Car insurance costs $216 per month on average, but rates vary widely based on your age, driving record, credit score, location, vehicle type and coverage choices. Understanding how to compare car insurance companies effectively can help you find the best rate for your specific situation. Understanding how much car insurance you need and how to compare car insurance companies effectively can help you find the best rate for your specific situation.

Average Cost of Car Insurance in 2026

The national average cost of full coverage car insurance in 2026 is $216 per month or $2,575 annually, up 11.3% from 2026.

Find out how much car insurance costs for your driver profile below. Are you overpaying?

Updated: February 3, 2026

Advertising & Editorial Disclosure

The average cost of full coverage car insurance is $2,575 annually or $216 monthly, while minimum coverage costs $1,202 or $100 per month.

Car insurance costs continue rising due to increased repair costs and higher vehicle values. Car insurance rates have increased 11.3% in the last year and 57% since early 2022.

Your driver profile, location, credit score (in most states), insurance company choice and vehicle type most impact your car insurance cost. Location creates one of the biggest rate differences, with costs ranging from $75 to $243 monthly by state.

Ensure you are getting the best rate for your insurance. Compare quotes from the top insurance companies.

Why You Can Trust MoneyGeek

MoneyGeek's average car insurance cost data is derived from analyzing 83,056 quotes from 46 companies across 473 ZIP codes, with rate information sourced from Quadrant Information Services and state insurance departments. We started with a baseline of a 40-year-old driver with a clean record, then systematically adjusted age, gender, location, vehicle type, credit score, and driving record to show you exactly how each factor affects your premium—helping you make informed decisions and identify opportunities to lower your costs.

*Full coverage refers to a policy with 100/300/100 liability limits, comprehensive and collision coverage with a $1,000 deductible. Minimum coverage represents the minimum required coverage mandated by each state and D.C., which varies by location.

How Much Is Car Insurance?

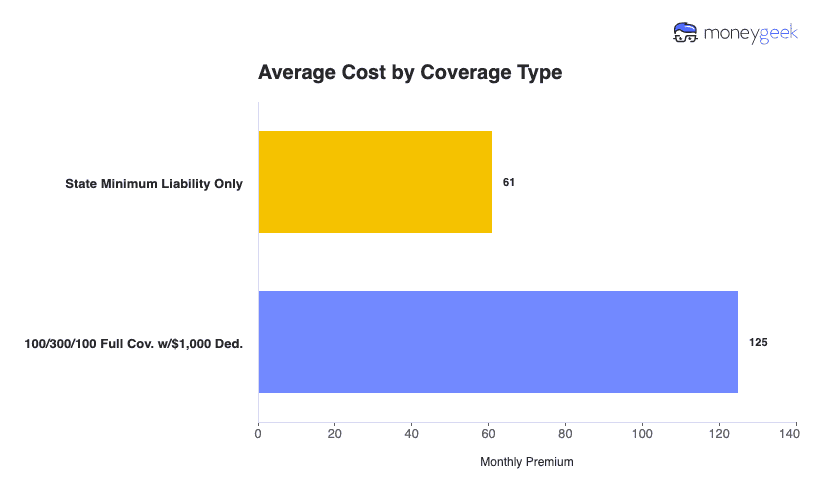

| Full Coverage | $125 | $1,495 |

| Minimum Coverage | $61 | $727 |

Average Car Insurance Cost

Car insurance costs range from $120 to $537 monthly depending on your driver profile—a $417 difference for the same full coverage policy. Clean-record adults aged 25-54 pay $215 monthly for full coverage, while young drivers (19-25) pay $537—a 150% increase. Credit scores create an equally large impact: excellent credit earns rates as low as $120 monthly, while poor credit results in $313 monthly premiums.

