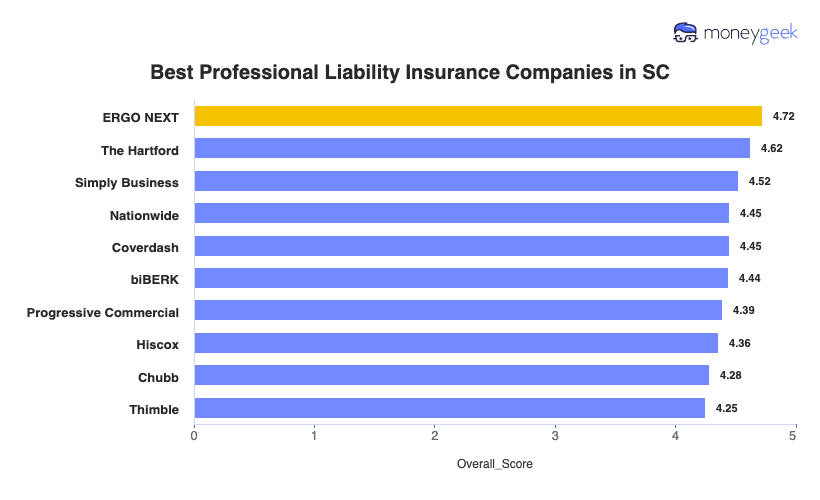

ERGO NEXT leads our South Carolina rankings as the best professional liability insurance provider with competitive rates, excellent customer service and easy-to-use digital tools. The Hartford offers the cheapest professional indemnity insurance in South Carolina at $73 monthly, saving businesses $7 compared to the state average. Simply Business, Nationwide, Coverdash and biBerk also earned top spots in our analysis of errors and omissions insurance providers in South Carolina.

Best Professional Liability Insurance in South Carolina

Get SC professional liability insurance quotes starting at $27 monthly from MoneyGeek's top companies like ERGO NEXT, The Hartford and Simply Business.

Get matched to the best professional liability insurance in SC for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

ERGO NEXT provides the best professional liability insurance in South Carolina, while The Hartford delivers the most affordable coverage starting at $73 monthly (Read More).

Professional liability insurance costs average $80 monthly or $959 annually in South Carolina, placing it among the more affordable states nationwide (Read More).

Professional liability insurance protects South Carolina businesses from financial losses due to professional mistakes, negligence claims and missed deadlines (Read More).

South Carolina doesn't mandate professional liability insurance for most businesses, though health care providers and other licensed professionals need coverage (Read More).

Getting multiple small business insurance quotes allows South Carolina business owners to compare coverage limits and find the most suitable professional liability policy (Read More).

Best Professional Liability Insurance Companies in South Carolina

| ERGO NEXT | 4.72 | $75 |

| The Hartford | 4.62 | $73 |

| Simply Business | 4.52 | $79 |

| Nationwide | 4.45 | $85 |

| Coverdash | 4.45 | $80 |

| biBERK | 4.44 | $82 |

| Progressive Commercial | 4.39 | $77 |

| Hiscox | 4.36 | $79 |

| Chubb | 4.28 | $91 |

| Thimble | 4.25 | $78 |

How Did We Determine the Best Professional Liability Insurance in South Carolina?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

Professional liability insurance in South Carolina covers just one aspect of business protection. Explore these additional state-specific resources to build comprehensive coverage:

1. ERGO NEXT: Best Professional Liability Insurance in SC

Ranks first nationally for customer service and digital experience

Backed by Munich Re's A+ Superior financial strength rating

Coverage and certificates available instantly in 10 minutes

Personalized coverage matching for both types and limit amounts

Ranks sixth for financial stability among providers reviewed

Claims process ranks fourth with slower resolution times

South Carolina business owners choose ERGO NEXT to eliminate insurance delays that cost clients. A Charleston consultant starts bidding on contracts immediately instead of waiting days for traditional insurers. When a Greenville freelancer's prospect requests proof of insurance after hours, the freelancer sends certificates instantly from a phone and closes the deal. ERGO NEXT ranks first nationally for customer service; business owners spend less time on insurance and more time earning revenue. Munich Re's backing means claims get paid without lengthy disputes.

2. The Hartford: Cheapest Professional Liability Insurance in SC

Lowest professional liability rates in South Carolina

Claims process ranks first with fastest resolution times

Holds A+ Superior financial strength rating from AM Best

Great personalized E&O coverage options for tech, law and medical professionals

Digital experience ranks tenth with limited online tools

South Carolina business owners save $81 annually with The Hartford's professional liability insurance. A Columbia consultant uses the savings for marketing expenses, while a Charleston freelancer covers software subscriptions with the extra $7 monthly. The Hartford ranks first nationally for claims processing speed and financial stability. Policyholders receive claim payments quickly without lengthy disputes over coverage. The insurer's A+ Superior rating from AM Best reflects its ability to pay claims reliably even during economic downturns.

