to 4 years old

- Younger cats: 1 to 5 years old

- Middle-aged dogs: 5 to 9 years old

- Middle-aged cats: 6 to 10 years old

- Senior dogs: 10+ years old

- Senior cats: 11+ years old

Best California Pet Insurance by Breed

The choices for the best pet insurance in California by breed vary from our general recommendations. AKC finishes on top with the most dog and cat breeds, primarily due to its willingness to cover incurable pre-existing conditions. Rainwalk is our study's best provider for many cat breeds, and Lemonade performs well overall for higher risk breeds. Pets Best is the best provider for Scottish Deerhounds.

| Abyssinian | Rainwalk | $42 | 1 | 4 |

| Affenpinscher | Rainwalk | $57 | 1 | 4 |

| Afghan Hound | AKC | $78 | 3 | 1 |

| Airedale Terrier | AKC | $75 | 3 | 1 |

| Akita | AKC | $76 | 3 | 1 |

| Alaskan Husky | AKC | $71 | 3 | 1 |

| Alaskan Malamute | AKC | $72 | 3 | 1 |

| Alsatian | AKC | $84 | 3 | 1 |

| Alsatian | AKC | $80 | 3 | 1 |

| American Bulldog | Lemonade | $70 | 3 | 6 |

| American Bully | AKC | $96 | 3 | 1 |

| American Eskimo | AKC | $56 | 3 | 1 |

| American Foxhound | AKC | $60 | 3 | 1 |

| American Hairless Terrier | AKC | $54 | 3 | 1 |

| American Staffordshire Terrier | AKC | $85 | 3 | 1 |

| Australian Cattle Dog | AKC | $59 | 3 | 1 |

| Australian Kelpie | AKC | $61 | 3 | 1 |

| Australian Mist | Rainwalk | $40 | 1 | 4 |

| Australian Shepherd | AKC | $52 | 3 | 1 |

| Australian Silky Terrier | AKC | $55 | 3 | 1 |

| Australian Terrier | AKC | $55 | 3 | 1 |

| Balinese | Rainwalk | $39 | 1 | 4 |

| Basenji | AKC | $54 | 3 | 1 |

| Basset Fauve de Bretagne | AKC | $68 | 3 | 1 |

| Basset Hound | AKC | $85 | 3 | 1 |

| Beagle | AKC | $61 | 3 | 1 |

| Bearded Collie | AKC | $60 | 3 | 1 |

| Belgian Shepherd Malinois | AKC | $69 | 3 | 1 |

| Bengal | AKC | $46 | 3 | 1 |

| Bernese Mountain Dog | Lemonade | $97 | 3 | 6 |

| Bichon Frise | AKC | $58 | 3 | 1 |

| Birman | Rainwalk | $36 | 1 | 4 |

| Bloodhound | AKC | $100 | 3 | 1 |

| Bombay | AKC | $41 | 3 | 1 |

| Border Collie | AKC | $55 | 3 | 1 |

| Border Terrier | AKC | $56 | 3 | 1 |

| Borzoi | AKC | $89 | 3 | 1 |

| Boston Terrier | AKC | $61 | 3 | 1 |

| Boxer | Lemonade | $59 | 3 | 6 |

| Bracco Italiano | AKC | $67 | 3 | 1 |

| Briard | AKC | $72 | 3 | 1 |

| British Bulldog | Lemonade | $87 | 3 | 6 |

| British Longhair | AKC | $41 | 3 | 1 |

| British Shorthair | AKC | $48 | 3 | 1 |

| Brussels Griffon | AKC | $58 | 3 | 1 |

| Bullmastiff | AKC | $137 | 3 | 1 |

| Bullmastiff | AKC | $140 | 3 | 1 |

| Bull Terrier | AKC | $84 | 3 | 1 |

| Burmese | Rainwalk | $36 | 1 | 4 |

| Cairn Terrier | AKC | $60 | 3 | 1 |

| Cane Corso | AKC | $112 | 3 | 1 |

| Caucasian Shepherd Dog | AKC | $97 | 3 | 1 |

| Cavachon | AKC | $49 | 3 | 1 |

| Cavalier King Charles Spaniel | AKC | $63 | 3 | 1 |

| Cavapoo | AKC | $46 | 3 | 1 |

| Central Asian Shepherd Dog | AKC | $87 | 3 | 1 |

| Chihuahua | AKC | $39 | 3 | 1 |

| Chinchilla | AKC | $45 | 3 | 1 |

| Chow Chow | AKC | $76 | 3 | 1 |

| Clumber Spaniel | AKC | $73 | 3 | 1 |

| Cockapoo | AKC | $45 | 3 | 1 |

| Cocker spaniel | AKC | $72 | 3 | 1 |

| Collie | AKC | $65 | 3 | 1 |

| Corgi | AKC | $75 | 3 | 1 |

| Cornish Rex | AKC | $48 | 3 | 1 |

| Coton De Tulear | AKC | $52 | 3 | 1 |

| Dachshund | AKC | $53 | 3 | 1 |

| Dalmatian | AKC | $80 | 3 | 1 |