Clean record adult (25-54) | $215 | $100 |

Young driver (19-25) | $537 | $251 |

$270 | $135 | |

Driver with not-at-fault accident | $228 | $106 |

$310 | $145 | |

$377 | $177 | |

Driver with excellent credit | $120 | $57 |

$313 | $144 |

*Insurance costs vary widely from person to person because each insurer calculates rates differently based on age, driving record, credit-based insurance score, state and vehicle type.

Average Cost of Car Insurance by State

Location creates the biggest effect on car insurance costs, with monthly premiums ranging from $75 in Vermont to $243 in Florida—a $168 difference for the same coverage. State insurance rules, local risk factors and regional economics cause these wide differences. The table below shows full coverage rates for an ideal driver profile in each state. For detailed state-specific information, explore our guides on the cheapest car insurance companies and the cost of car insurance in different states, or find the best car insurance companies nationwide.

| Alabama | $104 | $1,245 |

| Alaska | $106 | $1,278 |

| Arizona | $136 | $1,628 |

| Arkansas | $114 | $1,373 |

| California | $155 | $1,861 |

| Colorado | $146 | $1,754 |

| Connecticut | $145 | $1,745 |

| Delaware | $179 | $2,149 |

| District of Columbia | $164 | $1,963 |

| Florida | $243 | $2,912 |

| Georgia | $135 | $1,620 |

| Hawaii | $82 | $983 |

| Idaho | $79 | $952 |

| Illinois | $99 | $1,189 |

| Indiana | $84 | $1,009 |

| Iowa | $97 | $1,162 |

| Kansas | $116 | $1,389 |

| Kentucky | $132 | $1,580 |

| Louisiana | $236 | $2,827 |

| Maine | $76 | $908 |

| Maryland | $150 | $1,802 |

| Massachusetts | $99 | $1,193 |

| Michigan | $138 | $1,652 |

| Minnesota | $109 | $1,310 |

| Mississippi | $123 | $1,472 |

| Missouri | $124 | $1,486 |

| Montana | $112 | $1,346 |

| Nebraska | $110 | $1,320 |

| Nevada | $152 | $1,826 |

| New Hampshire | $82 | $984 |

| New Jersey | $180 | $2,160 |

| New Mexico | $116 | $1,388 |

| New York | $120 | $1,435 |

| North Carolina | $105 | $1,264 |

| North Dakota | $90 | $1,078 |

| Ohio | $83 | $990 |

| Oklahoma | $133 | $1,599 |

| Oregon | $115 | $1,376 |

| Pennsylvania | $117 | $1,407 |

| Rhode Island | $126 | $1,518 |

| South Carolina | $130 | $1,559 |

| South Dakota | $106 | $1,269 |

| Tennessee | $103 | $1,233 |

| Texas | $150 | $1,799 |

| Utah | $127 | $1,524 |

| Vermont | $75 | $902 |

| Virginia | $97 | $1,162 |

| Washington | $109 | $1,305 |

| West Virginia | $111 | $1,326 |

| Wisconsin | $87 | $1,038 |

| Wyoming | $82 | $984 |

Car Insurance Calculator

Get personalized car insurance cost estimates based on your specific situation. Our car insurance calculator considers your age, location, driving record and vehicle type to show what you'll actually pay—not just generic averages.

Average Car Insurance Cost by Company

Major national insurers show rate differences for identical coverage. Average monthly rates range from $97 (Travelers) to $161 (Allstate) for full coverage. Since insurers weigh risk factors differently, comparing quotes from multiple companies leads to savings—often $50 to $100 monthly for the same driver profile. Learn more about individual insurers through our detailed company reviews: State Farm review, Progressive review and Nationwide review.

| Travelers | $97 | $-39 | -29% |

| State Farm | $121 | $-15 | -11% |

| Progressive | $125 | $-11 | -8% |

| Nationwide | $127 | $-9 | -6% |

| Farmers | $152 | $16 | 12% |

| Allstate | $161 | $26 | 19% |

Average Car Insurance Cost by Age

Car insurance costs vary by age group. Young drivers aged 19 to 25 pay $537 monthly for full coverage or 150% more than adult drivers who pay $215 monthly. Seniors pay $270 monthly, about 26% more than adults.

