Travelers offers the cheapest full coverage car insurance at $67 monthly or $807 annually, 45% below Pennsylvania's state average. Pennsylvania drivers who'd prefer a regional insurer can choose Erie at $79 monthly, just $3 more than Nationwide's average premium.

Cheapest Car Insurance in Pennsylvania

Westfield offers Pennsylvania's most affordable minimum coverage at $234 annually, while Travelers offers the cheapest full coverage at $807 annually.

Find low-cost Pennsylvania car insurance for you below.

Updated: February 3, 2026

Advertising & Editorial Disclosure

Full coverage: Travelers, $67

Liability-only coverage: Westfield, $20

Teens: Westfield, $83

Young adults: Travelers, $50

Seniors: Travelers, $52

DUI: Travelers, $39

SR-22: Travelers, $65

Non-owner: Travelers, $63

Bad credit: Westfield, $36

Why You Can Trust MoneyGeek

We analyzed car insurance rates from major insurers across all Pennsylvania ZIP codes for various driver profiles, including clean records, violations and age groups. Rates show averages for a 40-year-old driver with good credit and a clean record unless otherwise noted. Your actual rate may differ based on your circumstances, location, driving history and coverage options. All data is current as of November 2025. Read more about MoneyGeek's methodology.

Cheapest Full Coverage Car Insurance in Pennsylvania

| Travelers | $67 | $807 | 45% |

| Nationwide | $76 | $918 | 38% |

| Erie Insurance | $79 | $945 | 36% |

| Donegal Insurance | $80 | $964 | 34% |

| Westfield Insurance | $103 | $1,234 | 16% |

Cheapest Minimum Coverage Car Insurance in Pennsylvania

Westfield offers the cheapest liability-only rates at $20 monthly or $234 annually, 61% below the state average. Chubb charges $36 monthly for the same required coverage. Westfield customers save $192 annually, nearly the cost of a full year of coverage.

Residents aiming to keep insurance costs manageable may benefit from pairing minimum coverage options with affordable car insurance for drivers with low income in Pennsylvania.

| Westfield Insurance | $20 | $234 | 61% |

| Erie Insurance | $28 | $334 | 45% |

| Travelers | $30 | $358 | 41% |

| Nationwide | $33 | $396 | 35% |

| Chubb | $36 | $426 | 30% |

Cheapest Car Insurance in Pennsylvania by City

Travelers offers Pennsylvania's cheapest minimum coverage rates in nine of the state's 15 largest cities. Philadelphia's $55 monthly rate nearly doubles Bethlehem's $28, a $324 annual difference for drivers in neighboring markets.

| Abington | Travelers | $38 | $86 | 43% |

| Allentown | Donegal Insurance | $38 | $78 | 41% |

| Bensalem | Travelers | $39 | $89 | 46% |

| Bethlehem | Travelers | $28 | $64 | 45% |

| Erie | Travelers | $31 | $72 | 41% |

| Harrisburg | Erie Insurance | $24 | $67 | 43% |

| Haverford | Travelers | $42 | $95 | 37% |

| Lancaster | Erie Insurance | $29 | $78 | 37% |

| Philadelphia | Travelers | $55 | $126 | 48% |

| Pittsburgh | Donegal Insurance | $36 | $75 | 36% |

| Reading | Travelers | $29 | $66 | 46% |

| Scranton | Nationwide | $31 | $71 | 41% |

| Upper Darby | Travelers | $44 | $101 | 48% |

| Wilkes-Barre | Nationwide | $31 | $71 | 44% |

| York | Travelers | $25 | $57 | 47% |

Cheapest Car Insurance in Pennsylvania for Teens and Young Adults

Westfield charges $115 monthly for 16-year-olds, but those same drivers pay just $50 monthly by age 25 through Travelers, saving $780 annually. Westfield offers the lowest rates for teen drivers ages 16 to 18, with minimum monthly coverage costs ranging from $83 to $115. Travelers becomes the cheapest choice for young adults at age 19.

Teens under 18 can't legally purchase auto insurance without a parent or guardian as a cosigner in most cases.