| Devon Rex | AKC | $45 | 3 | 1 |

| Dingo | AKC | $53 | 3 | 1 |

| Doberman Pincher | AKC | $98 | 3 | 1 |

| Doberman Pinscher | Lemonade | $97 | 3 | 6 |

| Dogue de Bordeaux | AKC | $139 | 3 | 1 |

| Domestic Shorthair | AKC | $39 | 3 | 1 |

| English Bulldog | Lemonade | $89 | 3 | 6 |

| English Foxhound | AKC | $59 | 3 | 1 |

| English Mastiff | Lemonade | $79 | 3 | 6 |

| English Pointer | AKC | $69 | 3 | 1 |

| English Setter | AKC | $67 | 3 | 1 |

| English Springer Spaniel | AKC | $64 | 3 | 1 |

| English Toy Terrier | AKC | $56 | 3 | 1 |

| Estrela Mountain Dog | AKC | $82 | 3 | 1 |

| Exotic Shorthair | Rainwalk | $41 | 1 | 4 |

| Field Spaniel | AKC | $63 | 3 | 1 |

| Finnish Lapphund | AKC | $59 | 3 | 1 |

| Foxhound | AKC | $63 | 3 | 1 |

| Fox Terrier | AKC | $55 | 3 | 1 |

| French Bulldog | AKC | $109 | 3 | 1 |

| German Pinscher | AKC | $59 | 3 | 1 |

| German Shepherd | AKC | $73 | 3 | 1 |

| German Shorthaired Pointer | AKC | $66 | 3 | 1 |

| German Spitz | AKC | $62 | 3 | 1 |

| Giant Mix (100 pounds+) | AKC | $69 | 3 | 1 |

| Giant Mix (110 pounds+) | AKC | $65 | 3 | 1 |

| Giant Mix (111 pounds+) | AKC | $59 | 3 | 1 |

| Giant Mix (90 pounds+) | AKC | $87 | 3 | 1 |

| Goldendoodle | AKC | $57 | 3 | 1 |

| Golden Retriever | AKC | $77 | 3 | 1 |

| Gordon Setter | AKC | $88 | 3 | 1 |

| Great Dane | AKC | $126 | 3 | 1 |

| Great Pyrenees | AKC | $88 | 3 | 1 |

| Greyhound | AKC | $87 | 3 | 1 |

| Groodle | AKC | $51 | 3 | 1 |

| Harrier | AKC | $69 | 3 | 1 |

| Havanese | AKC | $48 | 3 | 1 |

| Himalayan | AKC | $46 | 3 | 1 |

| Hungarian Vizsla | AKC | $78 | 3 | 1 |

| Husky | AKC | $58 | 3 | 1 |

| Icelandic Sheepdog | AKC | $60 | 3 | 1 |

| Irish Setter | AKC | $72 | 3 | 1 |

| Irish Terrier | AKC | $59 | 3 | 1 |

| Italian Greyhound | AKC | $59 | 3 | 1 |

| Italian Spinone | AKC | $67 | 3 | 1 |

| Jack Russell Terrier | AKC | $47 | 3 | 1 |

| Japanese Chin | AKC | $53 | 3 | 1 |

| Japanese Spitz | AKC | $55 | 3 | 1 |

| Kangal Shepherd Dog | AKC | $117 | 3 | 1 |

| Keeshond | AKC | $66 | 3 | 1 |

| Komondor | AKC | $83 | 3 | 1 |

| Labradoodle | AKC | $57 | 3 | 1 |

| Labrador Retriever | AKC | $73 | 3 | 1 |

| Large Mix (51-100 pounds) | AKC | $59 | 3 | 1 |

| Large Mix (51-110 pounds) | AKC | $54 | 3 | 1 |

| Large Mix (55-90 pounds) | AKC | $60 | 3 | 1 |

| Large Mix (60-109 pounds) | AKC | $65 | 3 | 1 |

| Large Mix (61+ pounds) | AKC | $60 | 3 | 1 |

| Large Mix (71+ pounds) | AKC | $109 | 3 | 1 |

| Large Mix (Over 70 pounds) | AKC | $59 | 3 | 1 |

| Lhasa Apso | AKC | $52 | 3 | 1 |

| Lurcher | AKC | $87 | 3 | 1 |

| Maine Coon | Rainwalk | $41 | 1 | 4 |

| Maltese | AKC | $48 | 3 | 1 |

| Maltipoo | AKC | $42 | 3 | 1 |

| Medium Mix (20-55 pounds) | AKC | $47 | 3 | 1 |

| Medium Mix (20-70 pounds) | AKC | $50 | 3 | 1 |

| Medium Mix (21-70 pounds) | AKC | $112 | 3 | 1 |

| Medium Mix (23-70 pounds) | AKC | $60 | 3 | 1 |

| Medium Mix (26-50 pounds) | AKC | $50 | 3 | 1 |

| Medium Mix (26-59 pounds) | AKC | $65 | 3 | 1 |

| Medium Mix (31-50 pounds) | AKC | $50 | 3 | 1 |

| Medium Mix (31-59 pounds) | AKC | $49 | 3 | 1 |

| Miniature Bull Terrier | AKC | $80 | 3 | 1 |

| Miniature Dachshund | AKC | $55 | 3 | 1 |

| Miniature Poodle | AKC | $47 | 3 | 1 |

| Miniature Schnauzer | AKC | $58 | 3 | 1 |

| Miniature Fox Terrier | AKC | $58 | 3 | 1 |

