ERGO NEXT ranks as Utah's best professional liability insurance provider with the lowest rates at $67 monthly, $7 below the state average. You'll get instant certificates through the insurer's mobile platform and top-rated customer service. The Hartford follows as the cheapest professional indemnity insurer among traditional carriers at $68 monthly with strong claims handling. Simply Business, Coverdash and Nationwide round out Utah's top errors and omissions insurance providers for specialized coverage needs.

Best Professional Liability Insurance in Utah

Get UT professional liability insurance quotes starting at $24 monthly from MoneyGeek's top companies like ERGO NEXT, The Hartford and Simply Business.

Get matched to the best professional liability insurance in UT for you below.

Updated: February 1, 2026

Advertising & Editorial Disclosure

ERGO NEXT offers both the best professional liability insurance and most affordable coverage in Utah at $67 monthly (Read More).

Professional liability insurance costs in Utah average $74 monthly ($889 annually), placing the state among the more affordable options nationwide (Read More).

Professional liability insurance protects Utah businesses from damages caused by professional mistakes, negligence claims and unmet service obligations (Read More).

Utah businesses usually face no legal requirement for professional liability coverage, though health care providers and other regulated professions often must carry this protection (Read More).

Utah business owners should evaluate multiple small business insurance quotes and coverage features to secure the most suitable professional liability protection for their needs (Read More).

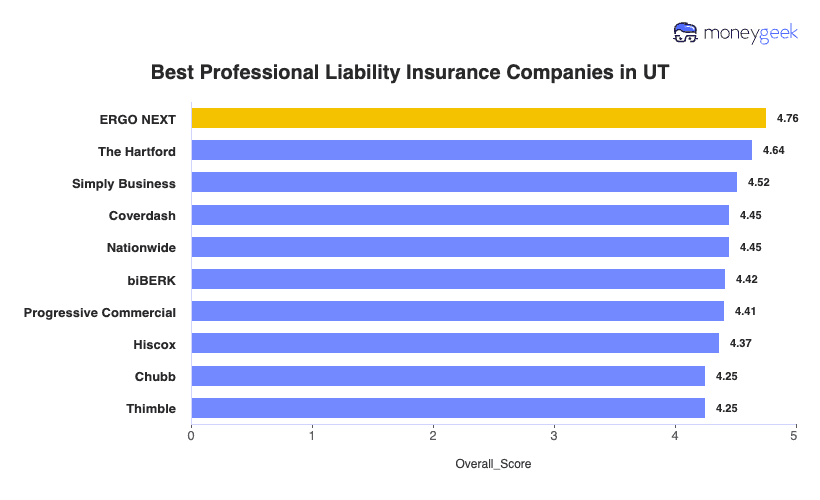

Best Professional Liability Insurance Companies in Utah

| ERGO NEXT | 4.76 | $67 |

| The Hartford | 4.64 | $68 |

| Simply Business | 4.52 | $73 |

| Coverdash | 4.45 | $74 |

| Nationwide | 4.45 | $78 |

| biBERK | 4.42 | $76 |

| Progressive Commercial | 4.41 | $72 |

| Hiscox | 4.37 | $74 |

| Chubb | 4.25 | $85 |

| Thimble | 4.25 | $73 |

How Did We Determine The Best Professional Liability Insurance in Utah?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

Professional liability insurance represents just one piece of comprehensive business protection in Utah. Explore these additional state-specific resources to build complete coverage for your company:

1. ERGO NEXT: Best Professional Liability Insurance in UT

Lowest professional liability rates in Utah

Top-rated customer service and digital experience nationwide

Instant certificates through mobile app for contract requirements

A+ Superior AM Best rating backed by Munich Re

Less than 10 years in business

Claims resolution slower than top three competitors

ERGO NEXT offers Utah's lowest professional liability rates at $67 per month, saving you $83 annually. You'll get same-day coverage when Provo tech clients or Salt Lake City contractors demand proof of insurance before signing contracts. Your certificate downloads instantly through the mobile app, eliminating "we can't start until you're insured" delays that cost your three-person business real revenue. ERGO NEXT's A+ Superior rating (backed by Munich Re) provides the financial strength of century-old carriers without their week-long approval processes.

2. Simply Business: Best Professional Liability Insurance Coverage Options in UT

Ranks first for coverage options with 18+ carrier access

Finds coverage for hard-to-insure businesses other carriers reject

Access to top-rated carriers including A++-rated insurers

Third-ranked digital experience for quote comparisons

Claims resolution slower than other insurers in our study

Customer service ranks seventh nationally

When your Park City SaaS startup needs tech E&O or your Ogden manufacturing consultant gets rejected by direct insurers, Simply Business finds specialized coverage through 18+ carriers in one session. That lets you skip the week spent calling Hiscox, CNA and Markel individually. You'll be able to compare policies side-by-side and bind coverage in 10 minutes instead of waiting for callbacks. Simply Business's broker model gives your three-person business access to specialized professional liability coverage unavailable when you're limited to a single carrier's appetite.

