ERGO NEXT ranks first for professional liability insurance in New York, offering competitive rates, highly rated digital tools and strong customer service. At $82 per month, ERGO NEXT ties with The Hartford as the cheapest professional indemnity insurer in the state. That's $8 below the New York average. Simply Business, biBerk and Coverdash complete our recommendations for New York businesses seeking top errors and omissions insurance.

Best Professional Liability Insurance in New York

Get NY professional liability insurance quotes starting at $30 monthly from MoneyGeek's top companies like ERGO NEXT, The Hartford and Simply Business.

Get matched to the best professional liability insurance in NY for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

ERGO NEXT provides both the best professional liability insurance and most affordable coverage in New York starting at $82 monthly (Read More).

Professional liability insurance costs average $90 per month in New York ($1,077 annually), placing the state among moderately priced options nationally (Read More).

Professional liability insurance protects New York businesses against financial losses from professional mistakes, negligence claims and missed contractual deadlines (Read More).

New York doesn't mandate professional liability insurance for most businesses, though health care professionals and other regulated industries need coverage (Read More).

Getting multiple small business insurance quotes from different providers helps New York businesses secure the most suitable professional liability coverage (Read More).

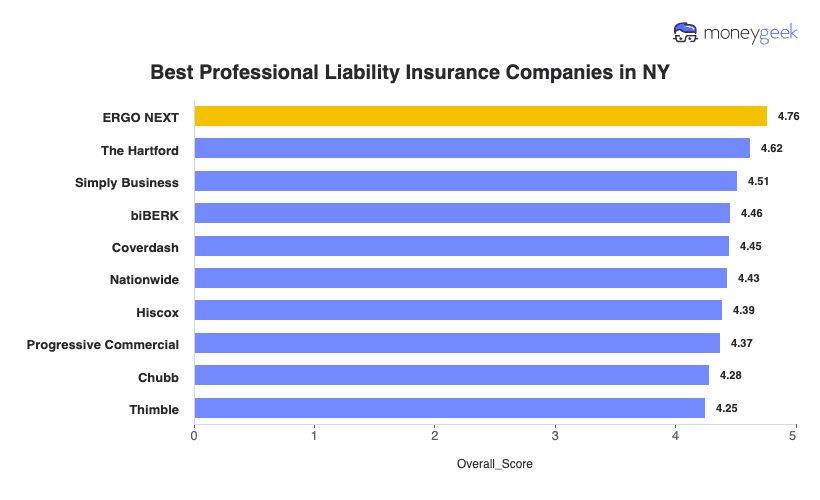

Best Professional Liability Insurance Companies in New York

| ERGO NEXT | 4.76 | $82 |

| The Hartford | 4.62 | $82 |

| Simply Business | 4.51 | $89 |

| biBERK | 4.46 | $91 |

| Coverdash | 4.45 | $90 |

| Nationwide | 4.43 | $97 |

| Hiscox | 4.39 | $88 |

| Progressive Commercial | 4.37 | $89 |

| Chubb | 4.28 | $103 |

| Thimble | 4.25 | $86 |

How Did We Determine the Best Professional Liability Insurance in New York?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

Beyond professional liability insurance in New York, we've provided the following state-specific resources to get the best coverage for your business:

1. ERGO NEXT: Best Professional Liability Insurance in NY

Lowest professional liability rates in New York

Ranks first nationally for customer service experience

Instant coverage and certificates in 10 minutes

Highest-rated mobile app and digital experience

Personalized coverage matching for both types and limit amounts

Less than 10 years in business

Claims processing ranks fourth nationally

New York business owners choose ERGO NEXT to keep more money in your business while accessing coverage quickly. At $82 monthly, you'll save $88 annually compared to typical New York rates, which matter when managing tight margins. You can secure coverage and send certificates to clients within 10 minutes. Manhattan consultants and Buffalo contractors don't lose contract opportunities while waiting for paperwork. ERGO NEXT's mobile app lets you prove insurance to clients instantly from job sites or meetings, eliminating back-and-forth emails and delays.

2. Simply Business: Best Professional Liability Insurance Coverage Option in NY

Ranks first nationally for coverage options

Access to 16+ carriers for specialized policies

Backed by Travelers' A++ Superior financial rating

Compares multiple quotes in 10 minutes online

Broker model finds coverage for hard-to-insure businesses that other insurers reject

Claims process ranks eighth nationally

Customer satisfaction scores rank seventh nationally

Costs slightly more than New York state average

Simply Business solves coverage problems other New York insurers reject. Access to 16+ carriers means Albany consultants and Rochester tech startups find specialized policies when direct insurers say no. The broker model matches your business with carriers willing to cover unique risks. Compare multiple quotes in 10 minutes instead of calling insurers individually, saving hours of research time. Simply Business connects hard-to-insure New York businesses with the right coverage options.