| Miniature Pinscher | AKC | $54 | 3 | 1 |

| Mixed Breed | AKC | $64 | 3 | 1 |

| Mixed Breed Giant (>90 lbs) | AKC | $91 | 3 | 1 |

| Mixed Breed Large (51-90 lbs) | AKC | $60 | 3 | 1 |

| Mixed Breed Medium (31-50 lbs) | AKC | $45 | 3 | 1 |

| Mixed Breed Small (>10 lbs) | AKC | $37 | 3 | 1 |

| Mixed Breed Small (11-30 lbs) | AKC | $38 | 3 | 1 |

| Mixed breed Small (up to 20lbs when full grown) | AKC | $36 | 3 | 1 |

| Mixed Dog (21-50 pounds) | AKC | $53 | 3 | 1 |

| Mixed Dog (51-90 pounds) | AKC | $64 | 3 | 1 |

| Mixed Dog (91 pounds+) | AKC | $67 | 3 | 1 |

| Morkie | AKC | $43 | 3 | 1 |

| Munchkin | AKC | $45 | 3 | 1 |

| Newfoundland | AKC | $117 | 3 | 1 |

| Norfolk Terrier | AKC | $58 | 3 | 1 |

| Norwegian Elkhound | AKC | $60 | 3 | 1 |

| Norwegian Forest cat | Rainwalk | $34 | 1 | 4 |

| Norwich Terrier | AKC | $59 | 3 | 1 |

| Olde English Bulldogge | Lemonade | $95 | 3 | 6 |

| Old English Buldogge | Lemonade | $69 | 3 | 6 |

| Old English Sheepdog | AKC | $76 | 3 | 1 |

| Papillon | AKC | $53 | 3 | 1 |

| Pekingese | AKC | $57 | 3 | 1 |

| Pembroke Welsh Corgi | AKC | $64 | 3 | 1 |

| Persian | Rainwalk | $39 | 1 | 4 |

| Peruvian Hairless Dog | AKC | $55 | 3 | 1 |

| Petit Basset Griffon Vendeen | AKC | $81 | 3 | 1 |

| Petit Basset Griffon Vendeens | AKC | $60 | 3 | 1 |

| Pitbull | AKC | $82 | 3 | 1 |

| Pointer | AKC | $65 | 3 | 1 |

| Pomeranian | AKC | $53 | 3 | 1 |

| Portuguese Water Dog | AKC | $71 | 3 | 1 |

| Pug | AKC | $65 | 3 | 1 |

| Puggle | AKC | $48 | 3 | 1 |

| Puli | AKC | $73 | 3 | 1 |

| Ragdoll | AKC | $42 | 3 | 1 |

| Rhodesian Ridgeback | AKC | $81 | 3 | 1 |

| Rottweiler | AKC | $123 | 3 | 1 |

| Rough Collie | AKC | $69 | 3 | 1 |

| Russian Blue | AKC | $42 | 3 | 1 |

| Saint Bernard | AKC | $133 | 3 | 1 |

| Saluki | AKC | $77 | 3 | 1 |

| Samoyed | AKC | $66 | 3 | 1 |

| Savannah | AKC | $48 | 3 | 1 |

| Schnoodle | AKC | $49 | 3 | 1 |

| Scottish Deerhound | Pets Best | $67 | 5 | 2 |

| Scottish Fold | Rainwalk | $37 | 1 | 4 |

| Scottish Terrier | AKC | $69 | 3 | 1 |

| Serengeti | Rainwalk | $36 | 1 | 4 |

| Shar Pei | Lemonade | $73 | 3 | 6 |

| Shetland Sheepdog | AKC | $56 | 3 | 1 |

| Shiba Inu | AKC | $50 | 3 | 1 |

| Shih Tzu | AKC | $44 | 3 | 1 |

| Siamese | Rainwalk | $33 | 1 | 4 |

How We Decided the Best Pet Insurance in California by Breed

We researched over 200 breeds across the United States for a $5,000 annual limit policy with a $500 deductible and 80% reimbursement.

Best California Pet Insurance Reviews

We analyzed California's best pet insurance providers for affordability, coverage and customer experience.

Best California Pet Insurance Overall

Average Monthly California Pet Insurance Rate for Dogs

$65Average Monthly California Pet Insurance Rate for Cats

$31Trustpilot Customer Rating

4.1/5Unique California Pet Coverage Feature

0 day waiting period for accidents

- pros

Most affordable pet insurance in California

Great customer experience

Most customizable pet insurance on the market

consNo unlimited annual limit coverage

Maximum enrollment age varies by breed (up to 14 years old)

Lemonade's greatest qualities are its affordability, especially for dogs, and its highly rated customer experience online. It also has one of the most customizable policies on the market, helping you save money.

