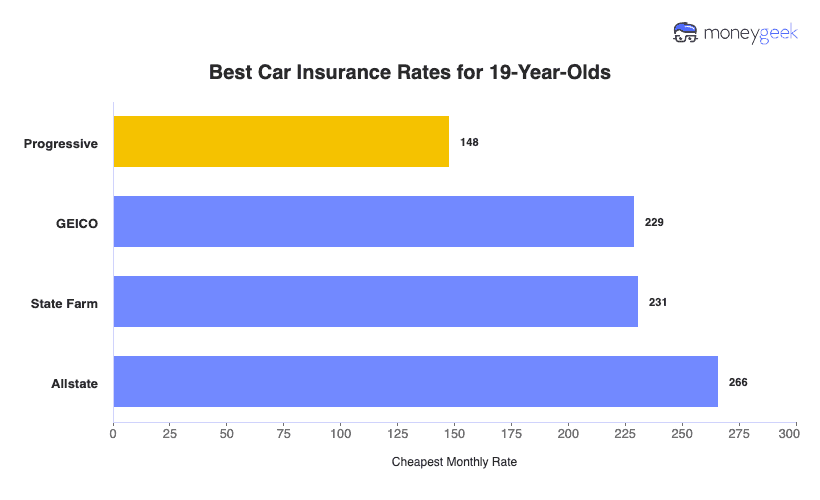

Progressive stands out with the lowest monthly rate at just $148, making it an excellent starting point for price-conscious families. While the monthly differences might seem small, they add up. Choosing Progressive over Allstate saves you nearly $1,400 annually.

These four companies consistently deliver competitive rates for young drivers on family policies. The rates below represent teens with clean driving records added to family policies.