Average Cost of Professional Liability Insurance in New York

Professional liability insurance costs in New York vary across industries. Home-based businesses pay the most affordable rates at around $43 per month, while mortgage brokers face the highest average costs at approximately $193 per month. Use the filtering tool below to find specific rates for your industry and get accurate pricing for your business needs.

| Accountants | $168 | $2,018 |

| Ad Agency | $115 | $1,379 |

| Auto Repair | $96 | $1,146 |

| Automotive | $86 | $1,030 |

| Bakery | $62 | $741 |

| Barber | $50 | $595 |

| Beauty Salon | $57 | $685 |

| Bounce House | $69 | $822 |

| Candle | $50 | $595 |

| Cannabis | $140 | $1,679 |

| Catering | $91 | $1,089 |

| Cleaning | $63 | $757 |

| Coffee Shop | $71 | $847 |

| Computer Programming | $123 | $1,479 |

| Computer Repair | $72 | $864 |

| Construction | $90 | $1,075 |

| Consulting | $125 | $1,500 |

| Contractor | $72 | $867 |

| Courier | $57 | $681 |

| DJ | $53 | $636 |

| Daycare | $124 | $1,488 |

| Dental | $96 | $1,157 |

| Dog Grooming | $63 | $755 |

| Drone | $121 | $1,453 |

| Ecommerce | $73 | $871 |

| Electrical | $74 | $889 |

| Engineering | $120 | $1,443 |

| Excavation | $79 | $953 |

| Florist | $44 | $527 |

| Food | $128 | $1,536 |

| Food Truck | $69 | $825 |

| Funeral Home | $93 | $1,120 |

| Gardening | $47 | $561 |

| HVAC | $94 | $1,130 |

| Handyman | $62 | $739 |

| Home-based business | $43 | $514 |

| Hospitality | $86 | $1,036 |

| Janitorial | $58 | $696 |

| Jewelry | $72 | $862 |

| Junk Removal | $78 | $937 |

| Lawn/Landscaping | $61 | $726 |

| Lawyers | $166 | $1,988 |

| Manufacturing | $67 | $808 |

| Marine | $101 | $1,207 |

| Massage | $122 | $1,460 |

| Mortgage Broker | $193 | $2,313 |

| Moving | $94 | $1,123 |

| Nonprofit | $58 | $694 |

| Painting | $74 | $893 |

| Party Rental | $64 | $762 |

| Personal Training | $81 | $978 |

| Pest Control | $112 | $1,344 |

| Pet | $53 | $639 |

| Pharmacy | $66 | $796 |

| Photography | $73 | $872 |

| Physical Therapy | $109 | $1,305 |

| Plumbing | $105 | $1,257 |

| Pressure Washing | $66 | $797 |

| Real Estate | $145 | $1,736 |

| Restaurant | $95 | $1,139 |

| Retail | $63 | $757 |

| Roofing | $113 | $1,362 |

| Security | $115 | $1,386 |

| Snack Bars | $54 | $652 |

| Software | $108 | $1,297 |

| Spa/Wellness | $127 | $1,523 |

| Speech Therapist | $117 | $1,399 |

| Startup | $83 | $992 |

| Tech/IT | $113 | $1,354 |

| Transportation | $110 | $1,317 |

| Travel | $111 | $1,337 |

| Tree Service | $85 | $1,022 |

| Trucking | $127 | $1,524 |

| Tutoring | $71 | $855 |

| Veterinary | $135 | $1,624 |

| Wedding Planning | $87 | $1,047 |

| Welding | $90 | $1,078 |

| Wholesale | $72 | $868 |

| Window Cleaning | $71 | $857 |

How Did We Determine These New York Professional Liability Insurance Rates?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

What Does New York Professional Liability Insurance Cover?

Professional liability insurance in New York protects your business when clients claim you made mistakes or failed to deliver what you promised. Professional liability insurance covers the costs of these claims plus any legal fees you face defending yourself. This coverage goes by several different names:

- Errors and omissions insurance (E&O)

- Malpractice insurance (used mainly in health care and law)

- Professional indemnity insurance

How Much Professional Liability Insurance Do I Need in New York?

New York doesn't require professional liability insurance for most businesses. Standard coverage of $1 million per occurrence and $2 million aggregate satisfies typical client contract requirements. Health care providers need higher limits. Hospitals require $1.3 million per occurrence and $3.9 million aggregate for admitting privileges. Physicians on probation for professional misconduct must carry $2 million per occurrence and $6 million aggregate coverage under New York Public Health Law.