Lemonade pet insurance costs in California start at $12 monthly and can go up to $126, depending on what coverage you choose and your pet's age and breed. This makes it the most affordable provider in the state. However, the company doesn't offer pet insurance discounts and provides only price reductions for pet-related products through select retailers.

Compare personalized costs for your particular California pet and desired coverage to see how it stacks up.

Data filtered by:Cat$10,000$10060%Middle Aged$41 $488 1 Lemonade offers a strong customer experience nationwide for pet insurance. On Trustpilot, customers rate the company 4.1 out of 5. Most comments on Reddit and similar forums are positive, with 23 out of 32 (72%) favorable. The most common themes across platforms are praise for customizable coverage options and low pricing, while negative feedback focuses on long claim wait times.

Lemonade offers standard accident and illness coverage but compensates with lower pricing and the ability to select which items you want as add-ons. The company also has one of the shortest waiting periods for orthopedic conditions at 30 days (compared to the industry average of six months), meaning coverage for conditions like hip dysplasia begins sooner after enrollment. However, depending on breed, it covers only up to a certain age (as high as 14).

Best Pet Insurance Customer Experience in California

Average Monthly California Pet Insurance Rate for Dogs

$72Average Monthly California Pet Insurance Rate for Cats

$36Trustpilot Customer Rating

4.6/5Unique California Pet Coverage Feature

Vaccination and training coverage

- pros

Best customer experience for California pet insurance

Best cheap option for senior pets in California

Great rates for rarer breeds of cats

consLess affordable for most pets

Doesn't offer unlimited coverage

Rainwalk pet insurance isn't as affordable as other providers in California on our list. The company, founded in 2018, is relatively new to the market but provides an excellent customer experience from beginning to end. It also offers plenty of included coverages and add-ons to fill any gaps within its standard plans.

Rainwalk pet insurance isn’t the cheapest provider, ranking eighth for affordability for dogs and 10th for cats. However, it's much more affordable for senior pets, with rates of $60 monthly (second most affordable) for cats and $92 for dogs (first for affordability). It also offers discounts up to 10% for bundling multiple pet policies and other premium reductions for being referred and a customer with Pettable.

See how Rainwalk stacks up for affordable pet insurance in California.

Data filtered by:Cat$10,000$10070%Middle Aged$62 $752 7 Rainwalk earns our top spot for pet insurance customer service in California with high scores from customers on Trustpilot of 4.6 out of 5 and a 71% positive customer sentiment on Reddit and similar platforms. The company's customers frequently talk about its fast claims process and reimbursement and helpful agents. Any negative comments are relatively minor or were resolved within a few days after the complaint was made.

Rainwalk's add-on coverage options are extensive, with additional coverage for vaccines and routine care, boarding, alternative treatments and exam fees available. In standard plans, you'll also have access to 24/7 telehealth services, free training services and a $100 annual vaccination cost limit. Its standard coverage options are more limited, with only up to $20,000 annual limits, $100 to $750 in deductibles and industry-standard reimbursement between 70% and 90%.

Best California Pet Insurance That Pays Vets Directly

Average Monthly California Pet Insurance Rate for Dogs

$67Average Monthly California Pet Insurance Rate for Cats

$35Trustpilot Customer Rating

4.0/5Unique California Pet Coverage Feature

Direct vet payment for claims

- pros

Offers to pay the vet directly for claims

Good customer service reputation

Unlimited coverage

consNot many add-ons; lacks coverage flexibility

Less affordable than other competitors

Pets Best's key advantage for pet insurance in California is its ability to pay out claims directly to vets rather than your bank account, making claims easier than with competitors. Coverage customization is limited, and rates are higher, but you can choose cheaper pre-designated plans with only the coverage you need.

Pets Best ranks sixth for affordability in California, with an average annual rate for the most common plan choice being $416 for cats (sixth) and $723 for dogs (seventh). Rates range from $126 to $4,754 annually, depending on your pet's details and your preferred coverage level. We've broken down its pricing for every factor possible to help you understand if it's a cheap option for you.

Data filtered by:Cat$10,000$1,00070%Middle Aged$21 $253 2 Pets Best has a good reputation with customers. Over 5,000 customers give it a 3.9 out of 5 average on Trustpilot, and 70% give positive sentiment on Reddit. This ranks the company fifth overall for pet insurance customer service in California. Most people who use its product enjoy its easy-to-use app and reimbursement flexibility for claims, but others report a difficult claims filing process.

The signature feature of Pets Best is its direct vet pay option for claims, one of three companies offering this option and the only one to offer less than unlimited for annual limits. Wellness plans with the company are also the most extensive in the industry, with the highest overall limits in its BestWellness plan. Beyond direct vet pay, selections are standard with three pre-determined plan selections that limit customization options.

