ERGO NEXT ranks first for professional liability insurance in North Dakota, earning top marks for customer service and digital experience alongside competitive pricing. Both ERGO NEXT and The Hartford deliver the state's lowest rates as the cheapest professional indemnity insurers at $63 monthly ($5 below North Dakota's $68 average). Simply Business, Coverdash and Nationwide follow as top errors and omissions insurance options for businesses requiring specialized coverage or broker access.

Best Professional Liability Insurance in North Dakota

Get ND professional liability insurance quotes starting at $23 monthly from MoneyGeek's top companies like ERGO NEXT, The Hartford and Simply Business.

Get matched to the best professional liability insurance in ND for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

ERGO NEXT provides both the best professional liability insurance and most affordable coverage in North Dakota at $63 monthly (Read More).

Professional liability insurance costs in North Dakota average $68 monthly, totaling $810 annually, and rank among affordable states (Read More).

Professional liability insurance covers North Dakota businesses against claims from professional mistakes, negligence and failure to deliver promised services (Read More).

Professional liability insurance remains optional for most North Dakota businesses, though health care providers and other licensed professionals need coverage (Read More).

North Dakota business owners should request small business insurance quotes from multiple providers to compare coverage limits and find optimal professional liability protection (Read More).

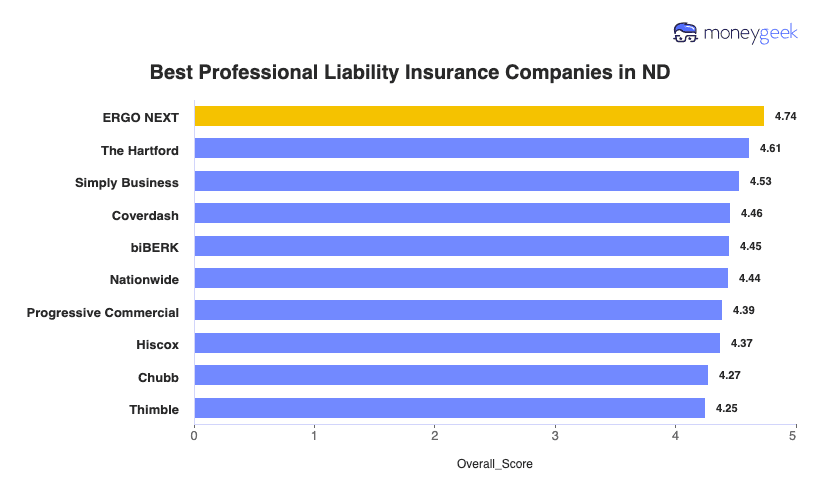

Best Professional Liability Insurance Companies in North Dakota

| ERGO NEXT | 4.74 | $63 |

| The Hartford | 4.62 | $63 |

| Simply Business | 4.53 | $66 |

| Coverdash | 4.46 | $67 |

| Nationwide | 4.45 | $72 |

| biBERK | 4.44 | $69 |

| Progressive Commercial | 4.38 | $66 |

| Hiscox | 4.37 | $67 |

| Chubb | 4.28 | $77 |

| Thimble | 4.25 | $66 |

How Did We Determine the Best Professional Liability Insurance in North Dakota?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

Beyond professional liability insurance in North Dakota, we've provided the following state-specific resources to get the best coverage for your business:

1. ERGO NEXT: Best Professional Liability Insurance in ND

Best overall professional liability insurance provider in North Dakota

Lowest rates in state at $63 monthly

Ranks first for customer service and digital experience

Instant coverage and certificates in under 10 minutes

Personalized coverage matching for both types and limit amounts

Claims process ranks fourth among studied providers

Less than 10 years operating in insurance market

North Dakota business owners pay $63 monthly with ERGO NEXT versus the $68 state average, saving $5. That might seem small, but it gives you an annual savings of $60. You'll skip agent calls and get covered in under 10 minutes, which is critical when Fargo consultants or Bismarck contractors need immediate proof of insurance for client contracts. ERGO NEXT ranks first for digital experience and policy management among all providers, so Grand Forks businesses avoid the frustrating phone trees and delayed certificates common with traditional insurers.

2. Simply Business: Best Professional Liability Insurance Coverage Option in ND

Ranks first for coverage options

Broker model accesses 16+ carriers for specialized policies

Shows multiple quotes in 10 minutes

Ranks third for digital experience

Backed by Travelers' A++ Superior financial rating

Ranks eighth for claims processing

Ranks seventh for customer satisfaction

Higher rates than direct insurers

Simply Business finds professional liability coverage for North Dakota businesses that direct insurers turn away. You'll pay $66 monthly versus $63 with direct insurers, but that $3 premium connects Minot oil contractors and Williston energy consultants to 16+ carriers offering specialized policies for complex risks. Simply Business ranks first for coverage breadth. Fargo tech startups and Grand Forks agricultural consultants tailor policies to specific liability exposures rather than accepting generic coverage that leaves gaps.