Who Needs Professional Liability Insurance in New York?

Professionals handling client contracts or providing specialized services in New York should consider professional liability insurance. Negligence claims, missed deadlines or contract disputes can result in costly lawsuits that threaten your business and personal finances.

New York's technology sector raised over $232 billion in startup funding since 2019, with Silicon Alley now employing more workers than Wall Street. Tech E&O insurance protects software developers, IT consultants and tech startups in Manhattan and Brooklyn from claims involving data breaches, system failures or missed project deadlines. These risks are amplified when your clients are financial services firms demanding zero downtime.

Professional services firms in New York City, the state's largest industry by employment with average wages of $150,800, serve high-net-worth clients and major corporations where your advice directly affects investments worth millions. A single negligence claim from a client who loses money following your recommendations can bankrupt your practice in New York's litigious environment where nuclear verdicts are common.

New York hospitals require physicians to carry $1.3 million per occurrence and $3.9 million aggregate malpractice insurance for admitting privileges—substantially higher than most states. Without damage caps, malpractice verdicts regularly exceed $100 million, meaning inadequate coverage leaves your practice and personal assets vulnerable to a single claim.

New York's construction market reached $83 billion in 2023 and will hit $115 billion by 2025, but contractors face strict liability for workplace injuries under New York Labor Law. These laws drive multimillion-dollar settlements even when you followed safety protocols, making professional liability insurance essential for protecting your contracting business in New York City, Albany or Buffalo.

NYC's 500 million square feet of office space, the largest office market in the United States, means your disclosure failures or transaction errors involve deals worth millions. Errors and omissions insurance for real estate professionals covers claims from paperwork mistakes or missed deadlines that could cost more than your annual commission income.

New York's position as home to the world's highest concentration of legal services firms creates intense competition and high-stakes litigation where client expectations are extraordinarily high. A single missed deadline, procedural error or inadequate research on a Manhattan corporate deal can trigger malpractice claims exceeding your firm's annual revenue.

How to Get the Best Professional Liability Insurance in New York

Our step-by-step guide walks you through getting business insurance in New York that matches your professional liability needs and budget. New York's complex regulatory environment and high litigation risks require careful coverage selection. Follow these six steps to secure coverage that protects your business.

- 1

Assess your professional liability insurance coverage needs

Evaluate your business risks based on your clients' industries and contract requirements, which matter more in New York's high-stakes business environment. A Manhattan consultant advising Wall Street firms needs higher coverage limits than an Albany marketing agency serving local retailers, even if both provide similar services.

- 2

Work with a local agent

Find an agent familiar with New York's sharp business insurance costs variations between downstate and upstate regions, where premiums can differ by 40% or more. Agents who understand New York's strict liability laws can explain why Brooklyn contractors encounter different exposures than Rochester contractors despite doing identical work.

- 3

Get quotes and compare coverage details

Request quotes from at least three insurers familiar with New York's regulatory environment and compare policy exclusions related to New York Labor Law exposures. Don't just chase affordable business insurance rates: a Syracuse tech consultant needs to verify coverage includes protection for claims under New York's stringent data breach notification laws.

- 4

Research the best providers

Prioritize insurers with strong AM Best ratings and proven claims experience in New York's litigious environment where nuclear verdicts are common. Check the New York Department of Financial Services database to confirm your insurer is licensed in New York and review complaint ratios specific to professional liability claims.

- 5

Consider bundling discounts

Bundling professional liability with general liability or cyber insurance can offset New York's higher-than-average insurance costs by 15% to 25%. A White Plains accounting firm handling both tax preparation and financial advisory work saves more by bundling multiple types of business insurance than buying separate policies in New York's expensive market.

- 6

Don't let your coverage lapse

Professional liability policies protect you only from lawsuits filed while your policy is active, even if the work happened years ago. A Long Island consultant who cancels a claims-made policy without tail coverage (extended reporting coverage) remains exposed to lawsuits from work performed during the policy period but filed after cancellation.

Get New York Professional Liability Insurance Quotes

MoneyGeek matches you with top professional liability insurance providers in New York for your industry. Use our tool below to identify your best insurer match and receive custom quotes for your business.

Get Matched to the Best NY Professional Liability Insurer for You

Select your industry and state to get a customized NY professional liability insurer match and get tailored quotes.

New York Professional Liability: Bottom Line

Choosing the right professional liability insurance in New York comes down to understanding your business risks, client contracts and budget. ERGO NEXT ranks first in our analysis, but your industry and client requirements should guide your final decision. Start by assessing your needs, then work with a local New York agent to compare options and secure coverage that financially protects your business.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.