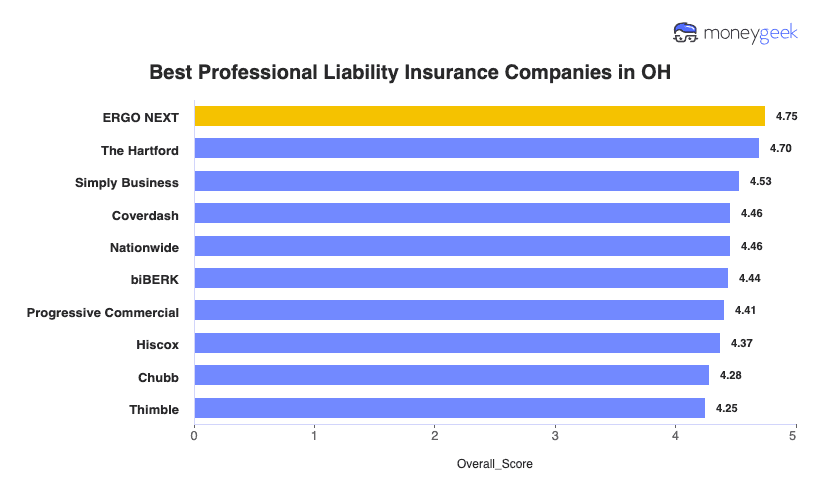

ERGO NEXT leads Ohio's professional liability insurance market with top-rated customer service, comprehensive coverage options and easy-to-use digital tools. The Hartford ranks as Ohio's cheapest professional indemnity insurer, averaging $66 monthly ($6 below the state average). Simply Business, Coverdash and Nationwide round out the top errors and omissions insurance providers in Ohio.

Best Professional Liability Insurance in Ohio

Get OH professional liability insurance quotes starting at $23 monthly from MoneyGeek's top companies like ERGO NEXT, The Hartford and Simply Business.

Get matched to the best professional liability insurance in OH for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

ERGO NEXT provides the best professional liability insurance in Ohio, while The Hartford offers the most affordable coverage starting at $66 monthly (Read More).

Professional liability insurance costs in Ohio average $72 per month ($864 annually), placing the state among the more affordable options nationwide (Read More).

Professional liability insurance protects Ohio businesses against claims involving professional mistakes, negligence and failure to deliver promised services (Read More).

Ohio doesn't require professional liability insurance for most businesses, though health care providers and other regulated professions need coverage (Read More).

Ohio business owners should gather small business insurance quotes from multiple providers to compare coverage limits and find optimal protection (Read More).

Best Professional Liability Insurance Companies in Ohio

| ERGO NEXT | 4.75 | $67 |

| The Hartford | 4.70 | $66 |

| Simply Business | 4.53 | $71 |

| Coverdash | 4.46 | $72 |

| Nationwide | 4.46 | $76 |

| biBERK | 4.44 | $74 |

| Progressive Commercial | 4.41 | $70 |

| Hiscox | 4.37 | $72 |

| Chubb | 4.28 | $82 |

| Thimble | 4.25 | $71 |

How Did We Determine the Best Professional Liability Insurance in Ohio?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

Beyond professional liability insurance in Ohio, we've provided the following state-specific resources to get the best coverage for your business:

1. ERGO NEXT: Best Professional Liability Insurance in OH

Tops Ohio for customer service and digital experience ratings

10-minute online purchase with instant certificates of insurance

A+ Superior AM Best rating backed by Munich Re

Personalized coverage matching for 1,300+ industries statewide

Less than 10 years in business

Claims process ranks fourth, slower than top competitors

$5 million revenue limit excludes larger businesses

Ohio business owners avoid wasting time on insurance tasks with ERGO NEXT. A Columbus consultant needing proof of insurance for tomorrow's client meeting can buy coverage tonight and email certificates within 10 minutes. That means no agent callbacks or business hour waits. Cleveland freelancers and Cincinnati contractors update policies from job sites through ERGO NEXT's mobile app instead of losing billable hours to paperwork. The company's A+ Superior financial backing from Munich Re ensures claims get paid when needed most.

