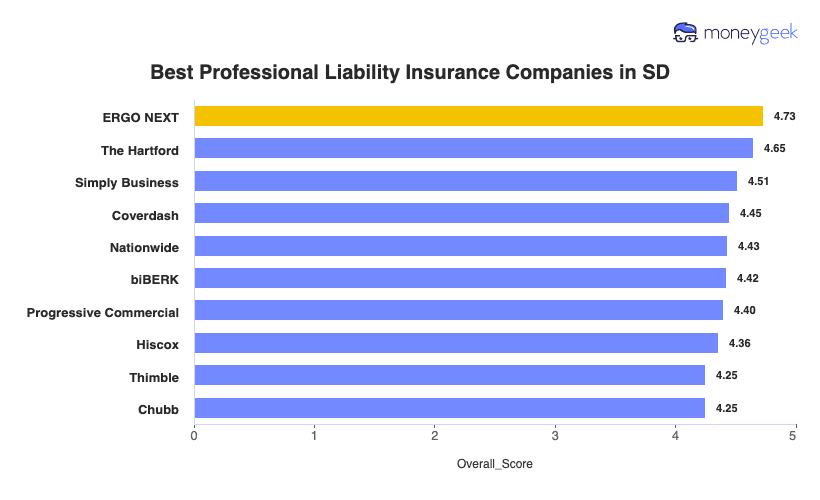

ERGO NEXT leads South Dakota for professional liability insurance with competitive rates, top-rated customer service and digital tools that let you get coverage in minutes. The Hartford ranks as the cheapest professional indemnity insurer in South Dakota at $67 monthly, saving you $6 compared to the state average. Simply Business, Coverdash and Nationwide also offer strong errors and omissions insurance options for South Dakota small businesses.

Best Professional Liability Insurance in South Dakota

Get SD professional liability insurance quotes starting at $24 monthly from MoneyGeek's top companies like ERGO NEXT, The Hartford and Simply Business.

Get matched to the best professional liability insurance in SD for you below.

Updated: February 2, 2026

Advertising & Editorial Disclosure

ERGO NEXT provides the best professional liability insurance in South Dakota, while The Hartford delivers the most affordable coverage at $67 monthly (Read More).

Professional liability insurance costs in South Dakota average $73 monthly, placing the state among the more affordable options nationwide (Read More).

Professional liability insurance protects South Dakota businesses from financial losses due to professional mistakes, negligence claims and unmet service obligations (Read More).

South Dakota doesn't mandate professional liability coverage, though health care professionals and other licensed practitioners need this protection (Read More).

South Dakota business owners should request small business insurance quotes from multiple carriers to secure optimal professional liability coverage and pricing (Read More).

Best Professional Liability Insurance Companies in South Dakota

| ERGO NEXT | 4.73 | $68 |

| The Hartford | 4.65 | $67 |

| Simply Business | 4.51 | $72 |

| Coverdash | 4.45 | $73 |

| Nationwide | 4.43 | $77 |

| biBERK | 4.42 | $74 |

| Progressive Commercial | 4.40 | $70 |

| Hiscox | 4.36 | $72 |

| Thimble | 4.25 | $71 |

| Chubb | 4.25 | $83 |

How Did We Determine the Best Professional Liability Insurance in South Dakota?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

Professional liability insurance covers one aspect of business protection in South Dakota, but you may need additional coverage types to fully protect your company:

1. ERGO NEXT: Best Professional Liability Insurance in SD

Ranks first in South Dakota for overall quality and customer service

Get coverage online in minutes with instant proof of insurance

Top-rated digital tools let you manage policies from your phone

Highest customer scores for policy management and recommendations

Second-lowest rates for professional liability insurance in South Dakota

Claims handling scores lower than top-tier competitors

Founded in 2016, newer than traditional insurers

ERGO NEXT earns the top spot for South Dakota professional liability insurance by saving you time and money without sacrificing coverage quality. You'll pay $68 monthly and get matched coverage in under 10 minutes online, no agent appointments required. Sioux Falls consultants and Rapid City contractors avoid coverage gaps by accessing proof of insurance instantly when clients demand it, and you can update your policy from your phone instead of waiting on hold or scheduling meetings.

2. The Hartford: Cheapest Professional Liability Insurance in SD

Lowest professional liability rates in South Dakota at $67 monthly

Ranks first nationally for claims handling and customer satisfaction

Great personalized E&O coverage options for tech, law and medical professionals

Over 200 years of experience insuring businesses

Digital experience ranks 10th among providers

Not available in Alaska or Hawaii

The Hartford offers South Dakota's lowest professional liability rates at $67 monthly, saving you $72 annually compared to the state average. You'll get faster claims payments when clients dispute your work, backed by the highest financial stability rating in our study. Aberdeen accountants and Brookings consultants choose The Hartford for claims expertise that protects you when clients file lawsuits, and agent support helps you navigate complex coverage decisions instead of handling everything yourself online.

