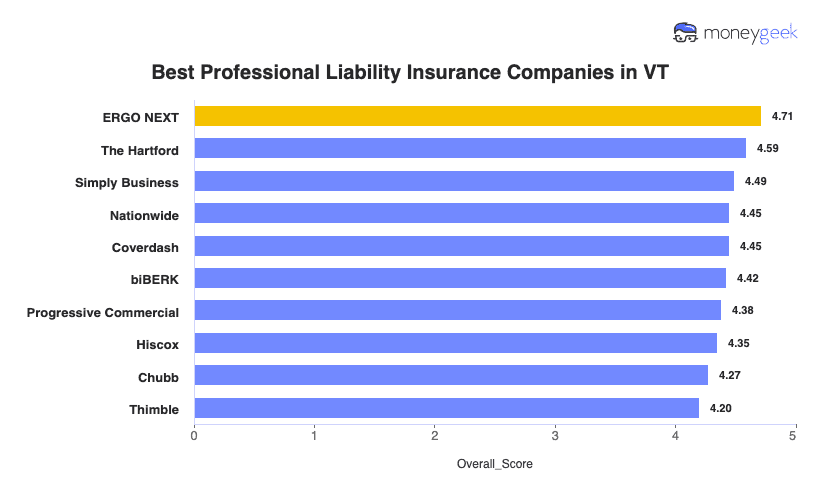

Vermont small business owners seeking affordable professional liability protection will find ERGO NEXT at the top of MoneyGeek's rankings with strong service ratings, competitive rates and streamlined digital tools. ERGO NEXT and The Hartford tie as the cheapest professional indemnity insurers in Vermont at $69 monthly, $6 below the state average. Simply Business, Coverdash and Nationwide also merit consideration when comparing top errors and omissions insurance options in Vermont.

Best Professional Liability Insurance in Vermont

Get VT professional liability insurance quotes starting at $24 monthly from MoneyGeek's top companies like ERGO NEXT, The Hartford and Simply Business.

Get matched to the best professional liability insurance in VT for you below.

Updated: January 30, 2026

Advertising & Editorial Disclosure

ERGO NEXT provides the best professional liability insurance in Vermont, while The Hartford offers the most affordable coverage starting at $69 monthly (Read More).

Professional liability insurance costs average $75 monthly or $894 annually in Vermont, placing it among the more affordable states nationwide (Read More).

Professional liability insurance protects Vermont businesses against claims from professional mistakes, negligence and failures to deliver promised services (Read More).

Vermont businesses aren't required to carry professional liability insurance, though health care providers and other regulated professions need coverage (Read More).

Getting multiple small business insurance quotes from different providers helps Vermont businesses secure the best professional liability coverage for their budget (Read More).

Best Professional Liability Insurance Companies in Vermont

| ERGO NEXT | 4.71 | $69 |

| The Hartford | 4.59 | $69 |

| Simply Business | 4.49 | $73 |

| Nationwide | 4.45 | $79 |

| Coverdash | 4.45 | $74 |

| biBERK | 4.42 | $77 |

| Progressive Commercial | 4.38 | $72 |

| Hiscox | 4.35 | $74 |

| Chubb | 4.27 | $85 |

| Thimble | 4.20 | $73 |

How Did We Determine the Best Professional Liability Insurance in Vermont?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

Professional liability coverage is just one piece of protecting your Vermont business. Explore these additional state-focused guides to build comprehensive coverage:

1. ERGO NEXT: Best Professional Liability Insurance in VT

Tops MoneyGeek's Vermont rankings for overall professional liability coverage

Ranks first nationally for customer service and digital experience

Competitive professional liability rates in Vermont at $69 monthly

Best-rated policy management and customer recommendation scores

Claims process ranks fourth, behind top competitors

Financial stability score ranks sixth among reviewed providers

Founded in 2016, offering less operational history

When a Burlington consultant lands a last-minute contract requiring proof of insurance by 5 p.m., or a Stowe contractor needs a certificate between job sites, you need coverage now, not after days of agent callbacks. ERGO NEXT delivers Vermont's lowest rates at $69 monthly with instant policy management from your phone. The insurer ranks first nationally for customer service and digital experience, giving you control when clients demand quick turnaround.

