ERGO NEXT leads our Texas professional liability insurance rankings with competitive rates, reliable customer service and a digital platform you can manage in minutes. The Hartford ranks as the cheapest professional indemnity insurer in Texas, averaging $72 per month and saving you $6 compared to typical state rates. Simply Business, Coverdash and Nationwide also provide top errors and omissions insurance worth considering for your Texas business.

Best Professional Liability Insurance in Texas

Get TX professional liability insurance quotes starting at $26 monthly from MoneyGeek's top companies like ERGO NEXT, The Hartford and Simply Business.

Get matched to the best professional liability insurance in TX for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

ERGO NEXT provides the best professional liability insurance in Texas, while The Hartford offers the most affordable coverage starting at $72 monthly (Read More).

Professional liability insurance costs in Texas average $78 monthly or $939 annually, placing the state among the more affordable options nationwide (Read More).

Professional liability insurance shields Texas businesses from financial losses due to professional mistakes, missed deadlines and claims of inadequate work performance (Read More).

Texas doesn't mandate professional liability insurance for most businesses, though health care providers, attorneys and other licensed professionals often face industry-specific requirements (Read More).

Getting multiple small business insurance quotes from different providers helps Texas business owners secure the most suitable professional liability coverage for their budget (Read More).

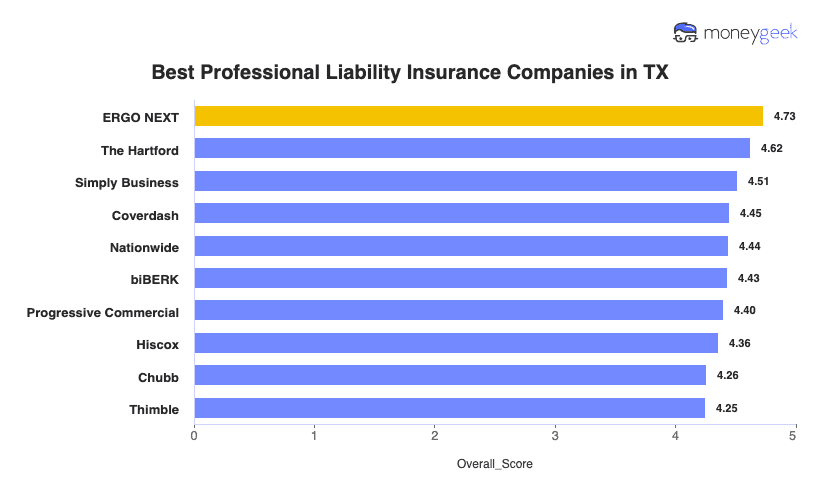

Best Professional Liability Insurance Companies in Texas

| ERGO NEXT | 4.73 | $73 |

| The Hartford | 4.62 | $72 |

| Simply Business | 4.51 | $77 |

| Coverdash | 4.45 | $78 |

| Nationwide | 4.44 | $83 |

| biBERK | 4.43 | $80 |

| Progressive Commercial | 4.40 | $76 |

| Hiscox | 4.36 | $78 |

| Chubb | 4.26 | $89 |

| Thimble | 4.25 | $76 |

How Did We Determine The Best Professional Liability Insurance in Texas?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

Professional liability insurance in Texas is just one piece of your business protection puzzle. Check out these additional state-focused resources to build comprehensive coverage:

1. ERGO NEXT: Best Professional Liability Insurance in TX

Ranks first in Texas for customer service and experience

Get coverage and instant certificates in under 10 minutes

Top-rated for policy management and customer recommendations

A+ Superior AM Best rating with Munich Re backing

Personalized coverage matching for both types and limit amounts

Claims process ranks fourth nationally versus top competitors

Digital-only model without in-person agent offices

Less than 10 years in business

When a Houston general contractor demands proof of insurance by end-of-day to start your project, you'll pull the certificate from ERGO NEXT's app in seconds instead of scrambling to reach an agent. Your $73 monthly premium won't spike when you add the additional insured your Austin tech client requires. If a Dallas business claims your advice cost them $50,000, ERGO NEXT's A+ Superior rating means Munich Re backs your claim payment when you need it most.

2. The Hartford: Cheapest Professional Liability Insurance in TX

Lowest Texas rates at $72 monthly for professional liability

Claims resolved within seven days for most policyholders

200+ years supporting businesses with A+ Superior AM Best rating

Great personalized E&O coverage options for tech, law and medical professionals

Specialists handle complex coverage increases versus automated systems

Digital tools rank last among competitors

Requires phone call to completes purchase

The Hartford charges $72 monthly and resolves claims within seven days. A Dallas client sues claiming your advice cost them $30,000 in lost revenue? Your claim gets approved in days, not months of uncertainty. If Houston energy clients demand $2 million coverage proof before signing tomorrow's $200,000 contract, specialists expedite coverage increases so you close deals instead of losing revenue to competitors with faster insurance approval. You get claims certainty and contract flexibility without premium increases.