| Adult Drivers | $215 | $2,575 |

| Senior Drivers | $270 | $3,236 |

| Young Drivers | $537 | $6,442 |

Young drivers aged 16 to 19 have crash rates nearly four times higher per mile driven than drivers 20 and older. They're more likely to speed, drive distracted and make risky decisions due to inexperience and brain development factors. This elevated risk translates to higher insurance costs—teen drivers can add $322 monthly to a family policy. If you're looking for affordable coverage for young drivers, check out our guide to the cheapest car insurance for new drivers.

Senior drivers see rate increases after age 70 due to age-related changes including slower reaction times, vision changes and medication effects that increase accident risk. Learn more about when car insurance rates go down as you age and the average cost of car insurance for 16-year-olds.

Average Cost of Car Insurance for Drivers With Violations

Traffic violations result in higher car insurance costs, with premiums rising by 6% to 75% depending on the severity of the violation. Your driving record directly impacts what insurers charge, as violations signal higher risk to insurance companies. If you have multiple infractions or serious violations, finding the cheapest high-risk car insurance becomes essential since standard rates may no longer be available. Different violations affect your rates differently. Here's how monthly car insurance costs change based on your driving record:

| Clean | $215 | $2,575 |

| Not At Fault Accident ($1000-$1999 Prop Dmg) | $228 | $2,734 |

| Speeding 11–15 MPH Over Limit | $268 | $3,217 |

| Texting While Driving | $272 | $3,265 |

| At Fault Accident ($1000-$1999 Prop Dmg) | $310 | $3,721 |

| DUI - BAC >= .08 | $377 | $4,530 |

Average Cost of Car Insurance by Credit Score

Car insurance costs vary widely based on credit scores, creating some of the largest price differences in the industry. Costs range from $120 monthly for drivers with excellent credit to $313 for those with poor credit. This $193 monthly difference equals $2,316 annually in extra premiums. If you're concerned about credit checks, explore our list of insurance companies that don't check credit scores.

| Below Fair | $236 | $2,836 |

| Excellent | $120 | $1,442 |

| Fair | $187 | $2,247 |

| Good | $125 | $1,495 |

| None | $215 | $2,575 |

| Poor | $313 | $3,752 |

*While Hawaii, Massachusetts, Michigan and California prohibit insurers from considering credit history in rates, most states allow it as a factor.

Average Car Insurance Costs by Vehicle Type

Auto insurance rates differ based on the vehicle you drive, with annual premiums ranging from $1,291 for minivans to $3,006 for luxury sports cars. Vehicle type affects costs because repair expenses, replacement values and theft rates differ between vehicle categories. For truck owners specifically, see our guide to the best car insurance for pickup trucks.

| Minivan | $1,291 |

| Compact SUV | $1,378 |

| SUV | $1,387 |

| Pickup Truck | $1,429 |

| Compact | $1,436 |

| Sedan | $1,479 |

| Electric | $1,514 |

| Luxury Compact SUV | $1,561 |

| Sports Car | $1,713 |

| Luxury Compact | $1,745 |

| Luxury SUV | $1,792 |

| Luxury Sedan | $1,967 |

| Luxury Electric | $2,722 |

| Luxury Sports Car | $3,006 |

Car Insurance Rate Trends: Why Costs are High and How They've Changed (2020-2025)

Average car insurance rates jumped 51% since late 2019, putting financial pressure on drivers nationwide. Modern vehicles with advanced technology cost far more to repair. A replacement bumper with sensors costs $3,000 compared to $500 for older cars. Repair costs increased over 10% annually since 2022 compared to 3% to 5% pre-pandemic.