2. The Hartford: Cheapest Professional Liability Insurance in OH

Lowest professional liability rates in Ohio

Best claims handling and overall customer satisfaction rankings from current customers

A+ Superior financial rating with strongest capitalization level

Specialized coverage for 50+ industries with 200+ years experience

Digital experience ranks 10th nationally among studied providers

Not available in Alaska or Hawaii

Ohio business owners save $71 annually with The Hartford's professional liability coverage at $66 monthly, $6 below Ohio's average. A Columbus accounting firm that budgets $800 for errors and omissions insurance pays $793 instead, redirecting savings toward growth. Cleveland consultants and Cincinnati contractors get faster claim settlements with The Hartford's rank-first claims handling when clients sue for professional negligence. The company's A+ Superior rating and 200+ years in professional liability mean your claims get paid when needed most.

3. Simply Business: Best Professional Liability Insurance Coverage Options in OH

Ranks first for coverage options with access to more than 16 carriers offering specialized policies

Backed by Travelers' A++ Superior financial rating

Lets you compare multiple quotes in 10 minutes instead of calling individual insurers

Broker model finds coverage for hard-to-insure businesses that other insurers reject

More expensive than other providers in MoneyGeek's study

Claims process ranks eighth nationally, indicating slower resolution times

Ohio business owners find specialized professional liability coverage through Simply Business's broker model, which connects you to 16+ carriers instead of one insurer's limited options. A Columbus IT consultant needing tech errors and omissions coverage compares policies from CNA, Hiscox and Markel in 10 minutes rather than calling each insurer separately. Cincinnati cannabis consultants and Cleveland contractors with unique risks get coverage through the broker's extensive carrier network. Travelers' A++ Superior backing ensures your policy stays financially solid when claims arise.

Average Cost of Professional Liability Insurance in Ohio

Professional liability insurance costs in Ohio vary by industry. Home-based businesses pay the lowest rates at around $34 per month, while mortgage brokers face the highest average costs at about $150 per month. You can find specific rates for your business type using the filtering tool below.