Average Cost of Professional Liability Insurance in Utah

Professional liability insurance costs in Utah vary by industry. Home-based businesses pay the lowest rates at around $35 per month, while mortgage brokers pay the highest average costs at approximately $160 per month. You can find specific rates for your industry using the filtering tool below to get accurate pricing for your business needs.

| Accountants | $141 | $1,691 |

| Ad Agency | $94 | $1,133 |

| Auto Repair | $79 | $949 |

| Automotive | $72 | $863 |

| Bakery | $50 | $603 |

| Barber | $41 | $488 |

| Beauty Salon | $47 | $568 |

| Bounce House | $56 | $671 |

| Candle | $40 | $480 |

| Cannabis | $117 | $1,409 |

| Catering | $76 | $913 |

| Cleaning | $52 | $620 |

| Coffee Shop | $58 | $693 |

| Computer Programming | $98 | $1,180 |

| Computer Repair | $60 | $722 |

| Construction | $73 | $872 |

| Consulting | $102 | $1,221 |

| Contractor | $60 | $716 |

| Courier | $48 | $573 |

| DJ | $45 | $536 |

| Daycare | $104 | $1,242 |

| Dental | $80 | $959 |

| Dog Grooming | $53 | $635 |

| Drone | $102 | $1,223 |

| Ecommerce | $59 | $710 |

| Electrical | $60 | $725 |

| Engineering | $102 | $1,225 |

| Excavation | $65 | $780 |

| Florist | $36 | $429 |

| Food | $106 | $1,270 |

| Food Truck | $55 | $665 |

| Funeral Home | $77 | $923 |

| Gardening | $38 | $457 |

| HVAC | $80 | $956 |

| Handyman | $53 | $635 |

| Home-based business | $35 | $420 |

| Hospitality | $70 | $837 |

| Janitorial | $46 | $555 |

| Jewelry | $58 | $695 |

| Junk Removal | $64 | $765 |

| Lawn/Landscaping | $49 | $594 |

| Lawyers | $140 | $1,676 |

| Manufacturing | $56 | $676 |

| Marine | $83 | $1,000 |

| Massage | $100 | $1,195 |

| Mortgage Broker | $160 | $1,925 |

| Moving | $76 | $913 |

| Nonprofit | $48 | $573 |

| Painting | $59 | $714 |

| Party Rental | $52 | $630 |

| Personal Training | $67 | $808 |

| Pest Control | $91 | $1,097 |

| Pet | $45 | $537 |

| Pharmacy | $53 | $633 |

| Photography | $61 | $737 |

| Physical Therapy | $90 | $1,086 |

| Plumbing | $85 | $1,020 |

| Pressure Washing | $56 | $668 |

| Real Estate | $121 | $1,451 |

| Restaurant | $79 | $947 |

| Retail | $53 | $637 |

| Roofing | $94 | $1,129 |

| Security | $94 | $1,124 |

| Snack Bars | $45 | $541 |

| Software | $91 | $1,094 |

| Spa/Wellness | $105 | $1,258 |

| Speech Therapist | $95 | $1,136 |

| Startup | $68 | $820 |

| Tech/IT | $95 | $1,142 |

| Transportation | $90 | $1,083 |

| Travel | $91 | $1,094 |

| Tree Service | $73 | $879 |

| Trucking | $105 | $1,257 |

| Tutoring | $58 | $693 |

| Veterinary | $109 | $1,308 |

| Wedding Planning | $73 | $872 |

| Welding | $74 | $885 |

| Wholesale | $58 | $700 |

| Window Cleaning | $59 | $712 |

How Did We Determine These Utah Professional Liability Insurance Rates?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

What Does Utah Professional Liability Insurance Cover?

Utah professional liability insurance protects businesses from financial damages when clients claim negligence or unmet contractual obligations. The policy also covers legal fees tied to these claims. This coverage goes by several different names in the insurance market:

- Errors and omissions insurance (E&O)

- Malpractice insurance (specialized type, typically in legal and medical fields)

- Professional indemnity insurance

How Much Professional Liability Insurance Do I Need in Utah?

Utah doesn't require professional liability insurance for most businesses. Licensed contractors must carry $100,000 per occurrence and $300,000 aggregate coverage under Division of Occupational and Professional Licensing (DOPL) regulations. Contract work in other industries requires $1 million per occurrence and $2 million aggregate annually. Health care providers face no state mandate, though hospitals commonly require $1 million per occurrence and $3 million aggregate coverage.

