For drivers in their 50s, GEICO provides the most affordable minimum coverage at $43 per month, based on MoneyGeek’s cost analysis and sample driver profile. However, your cheapest option may change depending on the coverage you need. The table below compares low-cost providers for 50-year-olds across different coverage types.

Cheap Car Insurance for 50-Year-Olds

MoneyGeek’s analysis shows that GEICO, Travelers and National General offer the cheapest car insurance for 50-year-olds.

Find out if you are overpaying for car insurance below.

Updated: December 29, 2025

Advertising & Editorial Disclosure

GEICO has the lowest car insurance rates for 50-year-old drivers, costing an average of $43 per month.

For 50-year-olds prioritizing customer service, Travelers stands out as the top-rated provider, earning a MoneyGeek score of 94 out of 100.

Car insurance premiums are usually lower for 50-year-olds. Bundling home and auto insurance, maintaining a clean record and using discounts can further reduce costs.

Ensure you are getting the best rate for your insurance. Compare quotes from the top insurance companies.

Cheapest Car Insurance for 50-Year-Olds

| GEICO | $43 | $522 | -35% |

| Travelers | $50 | $601 | -25% |

| National General | $50 | $605 | -25% |

| State Farm | $51 | $616 | -24% |

| Amica | $56 | $670 | -17% |

| Chubb | $61 | $728 | -10% |

| Kemper | $62 | $744 | -8% |

| Progressive | $67 | $802 | 0% |

| AAA | $69 | $822 | 2% |

| Nationwide | $71 | $852 | 6% |

| Farmers | $78 | $938 | 16% |

| Allstate | $81 | $971 | 21% |

| AIG | $81 | $972 | 21% |

| UAIC | $119 | $1,433 | 78% |

Rates shown are based on sample profiles and may not reflect your individual pricing. Contact insurers directly for personalized quotes.

Cheapest Car Insurance for 50-Year-Olds by State

Car insurance rates for 50-year-olds aren’t the same across the country. For example, GEICO offers the lowest rates in Wyoming at $14 per month, while NYCM is the most affordable option in New York, with average premiums of $25 per month.

| AIG | $22 | $268 | -60% |

Rates shown are based on sample profiles and may not reflect your individual pricing. Contact insurers directly for personalized quotes.

Car insurance costs vary significantly by state, and not every company operates nationwide. To find the most affordable car insurance for 50-year-olds, compare at least three quotes side-by-side. Use a quote comparison tool to find competitive offers fast.

Best Car Insurance for 50-Year-Olds

If service quality matters more to you than a low premium, Travelers is MoneyGeek’s top pick for 50-year-olds. It earned a MoneyGeek score of 94 out of 100 and offers strong customer support at an average cost of $103 per month for minimum liability insurance.

| Travelers | $50 | 94 |

| Amica | $56 | 91 |

| GEICO | $43 | 91 |

| Progressive | $67 | 90 |

| State Farm | $51 | 89 |

| Chubb | $61 | 88 |

| National General | $50 | 87 |

| Farmers | $78 | 86 |

| Nationwide | $71 | 85 |

| AAA | $69 | 83 |

| Allstate | $81 | 83 |

| AIG | $81 | 80 |

| Kemper | $62 | 79 |

| UAIC | $119 | 67 |

Rates shown are based on sample profiles and may not reflect your individual pricing. Contact insurers directly for personalized quotes.

With more than 165 years of experience, Travelers provides broad coverage and a robust agent network for accessible support. It insures millions of drivers and holds 2.11% of the U.S. auto insurance market.

How Much Does Car Insurance Cost for 50-Year-Olds?

It costs about $61 per month to insure a 50-year-old male with minimum liability coverage. While rates at this age tend to be lower thanks to a history of safe driving and financial stability, your premium may vary based on your location, credit score, coverage level and driving record.

However, some states prohibit using certain factors in insurance pricing, including gender (California, Hawaii, Massachusetts, Michigan, Montana, North Carolina and Pennsylvania) and credit scores in some jurisdictions. Rate factors vary by state regulation.

Use the table below to estimate car insurance costs for 50-year-olds based on your situation.

| State Minimum Liability Only | $61 | $727 |

| State Minimum Liability w/ Full Cov. w/$1,000 Ded. | $74 | $886 |

| State Minimum Liability w/ Full Cov. w/$2,000 Ded. | $97 | $1,168 |

| 100/300/100 Full Cov. w/$1,000 Ded. | $125 | $1,495 |

| 50/100/50 Full Cov. w/$500 Ded. | $125 | $1,505 |

| State Minimum Liability w/ Full Cov. w/$250 Ded. | $128 | $1,539 |

| 300/500/300 Full Cov. w/$1,500 Ded. | $138 | $1,660 |

| State Minimum Liability w/ Full Cov. w/$0 Ded. | $151 | $1,812 |

Rates shown are based on sample profiles and may not reflect your individual pricing. Contact insurers directly for personalized quotes.

Auto Insurance for 50-Year-Olds: Buying Guide

Car insurance for 50-year-olds often comes with lower rates, but choosing the right policy still takes careful planning. This guide helps you compare coverage options, discounts and insurers. It outlines costs and coverage needs and provides tips on finding affordable, reliable protection suited to your needs.

How to Get Cheap Car Insurance for 50-Year-Olds

Adding a 50-year-old driver to a family insurance policy is one way to secure better car insurance rates. Covering the whole family under one policy can unlock discounts, such as bundling and multi-vehicle savings. Additional strategies can help further reduce costs for 50-year-old drivers.

- 1Shop around

Car insurance rates vary significantly between companies, so shopping around is a key way to find lower premiums. Our research shows drivers can save up to 32% annually by comparing quotes.