3. Simply Business: Best Professional Liability Insurance Coverage Options in TX

Broker model finds coverage for hard-to-insure businesses that other insurers reject

Compare multiple carrier quotes in 10 minutes online

Digital experience ranks third with instant certificates available 24/7

Travelers' A++ Superior backing provides strong financial stability

Claims processing ranks eighth nationally versus top competitors

Broker model means different carrier handles your actual claim

Customer satisfaction scores rank seventh

Simply Business charges $77 monthly and connects Texas businesses to carriers including Travelers, CNA and Hiscox. Customers report the broker model "took the mystery out of what I needed for my small business" and appreciated comparing "different coverages and pricing options all in one place" rather than calling insurers individually. You get instant coverage without agent calls, though claims satisfaction ranks eighth nationally because your chosen carrier handles claims directly instead of Simply Business managing the process.

Average Cost of Professional Liability Insurance in Texas

Professional liability insurance costs in Texas range across different industries. Florists pay the lowest rates at around $38 per month, while mortgage brokers face the highest costs at approximately $167 per month. The table below shows what your specific industry pays for coverage in Texas.

| Accountants | $148 | $1,774 |

| Ad Agency | $100 | $1,194 |

| Auto Repair | $82 | $988 |

| Automotive | $77 | $924 |

| Bakery | $52 | $623 |

| Barber | $43 | $516 |

| Beauty Salon | $50 | $597 |

| Bounce House | $58 | $696 |

| Candle | $42 | $501 |

| Cannabis | $125 | $1,497 |

| Catering | $80 | $955 |

| Cleaning | $55 | $656 |

| Coffee Shop | $61 | $733 |

| Computer Programming | $106 | $1,272 |

| Computer Repair | $63 | $758 |

| Construction | $77 | $928 |

| Consulting | $107 | $1,287 |

| Contractor | $63 | $758 |

| Courier | $51 | $610 |

| DJ | $46 | $550 |

| Daycare | $110 | $1,319 |

| Dental | $85 | $1,022 |

| Dog Grooming | $56 | $667 |

| Drone | $106 | $1,268 |

| Ecommerce | $62 | $749 |

| Electrical | $64 | $766 |

| Engineering | $105 | $1,256 |

| Excavation | $68 | $822 |

| Florist | $38 | $457 |

| Food | $110 | $1,320 |

| Food Truck | $61 | $727 |

| Funeral Home | $81 | $976 |

| Gardening | $40 | $485 |

| HVAC | $83 | $991 |

| Handyman | $56 | $674 |

| Home-based business | $39 | $462 |

| Hospitality | $75 | $905 |

| Janitorial | $51 | $617 |

| Jewelry | $63 | $751 |

| Junk Removal | $68 | $810 |

| Lawn/Landscaping | $51 | $617 |

| Lawyers | $146 | $1,756 |

| Manufacturing | $60 | $719 |

| Marine | $89 | $1,070 |

| Massage | $107 | $1,284 |

| Mortgage Broker | $167 | $2,007 |

| Moving | $82 | $979 |

| Nonprofit | $50 | $597 |

| Painting | $64 | $766 |

| Party Rental | $55 | $663 |

| Personal Training | $70 | $844 |

| Pest Control | $95 | $1,138 |

| Pet | $45 | $543 |

| Pharmacy | $57 | $680 |

| Photography | $63 | $761 |

| Physical Therapy | $96 | $1,150 |

| Plumbing | $92 | $1,100 |

| Pressure Washing | $57 | $686 |

| Real Estate | $129 | $1,546 |

| Restaurant | $81 | $977 |

| Retail | $56 | $675 |

| Roofing | $98 | $1,180 |

| Security | $100 | $1,201 |

| Snack Bars | $47 | $566 |

| Software | $97 | $1,159 |

| Spa/Wellness | $110 | $1,325 |

| Speech Therapist | $100 | $1,196 |

| Startup | $73 | $873 |

| Tech/IT | $98 | $1,173 |

| Transportation | $95 | $1,144 |

| Travel | $97 | $1,164 |

| Tree Service | $75 | $906 |

| Trucking | $114 | $1,364 |

| Tutoring | $60 | $720 |

| Veterinary | $118 | $1,410 |

| Wedding Planning | $77 | $926 |

| Welding | $78 | $931 |

| Wholesale | $61 | $733 |

| Window Cleaning | $63 | $751 |

How Did We Determine These Texas Professional Liability Insurance Rates?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

What Does Texas Professional Liability Insurance Cover?

Texas professional liability insurance protects your business from liability damages stemming from negligence or failure to fulfill client contracts. The policy also covers legal expenses tied to these claims.

This coverage goes by several other names:

- Errors and omissions insurance (E&O)

- Malpractice insurance (specialized type, typically in legal and medical fields)

- Professional indemnity insurance

How Much Professional Liability Insurance Do I Need in Texas?