Average Cost of Professional Liability Insurance in North Dakota

Professional liability insurance costs in North Dakota vary across industries. Home-based businesses pay the lowest rates at around $32 per month, while mortgage brokers face the highest average cost at approximately $140 per month. You can find specific pricing for your industry by using the filtering tool below to compare rates tailored to your business type.

| Accountants | $125 | $1,499 |

| Ad Agency | $87 | $1,043 |

| Auto Repair | $72 | $869 |

| Automotive | $65 | $785 |

| Bakery | $46 | $550 |

| Barber | $37 | $445 |

| Beauty Salon | $43 | $514 |

| Bounce House | $53 | $631 |

| Candle | $37 | $441 |

| Cannabis | $108 | $1,293 |

| Catering | $70 | $839 |

| Cleaning | $47 | $569 |

| Coffee Shop | $53 | $631 |

| Computer Programming | $92 | $1,101 |

| Computer Repair | $55 | $660 |

| Construction | $67 | $808 |

| Consulting | $91 | $1,098 |

| Contractor | $56 | $669 |

| Courier | $43 | $519 |

| DJ | $40 | $481 |

| Daycare | $92 | $1,104 |

| Dental | $75 | $895 |

| Dog Grooming | $47 | $569 |

| Drone | $91 | $1,097 |

| Ecommerce | $54 | $650 |

| Electrical | $56 | $671 |

| Engineering | $91 | $1,097 |

| Excavation | $58 | $698 |

| Florist | $33 | $394 |

| Food | $96 | $1,146 |

| Food Truck | $52 | $624 |

| Funeral Home | $70 | $843 |

| Gardening | $35 | $420 |

| HVAC | $71 | $849 |

| Handyman | $46 | $554 |

| Home-based business | $32 | $388 |

| Hospitality | $64 | $772 |

| Janitorial | $43 | $518 |

| Jewelry | $53 | $640 |

| Junk Removal | $59 | $710 |

| Lawn/Landscaping | $45 | $540 |

| Lawyers | $126 | $1,512 |

| Manufacturing | $53 | $639 |

| Marine | $75 | $905 |

| Massage | $92 | $1,103 |

| Mortgage Broker | $140 | $1,684 |

| Moving | $71 | $846 |

| Nonprofit | $45 | $534 |

| Painting | $55 | $661 |

| Party Rental | $48 | $578 |

| Personal Training | $59 | $713 |

| Pest Control | $84 | $1,002 |

| Pet | $39 | $473 |

| Pharmacy | $50 | $604 |

| Photography | $55 | $661 |

| Physical Therapy | $82 | $987 |

| Plumbing | $77 | $929 |

| Pressure Washing | $51 | $606 |

| Real Estate | $109 | $1,314 |

| Restaurant | $72 | $859 |

| Retail | $48 | $573 |

| Roofing | $86 | $1,031 |

| Security | $88 | $1,058 |

| Snack Bars | $42 | $500 |

| Software | $83 | $995 |

| Spa/Wellness | $96 | $1,148 |

| Speech Therapist | $87 | $1,040 |

| Startup | $63 | $759 |

| Tech/IT | $85 | $1,026 |

| Transportation | $82 | $986 |

| Travel | $84 | $1,009 |

| Tree Service | $65 | $785 |

| Trucking | $95 | $1,143 |

| Tutoring | $53 | $635 |

| Veterinary | $101 | $1,209 |

| Wedding Planning | $66 | $794 |

| Welding | $68 | $811 |

| Wholesale | $54 | $646 |

| Window Cleaning | $54 | $647 |

How Did We Determine These North Dakota Professional Liability Insurance Rates?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

What Does North Dakota Professional Liability Insurance Cover?

Professional liability insurance in North Dakota protects your business when clients claim you made mistakes or didn't deliver what you promised. This coverage handles the costs of defending these claims and any damages you might owe. It also pays for attorney fees and court costs that pile up during legal disputes.

This insurance goes by several different names:

- Errors and omissions insurance (E&O)

- Malpractice insurance (specialized type, typically in legal and medical fields)

- Professional indemnity insurance

How Much Professional Liability Insurance Do I Need in North Dakota?

North Dakota doesn't require professional liability insurance for most businesses. You'll need $1 million per occurrence and $3 million aggregate coverage when health care facilities or client contracts demand proof of insurance. Medical professionals need higher coverage standards: Sanford Medical Center in Fargo and Altru Hospital in Grand Forks require malpractice insurance for admitting privileges, though state law doesn't mandate it.

