GEICO is the cheapest car insurance provider for 30-year-old drivers based on MoneyGeek’s analysis, with an average annual cost of $43 per month for a state minimum, liability-only policy. However, the cheapest depends on your desired coverage. The table below compares the best rates for 30-year-olds across coverage types.

Cheap Car Insurance for 30-Year-Olds

Based on MoneyGeek’s analysis, GEICO offers the cheapest car insurance for 30-year-olds at $43 per month or $522 per year.

Find out if you're overpaying for car insurance below.

Updated: December 29, 2025

Advertising & Editorial Disclosure

GEICO, Travelers and National General are the cheapest car insurance providers for 30-year-olds.

Travelers is the best and cheapest provider for 30-year-olds who value customer service, earning a MoneyGeek score of 93 out of 100.

For 30-year-olds, a state minimum liability-only policy costs an average of $61 for males and $63 for females.

Ensure you are getting the best rate for your insurance. Compare quotes from the top insurance companies.

Cheapest Car Insurance for 30-Year-Olds

| GEICO | $43 | $522 | -35% |

| Travelers | $50 | $601 | -25% |

| National General | $50 | $605 | -25% |

| State Farm | $51 | $616 | -24% |

| Amica | $56 | $670 | -17% |

| Chubb | $61 | $728 | -10% |

| Kemper | $62 | $744 | -8% |

| Progressive | $67 | $802 | 0% |

| AAA | $69 | $822 | 2% |

| Nationwide | $71 | $852 | 6% |

| Farmers | $78 | $938 | 16% |

| Allstate | $81 | $971 | 21% |

| AIG | $81 | $972 | 21% |

| UAIC | $119 | $1,433 | 78% |

Cheapest Car Insurance for 30-Year-Olds by-State

The cost of car insurance for 30-year-olds varies by state. For instance, MoneyGeek found that the cheapest provider in Wyoming is GEICO, at an average monthly cost of $14, while the cheapest in Florida is Travelers, at an average monthly cost of $51.

| AIG | $22 | $268 | -60% |

Premiums vary widely by state, and some providers may not offer coverage in your area. To find the cheapest car insurance companies, compare at least three similar quotes to get the best deal. Use an auto insurance comparison tool to compare quotes quickly and easily.

Best Car Insurance for 30-Year-Olds

MoneyGeek’s analysis found that Travelers is the best car insurance for 30-year-olds if you value customer service more than affordability. Travelers balances affordability and customer service with a MoneyGeek score of 94 out of 100 and an average cost of $50 for a state-minimum liability-only policy.

| Travelers | $50 | 94 |

| Amica | $56 | 91 |

| GEICO | $43 | 91 |

| Progressive | $67 | 90 |

| State Farm | $51 | 89 |

| Chubb | $61 | 88 |

| National General | $50 | 87 |

| Farmers | $78 | 86 |

| Nationwide | $71 | 85 |

| AAA | $69 | 83 |

| Allstate | $81 | 83 |

| AIG | $81 | 80 |

| Kemper | $62 | 79 |

| UAIC | $119 | 67 |

Travelers brings 165 years of expertise and offers diverse coverage, from home to boat insurance. Backed by thousands of agents and reps, it ensures responsive service and nationwide accessibility. It holds 2.11% of the auto insurance market.

How Much Does Car Insurance Cost for 30-Year-Olds?

MoneyGeek found that it costs an average of $100 per month to insure a 30-year-old male driver with a state-minimum liability-only policy. Car insurance costs for 30-year-olds can change based on a number of factors: coverage level, gender, credit score, driving history, location and more.

However, some states prohibit the use of certain factors in insurance pricing.

Use the table below to see how much it costs for you based on your circumstances.

| State Minimum Liability Only | $104 | $1,248 |

| State Minimum Liability w/ Full Cov. w/$1,000 Ded. | $131 | $1,569 |

| State Minimum Liability w/ Full Cov. w/$2,000 Ded. | $173 | $2,073 |

| 100/300/100 Full Cov. w/$1,000 Ded. | $218 | $2,618 |

| 50/100/50 Full Cov. w/$500 Ded. | $223 | $2,680 |

| State Minimum Liability w/ Full Cov. w/$250 Ded. | $231 | $2,768 |

| 300/500/300 Full Cov. w/$1,500 Ded. | $242 | $2,909 |

| State Minimum Liability w/ Full Cov. w/$0 Ded. | $272 | $3,260 |

Auto Insurance for 30-Year-Olds: Buying Guide

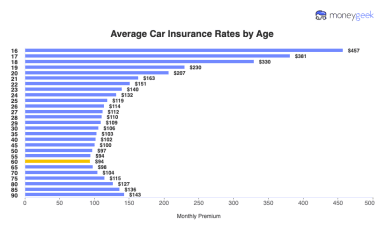

Insurance companies consider age when calculating premiums. As you age, your risks and needs change. This guide helps you understand the key factors to consider when deciding on the best car insurance policy, such as coverage options, discounts and how to lower premiums.

How to Get Cheap Car Insurance for 30-Year-Olds

Experienced 30-year-olds often pay lower car insurance rates, but there are ways to reduce premiums further. Here are some strategies to secure the best rate:

- 1Shop Around

Compare identical coverage from at least three insurers to find the best rate for your budget. Using a car insurance comparison tool that shows quotes from multiple companies also helps 30-year-olds find affordable options.

- 2Maintain a Clean Driving Record

Keep your record clean by following speed limits, avoiding distractions and staying alert to prevent accidents and tickets. A single speeding ticket raises insurance rates by 18% to 30% and more serious violations lead to even higher increases.