3. Simply Business: Best Professional Liability Insurance Coverage Option in SD

Ranks first for coverage options with access to 16+ carriers

Broker model finds coverage when direct insurers reject your hard-to-insure business

Ranks third for digital experience to compare quotes online

Backed by Travelers' A++ Superior financial rating

Claims process ranks eighth

Customer satisfaction scores lower than direct insurers

Higher rates than other providers

Simply Business ranks first for coverage options in South Dakota by connecting you to specialized policies other insurers won't offer. You'll pay $72 monthly and gain access to hard-to-find coverage through the broker network, rather than being rejected by direct carriers. Sioux Falls tech consultants and Rapid City construction firms with unique risks use Simply Business to compare multiple quotes in 10 minutes, and the broker model helps you secure coverage when your business doesn't fit standard underwriting boxes.

Average Cost of Professional Liability Insurance in South Dakota

Professional liability insurance costs in South Dakota vary across industries. Florists pay the lowest rates at around $35 per month, while mortgage brokers pay the highest costs at approximately $154 per month. This wide range shows why industry-specific pricing matters for your business planning. You can find exact rates for your profession using the filtering tool below to compare options and find affordable coverage.

| Accountants | $139 | $1,671 |

| Ad Agency | $92 | $1,108 |

| Auto Repair | $77 | $928 |

| Automotive | $71 | $851 |

| Bakery | $49 | $593 |

| Barber | $40 | $483 |

| Beauty Salon | $46 | $550 |

| Bounce House | $56 | $671 |

| Candle | $39 | $463 |

| Cannabis | $116 | $1,387 |

| Catering | $74 | $894 |

| Cleaning | $51 | $609 |

| Coffee Shop | $58 | $697 |

| Computer Programming | $98 | $1,182 |

| Computer Repair | $58 | $699 |

| Construction | $71 | $858 |

| Consulting | $101 | $1,207 |

| Contractor | $58 | $701 |

| Courier | $46 | $555 |

| DJ | $42 | $502 |

| Daycare | $103 | $1,240 |

| Dental | $78 | $941 |

| Dog Grooming | $52 | $623 |

| Drone | $101 | $1,209 |

| Ecommerce | $57 | $686 |

| Electrical | $60 | $718 |

| Engineering | $98 | $1,173 |

| Excavation | $63 | $756 |

| Florist | $35 | $418 |

| Food | $103 | $1,240 |

| Food Truck | $55 | $657 |

| Funeral Home | $76 | $913 |

| Gardening | $38 | $456 |

| HVAC | $76 | $912 |

| Handyman | $51 | $612 |

| Home-based business | $35 | $424 |

| Hospitality | $70 | $837 |

| Janitorial | $46 | $556 |

| Jewelry | $58 | $694 |

| Junk Removal | $64 | $764 |

| Lawn/Landscaping | $48 | $571 |

| Lawyers | $134 | $1,607 |

| Manufacturing | $56 | $670 |

| Marine | $81 | $970 |

| Massage | $98 | $1,179 |

| Mortgage Broker | $154 | $1,850 |

| Moving | $76 | $918 |

| Nonprofit | $47 | $568 |

| Painting | $60 | $721 |

| Party Rental | $51 | $614 |

| Personal Training | $67 | $799 |

| Pest Control | $89 | $1,072 |

| Pet | $43 | $518 |

| Pharmacy | $54 | $645 |

| Photography | $58 | $702 |

| Physical Therapy | $88 | $1,053 |

| Plumbing | $84 | $1,013 |

| Pressure Washing | $54 | $650 |

| Real Estate | $117 | $1,401 |

| Restaurant | $76 | $915 |

| Retail | $52 | $628 |

| Roofing | $91 | $1,088 |

| Security | $93 | $1,120 |

| Snack Bars | $44 | $527 |

| Software | $88 | $1,062 |

| Spa/Wellness | $104 | $1,253 |

| Speech Therapist | $91 | $1,096 |

| Startup | $68 | $811 |

| Tech/IT | $92 | $1,109 |

| Transportation | $89 | $1,063 |

| Travel | $90 | $1,084 |

| Tree Service | $70 | $843 |

| Trucking | $103 | $1,236 |

| Tutoring | $58 | $693 |

| Veterinary | $107 | $1,289 |

| Wedding Planning | $74 | $883 |

| Welding | $70 | $840 |

| Wholesale | $57 | $689 |

| Window Cleaning | $59 | $703 |

How Did We Determine These South Dakota Professional Liability Insurance Rates?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

What Does South Dakota Professional Liability Insurance Cover?