Who Needs Professional Liability Insurance in Utah?

Utah's diversified economy spans tech, health care, construction, financial services and real estate, creating professional liability exposure across multiple high-growth sectors. If your work involves client contracts or professional negligence risks, you need errors and omissions coverage to protect against liability damages.

Utah's "Silicon Slopes" tech economy employs over 67,400 workers across software development, systems design and IT services, creating exposure to data breach claims and project delivery failures. Tech professionals working with client data or custom software projects should secure tech E&O insurance to cover claims arising from system failures, missed deadlines or intellectual property disputes.

Lawyers often need a specialized type of professional liability insurance called malpractice insurance to protect them against risks related to negligence throughout the legal process. It is not required to get in Utah according to state law.

With over 106,000 health services workers statewide, Utah doesn't mandate professional liability insurance for physicians and nurses, but hospitals throughout the state commonly require $1 million per occurrence and $3 million aggregate coverage before granting practice privileges. Healthcare providers licensed through DOPL face substantial malpractice exposure from diagnostic errors, treatment complications and patient care disputes.

Utah contractors must carry $100,000 per occurrence and $300,000 aggregate professional liability coverage under Division of Occupational and Professional Licensing (DOPL) regulations to maintain active licensure. DOPL enforcement data shows contractors face frequent claims for project delays, defective work and failure to meet contract specifications.

Professional and business services employ over 146,000 workers in Utah's economy, with financial services designated as a targeted growth industry by the Governor's Office of Economic Opportunity. Financial advisors, consultants and business analysts need coverage against claims alleging negligent advice, missed investment opportunities or failure to meet contractual obligations.

Utah's Division of Real Estate licenses thousands of agents and brokers who face liability exposure throughout property transactions, from disclosure failures to contract disputes. Real estate professionals should secure errors and omissions insurance for real estate to protect against claims arising from misrepresentation, failure to disclose property defects or errors in transaction documents.

How to Get the Best Professional Liability Insurance in Utah

Our step-by-step guide walks you through how to get business insurance in Utah that matches your professional liability insurance needs and budget.

- 1Assess your professional liability insurance coverage needs

Evaluate coverage based on your business trajectory and client sophistication, not just current revenue. A Provo software startup securing its first enterprise contract with $2 million in claims history requirements needs higher limits than its $500,000 seed-stage coverage, while Ogden contractors must meet DOPL's mandatory $100,000 per occurrence minimum regardless of project size.

- 2Work with a local agent

Seek agents who understand how Utah's concentrated industries create unique coverage gaps and multi-state exposure. Silicon Slopes tech consultants serving California clients need agents familiar with both Utah business insurance costs and cross-border professional liability claims, while health care providers in Salt Lake City need agents experienced with Intermountain Health's specific insurance requirements.

- 3Get quotes and compare coverage details

Focus on policy exclusions and cyber liability add-ons rather than base premiums alone, especially for tech and financial services businesses. A Park City financial advisor handling cryptocurrency investments should verify whether affordable business insurance policies explicitly cover emerging financial products or exclude them as "speculative investments."

- 4Research the best providers

Prioritize insurers with Utah tech startup and professional services expertise who understand the state's rapid-growth business environment. Check whether carriers have experience handling claims from Utah's targeted industries (software/IT, life sciences, financial services, aerospace) and review their response times for claims in Salt Lake City's competitive market where delayed settlements can threaten business viability.

- 5Consider bundling discounts

Utah's startup-heavy economy makes business owner policies (BOPs) particularly valuable for combining professional liability with property and general liability coverage. A St. George consulting firm operating from a home office can save 20% by bundling professional liability with business insurance coverage types like general liability and business property rather than purchasing separate policies.

- 6Don't let your coverage lapse

Utah's active merger and acquisition market, especially in tech and health care, requires continuous coverage even when selling your business or joining a larger firm. A Lehi software developer acquired by a Utah County enterprise should purchase tail coverage (extended reporting coverage) for work completed before the acquisition, since the buyer's policy won't cover pre-merger professional services claims.

Get Utah Professional Liability Insurance Quotes

Compare professional liability insurance quotes from Utah's top providers matched to your industry and coverage needs. Use our tool below to identify the best insurers for your business and receive personalized rate estimates.

Get Matched to the Best UT Professional Liability Insurer for You

Select your industry and state to get a customized UT professional liability insurer match and get tailored quotes.

Utah Professional Liability: Bottom Line

Choosing professional liability insurance in Utah depends on your business risks, client contracts, DOPL requirements and budget. ERGO NEXT leads our rankings, while The Hartford offers the lowest rates and Simply Business provides the most coverage options. Your industry exposure determines the best provider match. Assess your needs, compare quotes from local agents and secure coverage that protects your business.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.