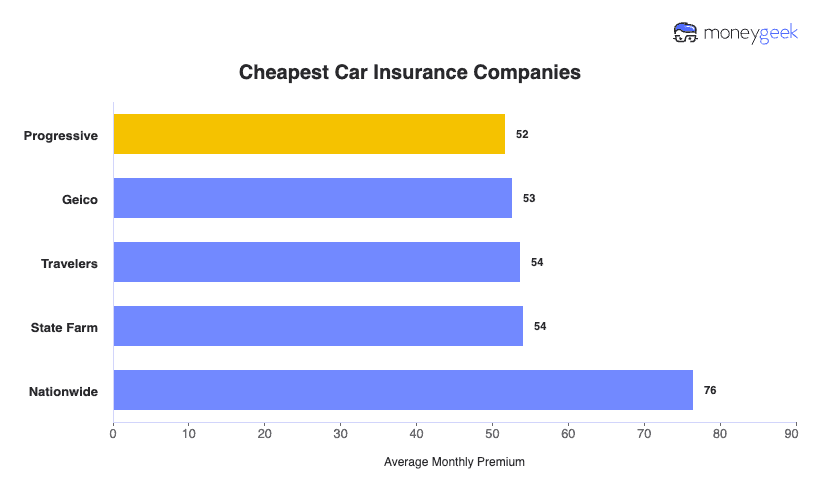

The five cheapest car insurance companies nationwide, on average are:

- Progressive: $52/mo

- GEICO: $53/mo

- Travelers: $54/mo

- State Farm: $54/mo

- Nationwide: $76/mo

Progressive beats all competitors at 38% below the national median. You save $374 yearly. GEICO, Travelers and State Farm cost within $2 monthly of each other, but each wins in different scenarios. Travelers: cheapest full coverage. GEICO: cheapest liability only. State Farm: cheapest for high-risk drivers with accidents, tickets or DUIs.

Compare quotes from the low-cost insurers below to find the best car insurance company for you to maximize your savings.