- 2Maintain a clean driving record

Even a small accident or speeding ticket on your record can raise your insurance rates. A DUI or major accident causes a bigger increase. Having multiple violations may make it hard to get insurance.

- 3Look for discounts

At 50, you may qualify for discounts like savings on multiple cars or bundling home and auto insurance. Early renewal, military or employer discounts could also apply. Safe driving and loyalty discounts are common if you’ve stayed with the same insurer for years.

- 4Assign the cheapest car to your young driver

Car insurance companies usually require all licensed drivers in your household to be listed on your policy. To save money when adding your child to your policy, assign them to your least expensive car, as young drivers often have the highest rates.

- 5Bundle policies

Bundling home and auto insurance can simplify your bills and often reward you with discounts.

- 6Regularly review your coverage needs

At 50, your insurance needs may have changed. Review your coverage to ensure it fits your current situation, and consider reducing unnecessary coverage to save money.

- 7Drive an affordable car to insure

Sports and luxury cars cost more to repair, making them more expensive to insure. A sedan or minivan can help keep your rates lower.

Car Insurance Discounts for 50-Year-Olds

Many insurers offer discounts to help 50-year-old drivers save on car insurance. Using these opportunities can greatly reduce your premiums. Here are some common discounts for older drivers:

Experienced drivers with clean records can enjoy significant savings. Avoiding accidents and tickets over time makes you a low-risk customer, leading to lower rates.

Bundling auto and home or renters insurance can simplify coverage and provide significant savings for 50-year-olds. This is especially helpful for homeowners seeking easy insurance management.

Retired or semi-retired drivers who no longer commute daily may qualify for lower premiums. Driving less reduces your risk, which insurers reward with discounts.

Usage-based programs like Progressive’s Snapshot or State Farm’s Drive Safe & Save can reward safe habits such as gentle braking, limited night driving and low mileage. These programs are ideal for 50-year-olds who have established responsible driving patterns.

Many insurers offer discounts for completing a defensive driving course. These courses can save money and refresh your knowledge of road safety and updated laws.

If you’ve been with the same insurer for years, you may qualify for a discount. Loyalty can pay off, but it’s still worth comparing rates to ensure your current policy remains competitive.

Credit scores often improve with age and financial stability, making many 50-year-olds eligible for big discounts. Maintaining good credit can lower premiums even further.

Cheap Auto Insurance for 50-Year-Old Drivers: Bottom Line

If you're a 50-year-old driver looking for cheap car insurance, GEICO offers the lowest rates at around $43 per month for minimum coverage. Other affordable options include Travelers, National General and State Farm. Travelers stands out for excellent customer service. Premiums at age 50 are lower, but your exact rate will still depend on your driving history, location, and coverage level.

Car Insurance for 50-Year-Olds: FAQ

We explain key aspects of car insurance for 50-year-olds to help you make informed decisions confidently.

What is the cheapest car insurance for a 50-year-old?

If you're a 50‑year‑old driver, GEICO is the cheapest car insurance option based on MoneyGeek’s rate data, averaging $43 per month for state-minimum, liability-only coverage.

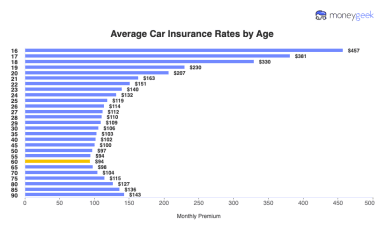

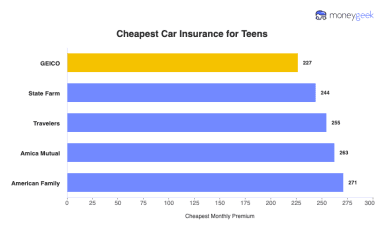

At what age is car insurance most expensive?

Car insurance is most expensive for teenagers and young drivers under 25 due to their higher risk of accidents.

Does insurance go down when you turn 50?

Insurance rates don’t automatically drop at 50. Rates may decrease yearly if you maintain a clean driving record and other factors stay the same. Drivers in their 50s often benefit from lower rates due to experience and stable records, but rates typically rise after age 65.

Best Car Insurance for 50-Year-Olds: Our Review Methodology

Why Trust MoneyGeek?

We collected data from Quadrant Information Services and state insurance departments to analyze rates for different driver profiles and locations. This research highlights the importance of comparing car insurance rates, as costs for the same profile can vary by company.

Study Overview

MoneyGeek analyzed national and state average costs using a sample driver profile to determine the price of minimum coverage insurance, compare minimum vs. full coverage rates and examine how rates change for risky drivers with accidents or tickets.

Data Sources and Depth

Data came from state insurance departments and Quadrant Information Services. Our analysis included 1,904 quotes from six insurers across 100 ZIP codes.

Driver Profile

To find the average annual insurance costs, the sample driver profile used for our analysis included:

- Toyota Camry LE

- Clean driving record

- 12K miles driven annually

This profile was adjusted by location, coverage type and amount to calculate average costs across the U.S.

Coverage Levels and Deductibles Explained

- Deductible: A deductible is the amount you pay out-of-pocket before insurance covers the rest of a comprehensive or collision claim. Liability coverage does not have deductibles.

- Full coverage: Includes comprehensive and collision coverage for the most financial protection.

100/300/100 is shorthand for:

- $100,000 bodily injury liability per person

- $300,000 bodily injury liability per accident

- $100,000 property damage liability

50/100/50 is shorthand for:

- $50,000 bodily injury liability per person

- $100,000 bodily injury liability per accident

- $50,000 property damage liability

For national averages, we used 100/300/100 coverage with a $1,000 deductible. For state-specific data, we used 50/100/50 coverage with the same deductible.

Learn more about MoneyGeek's methodology.

Auto Insurance for 50-Year-Olds: Related Articles

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.