2. The Hartford: Cheapest Professional Liability Insurance in VT

Cheapest professional liability insurance in Vermont at $69 monthly

Ranks first nationally for claims handling and overall satisfaction

200+ years of business insurance experience and expertise

Great personalized E&O coverage options for tech, law and medical professionals

Digital experience ranks tenth, requiring more agent interaction

Policy changes need agent assistance, not self-service options

Your reputation matters more in Vermont's tight-knit professional community. One unhappy client in Burlington tells five others before you finish your morning coffee. The Hartford delivers Vermont's lowest rates at $69 monthly while ranking first nationally for claims handling, so when a client claims your missed deadline cost them a seasonal opportunity, you get expert defense that protects your standing in a small market. You save $72 annually without sacrificing support when winter heating bills arrive.

3. Simply Business: Best Professional Liability Insurance Coverage Options in VT

Ranks first for coverage options with access to 16+ carriers

Digital experience ranks third nationally for quote comparison tools

Backed by Travelers' A++ Superior financial rating and stability

Broker model finds coverage for hard-to-insure specialized businesses

Claims process ranks eighth, indicating slower resolution times

Customer satisfaction and recommendation scores rank seventh and eighth

Costs more than other insurers in MoneyGeek's study

Three insurers rejected your Montpelier architecture firm due to a past claim. Your Brattleboro craft brewery needs professional liability for recipe consulting plus product coverage. Calling individual carriers eats a week you don't have. Simply Business compares 16+ carriers in one session for $73 monthly and finds specialized coverage combinations standard policies miss. When your Vermont business doesn't fit the mold, the broker network gets you covered instead of turned away.

Average Cost of Professional Liability Insurance in Vermont

Professional liability insurance costs in Vermont vary by industry. Home-based businesses pay the most affordable rates at around $36 per month, while mortgage brokers face the highest costs at approximately $160 per month. Use the filtering tool below to find specific pricing for your industry and get accurate rates for your business needs.