Cheapest Pet Insurance in California

ASPCA offers the cheapest overall pet insurance for dogs in California, with an average rate of $65 monthly ($781 annually), while Pumpkin provides the lowest premium for cats at $27 monthly ($327 annually). These rates are based on coverage for middle-aged cats and dogs.

Here are the cheapest California pet insurance providers by pet age and their average monthly rates:

- Cheapest for puppies (under 1): Lemonade ($30)

- Cheapest for kittens (under 1): Figo ($14)

- Cheapest for younger dogs (1 to 4): Lemonade ($35)

- Cheapest for younger cats (1 to 5): Pumpkin ($16)

- Cheapest for middle-aged dogs (5 to 9): ASPCA ($65)

- Cheapest for middle-aged cats (6 to 10): Pumpkin ($27)

- Cheapest for senior dogs (10+): Rainwalk ($92)

- Cheapest for senior cats (11+): Lemonade ($53)

Lemonade | $40 | $480 |

Pumpkin | $42 | $501 |

ASPCA | $42 | $507 |

Hartville | $44 | $524 |

Spot | $44 | $532 |

How We Decided the Cheapest Pet Insurance in California

We judged all providers' rates for a $5,000 annual limit policy with a $500 deductible and 80% reimbursement for middle-aged cats (6 to 10) and dogs (5 to 9) to ensure our recommendations cover most pets.

Cheapest California Pet Insurance by Breed

While not the best overall provider by breed, Lemonade is the cheapest California pet insurance provider for most dog and cat types, with rates starting at $21 monthly. Pumpkin ranks second in the state with affordable rates for cats, and Pets Best offers cheap rates for rarer and smaller dog breeds. ASPCA provides the lowest rate for Bullmastiffs.