Professional liability insurance in South Dakota protects your business when clients claim you made errors or failed to deliver promised services. Professional liability insurance covers the costs of defending against these claims and any damages you might owe. It also pays for legal expenses that pile up during lawsuits. This coverage goes by several names:

- Errors and omissions insurance (E&O)

- Malpractice insurance (specialized type, typically in legal and medical fields)

- Professional indemnity insurance

How Much Professional Liability Insurance Do I Need in South Dakota?

For most businesses in South Dakota, you won't be required to have professional liability coverage. Even so, you will need $1 million per occurrence and $2 million aggregate per year coverage to cover you to cover contract work risk or will be required to have it the health care industry (malpractice insurance) by those you work for. Health care is the only exception and sets its provider requirements at $1 million per occurrence and $3 million aggregate per year coverage.

Who Needs Professional Liability Insurance in South Dakota?

If you deal with client contracts or your work could result in professional negligence claims, you need professional liability insurance in South Dakota. Businesses providing specialized services or advice have the greatest exposure to errors and omissions lawsuits.

South Dakota's health care sector employs over 74,000 workers across major systems like Sanford Health and Avera. You'll need coverage to protect against malpractice claims, which South Dakota tracks through its Board of Medical and Osteopathic Examiners reporting requirements.

South Dakota projects 30% employment growth for software developers through 2030, exceeding the national rate of 22%. Tech E&O insurance protects you when clients claim your software failed to perform as promised or your advice led to system vulnerabilities.

Financial services ranks among South Dakota's focus industries, with Wells Fargo among the state's top 10 private employers. You need coverage when clients claim your investment advice caused losses or your consulting recommendations failed to deliver promised results.

South Dakota's construction sector added 873 jobs in recent quarters, reflecting strong industry activity statewide. You need coverage when clients claim project delays, cost overruns or work that doesn't meet contract specifications, and construction contracts commonly require proof of professional liability insurance.

The South Dakota Board of Accountancy regulates CPAs statewide, while professional and business services added 754 jobs recently. Accountants' professional liability insurance protects you when clients claim tax preparation errors, missed deductions or faulty financial advice cost them money.

How to Get the Best Professional Liability Insurance in South Dakota

Our step-by-step guide walks you through getting business insurance in South Dakota that matches your professional liability needs and budget. Follow these steps and secure coverage that protects your business.

- 1

Assess your professional liability insurance coverage needs

Start by reviewing your client contracts and identifying where your business could be held liable for errors or omissions. Sioux Falls consultants serving agricultural clients often need higher limits than the state minimum because crop failure or equipment breakdown claims can reach hundreds of thousands of dollars.

- 2

Work with a local agent

Finding an agent in South Dakota who understands your industry can be challenging in smaller markets like Aberdeen or Watertown, but a knowledgeable agent will explain whether your business insurance costs should account for serving clients across state lines or seasonal revenue fluctuations. Ask about their experience with businesses like yours, since a Rapid City tech consultant's risks differ significantly from a Brookings accountant's exposure.

- 3

Get quotes and compare coverage details

South Dakota's small business market means you'll want quotes from at least three insurers to ensure you're not overpaying, but don't sacrifice coverage quality for affordable business insurance rates. A Pierre financial advisor should confirm whether the policy covers advice given to out-of-state clients, since many South Dakota professionals serve customers beyond state borders.

- 4

Research the best providers

Check AM Best ratings and claim response times, which matter more in South Dakota's tight-knit business community where a slow claim settlement could damage your reputation while waiting months for resolution. Read reviews from professionals in your field who've actually filed claims, not just those comparing premium quotes.

- 5

Consider bundling discounts

Most South Dakota insurers discount premiums 10% to 25% when you bundle professional liability with general liability or business owner policies, and these savings add up quickly for small businesses operating on thin margins. A Mitchell accounting firm paying $800 annually for professional liability could save $120 to $200 by adding general liability to create a business owner's policy covering both types of business insurance.

- 6

Don't let your coverage lapse

South Dakota's professional services community is small enough that coverage gaps become obvious when clients request certificates of insurance or when you're selling your practice to another local professional. If you're switching carriers, purchase tail coverage (extended reporting coverage) from your old insurer to protect against claims from past work, especially important for Sioux Falls health care providers or Rapid City consultants whose work may not show problems for years.

Get South Dakota Professional Liability Insurance Quotes

MoneyGeek connects you to South Dakota professional liability insurance providers that match your industry and coverage needs. Use our tool below to compare top insurers and get quotes tailored to your business.

Get Matched to the Best SD Professional Liability Insurer for You

Select your industry and state to get a customized SD professional liability insurer match and get tailored quotes.

South Dakota Professional Liability: Bottom Line

Finding the right professional liability insurance in South Dakota comes down to understanding your business risks and working with a provider that fits your needs. ERGO NEXT earns our top rating, but your industry, client contracts and budget should guide your final decision. Start by assessing your coverage needs, then let a local agent help you compare options and secure coverage that financially protects your business.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.