Texas doesn't require professional liability insurance for most businesses. Exceptions include home day care centers, HVAC installers, plumbers and real estate inspectors who need it for licensing. Standard contract work requires $1 million per occurrence and $2 million aggregate coverage. Health care facilities require $200,000 per claim and $600,000 annual aggregate, though Texas law doesn't mandate malpractice insurance for physicians.

Who Needs Professional Liability Insurance in Texas?

Texas businesses providing professional services or handling client contracts face liability claims that result in costly legal fees and damages. Professional liability insurance protects your business finances when clients allege negligence, errors or failure to deliver contractual obligations.

Austin's tech corridor ranks #1 nationally for semiconductor exports and employs the nation's second-largest semiconductor workforce. Software developers, IT consultants and technology firms need tech E&O insurance because client data breaches, project delays or software errors trigger six-figure lawsuits under Texas contract law.

Texas requires all public works designed under supervision of a licensed Professional Engineer, with over 69,000 PEs currently licensed statewide. The Texas Board of Professional Engineers mandates firm registration and holds engineers accountable for structural failures, design defects or code violations that endanger public safety, handling over 600 enforcement cases annually.

Houston's Texas Medical Center is the world's largest medical complex, employing thousands of physicians across 1,000+ biotechnology companies in the state. Texas doesn't mandate malpractice insurance by law, but health care facilities require providers to carry $200,000 per claim coverage to protect against misdiagnosis, surgical errors or medication mistakes.

Texas Department of Licensing and Regulation requires HVAC installers, plumbers and electricians to carry professional liability insurance for licensing. Construction added 8,100 jobs in recent months, with contractors facing liability for code violations, faulty installations or project delays that cause client financial losses.

Professional and Business Services added 10,500 jobs in September alone, with financial services expanding 67.3% in the Austin metro area. Accountants, financial advisors and consultants need coverage because investment losses, tax preparation errors or poor business advice trigger claims demanding reimbursement for client financial damages.

Texas earned the Governor's Cup for the 13th consecutive year with 1,368 capital investment projects in 2024, more than double second-place Illinois. Real estate agents and brokers need errors and omissions insurance for real estate because contract disputes, disclosure failures or misrepresented property conditions result in lawsuits from buyers or sellers seeking compensation.

How to Get the Best Professional Liability Insurance in Texas

Our step-by-step guide walks you through how to get business insurance in Texas that matches your professional liability insurance needs and budget.

- 1

Evaluate your coverage requirements and business risk exposure

Identify contract requirements from your largest clients and assess which professional services expose you to the highest liability risk. Austin tech startups pursuing Series A funding frequently discover venture capital firms require $2 million in professional liability coverage before closing investment rounds.

- 2

Find an agent familiar with Texas business environments

Work with agents who understand how business insurance costs fluctuate across Texas industries and regions. Houston energy consultants face different underwriting criteria and premium calculations than Dallas financial planners, requiring agents who know sector-specific liability exposures rather than offering generic quotes.

- 3

Collect multiple quotes and review policy specifications

Request quotes from three insurers minimum, comparing retroactive dates, defense cost coverage and per-claim deductibles alongside premiums. Plano engineering firms bidding on municipal contracts discovered that cheap business insurance with restrictive exclusions cost them $50,000 in legal fees the policies wouldn't cover.

- 4

Investigate insurer financial strength and industry expertise

Verify AM Best ratings of A- or higher and read customer reviews specific to claims handling speed. Texas's rapid growth means newer insurers enter the market frequently, but established carriers with decades of professional liability experience resolve disputes faster when clients threaten litigation.

- 5

Explore bundling opportunities for premium savings

Combine professional liability with cyber liability or general liability to unlock multi-policy discounts most carriers offer. Fort Worth accounting practices handling client tax data save 15% to 20% annually by bundling professional liability with cyber coverage through carriers offering types of business insurance packages designed for financial services.

- 6

Maintain continuous coverage to avoid claims gaps

Professional liability operates on claims-made basis, protecting only against lawsuits filed while your policy remains active. El Paso consultants switching carriers mid-year should purchase tail coverage (extended reporting period protection) from their previous insurer to cover potential claims from past client work.

Get Texas Professional Liability Insurance Quotes

MoneyGeek matches Texas business owners to professional liability insurance providers with deep industry expertise. Use our tool below to compare carriers, review coverage options and receive customized quotes for your business.

Get Matched to the Best TX Professional Liability Insurer for You

Select your industry and state to get a customized TX professional liability insurer match and get tailored quotes.

Texas Professional Liability: Bottom Line

Selecting professional liability insurance in Texas requires understanding your business risks and partnering with providers experienced in your industry. ERGO NEXT ranks highest in our analysis, though your client contracts, industry regulations and budget determine which coverage fits best. Assess your liability exposures first, compare quotes from local agents familiar with Texas business requirements and secure coverage protecting your finances when clients allege professional negligence.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.