Cheapest Car Insurance for Seniors in Pennsylvania

Travelers charges $52 per month at age 70 and $66 at age 80 for seniors seeking affordable minimum coverage, a modest $14 increase over 10 years. Pennsylvania's senior drivers benefit from years of experience and make fewer claims, with Travelers offering rates 45% to 47% below the state average across all senior age groups.

| 65 | Travelers | $56 | $62 | 45% |

| 70 | Travelers | $52 | $109 | 46% |

| 80 | Travelers | $66 | $136 | 47% |

Cheapest DUI Insurance in Pennsylvania

Travelers and State Farm charge $39 monthly for minimum coverage after a DUI conviction. High-risk drivers needing cheap full coverage can choose State Farm or Allstate at $120 monthly, both competitive alternatives to Travelers' $95 full coverage option.

| Travelers | $39 | $95 | 61% |

| State Farm | $39 | $120 | 54% |

| Allstate | $67 | $120 | 46% |

| Erie Insurance | $59 | $155 | 38% |

| Progressive | $90 | $202 | 16% |

Cheapest SR-22 Insurance in Pennsylvania

Travelers charges $65 monthly for minimum coverage for drivers needing cheap SR-22 insurance, 47% below Pennsylvania's average for SR-22 drivers. Westfield offers an alternative at $46 monthly for minimum coverage, while Travelers' full coverage at $149 monthly exceeds most competitors.

| Travelers | $65 | $149 | 47% |

| Westfield | $46 | $190 | 42% |

| Erie | $88 | $213 | 25% |

| Nationwide | $98 | $210 | 24% |

| State Farm | $100 | $255 | 12% |

Cheapest Non-Owner Car Insurance in Pennsylvania

Travelers charges $63 monthly for cheap non-owner coverage, 42% below the state average. This coverage is for drivers who don't own vehicles but need proof of insurance, usually for license reinstatement after suspension, SR-22 filing requirements or frequent car rentals. Non-owner policies are cheaper than standard auto insurance because insurers cover liability only: damage you cause to others, not damage to any specific vehicle.

| Travelers | $63 | 42% |

| Auto-Owners Insurance Co | $86 | 25% |

| Nationwide | $111 | 13% |

Cheapest Car Insurance After an Accident in Pennsylvania

Westfield offers affordable minimum coverage after an accident for $25 monthly, while Nationwide charges just $76 monthly for full coverage, compared to Westfield's $125. Your premiums will increase by 20% to 40% after an at-fault accident and stay high for three to five years.

| Nationwide | $33 | $76 | 47% |

| Erie Insurance | $32 | $89 | 42% |

| Travelers | $39 | $89 | 39% |

| State Farm | $36 | $113 | 28% |

| Westfield Insurance | $25 | $125 | 28% |

Cheapest Car Insurance With a Speeding Ticket

Westfield charges $21 monthly for cheap minimum coverage after a speeding ticket, or $252 annually. Drivers needing full coverage should consider Travelers at $82 monthly. Erie splits the difference at $89 monthly for full coverage, beating Westfield's $108 full coverage rate.

| Westfield Insurance | $21 | $108 | 37% |

| Erie Insurance | $32 | $89 | 42% |

| Travelers | $35 | $82 | 43% |

| Donegal Insurance | $39 | $101 | 33% |

| State Farm | $39 | $120 | 23% |

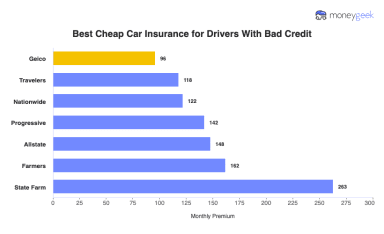

Cheapest Bad Credit Car Insurance in Pennsylvania

Westfield provides the cheapest minimum coverage for drivers with bad credit or low income at $36 monthly or $432 annually. Full coverage shoppers can choose Erie at $111 monthly, which undercuts Westfield's $133 full coverage rate by $22 monthly or $264 annually.

| Westfield Insurance | $36 | $133 | 34% |

| Erie Insurance | $45 | $111 | 38% |

| Nationwide | $61 | $118 | 30% |

| Geico | $69 | $131 | 21% |

| Travelers | $80 | $145 | 11% |

How to Get the Cheapest Car Insurance in Pennsylvania

Pennsylvania car insurance costs vary based on your location, driving record, age and credit history. Full coverage averages $67 monthly through Travelers, while minimum coverage costs as low as $20 with Westfield. Shopping strategically, comparing insurers and maximizing discounts can save you hundreds of dollars annually.

- 1Shop rates from national and regional carriers

Compare rates from at least three Pennsylvania insurers. Regional companies like Erie and Donegal frequently beat national carriers in metro areas.

Use MoneyGeek's auto insurance calculator for rate estimates of the cheapest car insurance based on your location and driver profile. It's free and requires no personal information.

- 2Maximize discounts

Bundle home and auto policies for 5% to 25% savings, use multi-car discounts for 10% to 25% off, enroll in defensive driver programs (especially for seniors), claim good student discounts for 10% to 15% off and qualify for low-mileage discounts of 15% to 30%.