| Abyssinian | Lemonade | $32 | $383 |

| Affenpinscher | Pets Best | $35 | $425 |

| Afghan Hound | Lemonade | $47 | $569 |

| Airedale Terrier | Lemonade | $53 | $635 |

| Akita | Pumpkin | $50 | $589 |

| Alaskan Husky | Pumpkin | $40 | $477 |

| Alaskan Malamute | Lemonade | $51 | $608 |

| Alsatian | Lemonade | $59 | $711 |

| Alsatian | Pumpkin | $47 | $567 |

| American Bulldog | Pumpkin | $67 | $805 |

| American Bully | Lemonade | $68 | $819 |

| American Eskimo | Pumpkin | $34 | $401 |

| American Foxhound | Pumpkin | $40 | $477 |

| American Hairless Terrier | Pumpkin | $34 | $401 |

| American Staffordshire Terrier | Lemonade | $58 | $697 |

| Australian Cattle Dog | Pets Best | $41 | $493 |

| Australian Kelpie | Lemonade | $46 | $554 |

| Australian Mist | Pumpkin | $27 | $323 |

| Australian Shepherd | Pets Best | $30 | $357 |

| Australian Silky Terrier | Pets Best | $30 | $360 |

| Australian Terrier | Pets Best | $29 | $342 |

| Balinese | Pets Best | $26 | $307 |

| Basenji | Pumpkin | $34 | $401 |

| Basset Fauve de Bretagne | Lemonade | $48 | $574 |

| Basset Hound | Lemonade | $58 | $698 |

| Beagle | Pets Best | $42 | $502 |

| Bearded Collie | Pumpkin | $40 | $477 |

| Belgian Shepherd Malinois | Pets Best | $46 | $548 |

| Bengal | Lemonade | $28 | $340 |

| Bernese Mountain Dog | Lemonade | $97 | $1,169 |

| Bichon Frise | Pets Best | $35 | $424 |

| Birman | Pumpkin | $24 | $284 |

| Bloodhound | Lemonade | $70 | $845 |

| Bombay | Pets Best | $21 | $249 |

| Border Collie | Pumpkin | $34 | $401 |

| Border Terrier | Pets Best | $34 | $406 |

| Borzoi | Pumpkin | $50 | $589 |

| Boston Terrier | Lemonade | $40 | $483 |

| Boxer | Lemonade | $59 | $707 |

| Bracco Italiano | Lemonade | $47 | $567 |

| Briard | Pumpkin | $47 | $567 |

| British Bulldog | Pumpkin | $76 | $915 |

| British Longhair | Pumpkin | $21 | $257 |

| British Shorthair | Pets Best | $26 | $313 |

| Brussels Griffon | Lemonade | $38 | $460 |

| Bullmastiff | ASPCA | $102 | $1,229 |

| Bullmastiff | Pumpkin | $103 | $1,240 |

| Bull Terrier | Lemonade | $58 | $694 |

| Burmese | Pets Best | $20 | $244 |

| Cairn Terrier | Pets Best | $34 | $410 |

| Cane Corso | Pumpkin | $76 | $915 |

| Caucasian Shepherd Dog | Lemonade | $77 | $924 |

| Cavapoo | Pumpkin | $29 | $355 |

| Central Asian Shepherd Dog | Pumpkin | $62 | $744 |

| Chihuahua | Pets Best | $23 | $275 |

| Cavachon | Pumpkin | $34 | $401 |

| Cavalier King Charles Spaniel | Lemonade | $44 | $524 |

| Chow Chow | Pumpkin | $47 | $567 |

| Clumber Spaniel | Pumpkin | $47 | $567 |

| Chinchilla | Pets Best | $22 | $263 |

| Cockapoo | Pumpkin | $29 | $355 |

| Cocker spaniel | Pets Best | $47 | $561 |

| Collie | Pumpkin | $40 | $477 |

| Corgi | Lemonade | $53 | $633 |

| Cornish Rex | Lemonade | $28 | $341 |

| Coton De Tulear | Lemonade | $34 | $411 |

| Dachshund | Pumpkin | $34 | $401 |

| Doberman Pincher | Lemonade | $68 | $820 |

| Dalmatian | Pets Best | $57 | $680 |

| Devon Rex | Pumpkin | $24 | $284 |

| Dingo | Lemonade | $39 | $469 |

| Dogue de Bordeaux | Pumpkin | $103 | $1,240 |

| Domestic Shorthair | Pets Best | $20 | $244 |

| English Bulldog | Lemonade | $89 | $1,064 |

| English Foxhound | Pumpkin | $40 | $477 |

| English Mastiff | Pumpkin | $76 | $915 |

| English Pointer | Lemonade | $47 | $565 |

| Doberman Pinscher | Lemonade | $97 | $1,170 |

| English Setter | Lemonade | $47 | $563 |

| English Springer Spaniel | Lemonade | $44 | $533 |

| English Toy Terrier | Lemonade | $38 | $451 |

| Estrela Mountain Dog | Lemonade | $58 | $696 |

| Exotic Shorthair | Lemonade | $31 | $377 |

| Foxhound | Lemonade | $44 | $524 |

| Field Spaniel | Lemonade | $47 | $565 |

| Finnish Lapphund | Lemonade | $43 | $516 |

| French Bulldog | Lemonade | $79 | $952 |

| German Pinscher | Pumpkin | $40 | $477 |

| German Shepherd | Pumpkin | $50 | $589 |

| German Shorthaired Pointer | Lemonade | $44 | $532 |

| German Spitz | Pumpkin | $34 | $401 |

| Giant Mix (100 pounds+) | Lemonade | $49 | $583 |

| Giant Mix (110 pounds+) | Lemonade | $46 | $550 |

| Fox Terrier | Lemonade | $39 | $467 |

| Giant Mix (111 pounds+) | Lemonade | $42 | $503 |

| Giant Mix (90 pounds+) | Lemonade | $62 | $738 |

| Goldendoodle | Pets Best | $39 | $464 |

| Golden Retriever | Lemonade | $54 | $652 |

| Gordon Setter | Lemonade | $56 | $671 |

| Great Pyrenees | Pumpkin | $47 | $567 |

| Great Dane | Pumpkin | $76 | $915 |

| Harrier | Pumpkin | $40 | $477 |

| Havanese | Pumpkin | $29 | $355 |

| Himalayan | Pets Best | $23 | $282 |

| Hungarian Vizsla | Pumpkin | $47 | $567 |

| Greyhound | Lemonade | $57 | $682 |

| Husky | Pumpkin | $34 | $401 |