| Accountants | $141 | $1,696 |

| Ad Agency | $93 | $1,111 |

| Auto Repair | $78 | $939 |

| Automotive | $70 | $839 |

| Bakery | $51 | $611 |

| Barber | $41 | $493 |

| Beauty Salon | $47 | $567 |

| Bounce House | $58 | $695 |

| Candle | $40 | $481 |

| Cannabis | $117 | $1,399 |

| Catering | $77 | $925 |

| Cleaning | $52 | $625 |

| Coffee Shop | $59 | $705 |

| Computer Programming | $101 | $1,208 |

| Computer Repair | $60 | $718 |

| Construction | $74 | $886 |

| Consulting | $102 | $1,228 |

| Contractor | $61 | $732 |

| Courier | $48 | $571 |

| DJ | $44 | $523 |

| Daycare | $105 | $1,257 |

| Dental | $80 | $956 |

| Dog Grooming | $53 | $631 |

| Drone | $104 | $1,243 |

| Ecommerce | $60 | $724 |

| Electrical | $61 | $737 |

| Engineering | $100 | $1,204 |

| Excavation | $64 | $767 |

| Florist | $36 | $435 |

| Food | $106 | $1,268 |

| Food Truck | $57 | $679 |

| Funeral Home | $77 | $918 |

| Gardening | $38 | $460 |

| HVAC | $77 | $926 |

| Handyman | $53 | $632 |

| Home-based business | $36 | $431 |

| Hospitality | $70 | $839 |

| Janitorial | $48 | $581 |

| Jewelry | $59 | $706 |

| Junk Removal | $65 | $781 |

| Lawn/Landscaping | $48 | $582 |

| Lawyers | $139 | $1,665 |

| Manufacturing | $57 | $684 |

| Marine | $84 | $1,004 |

| Massage | $101 | $1,212 |

| Mortgage Broker | $160 | $1,921 |

| Moving | $78 | $941 |

| Nonprofit | $49 | $582 |

| Painting | $61 | $735 |

| Party Rental | $53 | $632 |

| Personal Training | $67 | $805 |

| Pest Control | $91 | $1,097 |

| Pet | $44 | $528 |

| Pharmacy | $56 | $666 |

| Photography | $61 | $727 |

| Physical Therapy | $89 | $1,071 |

| Plumbing | $86 | $1,029 |

| Pressure Washing | $55 | $659 |

| Real Estate | $122 | $1,459 |

| Restaurant | $79 | $949 |

| Retail | $52 | $629 |

| Roofing | $95 | $1,136 |

| Security | $98 | $1,179 |

| Snack Bars | $45 | $539 |

| Software | $91 | $1,095 |

| Spa/Wellness | $106 | $1,267 |

| Speech Therapist | $96 | $1,152 |

| Startup | $70 | $834 |

| Tech/IT | $95 | $1,142 |

| Transportation | $89 | $1,069 |

| Travel | $92 | $1,102 |

| Tree Service | $73 | $872 |

| Trucking | $108 | $1,293 |

| Tutoring | $58 | $702 |

| Veterinary | $112 | $1,349 |

| Wedding Planning | $73 | $880 |

| Welding | $75 | $895 |

| Wholesale | $60 | $723 |

| Window Cleaning | $59 | $702 |

How Did We Determine These Vermont Professional Liability Insurance Rates?

These rates are estimates based on MoneyGeek's proprietary analysis of small businesses with two employees across 79 major industries and should not be considered quotes. Your actual rate will differ based on business-specific factors. Contact insurers directly for accurate pricing tailored to your business needs.

What Does Vermont Professional Liability Insurance Cover?

Vermont professional liability insurance protects your business when clients claim you made professional mistakes or failed to deliver promised services. This coverage pays for damages you owe and handles legal expenses when disputes arise.

This insurance goes by several other names:

- Errors and omissions insurance (E&O)

- Malpractice insurance (specialized type, typically in legal and medical fields)

- Professional indemnity insurance

How Much Professional Liability Insurance Do I Need in Vermont?

Vermont doesn't require professional liability insurance for most businesses. Vermont state contracts require $1 million per claim when you provide licensed professional services: legal, medical, financial, accounting, architecture, engineering, management consulting or technology work. Healthcare providers aren't required by Vermont statute to carry malpractice coverage.

Who Needs Professional Liability Insurance in Vermont?

Professional liability insurance protects Vermont businesses from claims arising from professional negligence, errors or failure to meet contractual obligations. If your work involves client contracts, professional advice or licensed services, you should consider errors and omissions coverage.

Vermont's aging population (27.1% are 60 or older, the highest in the nation) creates substantial malpractice exposure for medical providers, nurses, therapists and allied health professionals. While Vermont statutes don't mandate malpractice coverage, health care facilities and insurance networks require $1 million per occurrence and $3 million aggregate coverage.

Vermont requires contractors performing residential work valued at $10,000 or more to register with the Office of Professional Regulation as of April 1, 2023. Professional liability insurance protects you from claims related to construction defects, delayed completion or failure to meet building codes and energy standards.

Vermont's growing Professional and Technical Services sector includes software developers, IT consultants, and cybersecurity specialists who need tech E&O insurance to cover data breaches, software failures and missed project deadlines. Your clients in finance, health care and government contracting often require proof of professional liability coverage before signing contracts.

Vermont real estate brokers and salespersons must hold active licenses through the Office of Professional Regulation and face heightened liability exposure in a market where median home prices reach six times median household income. Errors and omissions insurance for real estate protects you from claims that can arise from Vermont's complex zoning laws, Act 250 environmental requirements and historic property regulations.