- 3Adjust your deductibles and coverage

Raising your deductible from $500 to $1,000 cuts premiums by 10% to 15%. Travelers' full coverage costs about $82 monthly with a $500 deductible and drops to $67 monthly with a $1,000 deductible, saving you $180 annually.

Limited tort coverage costs less but restricts your right to sue for pain and suffering after an accident. Full tort coverage gives you more legal rights but increases your premium. Consider your budget and risk tolerance when deciding how much car insurance you need.

- 4Meet Pennsylvania’s minimum requirements

Pennsylvania requires $15,000 per person for bodily injury, $30,000 per accident for bodily injury and $5,000 for property damage (15/30/5). You also need $5,000 in medical benefits coverage. These state minimums fall short in serious accidents since average vehicle repairs cost around $4,500, and total loss replacements exceed $20,000.

- 5Last-resort coverage through PA AIPSO

Drivers who can't get standard coverage can apply through the Pennsylvania Automobile Insurance Plan, though rates are higher.

Cheap Car Insurance in Pennsylvania: FAQ

Our insurance experts answer common questions about finding affordable car insurance in Pennsylvania.

How much does car insurance cost in Pennsylvania?

Pennsylvania car insurance costs between $20 and $55 monthly for minimum coverage and $64 to $126 monthly for full coverage, depending on the city. Philadelphia has the highest rates in the state, with $55 for minimum coverage and $126 for full coverage, while Bethlehem offers the lowest rates at $28 for minimum and $64 for full coverage.

Should you buy the cheapest car insurance in Pennsylvania?

While opting for the least expensive insurance can be tempting, make sure it provides sufficient coverage for major losses. Erie offers the best balance of affordability and quality coverage in Pennsylvania.

Is state minimum coverage enough in Pennsylvania?

Drivers in Pennsylvania must carry auto insurance to legally operate a vehicle. The state is a choice no-fault system, meaning drivers can select between limited or full tort options that affect their right to sue after an accident. By law, every policy must include liability coverage, first-party medical benefits and uninsured/underinsured motorist protection. Meeting these limits keeps you legal, but many drivers purchase higher coverage for better protection against serious claims.

Is Pennsylvania a no-fault state?

No, Pennsylvania isn't a completely no-fault state. Pennsylvania gives drivers a choice between limited tort, which offers lower premiums but limits lawsuit rights, and full tort, which has higher premiums but grants full lawsuit rights. All policies include medical benefits coverage regardless of fault.

Does Pennsylvania allow gender-based insurance pricing?

Pennsylvania allows insurers to consider gender when setting rates, so young male drivers usually pay more than young females. However, some Pennsylvania insurers voluntarily choose not to use gender as a rating factor.

Most Affordable Car Insurance in Pennsylvania: Related Articles

How We Found the Most Affordable Car Insurance in Pennsylvania

Our Research Approach

Pennsylvania's car insurance market is complex. Rates vary between Philadelphia and rural areas, and limited tort versus full tort choices affect premiums. The state's no-fault system adds another layer of complexity. Our research cuts through this complexity to identify which insurers offer the lowest rates across Pennsylvania's diverse markets.

We collected auto insurance data from the Pennsylvania Insurance Department and Quadrant Information Services, analyzing quotes from 12 major insurers and reviewing more than 200 million rate comparisons across every residential ZIP code in Pennsylvania.

Sample Driver Profile

Our baseline rates use a 40-year-old driver with good credit and a clean driving record. This profile represents typical Pennsylvania drivers without violations or poor credit that increase premiums. You'll see base rates here — your personal quote will adjust based on your specific driving history, credit and location.

Coverage Levels We Compared

We analyzed two coverage scenarios:

Minimum coverage: Pennsylvania's required liability limits of $15,000 per person for bodily injury, $30,000 per accident for bodily injury and $5,000 per accident for property damage (15/30/5). This meets legal requirements but often falls short in serious accidents.

Full coverage: Liability limits of $100,000/$300,000/$100,000 plus comprehensive and collision coverage with a $1,000 deductible. You're covered for damage you cause to others and repairs to your own vehicle.

Location Affects Your Rate

Pennsylvania rates swing wildly by city. Your neighbor one town over might pay 50% less for the same coverage. Our ZIP code analysis shows where drivers overpay because of geography.

For more information, see the detailed methodology here.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.

sources

- Insurance Information Institute. "Facts + Statistics: Auto insurance." Accessed February 7, 2026.

- Insurance Information Institute. "Facts + Statistics: Uninsured motorists." Accessed February 7, 2026.

- National Insurance Crime Bureau. "Vehicle Thefts Surge Nationwide in 2023 ." Accessed February 7, 2026.

- National Centers for Environmental Information . "Climate at a Glance ." Accessed February 7, 2026.