3. Simply Business: Best Professional Liability Insurance Coverage Option in SC

Ranks first nationally for coverage options and specialized policies

Connects you with over 16 carriers for hard-to-insure businesses

Offers 10-minute comparison shopping through its digital platform (third-ranked nationally)

Backed by Travelers' A++ Superior financial strength rating

Claims resolution times are slower than competitors (eighth nationally)

Policy management and renewal experience trails most competitors (seventh nationally)

South Carolina business owners turn to Simply Business when direct insurers reject their applications. A Greenville IT consultant secures a specialized tech errors and omissions policy unavailable through standard carriers, while a Columbia cannabis business obtains coverage after three rejections from traditional insurers.

Simply Business connects businesses with 16+ insurance carriers rather than limiting options to standard policies. It finds coverage for over 1,000 business classes through its broker network. Travelers' A++ Superior rating ensures financial strength for claim payments.

Average Cost of Professional Liability Insurance in South Carolina

Professional liability insurance costs vary across industries in South Carolina. Home-based businesses pay the lowest rates at around $38 per month, while mortgage brokers pay the highest at approximately $171 per month. The filtering tool below shows specific rates for your industry, helping you find coverage that fits your business needs.

| Accountants | $151 | $1,815 |

| Ad Agency | $100 | $1,197 |

| Auto Repair | $85 | $1,021 |

| Automotive | $78 | $937 |

| Bakery | $54 | $653 |

| Barber | $44 | $527 |

| Beauty Salon | $51 | $607 |

| Bounce House | $62 | $739 |

| Candle | $44 | $532 |

| Cannabis | $127 | $1,522 |

| Catering | $83 | $992 |

| Cleaning | $57 | $682 |

| Coffee Shop | $63 | $758 |

| Computer Programming | $108 | $1,299 |

| Computer Repair | $65 | $782 |

| Construction | $79 | $953 |

| Consulting | $108 | $1,297 |

| Contractor | $64 | $765 |

| Courier | $51 | $614 |

| DJ | $46 | $550 |

| Daycare | $113 | $1,351 |

| Dental | $86 | $1,029 |

| Dog Grooming | $57 | $678 |

| Drone | $109 | $1,306 |

| Ecommerce | $64 | $762 |

| Electrical | $66 | $787 |

| Engineering | $108 | $1,291 |

| Excavation | $70 | $846 |

| Florist | $39 | $465 |

| Food | $112 | $1,341 |

| Food Truck | $60 | $723 |

| Funeral Home | $82 | $983 |

| Gardening | $41 | $490 |

| HVAC | $84 | $1,005 |

| Handyman | $56 | $669 |

| Home-based business | $38 | $457 |

| Hospitality | $75 | $897 |

| Janitorial | $51 | $614 |

| Jewelry | $64 | $773 |

| Junk Removal | $70 | $838 |

| Lawn/Landscaping | $52 | $630 |

| Lawyers | $151 | $1,810 |

| Manufacturing | $62 | $742 |

| Marine | $91 | $1,094 |

| Massage | $108 | $1,301 |

| Mortgage Broker | $171 | $2,048 |

| Moving | $85 | $1,020 |

| Nonprofit | $52 | $624 |

| Painting | $67 | $800 |

| Party Rental | $56 | $669 |

| Personal Training | $71 | $856 |

| Pest Control | $97 | $1,159 |

| Pet | $47 | $563 |

| Pharmacy | $58 | $701 |

| Photography | $65 | $778 |

| Physical Therapy | $96 | $1,149 |

| Plumbing | $93 | $1,118 |

| Pressure Washing | $59 | $703 |

| Real Estate | $129 | $1,544 |

| Restaurant | $83 | $1,000 |

| Retail | $55 | $661 |

| Roofing | $100 | $1,198 |

| Security | $101 | $1,217 |

| Snack Bars | $49 | $585 |

| Software | $99 | $1,184 |

| Spa/Wellness | $114 | $1,369 |

| Speech Therapist | $104 | $1,244 |

| Startup | $74 | $889 |

| Tech/IT | $103 | $1,237 |

| Transportation | $99 | $1,191 |

| Travel | $101 | $1,210 |

| Tree Service | $77 | $921 |

| Trucking | $117 | $1,398 |

| Tutoring | $64 | $763 |

| Veterinary | $119 | $1,425 |

| Wedding Planning | $78 | $938 |

| Welding | $78 | $942 |

| Wholesale | $63 | $751 |

| Window Cleaning | $64 | $772 |

How Did We Determine These South Carolina Professional Liability Insurance Rates?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

What Does South Carolina Professional Liability Insurance Cover?

Professional liability insurance in South Carolina protects your business when clients claim you made errors or failed to deliver promised services. Professional liability insurance covers the costs of defending these claims and any damages you might owe. It also pays for attorney fees and court costs related to covered claims. This coverage goes by several different names:

- Errors and omissions insurance (E&O)

- Malpractice insurance (specialized type, typically in legal and medical fields)

- Professional indemnity insurance

How Much Professional Liability Insurance Do I Need in South Carolina?