Medical expenses for injury claims keep rising, and extreme weather events intensify. The U.S. experienced over $92 billion in climate-related damages in 2023. Average rate increases show recent moderation. Car insurance inflation dropped from a peak of 23% in April 2024 to 5.3%. Rate increases in 2025 hit 7.5% compared to 16.5% in 2024.

Factor | Impact |

|---|---|

Post-pandemic recovery issues | The ongoing effects of COVID-19 are still disrupting supply chains, driving up costs for car parts and repairs. Manufacturing took a hit while demand surged after the lockdowns ended. |

Rising inflation | General inflation affects all sectors, including insurance. As overall costs for goods and services rise, insurers increase premiums to maintain their operating margins. |

Higher repair costs | Modern vehicles come with advanced technology and more expensive parts to repair or replace, driving up insurance costs. While repair expenses rose by 3% to 5% each year before the pandemic, they have skyrocketed by over 10% since 2022, with the average repair cost reaching around $4,721 by 2023. |

Supply chain delays | Supply chain issues have made vehicle parts more scarce and expensive, leading to higher repair costs and, consequently, higher insurance rates. |

Rising vehicle values | The increasing prices of new and used vehicles add more challenges for insurers. Higher car values mean greater financial risks associated with total-loss claims. |

Increasing medical expenses | As the cost of medical care continues to rise, insurers face higher expenses for injury claims, which often results in higher premiums for drivers. |

Impact of climate change | The increasing frequency and intensity of extreme weather events, like hurricanes, wildfires and floods, have reshaped the insurance industry. In 2023, the U.S. experienced more than $92 billion in damage from climate-related disasters, putting immense pressure on insurance companies. |

Car Insurance Cost Factors

Your car insurance premium depends on how insurers assess your risk level. Four factors create the biggest rate differences:

Your state and ZIP code create wide rate variations. Vermont drivers pay just $75 monthly while Florida residents pay $243—a $168 monthly difference. Urban areas cost more due to traffic density and crime rates, while state insurance requirements drive regional differences.

Clean drivers pay $215 monthly, while a DUI violation spikes rates to $377 monthly—a 75% increase. Even minor violations add costs: speeding 11-15 MPH over adds $53 monthly, while an at-fault accident increases rates to $310 monthly. Learn more about why your car insurance went up after an incident.

Credit scores create large rate gaps in states that allow credit-based pricing. Excellent credit earns $120 monthly rates, while poor credit results in $313 monthly—nearly triple the cost. California, Hawaii, Massachusetts and Michigan prohibit credit scoring, creating more uniform rates.

Young drivers (19-25) pay $537 monthly compared to $215 for adults (25-54)—a 150% increase. Senior drivers (55+) pay $270 monthly, about 26% more than middle-aged adults. Teen drivers have crash rates nearly four times higher per mile driven than drivers 20 and older.

Older drivers have higher car insurance costs due to age-related changes including slower reaction times, vision changes and potential medication effects that increase accident risk.

Ensure you are getting the best rate for your car insurance. Compare quotes from the top insurance companies.

Average Car Insurance Cost: Bottom Line

Car insurance costs $216 monthly across all driver profiles, with rates ranging from $75 to $537 depending on your age, driving record, location and coverage choices. Young drivers pay the most at $537 monthly, while credit scores create differences of up to $193 monthly between excellent and poor credit.

Location matters, with rates varying by $168 monthly between the cheapest and most expensive states. Your driving record creates the most rate swings—a single DUI increases costs by $162 monthly compared to a clean record.

Shopping around, maintaining clean driving records and improving credit scores remain the most effective ways to reduce premiums. Compare quotes from at least three insurers to find the best rate for your profile. If you're struggling with high premiums, explore our guide on what to do if you can't afford car insurance.

Car Insurance Cost: FAQ

How much is car insurance per year?