| Accountants | $132 | $1,589 |

| Ad Agency | $94 | $1,133 |

| Auto Repair | $76 | $917 |

| Automotive | $68 | $814 |

| Bakery | $49 | $588 |

| Barber | $40 | $477 |

| Beauty Salon | $46 | $552 |

| Bounce House | $55 | $660 |

| Candle | $39 | $465 |

| Cannabis | $115 | $1,380 |

| Catering | $75 | $896 |

| Cleaning | $51 | $612 |

| Coffee Shop | $56 | $676 |

| Computer Programming | $98 | $1,179 |

| Computer Repair | $58 | $697 |

| Construction | $71 | $856 |

| Consulting | $101 | $1,214 |

| Contractor | $58 | $695 |

| Courier | $46 | $551 |

| DJ | $43 | $512 |

| Daycare | $100 | $1,200 |

| Dental | $75 | $904 |

| Dog Grooming | $50 | $598 |

| Drone | $100 | $1,203 |

| Ecommerce | $56 | $676 |

| Electrical | $60 | $719 |

| Engineering | $97 | $1,161 |

| Excavation | $62 | $747 |

| Florist | $35 | $422 |

| Food | $102 | $1,219 |

| Food Truck | $55 | $654 |

| Funeral Home | $74 | $893 |

| Gardening | $38 | $453 |

| HVAC | $75 | $899 |

| Handyman | $51 | $614 |

| Home-based business | $34 | $409 |

| Hospitality | $68 | $816 |

| Janitorial | $46 | $556 |

| Jewelry | $58 | $691 |

| Junk Removal | $62 | $742 |

| Lawn/Landscaping | $47 | $567 |

| Lawyers | $137 | $1,641 |

| Manufacturing | $56 | $666 |

| Marine | $81 | $976 |

| Massage | $99 | $1,194 |

| Mortgage Broker | $150 | $1,806 |

| Moving | $75 | $904 |

| Nonprofit | $46 | $547 |

| Painting | $59 | $710 |

| Party Rental | $51 | $615 |

| Personal Training | $66 | $795 |

| Pest Control | $89 | $1,071 |

| Pet | $43 | $513 |

| Pharmacy | $54 | $644 |

| Photography | $60 | $716 |

| Physical Therapy | $89 | $1,072 |

| Plumbing | $82 | $987 |

| Pressure Washing | $53 | $636 |

| Real Estate | $118 | $1,417 |

| Restaurant | $77 | $919 |

| Retail | $51 | $610 |

| Roofing | $92 | $1,100 |

| Security | $92 | $1,107 |

| Snack Bars | $43 | $520 |

| Software | $88 | $1,053 |

| Spa/Wellness | $101 | $1,210 |

| Speech Therapist | $90 | $1,085 |

| Startup | $67 | $802 |

| Tech/IT | $90 | $1,080 |

| Transportation | $89 | $1,064 |

| Travel | $91 | $1,092 |

| Tree Service | $69 | $826 |

| Trucking | $103 | $1,239 |

| Tutoring | $56 | $673 |

| Veterinary | $108 | $1,297 |

| Wedding Planning | $72 | $862 |

| Welding | $71 | $854 |

| Wholesale | $56 | $678 |

| Window Cleaning | $58 | $693 |

How Did We Determine These Ohio Professional Liability Insurance Rates?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

What Does Ohio Professional Liability Insurance Cover?

Professional liability insurance protects Ohio businesses when clients claim you made mistakes or failed to deliver promised services. Professional liability insurance covers the costs of defending these claims and any damages you might owe. It also pays for legal fees that can add up quickly during disputes.

You might see this coverage called by different names:

- Errors and omissions insurance (E&O)

- Malpractice insurance (specialized type, typically in legal and medical fields)

- Professional indemnity insurance

How Much Professional Liability Insurance Do I Need in Ohio?

Most Ohio businesses don't need professional liability insurance. Attorneys must either carry $100,000 per occurrence and $300,000 aggregate coverage or complete state ethics training starting January 2025. Contract work usually requires $1 million per occurrence and $2 million aggregate limits. Medical professionals without malpractice coverage must inform patients in writing before providing services. Standard health care limits are $1 million per occurrence and $3 million aggregate.

Who Needs Professional Liability Insurance in Ohio?

If your work involves client contracts or carries professional negligence risks, professional liability insurance protects your Ohio business from costly lawsuits. Ohio businesses across these industries should consider coverage based on their contract requirements and liability exposure.

Starting January 2025, Ohio became one of few states requiring attorneys engaged in private practice to either carry $100,000 per occurrence and $300,000 aggregate professional liability insurance or complete mandatory state ethics curriculum. Attorneys without coverage will receive license registration blocks and potential suspension until they comply with the new requirement or finish the mandatory ethics training.

Ohio doctors and surgeons without medical malpractice coverage must provide patients with written notice of their lack of insurance before delivering non-emergency services. The State Medical Board of Ohio regulates more than 67,000 medical licensees across the state's largest employment sector, which employs 788,922 health care workers (16.8% of Ohio's private workforce), and most health care facilities require physicians to maintain malpractice insurance as a condition of employment or hospital privileges.

Ohio's investing $150 million in innovation hubs near research institutions alongside major technology infrastructure including Intel's multi-billion dollar New Albany chip manufacturing facility and expanding broadband networks throughout the state. Tech professionals developing software, managing IT infrastructure or providing consulting services need tech E&O insurance to cover claims from system failures, data breaches or missed project deadlines that cause financial harm to clients.