South Carolina doesn't mandate professional liability insurance for most businesses. State statute permits the Medical Malpractice Association to issue health care policies up to $1 million per occurrence and $3 million aggregate per year. Health care providers in the voluntary Patients' Compensation Fund maintain minimum coverage of $200,000 per occurrence and $600,000 aggregate per year. Businesses should review their client contracts and industry requirements to determine appropriate coverage limits.

Who Needs Professional Liability Insurance in South Carolina?

Professional services involving client contracts or potential negligence claims warrant professional liability coverage in South Carolina. The state has had the highest employment growth in 2025, increasing risks across different industries.

South Carolina's information technology sector attracted $4.1 billion in capital investment during 2024, making it the state's largest industry sector where computer and mathematical occupations average $93,300 annually. Tech professionals working on software development, cybersecurity, or IT consulting projects should secure tech E&O insurance to cover claims arising from data breaches, system failures, or missed project deadlines.

Health care ranks as South Carolina's largest employment sector, with practitioners earning an average annual wage of $91,640 according to Bureau of Labor Statistics data. The state doesn't mandate malpractice insurance, but medical facilities and hospitals throughout Charleston, Columbia, and Greenville commonly require coverage before granting admitting privileges.

South Carolina's construction industry grew 33.3% from 2010 to 2019, outpacing most other sectors in the state. Licensed contractors under the SC Contractor's Licensing Board must post surety bonds ranging from $7,000 to $500,000, and professional liability insurance protects against claims of faulty workmanship, code violations, or project delays that bonds don't cover.

The financial sector, which includes real estate, grew 15.9% since 2019 as population increases across Charleston, Greenville, and Columbia drive housing demand. Real estate agents and brokers licensed through the SC Real Estate Commission need errors and omissions insurance for real estate to cover claims from contract disputes, disclosure failures, or valuation errors.

Advanced manufacturing employment in South Carolina grew 17% over the past decade, with automotive manufacturing jobs increasing 63% since 2013 as BMW, Mercedes-Benz, and Volvo expanded operations. South Carolina ranks third nationally in automotive exports at $12 billion annually. Engineers and manufacturing consultants licensed through the SC Board of Engineers and Surveyors carry liability exposure from design flaws, production inefficiencies, or safety compliance failures.

How to Get the Best Professional Liability Insurance in South Carolina

Our step-by-step guide walks you through getting business insurance in South Carolina that matches your professional liability needs and budget. These steps let you secure appropriate coverage for your business.

- 1

Assess your professional liability insurance coverage needs

Start by reviewing your client contracts and industry requirements, as many SC businesses discover coverage gaps only when losing a bid. A Charleston software developer lost a $200,000 health care contract because her $500,000 policy didn't meet the client's $1 million minimum requirement.

- 2

Work with a local agent

Find an agent familiar with South Carolina's diverse economy who understands business insurance costs across different sectors. An Upstate agent experienced with BMW and Michelin suppliers knows manufacturing risks that a Myrtle Beach agent focused on tourism and real estate might miss.

- 3

Get quotes and compare coverage details

Don't assume affordable business insurance offers adequate protection, so read the exclusions carefully before choosing the lowest premium. A Spartanburg engineering consultant discovered his cheapest quote excluded product liability claims, which represented 60% of his actual risk exposure working with automotive manufacturers.

- 4

Research the best providers

Check AM Best ratings and verify insurers understand South Carolina's rapid economic growth and industry concentrations. Choose carriers experienced in your sector, whether you're serving the state's booming $4.1 billion IT industry, supporting automotive exports, or navigating health care's complex malpractice landscape.

- 5

Consider bundling discounts

Bundling professional liability with other types of business insurance typically saves 10% to 25% on your total premium. A Columbia accounting firm reduced annual costs from $3,200 to $2,560 by combining professional liability, general liability, and cyber coverage with one insurer.

- 6

Don't let your coverage lapse

Switching carriers without proper planning creates dangerous coverage gaps for past work. A Greenville engineer who moved from Boeing to a consulting role needed tail coverage (extended reporting coverage) to protect against claims from his five years of aerospace projects, costing double of his final annual premium but covering potential million-dollar exposures.

Get South Carolina Professional Liability Insurance Quotes

MoneyGeek matches South Carolina businesses with professional liability insurers specializing in your industry. Use the tool below to compare top providers and receive customized quotes for affordable coverage.

Get Matched to the Best SC Professional Liability Insurer for You

Select your industry and state to get a customized SC professional liability insurer match and get tailored quotes.

South Carolina Professional Liability: Bottom Line

Securing the right professional liability insurance in South Carolina means balancing your business risks against available coverage and costs. ERGO NEXT ranks first in our analysis, but your industry demands and client contracts should determine your final carrier choice. Start by assessing your exposure, then work with a South Carolina agent to compare providers and obtain coverage that protects your business.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.