| Icelandic Sheepdog | Lemonade | $43 | $516 |

| Irish Setter | Lemonade | $48 | $577 |

| Irish Terrier | Lemonade | $41 | $496 |

| Italian Greyhound | Lemonade | $40 | $474 |

| Italian Spinone | Lemonade | $47 | $567 |

| Jack Russell Terrier | Pets Best | $28 | $333 |

| Japanese Chin | Pumpkin | $34 | $401 |

| Groodle | Lemonade | $36 | $433 |

| Japanese Spitz | Pumpkin | $34 | $401 |

| Kangal Shepherd Dog | Pumpkin | $62 | $744 |

| Keeshond | Pets Best | $41 | $492 |

| Komondor | Pumpkin | $47 | $567 |

| Labradoodle | Pumpkin | $40 | $477 |

| Labrador Retriever | Lemonade | $51 | $617 |

| Large Mix (55-90 pounds) | Lemonade | $43 | $517 |

| Large Mix (51-100 pounds) | Lemonade | $42 | $506 |

| Large Mix (51-110 pounds) | Lemonade | $39 | $463 |

| Large Mix (61+ pounds) | Lemonade | $42 | $506 |

| Large Mix (71+ pounds) | Lemonade | $77 | $922 |

| Large Mix (Over 70 pounds) | Lemonade | $42 | $504 |

| Lhasa Apso | Pets Best | $33 | $390 |

| Lurcher | Lemonade | $62 | $739 |

| Large Mix (60-109 pounds) | Lemonade | $46 | $550 |

| Maine Coon | Lemonade | $31 | $377 |

| Maltese | Lemonade | $33 | $398 |

| Maltipoo | Lemonade | $28 | $341 |

| Medium Mix (20-55 pounds) | Lemonade | $33 | $404 |

| Medium Mix (20-70 pounds) | Lemonade | $35 | $424 |

| Medium Mix (21-70 pounds) | Lemonade | $80 | $956 |

| Medium Mix (23-70 pounds) | Lemonade | $42 | $508 |

| Medium Mix (26-50 pounds) | Lemonade | $35 | $423 |

| Medium Mix (26-59 pounds) | Lemonade | $46 | $550 |

| Medium Mix (31-50 pounds) | Lemonade | $35 | $424 |

| Medium Mix (31-59 pounds) | Lemonade | $35 | $417 |

| Miniature Fox Terrier | Pets Best | $34 | $406 |

| Miniature Pinscher | Pets Best | $34 | $401 |

| Miniature Poodle | Pets Best | $31 | $379 |

| Miniature Schnauzer | Pets Best | $34 | $403 |

| Mixed Breed | Lemonade | $45 | $544 |

| Mixed Breed Giant (>90 lbs) | Lemonade | $64 | $772 |

| Mixed Breed Large (51-90 lbs) | Lemonade | $42 | $506 |

| Mixed Breed Medium (31-50 lbs) | Lemonade | $32 | $377 |

| Mixed breed Small (up to 20lbs when full grown) | Lemonade | $26 | $304 |

| Mixed Dog (21-50 pounds) | Lemonade | $37 | $449 |

| Mixed Dog (51-90 pounds) | Lemonade | $45 | $539 |

| Norfolk Terrier | Pets Best | $35 | $420 |

| Norwegian Elkhound | Lemonade | $45 | $539 |

| Norwegian Forest cat | Pumpkin | $22 | $254 |

| Norwich Terrier | Pets Best | $34 | $411 |

| Olde English Bulldogge | Lemonade | $95 | $1,140 |

| Old English Sheepdog | Pumpkin | $47 | $567 |

| Papillon | Pumpkin | $29 | $355 |

| Pekingese | Pets Best | $30 | $360 |

| Petit Basset Griffon Vendeens | Lemonade | $44 | $525 |

| Pitbull | Lemonade | $54 | $650 |

| Pug | Lemonade | $45 | $534 |

| Puggle | Lemonade | $33 | $395 |

| Puli | Pumpkin | $34 | $401 |

| Ragdoll | Pumpkin | $22 | $263 |

| Russian Blue | Pets Best | $19 | $227 |

| Saint Bernard | Pumpkin | $84 | $1,002 |

| Savannah | Lemonade | $31 | $376 |

| Schnoodle | Pumpkin | $34 | $401 |

| Scottish Deerhound | Pets Best | $67 | $794 |

| Serengeti | Pumpkin | $25 | $297 |

| Shar Pei | Lemonade | $73 | $877 |

| Shetland Sheepdog | Pumpkin | $34 | $401 |

| Shiba Inu | Pumpkin | $29 | $355 |

| Siberian | Lemonade | $29 | $353 |

| Siberian Husky | Pets Best | $40 | $477 |

| Siberian Husky | Pumpkin | $40 | $477 |

| Small Mix (0-20) | Lemonade | $25 | $299 |

| Small Mix (11-30) | Lemonade | $29 | $347 |

| Small Mix (20 and under pounds) | Lemonade | $61 | $737 |

| Small Mix (22 pounds or less) | Lemonade | $31 | $367 |

| Small Mix (25 and less pounds) | Lemonade | $30 | $350 |

| Staffordshire Bull Terrier | Lemonade | $49 | $589 |

| Standard Poodle | Lemonade | $47 | $562 |

| Standard Schnauzer | Lemonade | $43 | $516 |

| Tibetan Mastiff | Pumpkin | $62 | $744 |

| Vizsla | Pumpkin | $47 | $567 |

| Weimaraner | Lemonade | $58 | $700 |

| Welsh Corgi Cardigan | Pets Best | $42 | $504 |

| Welsh Corgi Pembroke | Lemonade | $44 | $533 |

| Welsh Springer Spaniel | Pumpkin | $29 | $355 |

| Miniature Bull Terrier | Lemonade | $56 | $672 |

| Miniature Dachshund | Pets Best | $39 | $468 |

| Mixed Breed Small (>10 lbs) | Lemonade | $26 | $314 |

| Mixed Breed Small (11-30 lbs) | Lemonade | $27 | $329 |

| Mixed Dog (91 pounds+) | Lemonade | $47 | $568 |

| Morkie | Pumpkin | $29 | $355 |

| Munchkin | Pets Best | $27 | $328 |

| Newfoundland | Pumpkin | $84 | $1,002 |

How We Decided the Cheapest Pet Insurance in California by Breed

All providers' rates cover a $5,000 annual limit policy with a $500 deductible and 80% reimbursement. We assessed middle-aged dogs and cats for each breed studied to cover most companions in the state.

How Much Is Pet Insurance in California?