Who Needs Professional Liability Insurance in North Dakota?

North Dakota's resource-based economy creates unique professional liability exposures across its dominant industries. Businesses handling client contracts or providing specialized services where errors could result in financial losses should secure coverage, particularly in sectors central to the state's $41.3 billion agriculture industry and $48.8 billion energy sector.

North Dakota ranks as the nation's third-largest oil producer, with the Williston Basin energy sector generating $48.8 billion annually and employing over 63,000 workers. Consultants advising oil companies, engineers managing drilling operations and environmental specialists conducting compliance assessments need professional liability insurance because errors can result in million-dollar project failures or regulatory violations affecting an industry that pays more than half of all state taxes collected.

Agriculture comprises 25% of North Dakota's economic base, supporting 123,360 jobs across 31,600 farms and ranches. Crop consultants, agronomists and farm management advisors serving producers of spring wheat, sunflowers, dry edible beans and honey need coverage because incorrect advice on seed selection, pest management or financial planning can destroy entire harvests and devastate farming operations operating on thin profit margins, including the state's growing value-added processing sector.

The Secretary of State requires contractors working on projects exceeding $4,000 to carry liability insurance for state licensing. Contractors need professional liability coverage beyond general liability because design errors, project management failures or failure to meet contract specifications can trigger lawsuits even when no physical damage occurs to property.

North Dakota leads nationally in unmanned aircraft systems as part of its targeted technology growth strategy. Software developers, IT consultants and UAS operators need tech E&O insurance because data breaches, software failures or system downtime can cause substantial financial losses for clients in the state's energy, agriculture and government sectors.

North Dakota's resource-based economy creates demand for specialized financial advice across energy, agriculture and business development sectors. CPAs, financial planners and business consultants need accountants' professional liability insurance because tax errors, incorrect financial projections or poor investment advice can trigger malpractice claims with damages exceeding typical general liability limits.

How to Get the Best Professional Liability Insurance in North Dakota

Our step-by-step guide walks you through how to get business insurance in North Dakota that matches your professional liability coverage needs and budget. Follow these steps to secure the right protection for your business.

- 1

Assess your professional liability insurance coverage needs

Start by understanding your business risks, client contract requirements and the liability exposures common in your industry. A Williston petroleum engineer advising on Bakken drilling operations needs higher coverage limits than a Fargo web designer serving local retailers.

- 2

Work with a local agent

Look for an agent who understands North Dakota's resource-based economy and how business insurance costs differ between industries. Agents familiar with the state can explain why Grand Forks agricultural consultants serving large farming operations have different coverage needs than Bismarck accountants working with government contractors.

- 3

Get quotes and compare coverage details

Request quotes from at least three insurers who serve your industry, comparing both affordable business insurance rates and policy exclusions specific to your work. A Minot environmental consultant assessing oil field compliance should examine whether policies cover regulatory defense costs, not just compare premiums on $1 million policies.

- 4

Research the best providers

When researching professional liability insurers, prioritize carriers with experience in North Dakota's dominant industries: energy, agriculture and technology. Check AM Best ratings for financial strength and read reviews from other professionals in your sector to find insurers who understand the unique risks of advising clients in the state's resource extraction and farming industries.

- 5

Consider bundling discounts

North Dakota insurers typically offer 10% to 25% premium reductions when you combine professional liability with other types of business insurance like general liability or commercial property. A Fargo CPA firm serving agricultural clients saves $450 annually by bundling professional liability with its business owner's policy.

- 6

Don't let your coverage lapse

Professional liability operates on a claims-made basis, meaning you're only covered for lawsuits filed while your policy is active, regardless of when you performed the work. A Bismarck engineering consultant who provided oil field design work three years ago needs continuous coverage or tail coverage (extended reporting period protection) to defend against claims from past projects when switching insurers.

Get North Dakota Professional Liability Insurance Quotes

MoneyGeek matches you to top professional liability insurance providers in North Dakota for your industry. Use our tool below to find the best company for your business and receive tailored quotes for your coverage needs.

Get Matched to the Best ND Professional Liability Insurer for You

Select your industry and state to get a customized ND professional liability insurer match and get tailored quotes.

North Dakota Professional Liability: Bottom Line

Finding the right professional liability insurance in North Dakota comes down to understanding your business risks and working with the right provider. ERGO NEXT earns our top rating, but your industry, client contracts and budget should guide your final decision. Start by assessing your needs, then let a local agent help you compare options and secure coverage that financially protects your business.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.