- 3Ask About Discounts

Qualifying for multiple discounts helps lower your premium. Taking a defensive driving course often reduces rates over time. Insuring a new car with safety features like anti-lock brakes, airbags and anti-theft systems also leads to additional savings.

- 4Bundle Policies

Combine your car insurance with homeowners or renters insurance to qualify for bundle discounts. Many insurers reward loyal customers who hold multiple policies with them.

- 5Review and Update Your Policy Regularly

Changes like moving, changing jobs or growing your family affect your coverage needs and rates. Review your policy regularly to keep your insurance aligned with your situation and uncover new ways to save.

- 6Maximize No-Claim Bonuses

Drivers in their 30s with a clean history save more through no-claim bonuses. These rewards lower your premium for every year you go without filing a claim, showing insurers that you’re a low-risk driver.

- 7Adjust Your Coverage Amount

If you own an older or less expensive car, choosing minimum coverage helps reduce costs. Keep in mind this doesn’t include comprehensive or collision coverage, so you’ll pay out of pocket for repairs if you cause an accident.

- 8Choose a Sedan Over a Sports Car

Sports cars and luxury vehicles usually have higher insurance rates. Before buying, get quotes for the cars you’re considering so you can estimate the coverage costs in advance.

Car insurance quotes vary between companies because each one uses its own way of calculating risk. To get the most accurate quote, share these details so insurers can match rates to your coverage needs:

- Age

- Gender

- Location

- Vehicle information

- Driver’s license number

- Other household drivers

Car Insurance Discounts for 30-Year-Olds

Most insurers offer discounts that help lower your premium. Review what’s available before choosing a policy. Some of the most common discounts include:

Many insurance companies offer discounts to drivers who have completed state-approved defensive driving courses.

Maintaining a clean driving record may qualify you for this discount. Insurers typically offer rewards to safe drivers due to less risks.

Bundling different insurance policies, such as home and auto insurance, may qualify you for a multi-policy discount. Some insurers also offer discounts for insuring multiple vehicles.

Insurance companies with telematics programs that track safe driving habits typically offer discounts to drivers who participate in the program. If you don't drive much, check if you qualify for a low-mileage discount.

Insurers usually offer discounts to clients who pay their premiums upfront instead of in monthly installments.

Cheap Auto Insurance for 30-Year-Olds: Bottom Line

GEICO offers the cheapest car insurance for 30-year-olds, averaging $43 per month for minimum coverage. Travelers, National General and State Farm also provide affordable options, with Travelers earning high marks for customer service.

Rates change depending on your state, driving record and coverage level, so it pays to compare. Get quotes from multiple providers to find the best deal.

Ensure you are getting the best rate for your insurance. Compare quotes from the top insurance companies.

Car Insurance for 30-Year-Olds: FAQ

This section covers the most common questions about car insurance costs for 30-year-olds.

What is the cheapest car insurance for a 30-year-old?

GEICO offers the lowest rates for 30-year-olds at $43 monthly or $521 annually for minimum coverage.

How much is car insurance for a 30-year-old?

The average cost of car insurance for 30-year-olds is $61 for males and $63 for females for a state-minimum, liability-only policy.

Does insurance go down at 30?

Insurance rates drop as you gain driving experience and maintain a clean record. Age matters less after 25, but 30-year-olds still pay lower premiums than younger drivers because insurers see them as more experienced and less risky.

Which gender pays more car insurance?

Young men pay higher car insurance rates because they have riskier driving statistics. This gap shrinks by age 30 as insurers focus more on driving history and vehicle choice than gender.

Are older cars cheaper to insure?

Older cars are generally cheaper to insure because their lower value decreases the potential payout in case of a claim. However, safety features and theft risk can also affect premiums.

Best Car Insurance for 30-Year-Olds: Our Review Methodology

Why Trust MoneyGeek?

MoneyGeek's analysis uses data from Quadrant Information Services and state insurance departments. We evaluated rates across different driver profiles and locations to show why comparing quotes matters. Rates vary widely between insurers for the same driver profile.

Study Overview

We gathered and analyzed rate data using a sample driver profile to calculate national and state averages. Our review focused on:

- Minimum coverage insurance costs

- How minimum and full coverage rates compare

- Rate changes for high-risk drivers with accidents or tickets

Data Sources and Scope

We analyzed 1,904 quotes from six companies across 100 ZIP codes using data from state insurance departments and Quadrant Information Services.

Driver Profile

We used a sample driver profile to find the average annual insurance costs based on this profile:

- Toyota Camry LE

- Clean driving record

- 12K miles driven annually

We modified this profile by location, coverage type and amount to identify average costs for drivers across the U.S. who have different coverage needs.

Coverage Levels and Deductibles

A deductible is the amount you pay out-of-pocket before insurance covers the rest of a comprehensive or collision claim. Comprehensive and collision, also called full coverage, offer the most financial protection.

100/300/100 is shorthand for:

- $100,000 bodily injury liability per person

- $300,000 bodily injury liability per accident

- $100,000 property damage liability

50/100/50 is shorthand for:

- $50,000 bodily injury liability per person

- $100,000 bodily injury liability per accident

- $50,000 property damage liability

National averages: Calculated with 100/300/100 full coverage and a $1,000 deductible.

State-specific data: Based on 50/100/50 full coverage and a $1,000 deductible.

Liability coverage provides financial protection for damages you cause to others and does not include deductibles. It doesn't include comprehensive and collision.

Learn more about MoneyGeek's methodology.

Affordable Car Insurance for 30-Year-Olds: Related Articles

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- GEICO. "Car Insurance Discounts." Accessed July 18, 2025.

- State Farm. "Take Control of Your Auto Insurance Discounts From State Farm®." Accessed July 18, 2025.