The average annual cost of car insurance for U.S. drivers is $1,202 for minimum coverage and $2,575 for full coverage. These averages vary based on location, driving history and vehicle type. Your actual cost depends on your specific driver profile—young drivers pay $6,442 annually while clean-record adults pay $2,575.

Who pays most for car insurance?

Young drivers (19-25) pay the most for car insurance at $537 monthly, followed by drivers with DUIs at $377 monthly. Drivers with poor credit pay $313 monthly, while those with at-fault accidents pay $310 monthly. Clean-record adults with good credit pay the least at $120-$215 monthly depending on age. For affordable options, see our guide to cheap car insurance for young adults.

Is car insurance higher for expensive cars?

Yes, car insurance costs more for expensive cars. Luxury sports cars cost $3,006 annually to insure, while minivans cost $1,291 annually—a $1,715 difference. Expensive vehicles cost more to repair or replace after accidents, and they're often targeted for theft. Higher replacement values mean insurers face greater financial risk with total-loss claims. Check out our guide to the cheapest car insurance for sports cars for affordable coverage options.

What factors most impact car insurance costs?

Four factors create the biggest rate differences: location (Vermont $75/month vs. Florida $243/month), driving record (clean $215/month vs. DUI $377/month), credit score (excellent $120/month vs. poor $313/month) and age (adults $215/month vs. young drivers $537/month). Your vehicle type, coverage choices and deductible amounts create additional variations.

How can I lower my car insurance costs?

Compare quotes from at least three insurers, as rates vary by $50-$100 monthly for identical coverage. Increase your deductible from $500 to $1,000 to save 10-15% on comprehensive and collision coverage. Apply all available discounts. Bundle your auto and home insurance for discounts of 15-25%. Maintain a clean driving record, improve your credit score and ask about good driver, good student and low-mileage discounts. For more savings tips, explore our guide to finding cheap full coverage car insurance

How long do traffic violations impact car insurance costs?

Most traffic violations affect your car insurance rates for three to five years. Minor violations like speeding tickets typically impact rates for three years, while major violations like DUIs affect rates for five to ten years depending on your state. The rate increase diminishes over time—you'll pay more immediately after the violation, with the surcharge gradually decreasing as years pass.

Here's how different violations affect monthly full coverage costs:

- Speeding 11-15 MPH over: $268 monthly (+$53)

- At-fault accident: $310 monthly (+$95)

- DUI: $377 monthly (+$162)

Why do state insurance requirements affect costs?

State insurance requirements affect costs because mandatory coverage types vary by state. States requiring personal injury protection (PIP) or uninsured motorist coverage have higher minimum premiums than states requiring only basic liability. Michigan's comprehensive first-party benefits system creates some of the nation's highest rates, while states with lower liability limits allow cheaper minimum coverage policies. Learn more about what liability car insurance coverage includes in your state.

Beyond mandated coverages, states with higher claim frequencies, weather patterns or vehicle theft rates see higher premiums. Urban density, medical costs and litigation environments also drive regional rate differences.

Cost of Auto Insurance: Methodology

Your specific profile drives dramatic car insurance rate differences. Understanding these differences helps you find coverage that fits your budget. This analysis shows which factors affect your premiums most and helps you find affordable coverage nationwide.

How we collected the data:

We gathered rate information from Quadrant Information Services and state insurance departments, analyzing 83,056 quotes from 46 companies across 473 ZIP codes. This dataset reflects real-world pricing across diverse communities nationwide, from urban centers to rural areas.

Our baseline driver profile:

We used a 40-year-old man with a clean driving record driving a 2012 Toyota Camry LE. This driver carries comprehensive and collision coverage with 100/300/100 liability limits and a $1,000 deductible, driving 12,000 miles annually. We adjusted age, gender, location, vehicle type, credit score and driving record to show how each factor affects what you pay.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Insurance Information Institute. "Senior Driving Safety and Insurance Tips." Accessed July 24, 2025.

- National Safety Council. "Age of Driver." Accessed July 24, 2025.