Vermont's $4 billion tourism industry served 15.8 million visitors in 2023, and includes guides, event planners, lodge operators and hospitality consultants who face liability from client injuries, event cancellations and service failures. Professional liability coverage protects against claims from wedding planning errors, guided tour accidents or failed event execution during Vermont's peak ski and fall foliage seasons.

Vermont's agriculture sector (representing 31% of state business loans) includes consultants advising on organic certification, farm-to-table operations, cheesemaking, craft beverages and sustainable practices. You need professional liability insurance to cover claims from failed organic certification applications, contaminated food production advice or business consulting that doesn't deliver promised results.

How to Get the Best Professional Liability Insurance in Vermont

Our step-by-step guide walks you through how to get business insurance in Vermont that matches your professional liability needs and budget. Following them to get financial protection.

- 1Assess your professional liability insurance coverage needs

Your coverage needs depend on client contracts, cross-border work requirements, and seasonal revenue patterns. If you're a Stowe hospitality consultant working with Canadian investors, you'll need higher limits than a Montpelier accountant serving local farms Both should consider how Vermont's tourism-driven economy affects year-round cash flow.

- 2Work with a local agent

Vermont's tight-knit professional community means your agent should understand state-specific regulations like Act 250 environmental requirements and the new contractor registration rules that took effect in 2023. A Rutland agent familiar with agricultural consulting business insurance costs can explain coverage differently than a Burlington agent working with tech firms serving Montreal clients.

- 3Get quotes and compare coverage details

Compare affordable business insurance options with deductibles that match your seasonal cash flow. October leaf-peeping revenue won't help if a claim hits in March. A Brattleboro wedding planner should evaluate whether $1,000 or $2,500 deductibles work better with uneven tourism income, not just which saves $30 monthly.

- 4Research the best providers

In Vermont's small market, word travels fast about claims handling, so ask other professionals in your Waterbury coworking space or Middlebury downtown about their experiences. Strong AM Best ratings matter when you need support during February, when meeting your insurer in person means navigating winter roads to Montpelier or waiting for a phone call.

- 5Consider bundling discounts

Vermont's fifth-highest property tax burden makes bundling savings significant. Combining professional liability with property coverage for your Burlington South End studio or general liability for your Essex Junction office cuts total types of business insurance costs, and craft beverage consultants save 20% by bundling E&O coverage with product liability for brewery tastings.

- 6Don't let your coverage lapse

Seasonal businesses closing from November through April still need continuous coverage; a Ludlow ski consultant's summer consulting work requires protection even when the mountain's closed. If you're switching insurers after Vermont's April 2023 contractor registration requirement, purchase tail coverage (extended reporting coverage) to protect against claims from pre-registration projects.

Get Vermont Professional Liability Insurance Quotes

MoneyGeek can get you professional liability insurance coverage in Vermont by matching you to top providers for your industry area. Use our tool below to get your top company match and get tailored quotes for your business.

Get Matched to the Best VT Professional Liability Insurer for You

Select your industry and state to get a customized VT professional liability insurer match and get tailored quotes.

Vermont Professional Liability: Bottom Line

Finding the right professional liability insurance in Vermont comes down to understanding your business risks and working with providers who know the state's unique landscape. ERGO NEXT earns our top rating, but your industry requirements, client contracts and seasonal revenue patterns should guide your final decision. Start by assessing your needs, then connect with a local agent who can compare options and secure coverage that financially protects your Vermont business.

About Mark Fitzpatrick

Mark Fitzpatrick, a Licensed Property and Casualty Insurance Producer, is MoneyGeek's resident Personal Finance Expert. He has analyzed the insurance market for over five years, conducting original research for insurance shoppers. His insights have been featured in CNBC, NBC News and Mashable.

Fitzpatrick holds a master’s degree in economics and international relations from Johns Hopkins University and a bachelor’s degree from Boston College. He's also a five-time Jeopardy champion!

He writes about economics and insurance, breaking down complex topics so people know what they're buying.