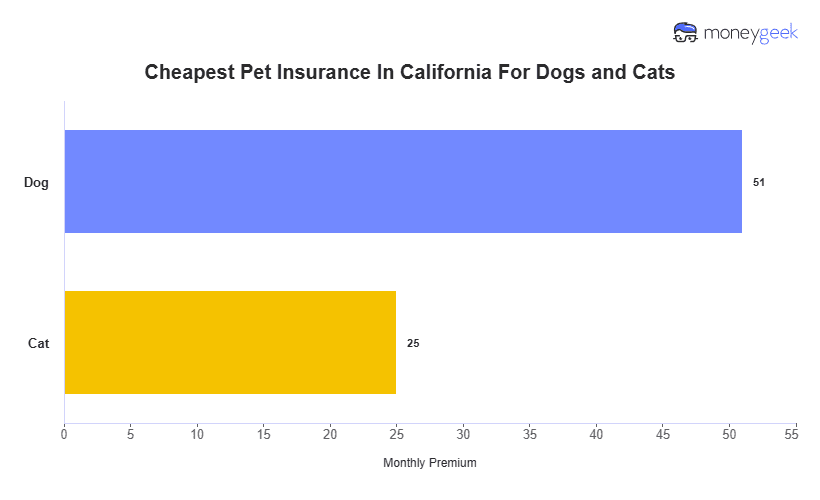

California pet insurance costs around $1,368 (26% more than average) annually for dogs, and cat coverage is about $689 (27% more than average). This represents a commonly recommended policy with terms of $5,000 in annual limits, 80% reimbursement and a $500 deductible. To better understand costs, use the filterable table below to see the pricing by coverage level.

| Cat | $58 | $689 | 26% |

| Dog | $114 | $1,368 | 27% |

How to Get the Best Cheap Pet Insurance in California

Follow these steps to find affordable pet insurance in California:

- 1Call local vets and research your pet's breed risks

Contact three to five local veterinary clinics for pricing on common procedures like exams, vaccinations, dental cleanings and emergency visits, since costs vary between urban cities like San Francisco and more rural ones like Amador City.

Also, research your pet's breed-specific health conditions and get estimates for treating them to understand risks specific to your pet. Factor in California-specific risks like valley fever (a fungal disease affecting dogs in certain regions), rattlesnake bites and wildfire smoke-related respiratory issues that are more common due to the state's climate and environment.

- 2Learn about pet insurance coverage and terms

Understand key terms for pet insurance coverage before you buy:

- Deductibles: What you pay before insurance kicks in ($100 to $1,000)

- Reimbursement rates: The percentage the insurer pays after your deductible (usually 70% to 90%).

- Annual limits: Coverage caps range from $5,000 to unlimited coverage.

- Waiting periods: How long you have to wait after buying a policy for coverage on certain items (14 days for illnesses, 7 or fewer days for accidents and 6 months for orthopedic conditions)

Most policies cover accidents and illnesses but exclude pre-existing conditions, cosmetic procedures and breeding costs. Check out sample policies on provider websites specific to California, since terms and conditions vary based on state regulations.

- 3Decide on insurance coverage needs for your pet

Based on your previous research, assess how much you can afford out-of-pocket for unexpected vet bills in California and decide whether pet insurance is worth it. Consider your pet's age, what type of companion it is (dog, cat, bird, etc.) and any hereditary and behavioral issues it's likely to have. Once you estimate your costs and what you're willing to budget, picking the coverage you need (if any) becomes clearer.

- 4Research pet insurance costs and discounts in California

Get quotes from at least five to seven providers, including national and regional companies, ensuring the coverage you select is apples-to-apples to get accurate comparisons. Calculate annual pet insurance plan costs against your budget to weed out options that don't fit your financial situation.

Consider provider pet insurance discount options, such as multiple pet bundles, association affiliation and those specific to occupation, to save up to 15%. Low-income pet insurance programs may also be available in your area to lower costs further if you qualify.

- 5Compare and research pet insurance providers in California

Read California-specific reviews for pet insurance providers on sites like Trustpilot and look for experiences specific to their buying, policy management and claims processes for a comprehensive view of their services. Compare coverage options, restrictions and inclusions in depth to ensure your coverage needs can be met before buying.

- 6Buy early and reassess your policy every year

Purchase insurance while your pet is young and healthy to lock in lower rates and ensure no conditions become classified as pre-existing. Review your policy at each annual renewal to track whether your actual vet expenses and reimbursements justify your premiums. Then adjust coverage as your pet ages and health risks change.

Spend an hour researching current providers to stay informed about new California insurance options. For very senior pets (12+ years for dogs, 15+ for cats), decide whether coverage is worth the cost or whether paying out of pocket is best.

Best Pet Insurance in California: Bottom Line

Lemonade is our top pick for pet insurance in California, while Pumpkin and ASPCA top the list for those seeking the cheapest policies. The right insurer depends on what works for you and your pet. For the best deal, compare multiple providers, research coverage options and decide on coverage before buying.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Trustpilot. "Lemonade Reviews." Accessed February 7, 2026.

- Trustpilot. "Pets Best Pet Health Insurance ." Accessed February 7, 2026.

- Trustpilot. "Rainwalk Reviews." Accessed February 7, 2026.