Ohio's $1.5 billion public infrastructure spending and $667 million All Ohio Future Fund are driving mega-projects like Intel's New Albany chip manufacturing facility and the Honda-LG battery factory in Jeffersonville, requiring construction contractors to carry professional liability coverage for design-build errors on large-scale industrial developments. Construction professionals working on commercial projects or government contracts need $1 million per occurrence coverage to meet client requirements and protect against claims from project delays or engineering mistakes.

Ohio's finance and insurance sector employs 235,929 workers concentrated in Hamilton County (Cincinnati) and Cuyahoga County (Cleveland), where average weekly wages of $1,572 and $1,528 exceed the national average of $1,527. Accountants, CPAs and financial advisors need accountants' professional liability insurance to protect against negligence claims when tax errors, audit mistakes or investment recommendations lead to client financial losses.

Ohio's professional, scientific and technical services sector employs 283,754 workers (6.1% of private employment) providing contract-based advisory services to businesses throughout the state. Management consultants, marketing advisors and strategy professionals need errors and omissions coverage when their business recommendations, implementation plans or project management services fail to deliver promised results and cause measurable financial harm to clients.

How to Get the Best Professional Liability Insurance in Ohio

Our step-by-step guide walks you through getting business insurance in Ohio that matches your professional liability coverage needs and budget.

- 1

Assess your professional liability insurance coverage needs

Start by evaluating your business risks, client contract requirements and the specific services you provide in Ohio's diverse economy. A Columbus software developer working with health care clients needs higher coverage limits than a Toledo manufacturing consultant advising small industrial businesses on operational efficiency.

- 2

Work with a local agent

Look for an Ohio-licensed agent who knows how business insurance costs differ between the state's health care-heavy markets and manufacturing centers. Cincinnati financial advisors serving high-net-worth clients require different coverage than Cleveland's corporate consultants working with Fortune 500 companies headquartered in the state.

- 3

Get quotes and compare coverage details

Request quotes from at least three Ohio-licensed insurers, comparing coverage limits, retroactive dates and defense costs beyond basic premiums. Don't assume cheap business insurance from a Dayton IT consultant's $500,000 policy provides adequate protection if your contracts require $1 million coverage.

- 4

Research the best providers

Check AM Best ratings and Ohio Department of Insurance complaint data to find insurers with strong financial stability and fair claims handling. Prioritize companies experienced with Ohio's dominant industries: health care in Cleveland, manufacturing in Akron or financial services in Cincinnati's Hamilton County.

- 5

Consider bundling discounts

Ohio insurers offer 15-25% savings when you bundle professional liability with general liability or business owner policies for multi-coverage protection. A Hamilton County CPA firm that combined its professional liability, cyber liability and general liability coverage with one carrier saved $1,850 annually compared to purchasing separate types of business insurance from different companies.

- 6

Don't let your coverage lapse

Ohio requires insurance records be maintained for three years, and professional liability claims can arise years after project completion. A Cleveland engineering consultant switching from Hiscox to The Hartford purchased tail coverage (extended reporting endorsement) covering five years of prior work to protect against delayed claims from past projects.

Get Ohio Professional Liability Insurance Quotes

MoneyGeek can get you professional liability insurance coverage in Ohio by matching you to top providers for your industry area. Use our tool below to get your top company match and get tailored quotes for your business.

Get Matched to the Best OH Professional Liability Insurer for You

Select your industry and state to get a customized OH professional liability insurer match and get tailored quotes.

Ohio Professional Liability: Bottom Line

Finding the right professional liability insurance in Ohio starts with understanding your business risks and choosing a provider that serves Ohio's diverse business landscape. ERGO NEXT earns our top rating for Ohio businesses, but you'll want to consider your industry, client contracts and budget when making your final decision. Assess your coverage needs first, then compare quotes from Ohio-licensed agents to secure protection that financially safeguards your business.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.